Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Amplats: refined production is flat, but on track for full year guidance (JSE: AMS)

PGM basket prices are still way down on a year ago though

There seems to be more talk of a potential bull market for PGMs this year, although you would be forgiven for asking how on earth that is possible when Anglo American Platinum is down 27% this year. This takes the 12-month view to a 37% drop. The share price is languishing, with the desperation of investors in the sector perhaps driving the calls for a recovery.

If things are going to improve, it’s going to be because basket prices have moved higher and so have production volumes. Neither of those conditions are in place at Amplats, at least not on a year-on-year view for the latest quarter.

Production was the highlight, with refined PGM production at similar levels to the comparable period despite own-managed mines production being down. Sales volumes were also broadly flat. That’s where the good news ends unfortunately, as the ZAR realised basket price is down by a hideous 26% year-on-year. It’s up 8% sequentially (i.e. vs. the preceding three months), which is what has given support to calls for a bull market, but there’s a very long way to go.

There isn’t anything that the company can do about PGM prices. They can only manage their production, with guidance for 2024 unchanged at this stage. The potential for Eskom load curtailment is an ever-present risk in this sector as well.

The Anglo American mothership has a good copper story to tell (JSE: AGL)

While the listed South African subsidiaries battle away with poor infrastructure

As you’ll read elsewhere in this edition of Ghost Bites, Anglo American Platinum and Kumba Iron Ore are struggling. Infrastructure is failing them. This obviously affects Anglo American as the ultimate controlling company, but shareholders in the mothership at least have other things to smile about, like the copper exposure.

Before we get to that, I want to touch on De Beers. Diamond production has been lowered in response to market inventory levels, which is a fancy way of saying that had to cut supply because demand was poor. The company has generally blamed macroeconomic conditions. I still believe that lab-grown diamonds are playing at the very least a supporting role here. Rough diamonds production was down 23% for the quarter and full year guidance has been lowered. On the plus side, diamond prices increased by 23%.

Let’s move onto the highlight now, which is copper production up by 11% thanks to higher throughput at Quellaveco and the operations in Chile. Operating in South America must seem like a breeze at the moment compared to South Africa.

Steelmaking coal production was up 7% thanks primarily to the Aquila and Capcoal operations. Iron ore was flat, with a strong performance at Minas-Rio offset by the challenges at Kumba. PGM production was 7% lower. Nickel is 2% lower and manganese ore is 7% lower.

There isn’t much to feel happy about in this quarter beyond the copper story. That really is where the focus is, with copper now representing 30% of total production at Anglo American.

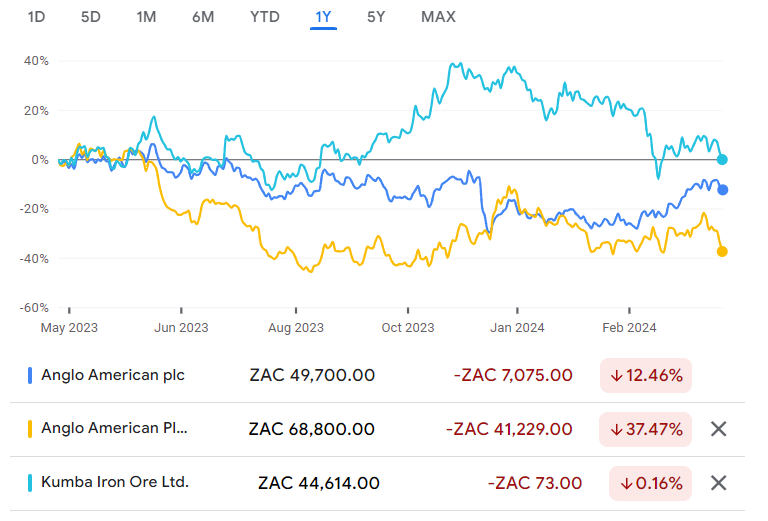

In this share price chart of Anglo American vs. Anglo American Platinum and Kumba Iron Ore, you can see that none of them have exactly given shareholders a great time over the past year:

Ascendis shareholders approve the delisting application (JSE: ASC)

The company has also commented on the TRP news

Ascendis held the rescheduled general meeting on Tuesday and achieved strong support for the resolutions related to the independent board fee, the management agreement and perhaps most importantly, the authority to apply for the delisting of the company from the JSE.

The company also took the opportunity to comment on the announcement published by the Takeover Regulation Panel (TRP), clarifying that the TRP isn’t launching a new investigation. Instead, the regulator is drawing a line in the sand for any new complaints to be submitted, while also setting the timelines for them to be addressed.

Mid-teens growth at Capitec (JSE: CPI)

The market liked it, despite plenty of growth already priced in

By now, you should know that initial market reactions are based on the narrative and direction of news rather than well informed views on the underlying numbers. Capitec is clearly already priced for growth, yet the share price closed 7.8% higher on the news of 16% growth in HEPS for the year ended 29 February 2024.

The total dividend for the year was also up 16% and the net asset value increased by 15%, so it’s a mid-teens performance all round.

There’s a great chart in the report that shows the five-year performance in the business. Given the craziness of 2020 in general and the inclusion of the business banking business for only part of that year, taking a four-year view is perhaps more sensible (i.e. 2021 to 2024, four years of data and three years of growth). Over that period, it’s worth noting that net interest income grew by a total of 42%. In contrast, non-interest income increased by 71%, so it’s not hard to see where the focus has been.

If we include credit impairments, then income from operations after credit impairments is up 80%. That’s a 21.6% compound annual growth rate (CAGR) on this line. With that knowledge, you can see that 16.6% growth in the past year is actually a slowdown from the post-pandemic growth.

Capitec is known for its efficiency and expense management. If we look at operating expenses, that line has grown by 47% over three years, or a CAGR of 13.8%. The cost-to-income ratio has improved from 41% to 39% over the period, with investors latching onto the operating leverage and buying up the shares accordingly.

But in the past year, operating expenses increased by 17.4%, so the operating leverage actually went the wrong way.

In summary: Capitec is still performing very well, but seems to be slowing down vs. the post-pandemic performance.

Return on equity took a knock in 2021 due to impairments on investments, so comparing to that year isn’t very helpful. Instead, I would rather point out that return on equity (ROE) has been 25% – 26% in each of the past three financial years. That’s impressive.

I don’t think anyone believes that Capitec is anything other than an excellent business. The problem has always been the valuation. With a net asset value per share of R376.11, the current share price of R2,174 is a price/book of 5.8x. If we compare this to the ROE of 26%, the effective ROE is around 4.5%. That is a very low return by South African standards, which is why value investors continue to feel frustrated by Capitec’s share price performance. The share price is trading 35% higher over 12 months, though I must point out that the five-year gain (with a nasty pandemic during that period) is only 60% in total, which isn’t an exciting annual growth rate.

Capitec has spent the past few years building a diversified financial services groups. They have focused on winning more fully banked clients, thereby increasing their share of wallet per client. They are encouraging value-added services. They’ve repositioned the business bank in such a way that it aligns to the retail bank strategy in terms of fees. They are building out the insurance business, having sold credit life insurance policies since May 2023.

There has been a lot of noise around this story in terms of the quality of the book and the credit loss ratios. As things have settled in a post-pandemic environment, I think Capitec has clearly shown the sustainability of the model.

Having said that, the share price remains incredibly expensive in my view, even for such a quality stock.

Kumba continues to be hamstrung by Transnet (JSE: KIO)

Production and sales numbers are lower

Kumba Iron Ore, which is part of the Anglo American stable, has released its production and sales report for the first quarter ended March.

Sadly, the business had to cut back in order to try and get closer to the capacity that Transnet is actually capable of dealing with. There really is no point in mining loads of iron ore that just gets stuck at the mines instead of railed to the ports and exported. Of course, this is terrible for GDP, job creation and tax revenue, but that’s the country we live in right now.

The Saldanha Bay Port is where the export issue is being felt, with Transnet apparently undertaking maintenance programmes. Whether this will help or not remains to be seen. In this quarter, ore railed to port by Transnet was flat year on year, with equipment failures and a derailment in March leading to lack of any improvement.

For the quarter, total production fell by 2% year-on-year (in line with the plan to reduce production) and total sales decreased 10% due to port performance problems, which really is disappointing.

Although Transnet issues are out of Kumba’s hands, guidance has been left unchanged for the full year.

Orion Minerals releases its quarterly activities report (JSE: ORN)

The word “spectacular” is back

I couldn’t help myself: when I saw this announcement came out, I hit ctrl-F for “spectacular” and wasn’t disappointed. At least they are consistent in describing the recent development in the copper exploration.

These quarterly reports are important for junior mining houses, as they need to give the markets detailed updates on progress being made. In Orion’s case, they now have a complete site-based operating team at Prieska Copper Zinc Mine and trial mining is delivering results that they are happy with, as they work to de-risk the process.

Another important step was the acquisition of surface rights that allowed drilling to commence to provide additional mineral resource information. This is intended to enhance the all-important Bankable Feasibility Study (BFS).

The Sasol hole: a bottomless pit? (JSE: SOL)

Shareholders had to stomach a drop of nearly 11% on Tuesday

Sasol was a rags to riches story from the depths of the pandemic until mid-2022, by which time the share price was basically a twenty bagger! If you bought right at the bottom in 2020 and sold right at the top in 2022, you made approximately 20x your money.

Sadly, the days of trading at over $400 have become a distant memory, with the share price down at $135. What went up has certainly come down:

Plagued by South African infrastructure and a few other things, the company has proven to be a poor proxy for the oil price. It hasn’t been a hedge against inflation, either. The only thing it has really hedged against is a feeling of happiness, helping shareholders remember that there’s always something in life to feel upset about.

The reason for the latest share price knock (almost 11% in a single day) is that Sasol’s performance isn’t good and neither is the outlook, based on the production update for the nine months to March 2024.

Production guidance at Secunda Operations has been reduced. In Chemicals, the average sales basket price year-to-date is down 20% vs. the prior period, leading to a 17% drop in revenue as volume growth couldn’t possibly offset this. Sure there are some highlights, including the recent regulatory victory around how emissions at Secunda are measured, but the overall direction of travel is clearly down.

If you were hoping to play a game of Eskom and Transnet bingo, then you won’t be disappointed. Sasol makes sure we know that the infrastructure in South Africa is a major part of the problem. This is despite an improved Transnet Freight Rail performance (albeit off a low base) that helped export coal sales increase by 9%.

Trustco increases its stake in Legal Shield Holdings (JSE: TTO)

This is a share-based deal with Riskowitz Value Fund as the sellers

Trustco already holds an 80% stake in Legal Shield Holdings, which is turn holds Trustco Insurance, Trustco Life and Trustco’s real estate portfolio. They seem to be particularly excited about the property portfolio, with a surprising comment that Namibia is experiencing an “acute shortage of serviced land” – Namibia may be sparsely populated, but I guess most of it is the desert. Gorgeous place, by the way. I hope to visit again one day.

Back to the deal, Trustco will issue 400 million shares at R1.17 each to Riskowitz Value Fund, which is a price vastly in excess of the current listed share price. Irritatingly, the announcement talks about the number of shares being acquired in Legal Shield, without indicating the percentage of the company that the shares represent.

Now, this is where it gets even more complicated. You see, the market cap of Trustco is only R247 million, so they are issuing shares worth much more than the current market cap. To avoid this being a takeover, Riskowitz Value Fund has given the chairperson of Trustco an irrevocable instruction regarding voting of the shares. And then for further confusion, there’s a put and call option structure between Trustco and Riskowitz Value Fund for 100 million shares at R1.17 per share.

You know what I like to invest in? Straightforward companies that do simple, logical, understandable things without unusual commercial terms. Trustco is usually the opposite of that, with the share price down 97% over five years.

Little Bites:

- Director dealings:

- An associate of a director of Workforce Holdings (JSE: WKF) has bought R19.6 million shares in an off-market deal. With average daily traded value of roughly R60k, there’s no way to buy a stake that size in on-market deals.

- A prescribed officer of ADvTECH (JSE: ADH) sold shares worth R2.8 million.

- The boardroom drama continues at MultiChoice (JSE: MCG), with a major change in direction around Imtiaz Patel sticking around as chairman. At the start of April, MultiChoice announced that Patel would be deferring his retirement as chairman in order to assist with the Canal+ deal. Fast forward a few Chasing the Sun episodes later and he’s on his way, with Elias Masilela taking over as chairman. Despite all of this, Patel will remain involved in assisting the group on a consultancy basis. Sometimes the only consistency in this world is inconsistency.

- Copper 360 (JSE: CPR) released an unusual announcement about suspected market manipulation. They talk about unusual and uncommercial trades in its shares, continuing for a period of several weeks. I guess we will find out if there’s any merit to these claims, or if the significant drop in the share price really is just the result of more sellers than buyers. It will be very embarrassing if nothing comes from these claims. In a separate update, the company noted that shareholders voted in favour of the share subscription facility with GEM Global Yield of up to R650 million.

- Kibo Energy (JSE: KBO) continues to sell shares in Mast Energy Developments (MED) to reduce the balance on the loan facility with RiverFort Global Opportunities PCC. This is literally the sale of assets to pay debt, which is just one of Kibo’s many challenges. The latest sale is worth just over £22k.

- Oando Plc (JSE: OAO) is playing catch-up on its financials, with results for the 12 months to December 2021 and December 2022 now released.

“Plagued by South African infrastructure and a few other things, the company has proven to be a poor proxy for the oil price. It hasn’t been a hedge against inflation, either. The only thing it has really hedged against is a feeling of happiness, helping shareholders remember that there’s always something in life to feel upset about.”

Eish – shots have been fired XD

Another good read, thanks Ghost and team.

Thanks! Let’s hope for some joy soon for battered Sasol holders…