AngloGold releases details behind the drop in earnings (JSE: ANG)

HEPS fell by 54% and free cash flow was negative in this period

In the six months ended June, probably the only highlight at AngloGold Ashanti is that the second quarter was better than the first quarter. If you add the two quarters together, you still get to a pretty horrible year-on-year performance.

It’s little wonder that the announcement focuses on the cadence (Q2 vs. Q1) rather than the year-on-year numbers. Production in the second quarter was 12% up on the first quarter and all-in sustaining costs were 4% better. The group is trying hard to convince investors that the second half of the year will suck a lot less than the first half, with full-year production guidance maintained and costs expected to improve.

The problem in the first half is that production was flat year-on-year and the average gold price received per ounce only increased by 2%. When all-in costs per ounce jumped by 15%, that’s a big problem for margins. Gross profit fell by 23% and HEPS tanked by 54% because of the impact of debt.

The free cash outflow of $205 million is concerning. The comparable period was an inflow of $471 million, admittedly boosted by legacy payments of $460 million from Kibali.

The challenge in the mining industry is that the capital expenditure requirements are substantial. If cash profits take a tumble, it can cause negative free cash flow and a deteriorating balance sheet. AngloGold will need to deliver a much-improved second half of the year.

Europa Metals releases further drilling results (JSE: EUZ)

The latest results from the Toral project in Spain are available

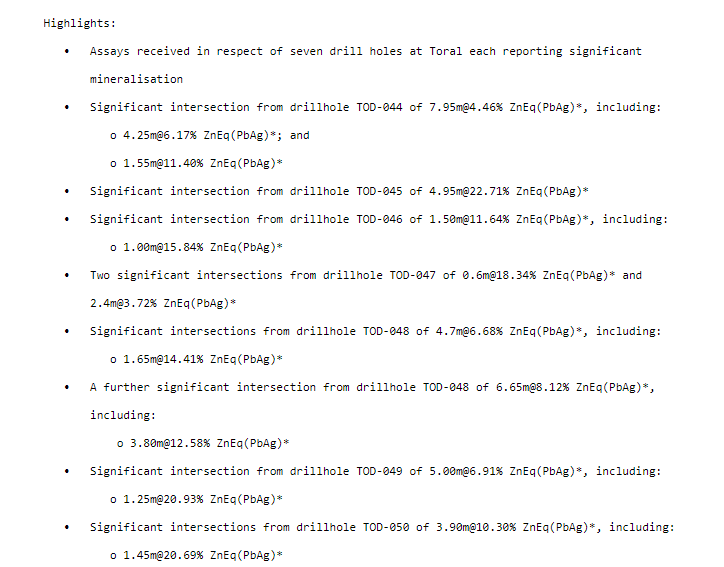

I always joke about how drilling announcements are basically impossible to understand unless you are a geologist. Allow me to show you why, courtesy of Europa Metals:

And that, dear Ghosties, is why I skip to the management commentary section to look for clues. A comment like “intersections reported to date have correlated well with the known existing resource” is very helpful.

The company is preparing for the mining licence application, with an environmental report due for completion later this month.

MTN Rwanda and Uganda release results (JSE: MTN)

It’s just a pity that MTN Rwanda didn’t update the website

I wasted 10 minutes looking through the Rwanda Stock Exchange website in desperation, hoping to find the interim results that weren’t on the MTN Rwanda website despite MTN announcing that they were available. Perhaps they will be there by the time you read this.

Thankfully, the team in Uganda seems to know how a website works. Services revenue in the six months to June increased by 15% and EBITDA was up by 16.8%, so EBITDA margin moved in the right direction by 40 basis points to 50.6%.

The interim dividend is 19% higher, as profit after tax only increased by 17.8%. Capital expenditure was flat year-on-year, so that helped keep dividend growth roughly in line with profit growth.

In case you’re wondering what went wrong between EBITDA and profit after tax, the answer lies firmly in the net finance costs line and its whopping 34.3% increase!

Standard Bank is still loving this cycle (JSE: SBK)

If things can stay like this, banking shareholders will be thrilled

The local banking sector finds itself at an interesting point in the cycle. If interest rate hikes stop, as we saw in the pause by the SARB at the last MPC meeting, then banking earnings should be excellent. If they continue, then the impact of impairments should start to offset the benefit of higher net interest margin.

For now at least, the banking party continues. Standard Bank closed 5.7% higher on Friday after releasing a trading statement indicating HEPS growth of between 30% and 35% for the six months ended June.

Detailed results will be released on 17 August.

Little Bites:

- Director dealings:

- A director of Capital Appreciation Limited (JSE: CTA) has sold shares worth over R2.3 million.

- After the big trades in Novus (JSE: NVS) earlier in the week, we now have confirmation that it was Value Capital Partners selling the last of its stake in the company.

- The transaction between Nikkel Trading and Brikor (JSE: BIK) has been approved by the Competition Commission with certain conditions. The announcement doesn’t go into further details, only confirming that the conditions are acceptable to Nikkel Trading.

- In a most unfortunate update by Kibo Energy (JSE: KBO), the joint venture that subsidiary Mast Energy Developments is working on has been delayed. This is because the principal at Seira Capital, the lead investor partner, has been involved in an accident and is in hospital in critical condition. The group obviously can’t commit to a completion date based on this.