Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Another twist in the Ascendis tale (JSE: ASC)

The High Court has given the TRP a bloody nose

The Ascendis story seems to be far from over. After the Takeover Regulation Panel (TRP) released its findings from its investigation, there was a lot of attention in the market on the parties involved. Ascendis quickly released an announcement noting that the company (and the concert parties) disagreed with the findings of the TRP and would consider next steps.

As a first step in rebuttal, Ascendis and the parties applied to the High Court to have the TRP ruling set aside. The High Court gave a nod of approval to this, setting aside the TRP ruling and compliance notice and remitting the matter to the TRP.

The reason? Lack of procedural fairness. Interesting.

The ball now seems to be in the TRP’s court. This dispute is far from over I think.

BHP reflects on the year with an activities report for the final quarter (JSE: BHG)

Production guidance for the full year was achieved for all commodities

BHP is a very large group, so any given year will include highlights and areas with challenges. Be careful when interpreting a statement that production guidance was met. Meeting guidance and having a good time are two different things.

Starting with the good news for the year ended June 2024, WAIO achieved its second consecutive year of record production – admittedly only up by 1%. The other major highlight is the copper business, with total production up 9% and operational highlights including a year of record production at Spence in Chile and positive news from the other copper operations as well. It’s also worth noting that metallurgical coal achieved the upper end of revised guidance.

One of the disappointments of the year has to be the temporary suspension of the Western Australia Nickel operations, as the global nickel market remains in a terribly oversupplied situation, putting continued pressure on nickel prices.

The market will now wait for detailed financial results.

Vukile is on a debt capital markets roadshow (JSE: VKE)

This is useful even for equity investors

Vukile Property Fund is one of the better REITs on the JSE that enjoys strong support among institutional investors. Being able to raise equity capital is only half the battle won, as REITs require ongoing support from debt providers as well. This is why Vukile is on a debt capital markets roadshow, with the full presentation available here for anyone interested.

One of the key points is that Vukile has achieved considerable geographical diversification, with 61% of the assets located in Spain. The portfolio is yielding 6.6% in Spain (that’s in euros) and 8.7% in South Africa, obviously in rands.

Within South Africa, what makes Vukile interesting is the exposure to the township and rural economies. The group has very little exposure to the Western Cape, with most of the properties up north and focused on retail opportunities in lower income areas that offer strong growth prospects. Importantly, the South African portfolio is currently enjoying positive reversions.

There are a large number of really interesting, detailed slides and charts in the presentation. If you’re interested in property, then I recommend reading it.

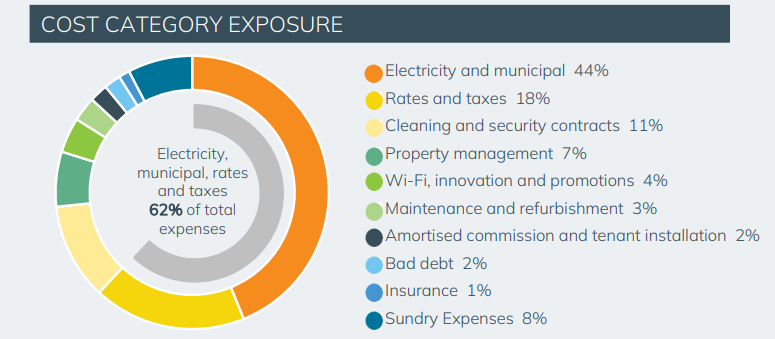

Where else have you seen detail like this:

With a loan-to-value ratio of 40.7% and a debt maturity profile of 2.9 years, Vukile is not having urgent discussions with debt providers. Instead, they are ensuring ongoing support from the market and an understanding of the Vukile model and risks, supported by the corporate long-term credit rating of AA(ZA). This is ahead of a plan to access the debt market in August via a public auction, with the proceeds intended to be used to repay corporate notes maturing in FY25.

Little Bites:

- Director dealings:

- A director of a subsidiary of Insimbi (JSE: ISB) has been selling shares for a little while now. The latest sale is for R85.5k worth of shares.

- A director of Visual International (JSE: VIS) bought shares worth R47k.

- Riskowitz Value Fund is buying 1.3% of the shares in Trustco Resources, a subsidiary of Trustco (JSE: TTO). Trustco talks about how this is an injection of capital into Trustco Resources, yet the deal is described as an acquisition of shares rather than a subscription for new shares. Either way, the deal is worth $4.55 million. An independent expert has determined the deal terms to be fair. As a small related party transaction, such an opinion was a prerequisite for the deal.

- Spear REIT (JSE: SEA) announced that the Competition Commission has approved Spear’s acquisition of Emira’s (JSE: EMI) Western Cape portfolio, subject to certain conditions that are acceptable to Spear.

- If you’re a Sygnia (JSE: SYG) shareholder and you would like to read the circular about the proposed share option scheme for staff, you’ll find the circular here.

- Grindrod Shipping (JSE: GSH) announced that the High Court of the Republic of Singapore approved the proposed selective capital reduction of the company, which is basically just a clever way to use the company’s balance sheet to take out minority shareholders and pay them $49.6 million – or $14.25 each.