Anglo American Platinum releases 2022 numbers

This wasn’t a happy year for the company

Before I delve into production numbers at Anglo American Platinum (Amplats), I have to point out the relationship between the PGM prices and the USD/ZAR cross. The dollar basket price per PGM ounce fell by 8% and the rand basket price increased by 2%. Our currency depreciation obviously lends a helping hand to the Amplats business.

Despite this, production issues and lower volumes meant a 24% decrease in revenue. Those fixed costs sadly don’t disappear just because production is lower, so adjusted EBITDA fell by 32% and EBITDA margin decreased from 65% to 57%.

Headline earnings per share fell by 38% and net cash fell by 43%. With that combination, it’s perhaps not surprising that the dividend fell by 62%.

The share price only fell by 2% as these results were well telegraphed to the market ahead of time.

CA Sales Holdings jumped 7.5%

This FMCG group released exciting numbers

In a trading statement covering the year ended December 2022, CA Sales Holdings indicated that HEPS would be up between 29% and 34%. That’s a juicy growth rate by any standards, with an expected HEPS range of 76.89 cents to 79.87 cents.

After the share price closed 7.5% higher at R7.05, this is still only a Price/Earnings multiple of around 9x at the midpoint of guidance.

City Lodge is profitable again

But HEPS looks a little light vs. the share price

In case you’ve been living under a rock, the tourists are back and the good times are flowing. City Lodge is thrilled to see the end of COVID, with numbers that are back in the green.

If we exclude the once-off settlement for business interruption insurance, then City Lodge achieved HEPS for the interim period of between 12.6 cents and 14.5 cents. That’s a vast improvement from the loss-making comparable period that was ruined by the pandemic.

Still, with a share price of R4.81, that doesn’t seem like a particularly great outcome. Even if we double this period, a simplification of note when you consider an ongoing month-on-month recovery (mitigated to some extent by recognising that the summer holidays must be the best time for this business), then it’s on an annualised Price/Earnings multiple of 17.8x.

Hmmm….that’s rather a lot, isn’t it?

The share price closed 2.8% lower after this announcement.

A positive Mpact

A 6.5% rally rewarded shareholders on Monday

For the year ended December, revenue from continuing operations was up 7%. The underlying operations did even better than this, as the base period included the major distribution agreement that Mpact terminated. Without that impact, revenue would’ve been up by 15% and volumes by 6%, so the benefit of higher pricing is clearly visible.

The volume growth was all in the Paper business, as the Plastics business saw flat volumes year-on-year across most of that division.

The joys of operating leverage are being felt here, with earnings before interest and tax (EBIT) up by 23% year-on-year. The “I” in “EBIT” is a bit painful though, with net finance costs of R180 million in 2022 vs. R140 million the year prior, driven by increased average net debt and higher interest rates.

Due to capital expenditure and increased working capital, net debt increased from R1.756 billion to R2.327 billion.

Looking ahead, Mpact will be investing R1.2 billion in its Mkhondo Paper Mill in response to growth in demand from the South African export fruit sector. Mpact hasn’t been shy to invest in its operations in general, including in major solar projects.

In case you’re wondering about discontinued operations, the Versapak business is held for sale. The company reported 20% growth in revenue and a strong improvement in profitability from net earnings of R2 million to R65 million. This is encouraging for potential offers that Mpact might receive.

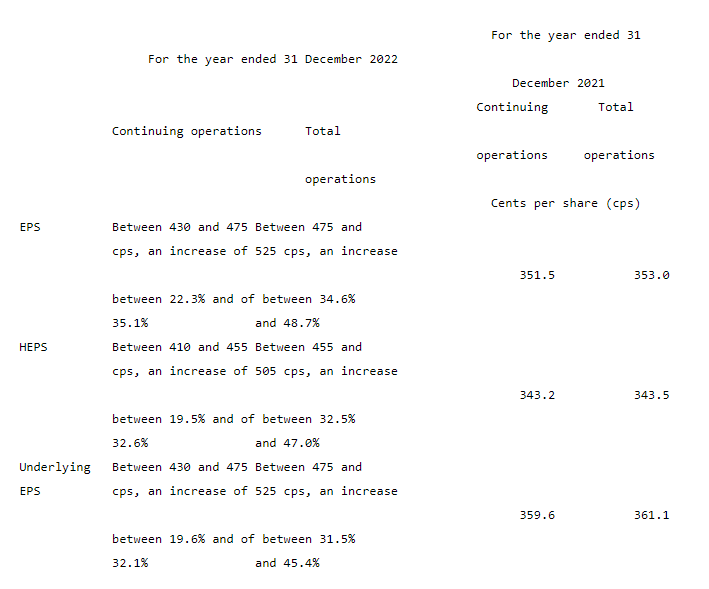

I would really love to tell you what the HEPS increase will be. Sadly, the formatting of the SENS announcement was a complete disaster, so I’ll just include it here for you to decide for yourself:

Either way, earnings are up strongly and the market liked that, even if nobody was quite sure how to read this.

Murray & Roberts says bye-bye to Bombela

Strong shareholder support was achieved

This is a short update for Murray & Roberts, but one that is too important to be buried in the Little Bites. The company desperately needs to make progress on fixing its balance sheet, with the disposal of Bombela Concession Company firmly part of that strategy.

At the general meeting of shareholders to vote on the deal, it received overwhelming support, with 99.988% of votes cast in favour of the transaction.

Clearly, this deal is moving forward.

No dividend at Texton

There’s an abundance of caution here

If you invest in a property fund, it’s usually because you want to earn a dividend. Sorry for you if Texton was your fund of choice, because the old dividend of 10 cents per share is but a distant memory. For the six months to December, there is no interim dividend at all.

This is despite an increase in distributable earnings of 5.2%.

The board wants to “conserve cash” and “manage its balance sheet liquidity through the current interest rate environment” – so time will tell how this plays out.

WBHO updates its earnings guidance

There is a strong year-on-year improvement in profitability

Construction group WBHO has finished its work on the accounting impact of the Australian tax position on the 2021 numbers.

Based on this calculation, HEPS from continuing operations is expected to be between 800 cents and 828 cents for 2022 vs. 591 cents in the comparable period, an increase of between 35% and 40%.

Little Bites:

- Director dealings:

- A director of a subsidiary of Tharisa has sold shares worth R221.5k

- A prescribed officer of Barloworld has bought shares worth R142k.

- An associate of a director of Huge Group has bought shares worth R58.2k.

- If you are an Alviva shareholder, keep an eye on your trading account on 6th March. That’s when the cash from the implementation of the Alviva delisting should be yours for the taking.

- Spear REIT repurchased 2.83% of shares in issue between July 2022 and February 2023, at an average price of R7.62 per share. The current share price is R7.13, so ongoing buybacks will hopefully continue to bring the average repurchase price down.

- The City of Johannesburg Valuation Appeal Board has upheld the municipal valuation proposed by the city for Sandton City, so the rates bill for Liberty Two Degrees is higher than they would like. With a provision needing to be recognised for arrear rates and interest, the impact on the year ended December 2022 is 2 cents per share. On a closing share price of R4.45, that’s not a huge impact on the yield.

- Jasco Electronics Holdings increased 9% despite reporting a headline loss from continuing operations of between -6.3 cents and -6.5 cents. For those looking for silver linings, at least the order book is a lot healthier.

Hi Ghost, is Mpact in direct competition with Nampak?

Hi Naresh. They are both packaging businesses and I have no doubt they come across each other in the market, but they are ultimately very different in terms of geographic and strategic focus. So yes, they are competitors, but not like Shoprite and Pick n Pay are competitors.