Welcome to the new Ghost Bites. Startups are all about experimentation and this one is no different. After much introspection, I felt that it was time for a change.

When I first built The Finance Ghost as a concept and a brand, it was all about delivering great insights in a fun and accessible way. Merging the InceConnect and weekly Ghost Mail publications was incredibly tricky and I feel that I swung too far towards “the news” rather than “the stuff you won’t read elsewhere” – and we all know which one is better.

So here we are. It’s time to have fun again!

If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Ghost Bites will still be a daily article. It will still focus on JSE news and will cover the biggest and most interesting news rather than all the news. If you got bored reading about British American Tobacco’s daily buybacks, imagine how I felt writing about them!

Don’t worry – if there’s a story you should know about on the JSE, chances are good that it will be in Ghost Bites.

But if you’re wondering what the exchange rate will be for your next dividend from Richemont, then you won’t find it here anymore. I’m only going to focus on the juicy stuff.

ARC needs a new performance benchmark

Rain has surpassed R1 billion EBITDA and Fledge Capital achieved a 78% IRR on the disposal of WeBuyCars to Transaction Capital

At the moment, ARC’s performance benchmark is on par with using me as a benchmark for the 100 metre sprint. It’s hardly difficult to outperform.

All they need to do is beat a 10% hurdle and they will earn performance participation shares in the investment manager. Based on how things are going with interest rates, you’ll soon be able to beat that with a decent fixed deposit.

Thankfully, shareholders will have the opportunity to approve a new fee structure at the AGM. This will be based on actual costs incurred by the asset manager plus a 5% profit margin. Here’s the bad news though: the 10% hurdle is the new structure. The previous structure had no hurdle whatsoever!

With ARC’s share price down by nearly a third over five years, the money has been made by the investment manager rather than the shareholders.

The intrinsic net asset value (INAV) per share increased by 14.7% in the year ended June 2022. As always, there were significant movements within the portfolio that I highlight below.

The fund sold Afrimat shares for R740 million and pumped R362 million into Kropz Plc during the period, funding the operational cash shortfall at Elandsfontein. R56 million was invested in Rain this year, which isn’t much when you consider that the spectrum auction participation was R1.43 billion. Rain achieved its budgeted EBITDA of R1 billion for the year ended February 2022.

On the financial services side (and remember that ARC Fund holds 49.9% in ARC Financial Services), ARC FS acquired 37.33% of Crossfin for R415 million and invested an additional R303 million into TymeBank. You may recall that TymeBank also received $142.5 million from Tencent and other investors. Tyme Global received $37.5 million as part of the same process.

Here’s another fun fact: Fledge Capital (another ARC investment) achieved a 78% IRR on its disposal of WeBuyCars to Transaction Capital. As private equity investments go, that’s phenomenal.

Attacq’s dividend is back

Gearing is down and a dividend of 50 cents per share has been declared. Exposure to Cell C is the blemish on this result

I hold Attacq in my portfolio. It hasn’t delivered the share price recovery I hoped for in the past year or so, with a flat performance. A distribution of 50 cents per share was still largely ignored by the market, with the share price closing at R6.74.

The balance sheet is healthier (gearing is down to 37.2% from 43.3%), with the proceeds of R850 million from the sale of the Deloitte head office and R444.5 million from the Equites transaction used to reduce debt. The net asset value (NAV) is up to R17.49. You don’t need to get the calculator out to see that the discount to NAV is large.

As a reminder, Attacq is synonymous with Waterfall City in Midrand. It also holds a 6.5% stake in MAS P.L.C. and some investments in Africa that it is trying hard to sell, along with co-investor Hyprop. Ironically, that’s the other property fund in my portfolio.

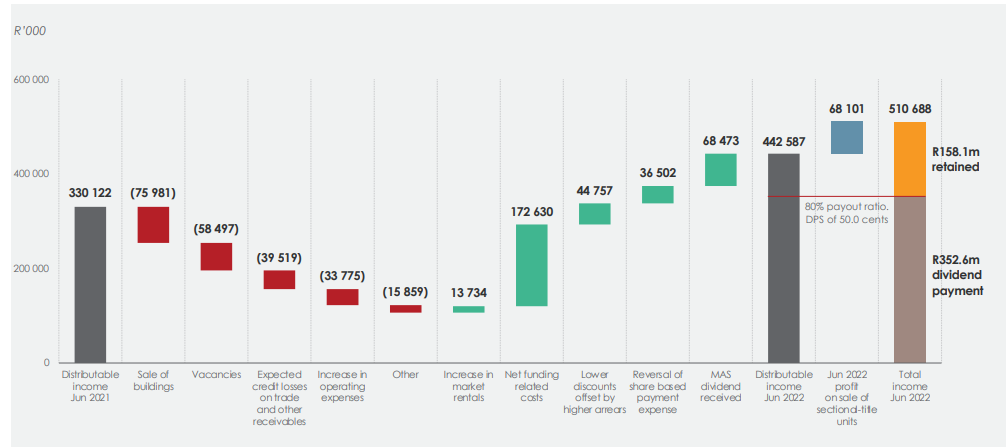

Attacq breaks down its distributable income by portfolio. Waterfall City contributed 32.3 cents per share out of 62.8 cents. Speaking of waterfalls, the company included this waterfall chart in its result:

Here’s a final fun fact: 83% of rand-denominated debt is hedged for interest rate risk, vs. 76.2% last year. This makes sense in the current environment.

One of the blemishes in the result is the exposure to Cell C and its office / warehouse campus, a large property that houses a telecoms company that has caused a lot of financial pain for people over the years. Speaking of Cell C, CEO Douglas Stevenson had to postpone the results announcement and roadshow because he has an upper respiratory tract infection.

I think most Cell C investors over the years would’ve happily swapped their exposure for such an infection.

Labat: the most confusing SENS headline

Labat has put together a joint venture to get more cannabis from Kenton-on-Sea to the global market

Labat’s share price closed 17.6% lower yesterday and I fear it was mostly due to extreme confusion around this SENS announcement:

Read it again. Slowly. And again…

The problem is that they tried to squeeze everything into the headline, like a tweet that should’ve been a thread. SENS needs to introduce threads.

What Labat is actually doing is setting up a distillate facility at the Sweet Waters facility in the Eastern Cape. One of the counterparties is Caliboyz Holdings, which sounds like a Chris Rock movie. Based in California, the company is involved in the design and manufacture of cannabis extraction and manufacturing facilities.

Most of the product will be exported.

Say cheeeeeeeese

Lancewood is the standout performer in Libstar’s results

Libstar’s revenue grew by 9.6% in the six months to June 2022 and EBITDA was only up by 4.6%, so margin deteriorated. Food producers are under a lot of pressure at the moment.

The Perishables category was the big winner, up 14.6% thanks mainly to a strong performance by Lancewood cheese. Normalised EBITDA in this category was up 27.8%.

In Groceries, revenue was up 2.2% and EBITDA fell by a nasty 17.7% because of supply chain challenges and increased logistics costs.

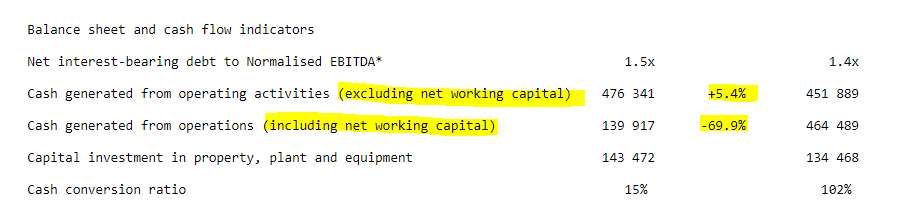

If you ever wondered about the impact of inventory pressures, supply chain issues and inflation on the balance sheet and the ability to generate cash, here’s a very good example of the pain it causes:

Libstar has been repositioning its portfolio towards value-added food products. The Household and Personal Care (HPC) division is performing better these days but is still being “evaluated” – a nice way of saying that Libstar would sell the division if someone would take it.

Toddler Ghost was raised on Umatie frozen baby foods. I can’t resist highlighting that Libstar has acquired that business. Based on our experience, it should be a winner!

Charl de Villiers will take over as CEO from the 1st of January, as co-founder Andries van Rensburg is stepping down after an incredible run at the helm of this group.

Things have slowed down at Mustek

Mustek remains well ahead of pre-pandemic levels, though

Although revenue at Mustek is up 11.5% for the year ended June, the gross profit margin fell from 14.9% to 14.3% and headline earnings per share (HEPS) is down 19.1%.

The dividend has followed suit, down 15.6% to 75 cents per share. For context, it was 90 cents in 2021, 26 cents in 2020 and 30 cents in 2019.

In other words, the year-on-year picture doesn’t look great but Mustek is still well ahead of pre-pandemic levels.

RFG Holdings is just peachy

RFG closed 8.4% higher on a bright red day for the JSE

Most investors were given a hiding by US inflation numbers. If you hold shares in RFG Holdings, you have something to smile about.

For the 11 months ended August, revenue is up 21.2%, driven by strong international demand for canned fruit and other fruit products. Last year’s peach crop in Greece failed, which makes a big difference in the market as Greece is the world’s largest exporter of canned peaches.

And you thought that economy was all about olive oil and high bond yields, didn’t you?

Input costs for those cans are causing pressure on margins, with the company finding it “challenging to fully recover cost increases” – an issue familiar to all food manufacturers.

The carbohydrate enthusiasts among you will be pleased to know that the pie category is recovering. Vegetable sales have been slower. Clearly, we are eating our problems.

Feedback is critical – let us know if you enjoyed the new Ghost Bites!

Enjoyed this enhancement to GB. More usable insight into industry and companies. Well done .

Thanks Les!

Nicely done, love the new version of GB – just how I like my morning content, short and precise!

Thanks so much!

Well done! Enjoyed the detail. Thanks for including Labat too – oh my, who knew that a relatively positive SENS announcement could cause so much harm to a share on a day like yesterday, of all days. 🥲

On the plus side, it’s hard not to enjoy a cannabis company doing a “joint venture”

I think the quirky tone of The Finance Ghost is back. Writers block I’m sure kicked in and @FinanceGhost keeping it authentic its all you have to do people love authenticity. @inceconnect has evolved and that’s what makes this partnership great!

Indeed – thanks for all the support on this journey Rox!

Great content, as always! Thank you for your effort, Ghost. To be 100% honest, I actually prefer the previous format with its compact info, but it may just be too soon to say, so I look forward to the next few days to see whether I am wrong! Thank you for your insight. 🙂

I’ll still be experimenting with length etc. so please do keep the feedback coming!

Yes I like this, easy to find structure.

Thanks Dave!

Very insightful as always. I miss the “Mergers & Acquisitions” info at the bottom:-)

At the top you mean haha, I left the unusual things for the bottom 😉 if there’s proper M&A news on any given day, I can almost guarantee that I’ll cover it in this format.

Love the “new” old GB! Thanks for the all the info!

Appreciate it!

Enjoying the insight

Thanks Thabang!

Good content as per usual. Prefer this format. The previous format was good too, but it did feel as though it was starting to get too long to read (if it returns in future, I’d go with the name Ghost Chunks :-)).

This was hilarious!

Precise and to the point. Admiration for how you keep this column innovative and stimulating with your changes from time to time. Who said finance investing must be boring. Thumbs up .

Thanks so much – indeed, business is never boring!

The Finance Ghost is back. Much prefer this format, thank you!

Thanks – that kind of comment is music to my ears! It does feel like my more natural style.

Mixed feeling tbh – I like the return to the tongue in cheek style, with deeper insights into special events. But I also found it valuable to be able to briefly run through a summary of all the noteworthy JSE updates, condensed into the inceconnect style. It was a nice way to get a taste of what was happening out there on the markets each day.

Back when you wrote for both inceconnect daily & the weekly ghost mail – I thought that made the perfect combination of routine summary of updates and the more fun and insightful commentary on special events.

I completely agree with you re: the ultimate combo. The problem is I was going to bed every night after midnight and that was before InceConnect became Ghost Mail (I now have the added responsibility of growing the business, not just writing). Only one of me sadly! But the Ghost Grads are coming on in leaps and bounds, so I’m moving towards building more capacity in the business. Will do my best to deliver the best combo in the meantime. Time will tell what the future holds! On a Friday by the way, the DealMakers articles also cover off much of the content I was doing in Ghost Bites.

Epic! Love what you’re doing with the space!

Good point about the dealmakers – I often thought there was some overlap

Well done, looks good. How come you didnt mention the fire at Libstar’s Denny mushroom facility at Shongweni, Durban.?

I thought about that actually! They didn’t mention it in their update. If it was material, I think a SENS would’ve come out. So part of me wanted to highlight it, but I also didn’t want to potentially cause concern over something that may be quite small?

Well done on the new look and feel.

Can you look to add in discussions around “Company Valuations 101” so that we can see how you assess companies that you write on? Is there a “Dummies Guide for Investing” that could be link on the Ghost Mail Site in the future?

Hi Graeme,

I’m also involved in a company called bizval (https://bizval.co/) where we will be producing quite a bit of valuation content. For example, we recently had a webinar on this topic and there’s another one next week on how to make a company more valuable! You can sign up for free here: https://my.demio.com/ref/jx7mavYreK4FOZJj

The previous issues of Ghost Bites were quite extraordinary and a fantastic new addition to information available, and they are my preferred version. Something as perfect did not require any adjustments, especially while still being “new”. It was great reading about daily BATS buybacks!

Hi Stefan – thanks for the kind words! I’m going to do my best to ensure that the most NB information still finds its way here. It was a huge undertaking to produce that article on a daily basis. You should make sure you read the DealMakers updates every Friday, as they typically summarise a lot of the same information that was in Ghost Bites! 🙂

Like the new format, miss director’s dealings, always interesting info.

Trust me, I’ll be keeping a close eye on those. Director dealings are very important. I won’t let any slip.

Absolutely love it. I really appreciate how you consistently make esoteric finance accessible to average Ks . That URT infection line.. delightfully dark!

I really enjoyed the new format, it was an easier and more interesting read. I also enjoy the slightly longer email body

I did enjoy today’s new version and found it quite punchy and to the point. My knowledge in trading is at frog spawn level, so you have taught me a lot. Thank you for constantly spelling out acronyms like EBITDA etc. to dummies like me. Your content also gives me a good chuckle almost daily.