AngloGold puts Córrego do Sítio on care and maintenance (JSE: ANG)

At a total cash cost way above the gold price, this mine is losing too much money

The Córrego do Sítio gold mine in Brazil is anything but a “gold mine” in the colloquial sense. With a total cash cost of $2,278/oz, it loses money on every ounce produced and sold. The all-in sustaining cost is a ridiculous $3,031/oz, so it’s no surprise that the mine cannot secure capital to ensure its future.

After the mine reported negative free cash flow of $30m in the first six months of the year, AngloGold simply has to stem the bleeding. This means putting the mine on care and maintenance, with associated job losses for employees that couldn’t be placed elsewhere.

Capital & Regional got some support on the cap raise (JSE: CRP)

I liked the underlying acquisition, but it’s a tough environment to raise capital

Earlier this month, Capital & Regional announced the acquisition of The Gyle Shopping Centre in Edinburgh for £40 million. The asset is being acquired at a net initial yield of 13.51%, which seems like a very attractive price. The debt is being provided by Morgan Stanley at a fixed cost of 6.5% for 5 years.

With those sort of numbers and an underwrite by Growthpoint for the equity raise, I expected to see more shareholders support the capital raise. At first blush, it looks like there was significant support because shareholders took up 74.97% of the shares being offered. You need to remember that Growthpoint is in this number though, so the percentage uptake from other shareholders is actually much lower.

Together with the underwritten portion, Growthpoint is taking up 87.40% of the shares being offered. This increases its stake in Capital & Regional to 67.64%.

It helps a lot to have a huge balance sheet behind you, especially in this environment where raising capital is so difficult.

Grindrod: one of the industrial winners this year (JSE: GND)

HEPS growth looks very strong

As we’ve seen with the likes of Bidvest, Grindrod has put in a strong earnings performance in this inflationary period. Perhaps my biggest learning of the past 12 months is that industrial firms seem to outperform consumer-focused companies in inflationary conditions. Unlike Bidvest though, the Grindrod share price hasn’t been exciting this year.

When looking at the latest Grindrod numbers, you need to note that the prior period has been restated to exclude Grindrod Bank which was disposed of.

In its core business, which is very much a logistics play (ports and rail), revenue increased by 32% and EBITDA was up 16%. Although there is clearly margin pressure, a 26% jump in headline earnings certainly doesn’t hurt.

The non-core business helps explain some of the share price disappointment, with the KZN property portfolio continuing to be a blemish on the story. Along with the private equity portfolio, Grindrod recognised R78.7 million in net impairment and fair value losses. For context, headline earnings was R487 million in this period, so the market doesn’t just ignore these losses.

An interim dividend of 34.40 cents has been declared, which is double last year’s interim dividend of 17.20 cents.

Charting Grindrod against Bidvest this year is fascinating:

Northam Platinum releases detailed results (JSE: NPH)

The trading statement was so detailed that the market knew what was coming

The main thing to remember about this financial period at Northam Platinum is that HEPS probably isn’t the best measure of management’s performance. This is unusual, as HEPS exists to take out the distortions and give shareholders a view of the underlying performance.

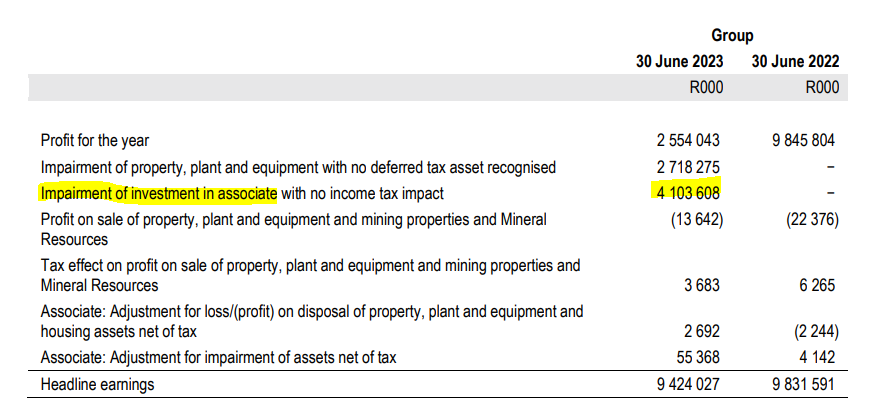

The problem is that in this case, HEPS ignores huge impairments in the group that I believe are relevant. In particular, the loss on the Royal Bafokeng Platinum stake really hurt shareholders, as Northam went on a campaign to make life as difficult as possible for Impala Platinum. Just take a look at this reconciliation to see how that played out:

Northam ended up accepting the offer from Impala Platinum for the shares in Royal Bafokeng Platinum and received R9bn in cash and a whole lot of Impala shares. In a separate announcement, Northam noted that 91.6% of the received shares have been sold for R2.9bn. Although this gives the balance sheet a boost as the cycle deteriorates, it also locks in a major loss.

So, HEPS fell by 7.5% in the year ended June 2023 and earnings per share (EPS) fell by 75% because of the impairments. You can choose which number you want to work with. I would treat HEPS as the operational performance (solid compared to peer group) and EPS as the management performance in terms of capital allocation (very poor).

A dividend of R6 per share has been declared. The share is trading at around R130.

STADIO keeps going from strength to strength (JSE: SDO)

This would’ve been a great addition to your portfolio this year

For the six months to June, core HEPS at tertiary education group STADIO is up by between 18.6% and 22.1%. That’s a rock solid outcome, although it’s arguably a bit light in the context of the valuation multiple.

On core HEPS guidance of between 13.4 and 13.8 cents for this interim period and core HEPS for the second half of the previous financial year of 9.4 cents, core HEPS over the last twelve months is between 22.8 cents and 23.2 cents. On a share price of R5.65, that’s a Price/Earnings multiple of 24.5x at the midpoint of guidance.

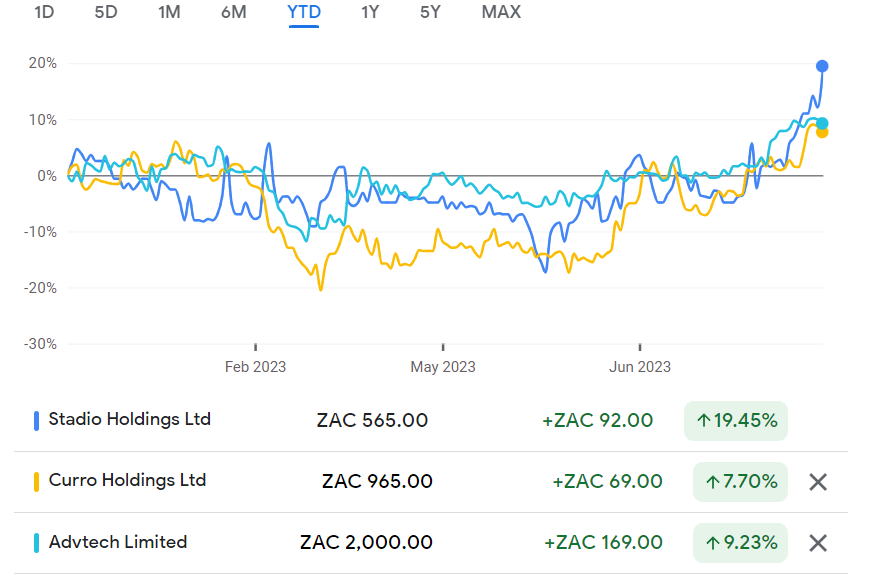

It’s been a volatile year in this sector and relative performance has moved around greatly, with STADIO pulling sharply ahead based on this announcement, closing 6.6% higher on the day:

For now at least, STADIO’s high multiple isn’t blunting share price performance vs. peers.

Little Bites:

- Director dealings:

- Des de Beer has bought another R2.9m worth of shares in Lighthouse Properties (JSE: LTE).

- A prescribed officer of Spear REIT (JSE: SEA) has sold shares worth R261k.

- The CEO of Mahube Infrastructure (JSE MHB) has sold shares worth R29k.

- Liberty Two Degrees (JSE: L2D) has released the circular for the take-private by Liberty Group. Interested shareholders can find it here.

- Salungano (JSE: SLG) announced that the party that had launched a liquidation application against subsidiary Wescoal Mining has agreed to settle the matter. The liquidation has thus been withdrawn. Despite this, Wescoal Mining will commence with a voluntary business rescue process.

- The resolutions related to the take-private of Advanced Health (JSE: AVL) were approved almost unanimously at a scheme meeting.

- AYO Technology (JSE: AYO) has entered a financial closed period and therefore needs to postpone the general meeting required to authorise the repurchase from the PIC. Of course, the longer the money stays in the AYO bank account, the better for the company.

- Kibo Energy (JSE: KBO) announced that subsidiary MAST Energy Development released interim results for the six months to June. The short-form announcement has no information on profitability and I lost interest after spending five minutes looking for the detailed results on the MED website without any luck. Companies usually trade at two cents a share for good reason.

Where does Des Debeer get all these millions to invest in Lightstone? Also, he’s been buying for so long now. How long before he owns all of it?