If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

AngloGold expands in Nevada

In a $150 million deal, AngloGold is buying more properties in the Beatty district

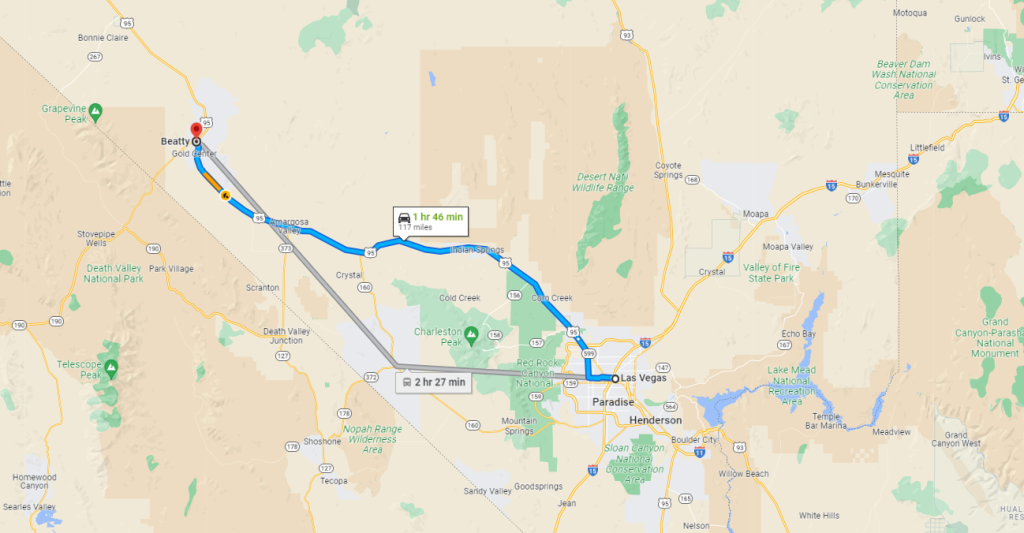

In case you’re curious about the proximity to Vegas, you weren’t the only one. Here you go:

It seems like an appropriate place to be looking for gold, doesn’t it?

AngloGold is acquiring various properties from Coeur Sterling. These are neighbouring properties to the mining giant’s existing properties in the region. The price is $150 million and it could increase to $200 million if the mineral resource is larger than 3.5 million ounces.

Other than weekend trips to Vegas for the mining executives, the obvious benefit to this deal is that they actually have electricity in that region.

Ethos Capital’s NAV goes the right way

Private equity in the public market

EPE Capital Partners, or Ethos Capital, is an investment holding company listed on the JSE. It co-invests with Ethos Private Equity, so investors can gain access to a portfolio of unlisted assets that otherwise wouldn’t be available to retail investors.

The company has released a trading statement noting that the net asset value (NAV) per share as at 30 June 2022 will be between R8.30 and R8.55, representing an increase of between 24% and 28%. As Brait is a major part of the portfolio and trades at a substantial discount to NAV, Ethos Capital notes that these numbers are based on Brait’s share price rather than its last reported NAV.

Interestingly, if you work off Brait’s NAV rather than share price, the NAV per share for Ethos Capital is between R10.47 and R10.72, with year-on-year growth of between 14% and 17%.

When assessing this, I would be inclined to use the lower growth rate as using Brait’s share price inflates the performance of the underlying investments. This is because Brait’s share price closed the gap to its NAV per share between June 2021 and June 2022, which isn’t necessarily a reflection on the underlying business.

After closing 3.7% higher at R5.65, Ethos Capital is trading at a significant discount to NAV. Based on the NAV using Brait’s share price (which I would personally use for this part of the analysis as I think Brait’s valuation of Virgin Active is a little insane), the traded discount to NAV is around 33%.

Just kill it with fire now

Luxe Holdings is best relegated to the dustbin of history as quickly as possible

Taste Holdings was a spectacular failure. With illusions of grandeur, the company tried to be so much more than just Scooters Pizza and a chain of jewellery stores. Instead of doing the smart thing and looking to be acquired by the right party, the management team embarked on a suicide mission to bring US fast food brands to South Africa.

In doing so, Scooters was killed off and replaced by Domino’s. It was aptly named in the end, as the American pizza franchise’s South African operations fell into liquidation. Nobody even wanted to buy it as a going concern.

Despite having nowhere near enough capital to make Domino’s a success, Taste had doubled down and tried to bring Starbucks into the country as well. Eventually, the master franchise licence was sold by Taste in 2019 for R7 million. There were just 12 stores at the time of sale, despite Taste having hoped to open between 150 and 200 Starbucks. The new owners have entered into a partnership with Checkers, which is why Starbucks hasn’t disappeared like Domino’s did.

When the food assets were finally taken out of the picture, all that was left were the jewellery stores. That’s really not enough to justify being listed.

After a period that saw enough management changes to make the SABC blush, we’ve now arrived at an outcome where Althea Gewar (the current CEO) also happens to be the sole director and shareholder of Go Dutch, a company that is looking to make an offer for Arthur Kaplan and World’s Finest Watches. This would leave very little behind in Luxe, though the announcement says that there would be enough cash to support the remaining operations.

Her previous activity on the JSE was on the board of Nutritional Holdings. I’ll leave it there.

Little Bites

- Sim Tshabalala (CEO of Standard Bank) seems to think that the run in banking shares isn’t over just yet, with the purchase of over R8.3 million worth of shares in the bank.

- Des de Beer has bought another R3.2 million worth of shares in Lighthouse. To make you feel poor, his entities have received R75 million in shares as a scrip distribution. Barry Stuhler didn’t do too badly either, receiving nearly R23 million in shares.

- A director of Barloworld has bought shares in the company worth over R500k. Interestingly, it was executed through the EasyEquities platform!

- Although the CEO of Omnia sold shares in the company worth R8.2 million, it was purely to cover the tax on shares received under an incentive programme. We can safely ignore that. In the same announcement though, a prescribed officer bought shares in the company worth R476k. That’s worth taking note of.

- Directors of subsidiaries of Blue Label Telecoms have been regular sellers of shares in recent months. The latest trades are by directors of different subsidiaries and come to R83k in total.

- An associate of Grindrod Shipping, Mark Koen, sold shares worth nearly $244k. He’s not hanging around for a potential offer from Taylor Maritime Investment Limited with an indicative price of $21 per share plus a $5 special dividend. His shares were sold at an average price of $23.39 per share.

- Impala Platinum has now breached the 40% mark, acquiring a further 0.92% in Royal Bafokeng Platinum and taking its holding to 40.11%.

- Mteto Nyati has joined the board of Nedbank, bringing extensive experience in the technology sector with him. Nyati’s previous roles include CEO at Altron and at MTN South Africa, as well as Managing Director of Microsoft South Africa.

A great read today….thank you