Anglo looks to the future

Production is lower in 2022, with Quellaveco still in ramp-up phase

Anglo American is an interesting, complicated group that has exposure to a variety of commodities including PGMs, iron ore, nickel and copper. Don’t forget that De Beers (the diamond giant) is in there as well. The management team talks about the group being a “resilient business through the cycle” – a clear nod to diversification.

In the latest update, Anglo American has advised that production should be down around 3% this year, with unit costs up by 16%. That’s an unhappy story as input cost pressures combine with production decreases to create a nasty outcome.

The situation should improve in 2023, with production expected to increase by 5% and unit costs expected to increase by only 3%. Capital expenditure is anticipated to be around $0.8 billion higher than in 2022 as the Woodsmith project picks up.

In 2024, production is expected to increase by 5% and capex would return to current levels. The expectation for 2025 is flat production (i.e. similar to 2024) and ditto for capex.

Woodsmith is the group’s next major greenfield project after Quellaveco, bringing a diversified source of income in the production of Poly4, the low carbon fertiliser. Speaking of copper project Quellaveco, that operation increases Anglo’s global production base by 10% and is expected to be highly margin accretive over the next decade.

Other than the immediate pressures, the group sounds bullish about its prospects.

Anglo American Platinum faces operational pressures

2022 production is expected to be within guidance, but beyond that looks tricky

At Anglo American Platinum, the good news for 2022 is that refined PGM production is 3.8 million ounces, smack in the middle of the guided range of 3.7 million to 3.9 million. The bad news is that because of inflationary pressures, the unit cost of R15,300 per ounce is higher than the guidance of R14,000 to R15,000.

There is a build up in work-in-progress inventory because of loadshedding and the delay in the Polokwane smelter rebuild. This inventory will be refined in 2023, which will give some benefit to the next financial year and 2024 as well.

Looking at the medium-term guidance (2023 – 2025), the business is clearly under pressure. Drilling initiatives have reflected a reduction in higher-grade ore volumes at Mogalakwena. There are also lower volumes expected from Amandelbult, with infrastructure closures, challenging geological ground conditions and the pending end to the life-of-mine of the current opencast operations. The company also expects to receive lower purchase-of-concentrate volumes than previously anticipated.

The production forecast for 2023 and 2024 is 3.6 million to 4.0 million ounces. It was previously between 3.8 and 4.2 million ounces for 2023 and between 4.1 and 4.5 million ounces for 2024, so this is a significant drop. It gets worse in 2025 (a new forecast), with production estimated at 3.3 million to 3.7 million ounces.

With ongoing inflationary pressures on top of production challenges, the unit cost guidance for 2023 is between R16,000 and R17,800 per PGM ounce.

This isn’t great news for shareholders at all, with a 7.3% drop in the share price on Friday as a result.

ARC gives an update on its investments

With investments like rain and TymeBank, this is always worth a read

The updates on each underlying company don’t go into much detail, but there’s enough to get a good sense of how the portfolio is doing.

African Rainbow Capital Investments (ARC) is split into a diversified investments portfolio and a financial services portfolio, so I’ll stick to that approach for this update.

Before going into the portfolio updates, take note that the lower management and performance fees for the fund were approved by shareholders in November. Although I still don’t like the structure, it’s better than it used to be.

Diversified investments

The only comment on rain is that the business is performing well and the additional spectrum is expected to positively impact the valuation.

At phosphate business Kropz, the Elandsfontein phosphate plant has suffered several setbacks to its commissioning. This caused operational cash shortfalls and ARC increased the convertible loan facility by R550 million as a result, of which R247.5 million has been drawn.

The last of the Afrimat stake was sold in November, generating an internal rate of return (IRR) of 21.72% on that investment. Another disposal of a public company was the 3.2% stake in Capital Appreciation, with an IRR of 12%.

Most of the assets in the ARC Services group of company are being disposed of in line with the carrying value of R291 million.

Bluespec is performing in line with expectations and meeting profit targets. Weelee, the online vehicle bidding platform, is also growing in line with the business plan.

The disposal of Humanstate and Payprop SA for R496 million has been concluded. The IRR on disposal was 20%, excluding any earn-out structures. There is the potential to receive another R52 million over 30 months.

Fledge Capital is in an acquisition phase, having sold its remaining investment in WeBuyCars earlier in the year.

Linebooker is enjoying strong month-on-month volume growth in the online booking platform and the management team is exploring options beyond South Africa.

Financial services

Alexforbes is a publicly listed company and ARC doesn’t go into any details beyond what the company already discloses in its own reporting.

TymeBank always gets a lot of focus and deservedly so, as this is a significant and interesting investment. October saw 228,000 new customers onboarded, a record month for the bank and vastly higher than 130,000 to 140,000 customers per month in the first half of 2022. With the acquisition of Retail Capital, TymeBank is looking to enhance its offering to its business banking clients. Retail Capital is a large SME funder that has disbursed over R5.5 billion to more than 43,000 business owners in the past decade. Notably, Tyme Global has launched GOtyme in the Phillipines.

Crossfin has increased the number of merchants utilising its services and has achieved revenue and EBITDA growth on a year-on-year basis.

In Sanlam, the deal with Absa Investments to create one of South Africa’s largest black-owned asset managers has been concluded. Also related to Sanlam, ARC highlights that Sanlam is looking to take a controlling stake in Afrocentric.

Rubies are red, Gemfields is green

After some major scares this year, Gemfields is at a 52-week high

There’s been no news for a while on the insurgency in Mozambique that got dangerously close to Gemfields’ Montepuez ruby mine. The army was sent in to stabilise the situation and it seems to have worked. Although the risks aren’t gone by any means, the market seems to have relaxed after seeing support from government to protect the mine.

In the latest ruby auction, the company achieved auction revenues of $66.8 million after selling 94% of the lots offered for sale. Over the full year, the 2021 auction revenue record for Montepuez rubies ($147.4 million) was smashed with a performance of $166.7 million.

Looking at the broader group (i.e. including the Kagem emerald mine in Zambia), Gemfields’ auction revenues of $316 million have set a new annual record, up 32% from 2021.

It’s been a year of immense volatility and huge opportunities for traders:

Italtile hints at its performance

Revenue is higher, but retail volumes are surely down

Italtile has updated the market on its sales for the five months to November.

It’s important to understand that the group has manufacturing operations (Ceramic Industries and Ezee Tile Adhesive Manufacturers) as well as retail operations (CTM, Italtile Retail, TopT and U-Light). The integrated supply chain import businesses are Cedar Point, International Tap Distributors and Distribution Centre.

The businesses continue to face serious macroeconomic headwinds. Under considerable pressure from interest rates and inflation, consumers are deferring or scaling down on renovations and new build projects. To make it worse, loadshedding is causing a lot of pain for Italtile in the manufacturing division.

Although the update doesn’t give the percentage increases in selling price inflation, we can safely assume that a 2.3% increase in sales in the Retail division means that volumes are down. This is the case where inflation is higher than the percentage increase in sales. I have the same concern about the integrated supply chain businesses, which are up just 3%.

The Manufacturing division is up 7.8%, a performance that is “primarily due to price increases” (which implies some volume growth at least).

The company expects difficult conditions to persist for the rest of the year and no specific earnings guidance has been given due to the uncertain operating conditions.

Kumba updates production guidance

With issues at Transnet, you can guess in which direction the guidance went

After a tricky first half of the year for Kumba, matters were made more difficult by a two-week strike at Transnet in October. This has a negative effect on throughput, which in turn leads to a build-up of iron ore stockpiles at the mines.

Something has to give somewhere, in this case in the form of lower production due to the lack of storage space. Thankfully, the group has managed to maintain its unit cost guidance for the year despite lower production.

For 2023, production is expected to be 35 – 37Mt, down from 39 – 41Mt. The unit cost is $44 per tonne, achieved through lower anticipated diesel prices and currency depreciation. Of course, if the macroeconomic picture works out differently, then things could get ugly.

There is some light at the end of this railway tunnel. Kumba highlights various steps being taken by Transnet to improve matters, including a major maintenance programme, an extra set of trains, the removal of speed restrictions and the implementation of weather-related mitigations. This supports a production outlook of 37 – 39Mt in 2024 and 39 – 41Mt in 2025.

Still, that’s well down from the 41 – 43Mt previously guided for 2024. Our infrastructure challenges are throttling our economy.

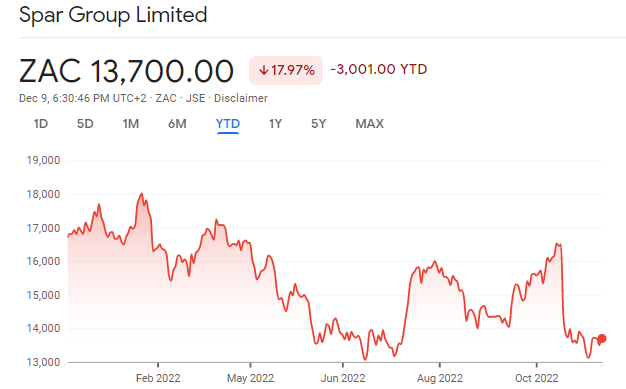

Spar responds to media allegations

The share price is quickly becoming the least of the problems

In an explosive recent piece by Ann Crotty of the Financial Mail, a number of allegations were put forward about governance at Spar. It also highlighted the legal proceedings by the Giannacopoulous Group, which owns 45 Spar stores.

In this edition of My Big Fat Greek Dispute, the article sets out a long-standing dispute between Spar and the Giannacopoulous Group with respect to its guild membership, a prerequisite for owning a Spar store (you need to remember that they are franchises).

A very embarrassing court judgement is quoted, in which high court judge Judy Kollapen talked about a “spectacular failure on the part of the Spar Group” – not what shareholders (or others for that matter) want to read.

The family is now claiming R2.1 billion in damages. That’s a lot. There is also a criminal proceeding underway, with the backing of AfriForum. This is getting very ugly, very quickly.

The governance concerns go deeper than just a legal dispute that hasn’t been given much attention in the company disclosure. There are allegations of fictitious loans and major question marks around Graham O’Connor’s independence as chairman. He was the previous CEO and his family appears to have various commercial interests with Spar.

I won’t reveal more of Ann Crotty’s excellent work in Financial Mail. Being a subscriber to the publication is a worthwhile investment and you can read it there (along with my weekly column in the magazine if you so desire).

On Friday, the retailer responded to the media allegations, the summary being as follows:

- The “fictitious and fraudulent loan allegations” relate to what Spar describes as an “isolated matter” – that’s not a great sign

- The company refutes allegations of discrimination against retailers based on race or store location, noting that “perfection” (a process of taking legal ownership under a bond i.e. Spar Group taking ownership of a franchise store) is only a method of last resort to protect Spar as a creditor

- O’Connor was appointed as chairman after serving as CEO because the board felt this was in the best interest of the company, with a lead independent director appointed to balance this as is suggested under the King Code

Amidst the allegations, O’Connor has stepped down as chairperson of the board and will remain a director. Andrew Waller, the current lead independent director, will serve as interim chairperson.

The share price tells the story here:

Little Bites:

- Director dealings:

- Having banked a juicy allocation of shares after the Avito disposal, Prosus and Naspers CEO Bob van Dijk exercised his options and disposed of all the shares. CFO Basil Sgourdos sold the shares required to cover the taxes and kept the rest.

- A director of Afrimat has sold shares worth around R4.5m

- A director of Sea Harvest has acquired shares worth R466k

- The chairman of Hulamin has bought shares worth R203k

- A director of HCI has sold shares worth R1.4m

- African Equity Empowerment Investments has provided Premier Fishing and Brands with notice of a firm intention to make an offer to acquire 6.14% of shares in the company. Premier would subsequently delist from the exchange if this scheme of arrangement is approved by shareholders. The offer price is R1.60 per share. In case you’re wondering about that shareholding, AEEI already holds 56.23% in Premier, 34.06% is held by 3Laws Capital and 3.57% is held by Sekunjalo. The 6.14% is therefore held by the general public. With such a tiny free float, there’s really no point in being listed.

- Equites has announced the development of a logistics campus for Shoprite, with this particular property being built in the joint venture that the company has with Shoprite (50.1% – 49.9% in favour of Equites). The structure is that the joint venture will acquire an existing warehouse from Shoprite for R90 million and extension land for R75.6 million. This is minor in the context of the development cost, which is over R1 billion! With a 20-year lease and three rights to renew for 10 years each, this substantially increases the weighted average lease expiry period of the portfolio. The initial yield is 7.8% and rentals will escalate at 5%. Equites recently joined us on Unlock the Stock to talk about the strategy and performance, with the recording available for you to watch here:

- SA Corporate Real Estate released a pre-close investor presentation. The portfolio has delivered like-for-like net property income growth of 7.3% with the office portfolio as the (predictable) ugly duckling. The vacancy rate in that part of the portfolio is over 20%, expected to reduce to below 17% by the end of December. The negative reversion in the office portfolio is huge at -27.6%! The Industrial portfolio has a vacancy rate of 0.82% and negative reversions of -5%. The retail portfolio has a 3.9% vacancy rate and although there is a slight negative reversion for the year thus far, this is expected to turn positive by December.

- After an oversubscribed bookbuild for sustainability-linked notes, Pan African Resources will issue notes to the value of R800 million. Pan African is the first mining company to issue a sustainability-linked bond in the South African market.

- Salungano Group released interim results for the six months to September. With the hilariously named Vanggatfontein on care and maintenance and lower demand from Eskom, the company hasn’t put in a good performance. Revenue fell by 13% and the group swung from an operating profit of R190 million to an operating loss of R16 million. The headline loss per share of 19.64 cents is ugly vs. HEPS of 20.69 cents in the comparable period.

- Delta Property Fund just can’t catch a break, with an embarrassing announcement that the interim results for the period ended August included an error. These aren’t small errors either, with some line items in the cash flow statement being wrong by over 30%. This shouldn’t be happening in a listed company.

- Trustco has renewed the cautionary announcements related to the management agreement and the resources transaction, both of which are making progress.

- The JSE has appointed Ms Fawzia Suliman as its group CFO. Many people forget that the JSE is a company that is listed on the JSE! This always confuses newcomers to the market. One is a corporate entity and the other is an exchange, so the company effectively uses its own product in order to be listed.

- Ascendis announced that Ms Bharti Harie has been appointed as chairman of the board.

- There are wholesale changes to the Grindrod Shipping board as part of the transaction with Taylor Maritime Investments. There are five new appointments to replace the two directors who have stepped down as part of the agreement with Taylor.

- Luxe Holdings doesn’t exactly have the best reputation in the market, so the news of the independent non-executive director resigning isn’t promising. He is also the Chairperson of the Audit and Risk Committee, so there’s another red flag for you.

- PBNJ Trading and Consulting has acquired 38.4% of the shares in Sable Exploration and Mining Limited, which means that there is now a mandatory offer process underway. A mandatory offer to all remaining shareholders is triggered whenever a company acquires a stake of more than 35% in a regulated company. At a price of R1 per share (the current market price), this gives shareholders a liquidity mechanism in this incredibly obscure company.