Diamonds are still forever at Anglo American (JSE: AGL)

The latest De Beers sales results are in line with expectations

In the second sales cycle for 2023, De Beers sold $495 million worth of rough diamonds. That’s higher than $454 million in the first cycle, but well down on $652 million in the second cycle last year.

The management team is unconcerned, as the expectation was for purchases to be pushed out to later in 2023 because of economic uncertainty towards the end of 2022. De Beers also highlights positive trends in client demand for diamond jewellery.

De Beers is a very helpful source of profits in Anglo American, with fundamentals that are far removed from the commodities in the group.

Cognition is cash flush after selling Private Property (JSE: CGN)

The share price is up 42% in the past year, trading at close to NAV

This was a lovely value unlock play if you got in before the Private Property transaction. Cognition Holdings managed to sell that business for a fantastic price, leading to a huge jump in cash on the balance sheet over six months of R114 million to R213 million.

With total assets of R265 million and total liabilities of R33 million, almost the entire net asset value can be attributed to cash. This is why the share price is trading at close to tangible net asset value per share.

The company is busy repositioning the remaining businesses and has seen some progress in that regard. The management team talks about “realistic prospects to unlock value to shareholders in the short term” which could well mean a large special dividend or perhaps even a sale of remaining businesses.

For now, patience is needed.

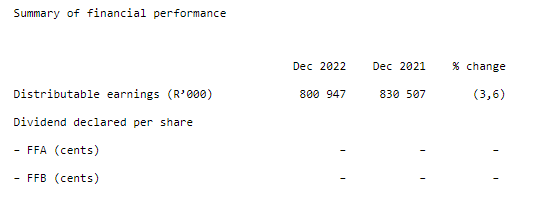

Fortress: do you believe in life after REIT? (JSE: FFA | JSE: FFB)

I bet that Cher song is now stuck in your head (unless you’re too young)

Fortress is no longer a REIT. It’s now a property company, which means that dividends are taxed differently and the company has more flexibility in capital allocation. As I wrote before this issue was finalised, that may not be a bad thing.

The company has accepted its fate, with no plans to put another proposal in front of shareholders to simplify the shareholding structure in the short term. The management team stresses that shareholders can capture the full equity value of Fortress by buying the FFA and FFB shares in equal numbers. The real problem is the dividend stalemate because of this structure, as explained quite beautifully in this table:

They may as well invest in energy solutions and reduce debt, since the profits are trapped in the company because of the distribution rules of the dual share class structure.

The 23.7% strategic interest in NEPI Rockcastle is proving useful, mainly because Central and Eastern Europe has electricity. That’s one up on the local portfolio, where Fortress is taking strain thanks to Eskom.

JSE Limited is still a cash cow, but margins are down (JSE: JSE)

And yes, the JSE is listed on its own exchange!

This always confuses market newbies. JSE Limited is the company that operates the Johannesburg Stock Exchange (JSE), so it can be listed on its own product. Before this confuses you further, remember that Microsoft runs on Microsoft systems. It’s the same principle.

The market sees the JSE as a cash cow that offers a resilient revenue stream but minimal growth. This has played out in the year ended December 2022, with HEPS growth of 4% and a 2% increase in the dividend. With a full year dividend of 769 cents per share, the trailing dividend yield is now 6.9%.

The goal is to increase revenue from non-trading activity, which sounds strange for a stock exchange group. This is to diversify and make the business more resilient.

With revenue up by 5% and expenses up by 7.5%, margins went the wrong way. Thanks to inflationary pressures and South Africa’s low growth environment (or even negative growth based on the latest GDP numbers), I wouldn’t expect a material change in that trend.

With a flat performance over the past year (admittedly with no shortage of volatility), all that investors can smile about is that dividend yield. It’s not enough when you can do better on government bonds.

Momentum at Momentum Metropolitan (JSE: MTM)

Growth in HEPS of 45% does the trick

With an improved mortality experience in the aftermath of Covid, Momentum Metropolitan delivered strong growth in the six months ended December. All but two business units put in a positive performance, with Momentum Investments struggling with new volumes and weak market performance and Non-Life Insurance dealing with a high claim ratio.

Interestingly, negative fair value movements in venture capital investments drove a 47% drop in the group’s investment return. I’m not sure that this company should be taking such risky bets to be honest.

Return on equity on an annualised basis was 18.4%, up from 15.9% in the prior period.

The interim dividend is 43% higher than the prior period, coming in at 50 cents per share which is roughly 34% of normalised headline earnings. The group expects a solid earnings performance in the second half of the year as well.

Mustek grows the top line but margins are down (JSE: MST)

The company simply had too many laptops in stock coming into this period

In an adaptation of the famous saying in golf: revenue for show, margins for dough.

Mustek managed to grow its revenue by 17.9% in the six months ended December. That happiness was blunted by gross profit margin contracting by 190 basis points to 14.1% because of discounting on entry-level laptops. The net result was a modest increase in gross profit from R677 million to R691 million.

With a jump in operating expenses of around 11.5%, profit from operations fell from R253 million to R242 million. That’s not too bad, until you see the jump in finance costs.

Companies with debt on the balance sheet in this environment are facing significant pressure on margins, as many businesses are struggling to grow operating profit at a time when funding costs have increased sharply. Mustek is no exception, with finance costs up from R31 million to R76.5 million.

With all said and done, HEPS fell by 6.5% to 221.74 cents. The share price is R16.35, so the annualised Price/Earnings multiple of 3.7x is a reminder of how low the multiple can be for small caps on the JSE. I must also caution that simply doubling interim earnings as a rough calculation is a very rough calculation. You need to do more work than that before deciding whether to buy or not.

Kudos to the management team here: Mustek is big on share buybacks and so they should be, particularly at this valuation.

Quilter puts in a relatively flat performance in 2022 (JSE: QLT)

The focus is on building distribution strength in the UK wealth industry

In this case, you need to work with adjusted profit before tax for anything to make sense. On that basis, Quilter is slightly down for the year ended December 2022, a solid performance based on broader asset values. If you use profit after tax as reported, you’ll see an 7.5x increase in earnings!

An important metric in this business is net inflows as a percentage of opening assets under management and administration. This is a way of measuring how effective the distribution network is, along with how well the products are resonating with clients. This ratio fell from 4% in 2021 to 2% in 2022, which is why the CEO believes there is work to be done in the business.

Impressively, the dividend grew by 13% in 2022 despite the broader market pressures.

In terms of the outlook, the company hopes to see an improvement in investor sentiment this year, which would lead to an improvement in net flows. There’s been an overall deterioration in market conditions, with the goal of a 25% operating margin pushed out to 2025 from the previously set goal of 2023.

That goal was established in 2021, before an interest rate hiking cycle with a severity that few expected.

Putprop maintains the dividend despite earnings falling (JSE: PPR)

The company owns 15 properties across various sectors

With a market cap of R163 million, Putprop is a rather obscure property company on the JSE. The net asset value per share is R16.14 and the share price is just R3.80, so the discount to NAV is huge in this case.

Load shedding and other pressures led to a 22.7% increase in property expenses, so this was never going to be a happy time for the company. In the six months ended December, HEPS fell sharply from 43.24 cents to 25.52 cents.

Despite this, the interim dividend was consistent at 4.25 cents. The company isn’t a REIT, so the dividend is a lot lower than HEPS.

Renergen gives detailed guidance on Phase 2 (JSE: REN)

At full production (by FY27), annual EBITDA of R5.7bn to R6.2bn is expected

This is a brave target to release into the wild, but at some point Renergen needed to give shareholders an idea of what profitability will look like. The long-term spot price assumption is $600 per MCF, although trying to form a view on that is also really hard. There’s also the currency to try and forecast and the local LNG price.

In other words, this is an educated guess at best. Still, it’s something.

To give an idea of how small Phase 1 is relative to the planned Phase 2, the current phase is designed to produce a maximum of 2,700 gigajoules of LNG and 350kg of liquid helium per day. The next phase is aiming for 34,400 gigajoules of LNG and 4,200kg of liquid helium per day.

A lot of capital will be needed to build this project – $1.16 billion of it! With Renergen’s market cap currently at less than a sixth of that number, existing shareholders are going to be heavily diluted. That’s ok, provided capital is raised at solid valuations.

Options on the table include a $750 million debt package, a 10% sale of the holding company of the local projects to the Central Energy Fund for R1 billion, a potential international IPO and other additional equity capital. There is much to be done before completion is anticipated in 2026.

In a separate announcement, the company is asking shareholders for authority to issue up to 67.5 million shares, including in the US. The price must be no more than a 10% discount to the 30-day VWAP or the price on the date of the general meeting. This is a raise of approximately R1.4 billion at current share prices.

Compared to the current market cap of R3 billion, this means that if you’re sitting with a loss of 40% in your Renergen position because you bought at the frothiest time, that loss is about to be locked in if such a large raise goes ahead at these prices.

If you want to understand more about Renergen, listen to my recent Ghost Stories podcast where I had a detailed discussion with CEO Stefano Marani about the company.

Will Royal Bafokeng’s results still justify a bidding war? (JSE: RBP)

Impala Platinum and Northam Platinum are fighting over a group with a 50.9% drop in HEPS

These are unhappy times for Royal Bafokeng Platinum. With Impala Platinum and Northam Platinum both trying to acquire the company and a stalemate playing out with regulators, Royal Bafokeng finds itself in strategic limbo. It is difficult to make capital allocation decisions and to attract or retain talent, as there is great uncertainty over what might happen depending on who the winning bidder is.

This is a dangerous situation, particularly at a time when energy is a major issue in South Africa and commodity prices aren’t playing ball. Luckily, the rand basket price per 4E ounce actually increased slightly by 1.5% for the year ended December, driven by weakness in the rand that more than offset commodity price weakness in dollars. Platinum contributed 24.8% of revenue and palladium and rhodium contributed a combined 60.1%.

With inflationary pressures in the cost base, that increase is already nowhere near enough to protect profitability. When you combine it with poor production numbers at Styldrift (down 16.1%), there’s serious trouble. A 6.8% increase in production at BRPM couldn’t save the day here.

When production numbers drop, there’s a flywheel effect on profitability (in the wrong direction) because the production cost per unit increases. With overall production of 4E ounces down by 3.9%, the net profit line never stood a chance in this environment.

EBITDA fell by 29.7% and HEPS was crushed by 50.9%. Although there is a final dividend of 535 cents per share, the risks here are clear.

Unless this impasse is resolved, there may not be much of a business left to acquire. A company cannot operate under this level of uncertainty for such an extended period without serious long-term consequences. And at some point, will the bidders eventually give up?

It’s not nice seeing a game of chess playing out with so many jobs on the line in the target company, but that’s how markets work sometimes.

Sea Harvest invests further in abalone (JSE: SHG)

Tough recent results notwithstanding, Sea Harvest is investing for growth

Sea Harvest Group already owns 54% of the shares in Viking Aquaculture, an abalone producer in the Western Cape and Northern Cape. There are also two oyster farming operations in this group.

With high-value seafood core to Sea Harvest’s growth strategy, buying more shares in this company makes sense. The stake is being increased from 54% to 82%, which will allow Sea Harvest to integrate the company into its operations and extract synergies.

To pay for the transaction, there are five equal annual instalments of R42 million, plus interest at Prime less 2% per annum. After the company made a loss of R32 million in the year ended December 2022, there’s clearly a lot of value in this business well beyond what recent results would suggest.

With a total deal value of around R210 million, this is a significant step for Sea Harvest. It’s small enough to be a Category 2 Transaction though, which means no shareholder vote will be required.

Little Bites:

- Director dealings:

- Adrian Gore has executed a massive hedge over a portion of his Discovery (JSE: DSY) shareholding, buying protection below R146 per share and giving away upside over R250 per share and again at R297 per share. The current share price is R145 per share, so he’s clearly worried about a drop here. He also sold R7.3 million worth of shares.

- In a surprise to surely nobody, the publication of the business rescue plan for Rebosis Property Fund (JSE: REB) has been delayed once again, this time to 17th March. Watch this space for the next delay (this is now the sixth extension).

- Cash shell Trencor (JSE: TRE) released a trading statement that HEPS would be between 1.5 cents and 1.8 cents per share. Nobody holding shares in this company cares much about the income statement.