Anglo American invests in Canada

The mining giant is acquiring a 9.9% stake in Canada Nickel Company

In addition to this minority stake in the company, Anglo American will have the exclusive right to buy up to 10% of the recoveries of nickel concentrate, iron and chromium in the magnetite concentrates, as well as any corresponding carbon credits from the Crawford project.

Concentrate indeed – that’s what you have to do when reading these mining announcements.

Put simply, this is part of Anglo’s strategy to expand its nickel offering in preparation for electric vehicle demand. I’m sure it also helps that Canada has electricity.

Farewell, Coronation dividend

An 11% drop in the share price accompanied the bad news from SARS

The only reason to invest in Coronation is for the dividend. When that’s gone, shareholders run for the hills. We have perfect evidence of this after the latest news regarding tax litigation in the group’s international operations.

This has been going on since 2021, when the Western Cape Tax Court ruled in favour of Coronation Investment Management. SARS went to the Supreme Court of Appeal in November 2022 and judgement was handed down yesterday, upholding SARS’ appeal and ordering Coronation to pay additional taxes together with interest and costs. Thankfully for shareholders, the claim for costs was dismissed.

This will have a “material impact on earnings and cash flows” although the company needs to quantify the claim first. For this reason, no interim dividend is expected.

Coronation is also considering an appeal to the Constitutional Court.

Lesaka jumps 13% after beating revenue guidance

The company is still loss-making, but to a far lesser extent than before

In the second quarter of the 2023 financial year, Lesaka (previously Net1) exceeded revenue guidance by 4%. The actual growth is a pointless measure, as the acquisition of Connect Group has vastly increased the size of the group.

The operating loss of $2.2 million is a 74% improvement from a loss of $9.4 million in the comparable period. The net loss has improved from $12.4 million to $6.6 million.

Perhaps the biggest milestone of all is positive net cash of $3.4 million vs. an outflow of $13.8 million in the comparative period. The return of the Consumer business to profitability was a major driver of this result.

Guidance for the full year has been reaffirmed, which the market seemed to like. Still, the group isn’t profitable yet and took on a lot of debt for the Connect Group acquisition, so there’s a lot of work still to be done.

Orion signs a definitive agreement with the IDC

The R250 million facility will help fund early works at Prieska

Orion’s funding package with the IDC has been in the works for a while, made possible by the initial $87 million funding package from Triple Flag. The IDC facility has been structured as a senior secured convertible loan facility worth R250 million.

The IDC loan can be converted into shares in the Prieska copper-zinc project based on a pre-money valuation of the project of R1.2 billion.

The company now has funding for demonstration trial mining and dewatering, critical to the early works bankable feasibility study which the company hopes to complete by mid-2023.

This is a mezzanine facility into a risky project, so seeing an interest rate of Prime + 3.5% isn’t surprising. This money doesn’t come for free even if Orion opted not to use it, with the IDC earning a raising fee of 1.25% and a commitment fee of 0.75%. It’s common to see these fees in funding packages.

Pick n Pay – for load shedding, that is

The share price was the most discounted item on the shelf today, down 8.5%

Pick n Pay released a trading update for the 43 weeks ended 25 December 2022. That’s a rather odd period to be reporting on, capturing effectively the 10 months preceding Christmas.

In grocery stores with an all-important cold chain, there’s absolutely no choice but to pay for energy backup solutions when Eskom does what it does best. The company notes “some impact on turnover” which makes sense based on my visit to a depressed, rather dark mall on Wednesday afternoon. The far bigger impact is on operating costs, with generators costing a fortune to run.

Pick n Pay is still tracking miles behind Shoprite, with sales growth in South Africa of 9% and an increase of only 4.8% in like-for-like sales. Rest of Africa was up 17% or 9% on a constant currency basis.

There’s a deceleration here in the South African business, with sales for the 17 weeks to 25 December posting like-for-like growth of just 2%. The shocker is Boxer, which managed just 0.2% like-for-like growth in that period vs. Pick n Pay at 2.8%. The company blames base effects, with like-for-like for Boxer returning to 9.7% in January.

Whichever way you cut it, volumes have dropped severely. Internal selling price inflation for the 17-week period was 10%, below CPI Food of 12.2%. This means volume declines of roughly 8%, which is extraordinary.

Not only is the sales performance poor, but the incremental increase in diesel costs year-on-year was R346 million to run generators. The current run rate is R60 million per month, which is a massive problem. Investment is being made in more efficient power solutions, which impacts the rate of growth in the store footprint. Basically, corporates now need to do what government is supposed to be doing, which will negatively impact economic growth.

Pick n Pay Clothing is a very good little business, with sales up 11% for the 10-month period and 6.2% for the 17-week period, running ahead of key competitors like Mr Price and Ackermans. The standalone clothing stores grew 11.4% in the 17-week period, with the clothing lines within supermarkets suffering from system upgrades.

Clothing isn’t enough, sadly. Previous guidance for earnings was that they would be flat for the full year. Based on these numbers and the management commentary, it’s almost certain that full year earnings will be down year-on-year.

Pick n Pay was managing to hang on to Shoprite in the good times. Now that things are tough, the gap between the two is being opened at a frightening rate.

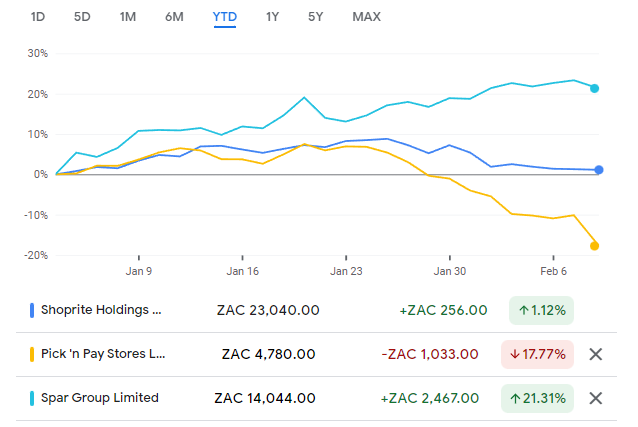

And in this chart, I demonstrate that “defensive” is the joke of the day when looking at grocery retailers:

Sappi: another way to get a klap on the market

With a drop of 10%, there really are some bruises after this day on the JSE

For the quarter ended December, sales ere down 2% but profit was up by 54%. Net debt reduced by 35%. Headline earnings per share increased by 55% and the company declared a dividend again.

So why on earth did the share price tank after Sappi released its best ever first quarter result?

If you skip right down to the bottom of the announcement, you’ll see a comment that they “anticipate a return to a normalised level of earnings in FY2023” – a stark reminder that share prices are forward looking.

The market assesses cadence (results vs. the immediately preceding quarter) rather than just year-on-year numbers, looking for signs of a slowdown in the conditions that have been so beneficial to Sappi. With customer inventory levels now much higher, there’s a destocking cycle that is hitting sales volumes.

That slowdown is clearly visible and Sappi is as cyclical as a company gets, so share price volatility is par for the course.

The good news is that the balance sheet is vastly stronger than it was a year ago, with net debt of $1.24 billion vs. $1.92 billion a year ago.

Steinhoff is shedding assets faster than Eskom sheds electricity

The latest sale is a portion of the stake in Pepkor

The Steinhoff garage sale continues. After recently reducing its stake in Pepco in Europe, the company is now selling a 6.5% stake in Pepkor. This would take its ownership from 51% to 44.5%. Needless to say, the proceeds will be used to reduce debt.

Investec and Morgan Stanley will be getting their cellphones (and Bloomberg terminals) out to find buyers. Keep an eye on the Pepkor share price on Thursday!

WBHO expects a significant jump in earnings

The share price closed 3.5% higher in response

With operating profit from continuing operations expected to be up by at least 10% thanks to a revenue increase of 12%, WBHO shareholders have something to smile about regarding the six months to December 2022. The Building and Civil Engineering segment worked all the magic, with operating profit up 50% vs. a decline of 8% in the Roads and Earthworks segment. The Construction Materials and Property Developments segment expects an increase of 8% in operating profit.

Looking abroad, the UK business was flat on the revenue line and down 35% at operating profit level. WBHO is in the middle of a complicated exit from Australia, with further costs of A$5.5 million recognised in this period.

In Africa, a notable update is that income from associates and joint ventures should be up 160% thanks to the completion of the refinancing of the Gigawatt Power Station in Mozambique.

The financial position has been strong over the six months, perhaps the most important measure in the construction industry.

It also helps that the continuing operations order book is at R26.5 billion vs. R22.2 billion at the end of June 2022 and R17 billion at the end of December 2021.

A tighter range for HEPS will be given once available, with the company flagging a 20% increase in earnings from continuing operations.

Little Bites:

- We only had Big Bites today!