If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Anglo Platinum stretches the definition of ESG

Is an employee share ownership plan now ESG as well?

When you give people a fashionable label, they will try and stick it on everything. The very best example of this is ESG, which has become the most flexible term in the world.

The latest example is Anglo Platinum’s headline, which proudly screams: “Anglo American Platinum continues to lead in ESG with the introduction of a new employee share ownership plan (ESOP)” – yes, these days, just incentivising your staff to keep working is leadership in ESG.

This is where my irritation with the entire “ESG industry” comes in. Paying your people fairly is good social practice, yes. It’s also just a sensible business practice, otherwise you’ll end up with labour unrest and all kinds of other issues. In most cases, ESG is a label that has been placed on things that are common sense, especially when it comes to staff.

For me, ESG is an appropriate label for initiatives like reducing carbon emissions. This isn’t necessarily a capitalist pursuit, though saving money on Eskom by using renewables makes business sense too. ESG is where companies look beyond their profits for the greater good.

I’m sorry Amplats, but achieving 2% evergreen staff ownership of Rustenburg Platinum Mines is many things, but it’s not ESG. In case you’re curious, the day 1 value of this new staff scheme is R6.5 billion. This is the organisation’s third ESOP and I suspect that if you fish out the announcements for the first two, the term “ESG” won’t be highlighted.

Barloworld is seeing solid results in its operations

After trying to wriggle out of the Ingrain acquisition during the pandemic, it’s proven to be a winner

Barloworld released a voluntary update for the 11 months ended 31 August 2022. Right up front, the company reminds investors that growth in the order book means pressure on working capital and the balance sheet in general. This is why actively managing the group’s funding is so important.

Barloworld paid R1.97 billion to settle UK defined benefit obligations (retirement obligations) and paid a special dividend of R2.3 billion back in January. Even after these big moves, the balance sheet is well within debt covenants.

In the Equipment Southern Africa business, revenue was 19.6% higher and operating margin was maintained at 10.2%. The joint venture in the DRC is delivering positive income. Thanks to strong mining demand, the order book is up from R4.5 billion to R5.3 billion.

Bottlenecks at Chinese ports negatively impacted the business in Mongolia, with revenue down by 2.6% in USD terms at Equipment Eurasia. Operating profit for the segment was 5.3% lower despite a 6.3% increase from Russia.

As sanctions have hit, the Russian order book has shrunk to $30 million from $94 million. Barloworld faces huge challenges in trying to manage its exposure there, including an effort to look after its employees.

Ingrain appears to be a great acquisition, with revenue up 36.4% and operating profit 40% higher. This is despite a 120 basis point contraction in gross margin as a result of sales mix.

The car rental business is classified as a discontinued operation. It’s doing a lot better though as people are moving around again, with revenue up 7.3% and operating profit up 110%. Fleet utilisation was 80%! Barloworld hopes to unbundle and separately list Avis, though this is hardly a friendly market for new listings.

The leasing side of the business is also a discontinued operation. It fought its way back to be 1% higher in revenue. Operating profit was 10% higher though, despite the almost flat revenue performance.

In the logistics segment, the only remaining business is in warehousing and distribution. This is in the process of being sold, which would sign off on a full exit from the logistics industry.

There are director dealings, and then there’s Motus

Motus execs formed a stampede for the exit door in the past couple of weeks

This story stinks. Truly, it does.

Motus was trading under cautionary since 28th June, citing a potential deal to acquire an offshore aftermarket parts business. On 14th September, they withdrew the cautionary as they were ready to announce details of the transaction.

But here’s the thing: they hardly announced any details. They didn’t even tell us who they are buying. In fact, all they did was give a deal value range and not much else.

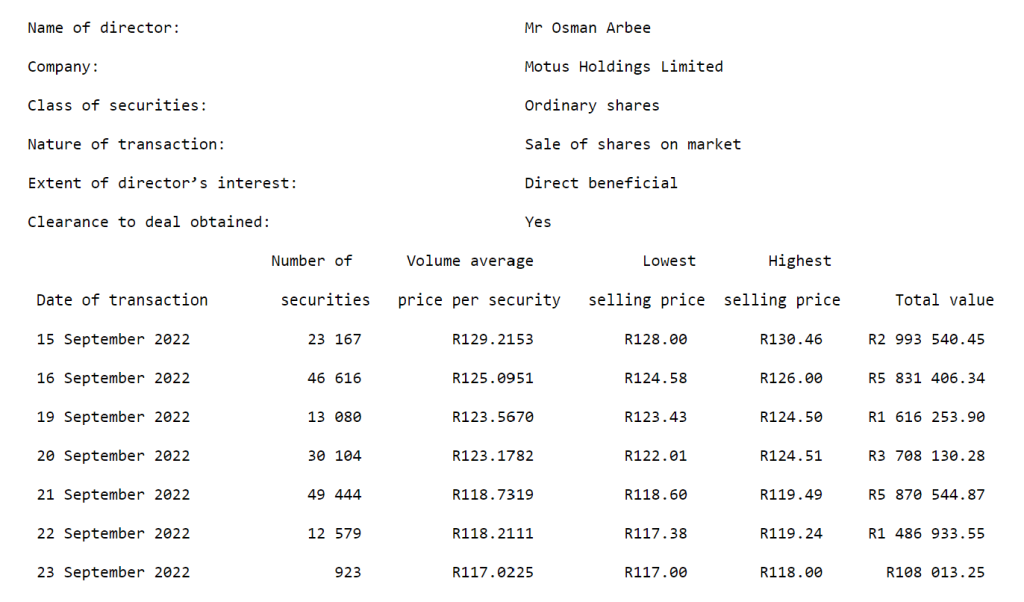

It all looks terribly suspicious in terms of timing. From 15th September, four directors hit the sell button in a big way. Here is just one example:

So, what do we notice here?

Firstly, why are director dealings from the 15th only announced on the 28th? I’ll tell you why. If such large sales were announced the day after they happened, the price would’ve started to fall. It’s far more favourable to the directors to announce the full tranche in one go.

Motus withdrew the cautionary without making a full acquisition announcement (which isn’t good) and the directors then got through enormous sales on the market before bothering to tell anyone about them.

We are talking about over R60 million sales by four directors.

Of course, you may choose to trust Motus after this. I’ve never owned shares in the company and after this little display of governance, I certainly never will.

Truworths: the corporate edition of Hunger Games

Announcing two deputy CEOs is never a good sign

Investors love seeing decisive, strong decisions around succession planning. The appointment of joint executive leaders is usually viewed with trepidation, as it sends a signal that the board can’t make a decision.

This is the problem when the group has had one CEO for a whopping 26 years. Michael Mark indicated that he would step down at the 2022 AGM. The board has now asked him to stick around, in a wonderful example of a corporate that just can’t let go.

In an attempt at succession planning, two deputy CEOs have now been appointed. Sarah Proudfoot comes with plenty of experience in store operations and procurement, so these are great skills in retail. Her competitor (even though the announcement would never bluntly say that) is Mannie Cristaudo, the current CFO of the group. This is clearly a financial skillset.

So not only is Truworths incapable of letting Michael Mark retire in peace, but the board also can’t decide whether the next CEO should be stronger at operations or finance.

The Truworths share price is trading at the same levels as in 2010. With zero value created since the 2010 World Cup other than dividends to shareholders, it’s perhaps not a surprise that the management transition looks like this.

Little Bites

- Director dealings:

- An associate of a non-executive director of PBT Group has sold R10.1 million worth of shares to Pulsent OH, the major B-BBEE investor in the group. The entity is linked to Pule Taukobong, a highly experienced venture capital investor.

- An associate of a director of Kaap Agri has bought shares in the company worth over R102k.

- The CEO of Sirius Real Estate has bought shares worth £11.3k. The share price came into 2022 on a ridiculous valuation and is down 58% this year.

- An associate of a non-executive director of Capital & Counties bought shares worth £100k

- In case you’re wondering what happened to the Distell deal, the company announced that the Competition Tribunal will consider the transaction at a hearing from 18 to 20 January 2023. Importantly, the Competition Commission has recommended that the Tribunal approve the deal with conditions.

- Ascendis Health released results for the year ended June. In continuing operations, revenue increased by 15% and the normalised operating loss was R317 million. The real story is the balance sheet, with senior debt of R498 million vs. a spectacular R7.8 billion at 30 June 2021. The vote for the disposal of Ascendis Pharma is due in October.

- Alviva released its results for the year ended June 2022 and they are great, with revenue up 57% and EBITDA up 62%. HEPS is up by a whopping 91%. The dividend per share is 90% higher at 55 cents. As a reminder, a non-binding expression of interest has been received by Alviva regarding a potential offer. At this stage, no firm offer has been made.

- With its share price having lost half its value this year, Ellies needs to do something to make its business more viable over the long term. In a cautionary announcement, the company notes that it is in negotiations for potential acquisitions in the solar, uninterrupted power supply and renewable energy sectors. Load shedding is literally creating a new sector in the economy. Non-binding term sheets have been signed and a due diligence is underway, so a more detailed announcement can’t be too far away. Of course, there’s every chance that it falls through and no deal gets announced.

- Tongaat Hulett has updated shareholders that its capital restructuring plan will be ready by 14 October, so investors need to be patient for a couple more weeks. Given the state of play at the company, it’s also notable that Louisa Stephens has been appointed as acting chair of the Audit and Compliance Committee following the resignation of Linda de Beer.

- EPE Capital Partners (Ethos Capital) released results for the year ended June 2022. If you use Brait’s share price to calculate the net asset value (NAV) per share, that metric increased by 27% in the past year. If you use Brait’s NAV instead, EPE’s NAV per share grew by 16%.

- Southern Palladium released its numbers for the year ended June 2022. This is a junior mining group, so an operating loss of A$2.5 million isn’t uncommon.

- There’s finally some continuity at Oceana Group, with Zafar Mahomed appointed as CFO designate. He will take the top finance job with effect from 1 February 2023 after a handover process from the existing interim CFO, Ralph Buddle. He comes to Oceana having previously served as CFO of Cell C and McDonald’s South Africa, two businesses that have walked very different financial roads.

- In an interesting move with its balance sheet, BHP is going to redeem and cancel £600 million worth of debt instruments that had been issued in 2015 and priced at 6.5%. They were due in 2077 – so I think we can all agree that this was a long-term debt instrument.

Motus Group – shocking turn of events. Wouldn’t want to be the Company Secretary caught up in that mess.

Regarding Motus:

Is it not worth noting who the Directors are. More than not trusting Motus, isn’t it worth the consideration not to trust any company on which those directors become board members?

In this case, I gave them the benefit of the doubt pending some kind of clarification from the company / announcement from the JSE. That clarification came today!

Brilliant! Great piece today. Love what you are doing.