An update on the ARC Investments portfolio (JSE: AIL)

Are they making it rain?

The African Rainbow Capital Investments (ARC) announcement starts with rain, so I’ll start there too. The focus is on the new product called rainOne, which is a result of rain’s positioning as a full mobile network operator after spectrum was acquired in the 2022 auction. In terms of numbers, the announcement only says that rain “continues to meet monthly financial targets” – but we don’t know what those are.

Moving on, the Kropz Elandsfontein project continues to use capital, with the ARC Fund giving a R285 million bridge loan facility in March 2023. It sounds like phosphate production came under pressure from supply chain issues.

The update on the agri portfolio is literally just a lot of gumph that says nothing, talking about how the portfolio is being “restructured and aligned” – whatever that means.

Alongside Fledge Capital, ARC has increased its stake in Upstream from 25% to 49% (with Fledge holding 13% in Upstream as well). This is a debt review and recovery business that is well positioned for current economic pressures.

Moving on to the financial services portfolio, TymeBank now has an annual revenue run rate of over R1.9 billion across South Africa and the Philippines. The group has over 7 million customers and is growing at a rate of 188,000 new customers per month. In a recent pre-Series C capital raise, Tyme attracted a total of $77 million in new capital. Norssken22 and Blue Earth Capital were welcomed to the shareholder register, with ARC also following its rights and remaining in control of the group. The Series C is underway with potential investors and is expected to close later this year.

The story sounds less bullish at Crossfin, where load shedding is impacting the point-of-sale businesses Adumo and ikokha. The Akelo group has been restructured. Despite all of this, the performance is apparently in line with expectations and ahead of the prior year.

At Capital Legacy, ARC FSI will dilute to a 25% holding after Sanlam announced a deal in 2023 to acquire 26% of Capital Legacy. There are synergies between Sanlam and Capital Legacy in terms of distribution and insurance. ARC FSI also extended a loan of R200 million to Capital Legacy that will either be converted into equity or repaid after 12 months.

Finally, ARC FSI sold its 30% stake in Rand Mutual Holdings in January 2023 for a price above the embedded value and the carrying value.

Novus moves into a headline loss (JSE: NVS)

Things seem to have deteriorated further since the interim period

For the year ended March 2023, Novus has guided a headline loss per share of between -3.36 cents and -11.34 cents. That’s a horrible situation vs. positive HEPS of 53.15 cents in the comparable period.

The announcement is light on any other details, so I went back to the interim results to see what those looked like. In the six months to September 2022, HEPS was 2.89 cents per share, way down from 28.49 cents in the comparable interim period but still positive.

This means that the second half of the financial year was sharply negative, with many of the pressures in the interim period presumably worsening over the year.

Detailed results are due on 19 June.

The Foschini Group piled on the debt (JSE: TFG)

The operations look strong but finance costs hurt the dividend

Operational metrics at The Foschini Group looked pretty strong for the year ended March. Revenue was up 19.4%, which drove a 12.4% increase in operating profit after gross margin contraction of 60 basis points to 47.9% was experienced.

With trading expenses steady at 41.3% of retail turnover, it was gross margin pressure (particularly in TFG Africa with a 220 basis points impact) rather than operating expenses that blunted the operating profit performance. Still, growth of 12.4% is solid.

So against that backdrop, how did HEPS managed to drop by 4%? More importantly, how did the final dividend decrease by 54.5%?

The answer lies in the balance sheet, where the Tapestry acquisition and other major strategic investments led to a massive increase in debt to R7.1 billion. Although hindsight is perfect, it’s very debatable whether taking on so much debt in this environment was a smart decision.

Excluding Tapestry, group retail turnover grew by 15.2%. Online turnover only increased by 6.6%, still a worthwhile result against a substantial base. It now contributes 9.1% to group turnover.

Looking in more detail at the operations, TFG Africa estimates lost turnover of R1.5 billion due to load shedding in this financial year, with 75% of turnover now covered by stores with back-up power. This required R200 million in “unplanned” capex.

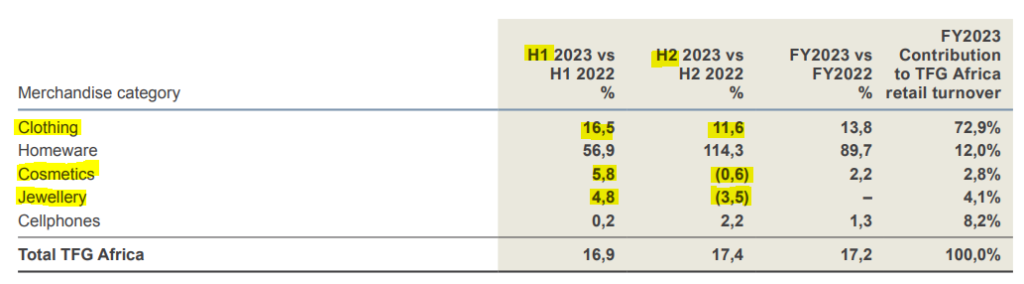

I am also concerned about the cadence in these numbers, or the H2 performance vs. the first half of the year. Ignore Homeware in this table, as it was heavily influenced by acquisitions. Rather look at the trend in the rest of the business (excluding cellphones which moved in the right direction):

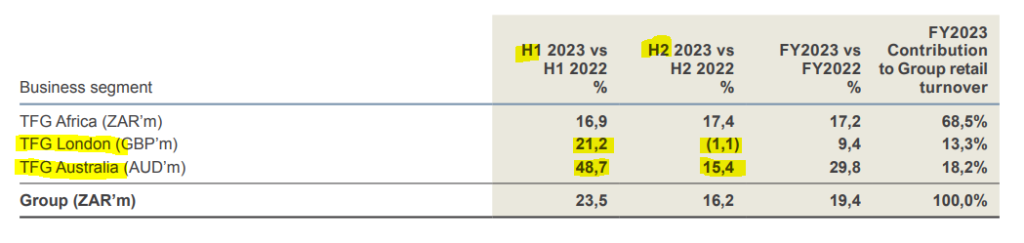

I appreciate this level of disclosure from the group, along with the next table that does a similar thing at geographical level. Ignoring South Africa which benefitted from the acquisition noted above, look at how the businesses in London and Australia also slowed down in the second half:

Looking ahead, the group is clearly calming down on the capital allocation front. Planned new store openings have been “curtailed” which should result in store capex being half the levels seen in FY22. The problematic cadence has continued into the new year, with revenue for the two months of the new financial year reflecting a 5.8% increase in TFG Africa (excluding Tapestry) and decline of 10.8% and 4.9% in London and Australia respectively.

That’s not what you want to read with so much extra debt on the balance sheet.

Despite this, the share price rallied 2.7% to take the year-to-date movement to -8%. I’m quite happy to not be holding these shares in this environment.

Little Bites:

- Director dealings:

- Mark Barnes and associated entities subscribed for over R6 million worth of shares in the Purple Group (JSE: PPE) rights offer and sold nil paid letters worth R327k. Although it’s so small that it hardly needs a mention, an associate of a different director sold nil paid letters worth R1.2k.

- A director of a major subsidiary of Mpact (JSE: MPT) has sold shares worth R1.3 million.

- A director of AfroCentric (JSE: ACT) has sold shares worth nearly R1 million.

- A director of Raubex (JSE: RBX) has bought shares worth over R161k.

- An associate of a director of Copper 360 (JSE: CPR) has bought shares in the company worth nearly R49k.

- Although there were several director dealings at Stefanutti Stocks (JSE: SSK), it looks as though it was mainly just a restructuring of the Schwegmann family holdings.

- I haven’t been giving daily updates on Impala Platinum (JSE: IMP) slowly increasing its stake in Royal Bafokeng Platinum (JSE: RBP). To avoid this falling off your radar entirely, I’ll mention it from time to time. After the latest acquisition of shares, Impala Platinum now owns just over 56% of Royal Bafokeng Platinum.

- Suspended catastrophe Afristrat Investment Holdings (JSE: ATI) has renewed its cautionary announcement as restructuring initiatives are still underway.