Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Ascendis swings sharply into the green (JSE: ASC)

You do need to read carefully for the once-offs though

Revenue at Ascendis may be down 5% for the six months to December 2023, but that’s where the bad news stops. Gross profit margin increased by 150 basis points to 40.9% and significant cost-cutting efforts have paid off, with a substantial drop in operating costs across the board. Without adjusting for once-offs, operating profit came in at R47.6 million vs. a loss of R122 million in the comparable period.

That’s quite the swing, isn’t it?

The group goes on to explain that there were major line items like a VAT provision reversal of R43.1 million and an accounting gain of R27.1 million. There were also various transaction costs and impairments. On an adjusted basis, operating profit was R8.9 million vs. a loss of R47 million in the comparative period.

Interest paid was R5.1 million, vastly less than R50.5 million in the comparable period after all the progress was made in reducing debt on the balance sheet.

Remember, Ascendis is currently at the centre of what became a controversial potential take-private transaction. This is being spearheaded by the current CEO, which is relevant information when there’s commentary in the announcement that the company may look to raise further equity from shareholders to enable growth. This suggests that if the take-private doesn’t go ahead, the group may look to equity funding mechanisms on the public market. Some will heed this warning and others may see it as a strategy to encourage the delisting.

Either way, aside from the extensive noise around the potential deal, it’s clear that things have improved significantly at Ascendis from an operational standpoint. The group is profitable, albeit not by much once you look at the adjustments.

Dividend disappointment at Bell Equipment (JSE: BEL)

HEPS up strongly, yet the dividend has disappeared

After a couple of trading statements, there’s been much excitement around Bell Equipment. With the release of annual results though and the disappointing news of no dividend at all, the share price closed around 10% lower on the day.

A revenue increase of 32% drove a HEPS improvement of 69%. The cash flow tells an incredibly different story though, with a massive cash outflow of R437 million for the year vs. an inflow of R14 million in the prior year.

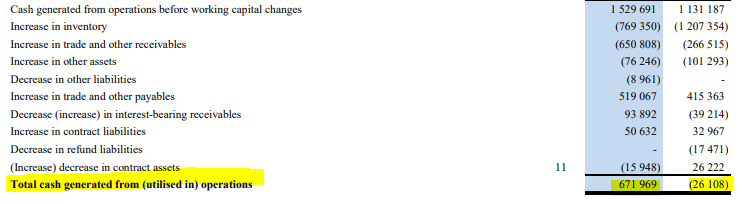

You may assume that this is related to working capital, but a deeper look reveals that this isn’t the case. You’ll find that cash generated from operations actually looked just fine thanks (with 2023 in dark blue):

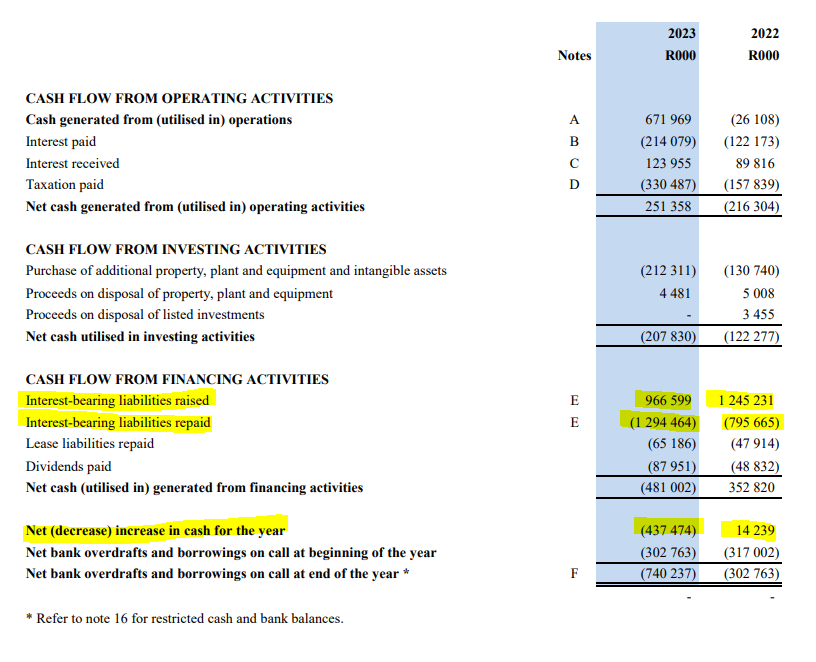

The biggest swing in cash actually happened in financing activities, shown here:

The company notes that working capital investment across inventory and receivables is the primary reason why the dividend is gone. That’s a forward looking view of where the cash might go in the coming year. Based on the financials, a contributing factor to why the dividend disappeared seems to be more related to the longer term debt on the balance sheet rather than working capital.

Emira sells two properties (JSE: EMI)

Makro Crown Mines and Market Square in Plett have been sold in separate deals

Emira has decided to recycle capital by selling two properties. The first is Makro Crown Mines, disposed of for R337.5 million. The second is Market Square in Plettenberg Bay, sold for R354 million. These are two separate deals with different buyers.

The net operating income for Makro Crown Mines for the six months ended September 2023 was R14.98 million. On an annualised basis, the property has been sold on a yield of 8.9%. Market Square’s net operating income over the same period is R12.4 million, implying an annualised yield of just under 7%.

The net proceeds will be used to reduce Emira’s debt and fund new acquisitions once opportunities are identified.

In a separate update, Emira gave investors a pre-close view for the 11 months to February 2024. The overall story is that the local commercial portfolio is performing in line with expectations. It’s rather interesting to note that retail vacancies increase from 3.2% at September 2023 to 4.1% at the end of February, whereas office vacancies actually improved from 12.0% to 11.3%! For completeness, the industrial portfolio improved marginally from 0.7% to 0.6%.

Moving on to residential, this was an important period for the company as the takeover of Transcend was completed. 486 units in the residential portfolio have been disposed of during the period at a small premium to book value. A further 74 units should transfer by the end of March.

In the US-based portfolio, vacancies increased from 3.6% to 4.7%. There are some larger tenant failures that have negatively impacted results.

The loan-to-value ratio of 43.7% as at the end of February is up from 41.2% at the end of September, with the increase driven by the acquisition of the remaining shares in Transcend. That does feel a bit high to me in this environment, with the firm continuing to recycle capital and diversify the fund. Perhaps some of that capital will be used to bring debt down.

Heriot took a knock from financing costs (JSE: HET)

The distribution per share has fallen for the interim period

Property fund Heriot reported a 4.2% decrease in the distribution per share for the six months to December 2023. This is despite a 12.9% increase in net property operating income. Property funds have been hit hard by the rising interest rates, with Heriot as just one of many examples.

The retail portfolio has been the biggest source of growth, with net operating income up by a very impressive 21.2%. The Industrial property increased by 9.9%. Office and residential assets have a less pleasing story to tell. Luckily, 71% of the portfolio is retail and 19% is industrial.

Heriot is looking to increase exposure to Safari Investments, with a 48.7% direct interest and a further 10.1% held by a concert party, Thibault REIT.

The net asset value per share at Heriot increased by 21.3% from R13.02 to R15.78. The share price is R13.50.

Renergen gives a quarterly update (JSE: REN)

There’s nothing new here, but it’s still a useful summary of the past three months

Renergen releases a quarterly update to give investors a summary on the latest strategic news and the state of the financials. The fourth quarter of the 2024 financial year can count the Mahlako Gas Energy investment as the major highlight, with that party putting in R550 million for a 5.5% equity stake in the South African operating entity. The investment by Airsol has also been completed.

Although LNG deliveries resumed in February, it’s the production of helium that investors are really waiting for. The helium system integration is nearly complete, with no significant issues detected. The OEM supplier is busy with pre-checks ahead of the final performance test.

Whatever the outcome of that test, I would expect a pretty big share price move either up or down, depending on the results.

RMB Holdings finds a way to exit Divercity Urban (JSE: RMH)

The group is trying to turn assets into cash – and some aren’t as easy as others

Trying to sell a tiny stake in a private company really isn’t easy. This is generally why listed groups avoid holding such stakes in the first place. RMB Holdings is trying to turn assets into cash as part of the strategy to return value to shareholders. On more strategic holdings, it’s a lot easier. For the 7.15% stake in Divercity Urban, there probably weren’t many buyers in town.

This is why RMB Holdings has agreed to the company repurchasing shares and shareholder loan claims held in and against Divercity. The company is loss-making, so RMB Holdings didn’t get a great price here. The carrying value of Divercity in RMB Holdings’ accounts as at 30 September 2023 was R87 million. In that period, there was a fair value loss of R9.8 million. The price for this repurchase is only R50 million, so that’s a long way down from the September carrying value.

This will in all likelihood lead to another special dividend to RMB Holdings shareholders once the deal is completed.

Workforce suffered major headline losses (JSE: WKF)

This is despite an increase in revenue

Revenue at Workforce Holdings increased by 4% for the year ended December 2023. Despite this, EBITDA came down sharply from R201.1 million to R151.3 million off a revenue base of R4.5 billion. Those are very skinny margins indeed.

It looks much worse at HEPS level, with a drop from 46.8 cents to a headline loss of 13.3 cents per share. There’s no final dividend, which is to be expected when there are losses.

The revenue increase was simply no match for margin erosion and increases in overheads. The company put steps in place to reduce costs, but they were only completed by September 2023. This suggests that a more palatable 2024 may be on the cards.

In general, a low margin company in a volatile market like South Africa is always going to be a rollercoaster.

At York, the assets go up in value and HEPS comes down (JSE: YRK)

The share price has been on a steady slide since 2022

York Timber has released results for the six months to December 2023. Revenue fell 2% and cash generated from operations was down R111 million, so it was another difficult period for the group. HEPS fell sharply from 13.27 cents to 4.67 cents. Core earnings per share deteriorated from a loss of 2.62 cents to 10.06 cents.

Despite the financial performance dropping faster than the trees being cut down for processing, the biological asset value increased by 5%. It strikes me as such a theoretical concept, as we can quite clearly see that extracting value from the trees is far harder than the valuation would otherwise suggest.

There’s no dividend for this interim period, just like in the last period as well.

The outlook isn’t a source of encouragement either, with York noting that the lumber market is expected to remain weak in terms of demand and pricing.

Little Bites:

- Director dealings:

- With the share price at Quantum Foods (JSE: QFH) continuing to run amok from speculation (now up to R13.50), the company announced that director Hendrik Lourens has agreed to buy shares worth R1.26 million for either R9.00 or R10.00 depending on which tranche you look at. Director Wouter Hanekom, acting through an associate, bought R1.7 million worth of shares at R10 per share.

- Following the release of the annual results, the chairman of Kore Potash (JSE: KP2) will subscribe for shares worth $150k. In those results, the company confirmed that it is still targeting the signing of full EPC documentation in Q2 2024, with funding required to help the company reach that point.

- If you’re closely following the MC Mining (JSE: MCZ) offer by Goldway and all the to-and-fro with the independent board, then you’ll want to check out the fourth supplementary bidder’s statement released by Goldway. They are focusing on trying to discredit the work of the independent expert here, which of course underpins the board’s decision to recommend that shareholders do not accept the offer. There’s far too much detail to go into here. If you hold shares in MC Mining, you need to read everything carefully.

- Jubilee Metals (JSE: JBL) released an update on its copper projects and expansion of chrome operations. On the copper side, International Resources Holding in Abu Dhabi has exercised its right to proceed with the formation of the joint venture for the implementation of the Waste Rock Project. At the Roan Project, ramp-up is expected to commence in April 2024. At Project Munkoyo, initial deliveries of copper ore to the Sable Refinery are expected in September 2024. Moving to local chrome and PGMs, the chrome tolling agreements have been extended to February 2027 and the construction of Thutse’s second chrome processing module is on track to commence in August 2024.

- Zeder (JSE: ZED) has appointed PSG Capital and Rabobank as co-advisors to consider any approaches from third parties regarding the investment in Zaad Holdings. This may or may not lead to a formal process to find a buyer. Zeder also confirmed that third parties have made approaches regarding the Pome Division that was excluded from the disposal of Capespan.

- enX (JSE: ENX) announced that the urgent application by Inhlanhla Ventures to try and interdict the general meeting for the disposal of Eqstra has been withdrawn. This means that the meeting will go ahead on 3 April as planned.

- Europa Metals (JSE: EUZ) released results for the six months to December 2023. As this is a resource development company, it shouldn’t really shock you that there are net losses. They came in at A$248k, which is a lot better than A$1.2 million in the comparable period. The company is developing the Toral project in Spain. Of critical important is the funding arrangement with Denarius, which gives that company the option to acquire up to 80% in the Toral project. If you’re investing in junior mining, you need to understand that massive dilution of your equity interest is par for the course, unless you have very deep pockets to help fund the development.

- DRA Global (JSE: DRA) released its annual report and announced a dividend of A$0.11 per share for the year ended December 2023. This is the company’s first dividend since listing. It works out to 136.35 cents per share. For reference, the share price is R22 at time of writing.

- The Foschini Group (JSE: TFG) has announced the appointment of Ralph Buddle as CFO, which relieves Anthony Thunström from the role as executive financial director in addition to being CEO. Buddle was previously interim CFO at Oceana Group and has been in an executive role at The Foschini Group since September 2023.

- Stefanutti Stocks (JSE: SSK) has reached agreement with its lenders to extend the capital repayments profile of the loan as well as its duration to 30 June 2025. This is part of the group’s restructuring plan.

- Sanlam (JSE: SLM) implemented a B-BBEE deal in 2019 that ended up being badly impacted by COVID. These highly leveraged structures depend on dividends and significant share price growth to be successful. When those things don’t happen, they end up underwater. This is what has happened here, with Sanlam looking to buy the shares back from that structure at a nominal value. It’s even worse than that really, as Sanlam had to step in to buy the preference shares from Standard Bank that funded the deal. It’s an expensive outcome for Sanlam shareholders.

- Wesizwe Platinum (JSE: WEZ) does not have any revenue at the moment. The auditors have also made it clear that there are uncertainties around the company’s ability to continue as a going concern, with the group’s existence dependent on ongoing support from the majority shareholder and a willingness not to call the current shareholder loans. Although the loss per tax for the year came down significantly from R134 million in the prior period to R25.2 million in 2023, it was still a substantial loss.

- Randgold & Exploration Company (JSE: RNG) is focused pursuing legal claims and limiting operational costs. It’s not the most inspiring company vision in the world, but somebody has gotta do it. The company reported an operating loss of R30.6 million for the year ended December 2023, worse than R22 million in the prior year.

- SAB Zenzele Kabili (JSE: SZK) released its annual report. The net asset value has increased from R2.26 billion to R2.67 billion, a direct result of a strong finish to the year for the AB InBev share price.

- In order to meet B-BBEE requirements under ICASA licensing provisions, Telemasters (JSE: TLM) is disposing of 30% in major subsidiary Catalytic Connections to the Sebenza Education and Empowerment Trust. This is a Category 2 transaction, so there is no shareholder vote on this. A more detailed announcement with terms of the deal will be released in due course.

- Chrometco (JSE: CMO) is an absolute mess that is suspended from trading. The reporting is running behind schedule and the company is struggling to appoint auditors because subsidiaries are in business rescue. On top of all this, the business rescue practitioner in on subsidiary is even suing another subsidiary! It sounds like only the lawyers are making money here, with the creditors meeting for the business rescue plan to be held on 11 April 2024.

- Afristrat Investment Holdings (JSE: ATI), perhaps the most broken company of all on the JSE, would really like to voluntarily liquidate itself. It can’t though, as a creditor is trying to liquidate it first. Yes, really.

- Deutsche Konsum (JSE: DKR) has basically zero liquidity on the JSE and has announced an intention to drop this listing. Still, in case you are one of the few local shareholders, it’s important for you to know that the company has sold off a large portfolio of properties to try reduce debt and is negotiating with bondholders to extend debt maturities.