Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

A sale and leaseback at Argent Industrial (JSE: ART)

This is a handy way to unlock funding

There’s always a lot of debate around whether operating companies should own the properties they operate from. It usually comes down to how strategic the property is, as it is certainly easier to move an office full of people than it is to move specialised industrial equipment.

Like most industrial groups, Argent Industrial has a property portfolio. This is a source of potential funding, particularly through sale and leaseback transactions. In these deals, investors are found who want to buy properties and lease them back to the company.

Argent Industrial will execute such a transaction on the Phoenix Steel properties in Gauteng, unlocking R45.4 million in the process. The proceeds will be used to settle debt on the properties and the rest will be used for share buybacks. That sounds like a good application of the money to me!

MiX Telematics and PowerFleet release their circular and prospectus (JSE: MIX)

This is a great opportunity to learn more about corporate finance

As we’ve known for a while now, MiX Telematics and US-based PowerFleet are looking to implement a merger. The structure is that PowerFleet would acquire all the shares in MiX Telematics in exchange for shares in PowerFleet. The merged entity would then be listed on the JSE under the PowerFleet name.

This means that MiX Telematics needed to release a circular to shareholders to approve the deal. Separately, PowerFleet needed to release a prospectus giving full details of the merged entity. Go check out the two documents to learn more about corporate finance transactions like these.

The rationale for the deal is that both businesses are sub-scale, so combining their efforts will build a larger telematics and Internet-of-Things business. The companies are obviously hopeful that they might get more attention on the Nasdaq as well.

The deal certainly isn’t cheap to implement, with the prospectus noting astronomical fees of $16.6 million!

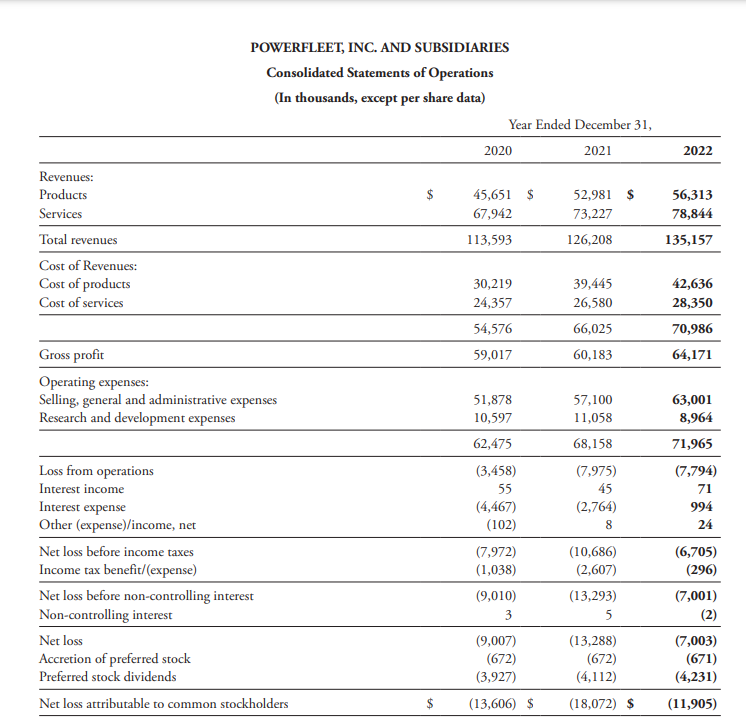

Annoyingly, due to the timing of the publication vs. financial disclosure, the last available numbers in the prospectus are for the year ended December 2022. That now feels very old. Perhaps it doesn’t matter, as PowerFleet is consistently loss-making:

Those advisory fees look even more gigantic once you’ve seen this income statement, don’t they? This is typical tech start-up kind of stuff, which works a lot better on the Nasdaq than on the JSE.

Pepkor’s core business put in a solid performance (JSE: PPH)

It’s also really good to see strong growth in Avenida

Before we delve into this, it’s time to draw a 12-month chart for this sector:

The reality is that Truworths is the only one you really wanted to own over the past year. The rest have ranged from bleh to bliksem.

Pepkor has reported decent numbers for the end of 2023. If nothing else, at least Ackermans seemed to turn the quarter with a gain in market share in December. It’s been on quite the downward trajectory, so it’s good to see the inventory strategy coming right there and a recovery underway.

Speaking of inventory, the group highlights port disruptions as a problem for stock inflows. This is a risk facing all local retailers to some extent.

Pepkor didn’t let that get them down though, with growth of 7.2% in revenue from continuing operations for the three months ended 31 December 2023. Like-for-like sales were up 4.1% for the quarter, with PEP Africa (17.9%) and Avenida (10.8%) doing particularly well – noting that those growth rates are on a constant currency basis. Core operation Pep only managed 3.3% like-for-like growth. The Building Company suffered a 0.7% decline, in line with the pressures we’ve seen across that sector.

The pressure on volumes (inflation was 6.5% in PEP, Ackermans and Speciality and like-for-like sales came in below that) means that store growth really helped to pull the result higher, taking group merchandise sales growth to 5.5%.

Things have improved in January with the back-to-school season. Like-for-like sales are up 7.8% in PEP and 8.7% in Ackermans.

And in case you needed any more evidence that local consumers are under huge pressure, group cash sales increased by 2.4% and credit sales were up 35.2%. Group credit sales as a percentage of total sales increased from 9% to 12%. The credit strategy comes through strongly in the Fintech segment in businesses like Tenacity and Capfin. This segment also houses the Flash business that serves the informal market, which achieved revenue growth of 16.8%. Flash contributes 66% to the Fintech segment. Total Fintech segment revenue was up 20.7%

There’s no stopping Shoprite (JSE: SHP)

This marks 58 consecutive months of market share gains!

Over five years, the Shoprite share price is up 65%. Pick n Pay is down 66% and SPAR lost 43% of its value. This has to be one of the very best examples of where stock picking within a specific sector can be profitable.

Supporting that share price move is 58 consecutive months of market share gains in Shoprite’s core local supermarkets business. This is an extraordinary achievement. If you can believe it, sales growth accelerated in the three months to December (the second quarter of the financial year) vs. the immediately preceding quarter. Q2 sales growth from continuing operations was 14.6% vs. 13.2% in Q1. Supermarkets RSA is driving the performance, up 15.8% in Q2 to take the six-month performance to growth of 14.6%. This dwarfs Supermarkets Non-RSA (up 6.2%) and Furniture (up 1.7%). Other operating segments jumped by 23.1%.

To get a better sense of performance, it’s useful to adjust for the impact of the stores that were acquired from Massmart. Taking those out of the mix shows Supermarkets RSA sales growth of 11.2% – still very good.

As we’ve become accustomed to, the stores resonate at all income levels. Checkers and Checkers Hyper grew 13.7% (with a shout-out of appreciation to Checkers Sixty60’s growth of 63.1%). Shoprite and Usave grew 13.1%. LiquorShop increased sales by 25.2%. Even OK Franchise within the Other segment is doing well, with group sales to franchisees up by 25%.

The big question is going to be around profitability. The group has given some clues here that the sales story is going to be the highlight and that the market should temper its enthusiasm around profits. The comparable period included non-recurring income of R244 million as a loss of profit insurance claim. They suffered R500 million in diesel costs in this half because of load shedding. They have also incurred a “notable” increase in finance charges due to higher interest rates.

Interim results are due on 5th March, at which point we will see how the sales growth is translating into growth in profits.

Transaction Capital to unbundle WeBuyCars (JSE: TCP)

Here’s the first major step in trying to rescue some value from this broken growth story

As a look at my brokerage account will quickly confirm, the fall from grace of Transaction Capital was rather hideous. What went up certainly came down. The company is now trying to engineer the best possible outcome, which is a bit like trying to sculpt a turd into something beautiful.

Deep within the excrement, we find WeBuyCars. I like this business and the way it put a liquidity floor into a used car market that was crying out for exactly that, with other dealers enjoying easy money for far too long. The market is cyclical of course, but the underlying business is solid in my opinion.

At this stage, the board of Transaction Capital has in principle resolved to unbundle the entire stake in WeBuyCars, which means a 74.9% shareholding. This is good news for market participants in general, as it means there’s a pure-play look at WeBuyCars.

Although WeBuyCars has been legally isolated from the impact of SA Taxi’s restructuring, the reality is that perceived group contagion is an issue that needs to be addressed. Unbundling the company and letting it build a profile away from Transaction Capital is the way to do it. Including the potential future financial obligation to SANTACO of R285 million, Transaction Capital’s net debt was R1.4 billion at 30 September 2023 and subsequently reduced to around R1.2 billion as per the integrated annual report. There’s a long road ahead and it would be better for WeBuyCars not to be caught up in that.

Importantly, the annual report notes that Transaction Capital has no intention of pursuing a rights issue. I suspect that the share price will show some love to the news of the WeBuyCars unbundling.

Little Bites:

- Director dealings:

- Aside from various management transactions related to share option schemes, there was also a disposal of shares by an executive of Richemont (JSE: CFR) to the value of R18.2 million.

- Heriot REIT (JSE: HET), acting through a subsidiary, bought R22.8 million worth of shares in Safari Investments (JSE: SAR). Heriot Properties is an associate of a non-executive director of Safari. Heriot and its concert parties hold 58.8% of Safari shares after this trade.

- The company secretary of Datatec (JSE: DTC) has sold shares worth R454k.

- The Praesidium partnership, an associate of a director of Huge Group (JSE: HUG) that regularly buys shares in the company, has bought another R2k worth of shares.

- Cash shell Trencor Limited (JSE: TRE) released a trading statement for the year ended December 2023. As a cash shell, it’s really about forex and other movements. HEPS will be between 71.4 and 71.7 cents.

- Conduit Capital (JSE: CND) has renewed its cautionary announcement related to the provisional liquidation of CICL, the company’s main subsidiary.