AngloGold tanks 7% on a rough day for mining (JSE: ANG)

I’m so glad that I cut my gold exposure a few weeks ago

I’ve given up on gold. After the rally at the start of the year, I decided to recycle my capital into more lucrative investments, like collecting leafblowers or vintage vacuum cleaners. I’m now convinced that almost anything is a better choice than gold miners.

With another horrible day on the market for these miners and a 7% drop at AngloGold after releasing results, nothing here is proving me wrong.

Despite gold production increasing by 11% in 2022 and all-in sustaining costs per ounce only increasing by 2%, adjusted EBITDA was lower. Why? Because the gold price just refuses to do well in a rising rates environment. It has failed as an inflation hedge and gold has limited utility outside of inflation hedging and jewellery.

The positive element to this story lies in free cash flow, which looks much better year-on-year.

I have no regrets in exiting this industry.

Bidcorp: food service is lucrative (JSE: BID)

The share price has gained another 2% after results were released

The food service industry is a beautiful thing. Restaurants, hotels and even hospitals aren’t going to send someone to the shops to go and buy supplies and ingredients. Instead, they let companies like Bidcorp do the hard work.

This puts Bidcorp at the perfect point in the value chain – literally the shovel in the restaurant gold rush. Restaurants come and go, but Bidcorp doesn’t. The same is true for Sysco ($SYY), the North American equivalent to Bidcorp. We’ve researched this company in Magic Markets Premium, a research platform that you can access at a really affordable rate.

Bidcorp is more than just a restaurant supplier. Only 42% of revenue is from hotels and restaurants, with a further 12% from fast food joints. Other major segments include butcheries, caterers, other wholesalers and healthcare providers.

Another important thing to know about Bidcorp is that the company offers genuinely global exposure to investors, with a small percentage of group revenue (5%) generated in South Africa. As rand hedges go, this is a goodie.

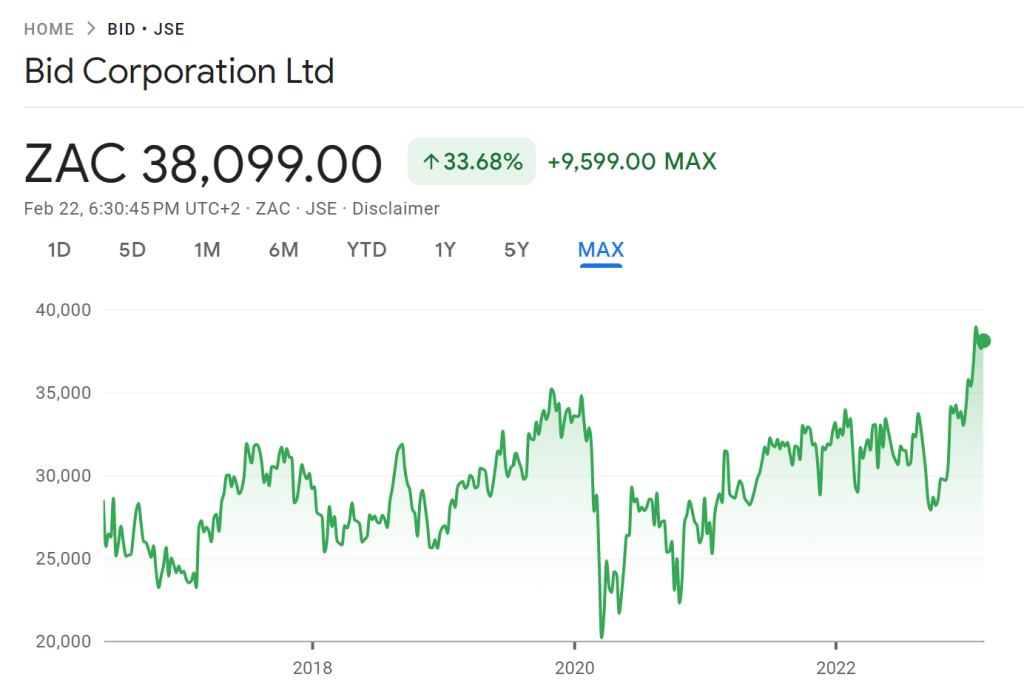

The market knows how good the business is, which is why it trades at such a high multiple that any slowdown in earnings growth gets punished with significant volatility:

Of course, the pandemic drove a massive drop in the share price. Hindsight is perfect, as this would’ve been a good choice to jump into. Recent momentum is sharply upwards and I always get nervous buying a chart like that. Huge climbs tend to correct themselves and consolidate.

Looking at the six months ended December, earnings look fantastic with revenue up 28.1% and HEPS up 45.5%. Cash generated from operations increased by 35.6%. This is why the market has gotten excited.

The “laggard” in this result was the Emerging Markets segment, which includes China that was heavily impacted by lockdowns in this period. Even in that segment, revenue grew 10.2% and trading profit was up 13%. The reopening in China has been part of the recent share price momentum, though it’s worth highlighting that China is also a relatively small contributor to group revenue.

The biggest part of the business actually sits in the UK (25%) and Australia (16%).

Though I would be wary of buying the recent jump, this is one of the ways on the JSE to truly give your money a passport.

Choppies expects a major drop in earnings (JSE: CHP)

Volumes are down and competitors are squeezing Choppies on price

In grocery retail, inflation can either help you or kill you. It all depends on the ability to increase prices, which in turn depends on product quality and the resilience of the customer base.

A less differentiated retailer can get into trouble in these conditions, especially when focusing on lower income consumers who are exceptionally price sensitive.

Choppies has suffered a drop in volumes as a direct result of stiff competition in a tough environment. Pricing increases couldn’t mitigate this impact, which is further proof that Choppies has little ability to hang on to customers for any reason other than price competitiveness.

For the six months ended December, HEPS is expected to be between 29% and 39% lower. Chopped, indeed.

Coronation puts a number on the tax dispute (JSE: CML)

Destination: Constitutional Court

Coronation’s market cap is R10.8 billion. The tax dispute with SARS is estimated to be worth between R800 million and R900 million, based on a decade’s worth of profits being attacked.

That’s not terminal for the company by any means, but it is terminal for the interim dividend.

The fight isn’t over yet. Coronation is going to apply to the Constitutional Court for leave to appeal against the Supreme Court of Appeal judgment.

Although it’s been on a rollercoaster ride this year, the share price is marginally higher year-to-date. Longer term performance is ugly, with a 60% drop over five years.

Grindrod continues to grow strongly (JSE: GND)

Although HEPS is up substantially, the market perhaps wanted more

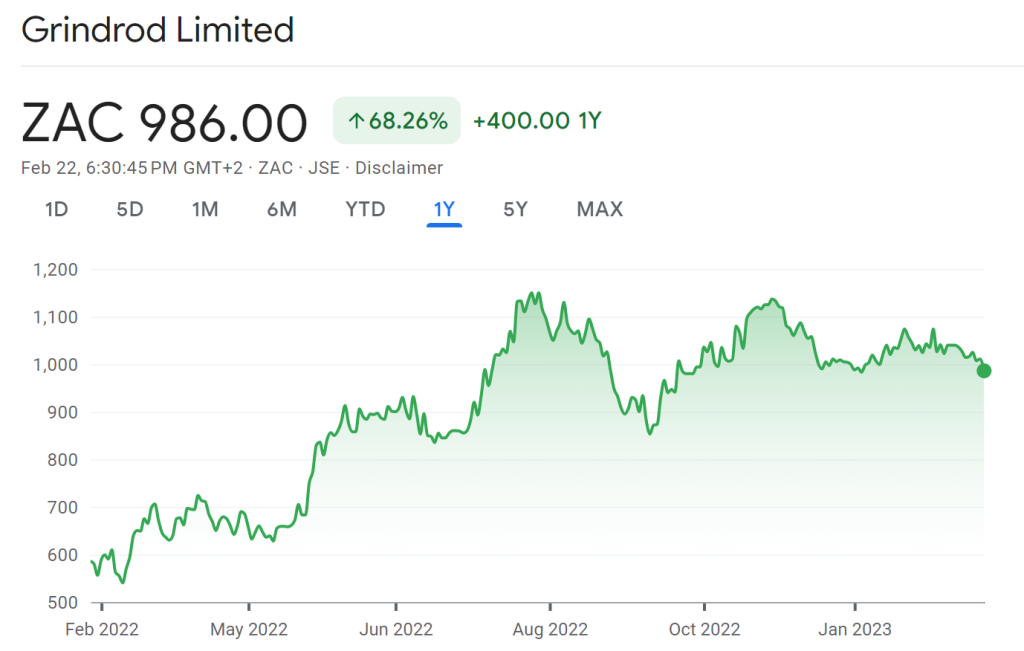

A share price is all about expectations. A share price movement is all about the difference between reality and those expectations. With a 2.5% drop in the price after releasing a trading statement, it seems that the market was hoping for a bit more from Grindrod.

For the year ended December, HEPS will be up between 37% and 43%. Detailed results are due on 2nd March.

After a sharp increase during 2022, the share price seems to have run out of gas:

Sasfin keeps disappointing (JSE: SFN)

In a year that was amazing for banks, Sasfin missed out

If you really don’t like money, you could consider being a long-term investor in Sasfin. Over three years, you would’ve made a whopping 4% in total (plus dividends). In the past year, when other banks have been flying, you would be flat.

In a trading statement for the six months ended December, HEPS is down between 16.8% and 24.7% vs. restated earnings. The restatement had a huge impact on prior period earnings, making them much higher than previously reported.

Not a single Sasfin share changed hands despite the update coming out at 4pm, so that probably tells you everything you need to know.

Standard Bank waves its flag once more (JSE: SBK)

As has been the trend in (most) local banks, earnings are up

In the year ended December, Standard Bank benefitted from the major trends that I’ve been highlighting as bullish for banks: inflation (hence larger balance sheets at corporates and even individuals) and significantly higher interest rates.

We aren’t at the point yet where interest rates are really hurting the credit loss ratio, so banks are performing beautifully (Sasfin excluded).

This trading statement doesn’t give us many details, but we know that HEPS for the year is up between 30% and 35%. Detailed results are due on 9th March.

Little Bites:

- Director dealings:

- A director of Old Mutual (JSE: OMU) bought shares worth nearly R15k.

- Directors of ultra-obscure company Nictus (JSE: NCS) bought shares worth R1.75k.

- Kibo Energy (JSE: KBO) sent out a notice for an Extraordinary General Meeting, as the company wants to give the directors the authority to issue a lot of new shares as part of the company’s growth strategy.

- Jasco Electronics (JSE: JSC) released results for the six months ended December. It was a very unhappy period in which revenue fell by 14% and the group swung from a profit of R4.7 million to a loss of R23.8 million. The situation is tense, as the company has breached its loan covenants with the Bank of China. CIH is looking to take the group private, so Jasco is likely to leave our market anyway.

- Hammerson Plc (JSE: HMN) has had to restate its 2021 financial results based on an accounting interpretation of forgiveness of rental payments during Covid. The property fund’s earnings for FY21 have been restated from £80.9 million to £65.5 million. The change in policy will have a positive impact on FY22 earnings, so watch out for a significant positive year-on-year swing from this change.

- The Competition and Markets Authority (CMO) in the UK has approved the merger of Capital & Counties Properties (JSE: CCO) and Shaftesbury without conditions.

- As part of an incredibly complicated sequence of events, Safari Investments (JSE: SAR) shareholders will be asked to vote on the company repurchasing a large number of shares for a total price of R311 million. With a market cap of only R1.8 billion, this is big.

- Famous Brands (JSE: FBR) has concluded its transaction to buy property from the group founders for R181 million.

- Homechoice (JSE: HIL) is highly illiquid, so I’ve included the trading statement under Little Bites as you would have to make many little bites to build up any kind of position. For the year ended December 2022, HEPS grew by between 30% and 50%. The bid-offer spread is wider than the average highway, so good luck with trading this one.

- If you happen to be a Trustco (JSE: TTO) shareholder and would like all the details on the accounting restatements that were necessary after the company lost its dispute with the JSE, then refer to the trading statement that was issued on Wednesday. The net asset value (NAV) per share is much higher in the latest numbers, with the share trading at a large discount to NAV anyway.

Dear Ghost, please excuse my ignorance. How many zeros does R15k have?

It has three of them! R15,000…