Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

AngloGold’s production rises sequentially (JSE: ANG)

Annual production guidance for 2023 has been affirmed

AngloGold owns a number of mines and they don’t all improve at the same time, but the direction of travel at group level is positive. Production in the third quarter was 3% higher than the second quarter. They had to grind it out the hard way though, with higher ore tonnes processed and a lower overall recovered grade.

This is good news with more international eyes on the company, as the primary listing was moved to the New York Stock Exchange on 25 September.

The other piece of good news is that production is expected to increase further into the final quarter of the year, thereby helping the company achieve full-year guidance.

Before you get too excited, the nine-month view still reflects a 3.2% drop in production year-on-year.

Life Healthcare releases the Alliance disposal circular (JSE: LHC)

The deal was first announced in early October

Life Healthcare is selling its investment in Alliance Medical Group. This is a Category 1 deal that requires shareholder approval. The purchaser is iCON Infrastructure.

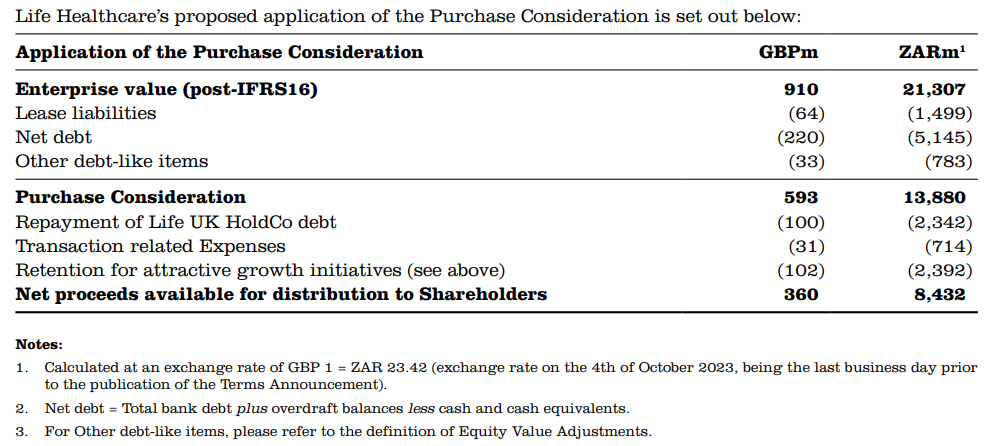

Alliance Medical Group has significant capex needs going forward, so Life Healthcare shareholders have dodged that bullet at a time when money is expensive. The cash will be used to reduce group debt, so this transaction makes a significant difference to the balance sheet vs. what might have been. The net proceeds from the transaction after offshore debt and expenses are estimated to be GBP360 million, or around R8.4 billion. The plan is to distribute this to shareholders within three months of completion date.

You may find this cash flow waterfall rather interesting:

Goldman Sachs and Barclays Bank acted as joint transaction advisors, earning GBP 10 million each in the process. Tough life.

If you’ve ever wondered how the relationship between doctors and hospitals works, here’s an interesting paragraph from the circular:

Doctors may have rental agreements in place where they practise, but do not otherwise work under contracts with Life Healthcare. To assist with the retention and motivation of doctors, Life Healthcare allows doctors to make equity investments in some of the operating companies where they practise. Life Healthcare also maintains a medical advisory committee at each of its hospitals, which provides an opportunity for doctors to be involved with the management and monitoring of the quality of care at the respective hospital. Life Healthcare has historically experienced low rates of turnover of doctors at its facilities.

Multichoice is getting burned by African forex (JSE: MCG)

If money needs to be remitted from Nigeria, life becomes painful very quickly

Much like MTN or Nampak, Multichoice is suffering because of what is going on in African currencies. A trading statement for the six months to September confirms this problem.

In fact, the board has now approved something called “adjusted core headline earnings per share” (yikes!) to show the operating performance with losses incurred on cash remittances from the Rest of Africa markets in the group. Simply, the quoted exchange rate and the actual rate at which cash can be remitted are two different things.

On a constant currency basis and despite significant investment in Showmax and a 16% increase in local content investment, trading profit is expected to be between 7% and 12% higher. But after forex losses, trading profit as reported is between 16% and 21% lower than previously reported.

Core HEPS is down between 3% and 8%. This excludes the losses on cash remittances from Nigeria. To put those losses in perspective, they came in at R0.5 billion which also happens to be the extent of additional investment in Showmax. These forex issues are a big problem.

Adjusted core HEPS is between 22% and 27% higher, but that must be because the base period had even worse cash remittance losses than this period.

Finally, HEPS in the same way that everyone else reports it will be a bigger loss than in the comparable period. After reporting a headline loss per share of 58 cents in the comparable interim period, the loss should now be between 287 cents and 291 cents.

Even the Rugby World Cup probably won’t save the result for the second half of the year. It’s all about the Nigerian currency and ever Pieter-Steph du Toit can’t tackle that problem.

Novus expects a massive increase in HEPS (JSE: NVS)

But take note that this is off a low base

Novus has released a trading statement dealing with the six months to September. The base period saw HEPS of only 2.89 cents, with this period reflecting at least a 500% increase on that number. This implies HEPS of at least 17.34 cents for the six months.

The current share price is R4.12.

PPC guides a swing into profits in the interim period (JSE: PPC)

PPC Zimbabwe has been the major positive shift in this period

For the six months to September 2023, PPC will report HEPS of between 25.5 cents and 26.5 cents. The prior period was a loss of 6 cents per share, though this number has been restated for certain accounting errors in the timing of impairments.

The big swing into profitability is a result of PPC Zimbabwe performing well in this period vs. the prior period when it had an extended kiln shutdown. PPC Zimbabwe has also changed its functional currency from the Zimbabwean dollar to the United States dollar, with a positive impact this period.

Little old Primeserv has grown earnings rather nicely (JSE: PMV)

With a market cap under R150 million, this isn’t exactly a widely-followed stock

Primeserv has been around for 25 years on the JSE, yet you’ve perhaps not even heard of it. The group is involved in businesses like outsourcing and staffing services, as well as training.

The company has released a trading statement for the six months to September 2023 that reflects HEPS growth of between 20% and 23%. This implies a range of 14.90 cents to 15.30 cents per share for the interim period.

For reference, the share price is R1.26.

Here’s another reminder of how cyclical Sappi is (JSE: SAP)

EBITDA has more than halved year-on-year

Sappi has released results for the quarter ended September 2023 and they are a useful reminder of how cyclical this sector is. Revenue is down 28% year-on-year and EBITDA excluding special items has fallen 57%. The group has even slipped into a headline loss position vs. a strong profit a year ago.

This quarter caps off the 2023 financial year, with full-year results showing a 20% drop in sales and 45% decrease in EBITDA. Headline earnings fell 62%.

Despite this, the full-year dividend was consistent at $0.15 per share.

Aside from geopolitical stability and a global economic downturn, one of the more specific drivers of the drop in performance was an underperforming Chinese economy. Another factor was that inventory destocking at buyers took longer than expected, with Sappi responding by trying to preserve selling prices and margins to the greatest extent possible. There have also been some major restructuring steps taken at some of the European sites.

There were some positives, like South Africa achieving record EBITDA for full year 2023. Also, net debt of $1.09 billion is the lowest level in 30 years!

None of this was enough to offset sharp drops in sales volumes, so Sappi will be hoping for a better year in FY24. Some parts of the business have experienced a structural decline though, like graphic papers where capacity is being reduced. With a strong balance sheet, Sappi sounds confident about its ability to rise to challenges.

Separately, the company announced several changes to the board among independent directors, including the chairman who is retiring after several years in the role.

Sephaku’s profits dipped in a tough environment (JSE: SEP)

Although revenue moved higher, both operations saw a contraction in margin

Sephaku Holdings has released interim financial results for the six months ended September. As I’ve reminded you before, that’s not quite true, as SepCem (one of the two major operations) has a December year-end and so this period for Sephaku Holdings represents the six months to June for SepCem and the six months to September for Metier and the group accounts.

The reason why the year-ends can’t be aligned is that Sephaku only holds a 36% shareholding in SepCem. This means that it equity accounts for the earnings (recognises its share of them) rather than consolidates the entire financial result.

With that out the way, we can note that although revenue grew in both underlying divisions, a contraction in EBITDA margin to 10% at Metier and 8.6% at SepCem means that HEPS fell from 11.26 cents to 7.54 cents, a 33% reduction in profits.

But if you read more deeply, you’ll find that Metier actually grew its profits because EBIT margin was stable even though EBITDA margin wasn’t. Profit after tax increased from R29.5 million to R37.8 million. SepCem is where the real pressure was felt, with equity accounted earnings swinging from a profit of R3.8 million to a loss of R14 million.

The challenge at SepCem will be to achieve price growth to recover input cost increases. This is anything but easy in such a soft market in terms of demand.

Sibanye-Stillwater isn’t shy of deals in tough times (JSE: SSW)

In fact, this is usually the best time to be buying assets

You need a strong stomach to operate in the mining industry. Neal Froneman and the team at Sibanye have been doing this for a long time, so they understand market timing and the value of buying when everyone is bleeding (including themselves).

To this end, Sibanye announced the acquisition of Reldan, a US-based metals recycler. The enterprise value is $211.5 million and the cash purchase price is $155.4 million.

This is part of Sibanye’s “circular economy” strategy of owning recycling and tailings businesses. Reldan is a bit different to the rest of Sibanye’s business, as the company reprocesses waste streams like industrial waste and electronic waste to recycle green precious metals. This means gold, silver, palladium, platinum and copper from waste items like semiconductor scrap and mobile phones!

In 2022, Reldan generated $371 million in revenue, $42 million in EBITDA, $39 million in earnings and $28 million in free cash flow.

This is an interesting diversification strategy!

Truworths is going backwards in South Africa (JSE: TRU)

My bearishness on SA retailers continues

Truworths released a sales update for the 17 weeks from 3 July 2023 to 29 October 2023. Sales increased by 10.9% year-on-year, which sounds decent at first blush. Account sales were 47% of total sales (down from 52% in the comparable period), so most of the growth was in cash sales (up 22.5%) vs. account sales (up just 0.1%).

So then why did the share price drop 3.8% on a day when the All Share only fell 0.3%?

The challenge sits in the South African business. The Truworths Africa division mostly consists of South Africa and saw sales increase by a paltry 1%. Account sales were steady at 70% of total sales and key credit metrics also appear to be consistent. Comparable store sales fell 2.2% despite high inflation of 9%, so volumes were down by double digits. The group expanded into this environment anyway, with trading space up 1.1% and expected to be up by between 1% and 2% for the 2024 financial period.

At least online sales grew locally, up 41% and contributing 4.7% to Truworths Africa’s total sales.

In the UK, the Office business grew sales by 18.9% in pounds, which is obviously a great result in rands – up 38.8%, in fact. This is despite trading space dropping by 5.5% as Office exited all seven of its stores in Germany. The business is expanding overall though, with trading space expected to be up by 9% for 2024.

In the UK, online sales contributed 45% of total sales, up from 41% in the comparable period and thus growing much faster than the bricks-and-mortar business.

The market is clearly worried about the underlying metrics in South Africa, as rand weakness isn’t a good reason to hold Truworths. In fact, it’s a good reason not to hold Truworths because of the impact on South African consumers and inflationary pressures like fuel and food.

Despite this setback, the share price has still been a great performer in 2023 because of the modest valuation, up 34% year-to-date.

Little Bites:

- Director dealings:

- Des de Beer really opened his wallet this time, buying R13.6 million worth of shares in Lighthouse Properties (JSE: LTE)

- An associate of a director of Wesizwe Platinum (JSE: WEZ) sold shares worth R1.75 million.

- A director of Old Mutual (JSE: OMU) bought shares worth R624k.

- Although a prescribed officer of Capitec (JSE: CPI) exercised options to acquire shares, the options must be exercised within nine months of the strike date and hence I’m not sure this gives us much insight into market timing.

- Finbond (JSE: FGL) has posted the circular dealing with the specific repurchase of 38.55% of shares in issue.

- Tongaat Hulett (JSE: TON) confirmed that the Secured Lender Group have entered into a transaction to sell their claims and security to a consortium of parties that includes Robert Gumede.

I have been following your comments. I see Des de Beer is continually buying Lighthouse Capital..

Do you know what percentage he now holds? is he likely, in your opinion, to delist the company.

Hi Tony! I’m not sure off-hand on percentage, but remember this is a R10bn company, so he would have to buy every day for a helluva long time. The JSE listing allows capital to be invested from SA into offshore jurisdictions without the restrictions that apply to unlisted companies, unless the SARB rules have changed since I was active in structuring. So long story short, I don’t expect to see a delisting of it.

Per Lighthouse Integrated Annual report for the year ended 31 December 2022 Des de Beer indirectly held 254 405 413 shares representing 14.99% up from 12.93% at the end of the previous year

The scrip dividends have certainly been a big help with that trend.

Hi. I think AngloGold’s ticker is ANG.

Whoopsie! You think correctly. That Anglo ticker is my Kryptonite, I’ve mixed them up before and must be more careful with them. Thank you!