Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Is the Ascendis story coming to an end? (JSE: ASC)

A consortium led by Carl Neethling might be taking the company private

Hot on the heels of its trading statement, Ascendis announced that a consortium led by Carl Neethling is in discussions with the company regarding a potential take-private. The crummy news for minority shareholders is that if there is an offer, it is “not expected to be at a significant premium” to the current traded price of 69 cents a share.

No formal offer has been made at this stage. It’s very unusual to see an offer at a low premium, so it will be interesting to see how this plays out.

Net asset value per share inches higher at Ethos Capital (JSE: EPE)

Pressure on the Brait share price has let the team down

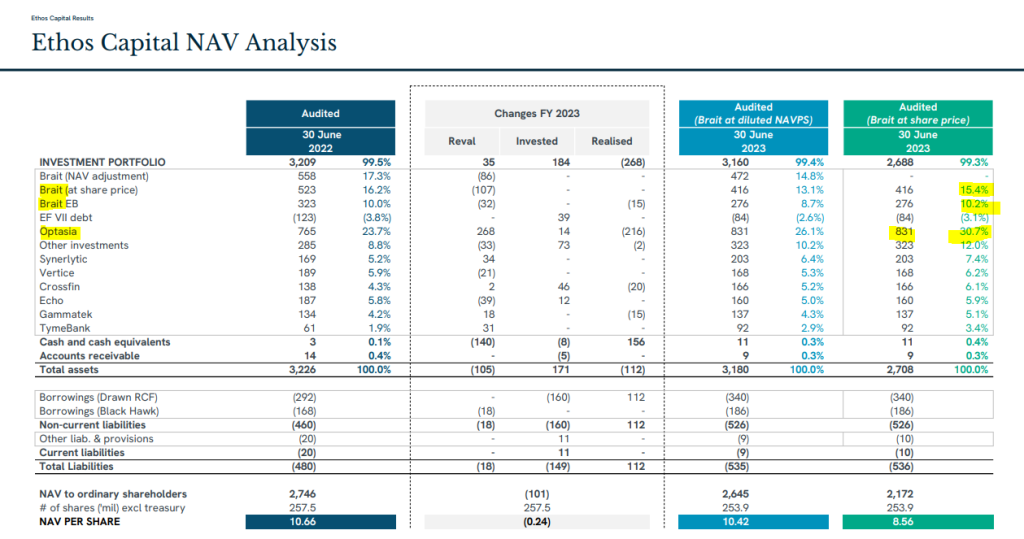

For the year ended June 2023, the net asset value per share of Ethos Capital increased by a paltry 0.8%. This is based on the Brait share price rather than Brait’s underlying net asset value. MTN Zakhele Futhi hasn’t helped either, with major drops in the listed portfolio that offset the 14% return in the unlisted portfolio.

I must point out here that the unlisted portfolio is the opinion of management, whereas the listed portfolio is the opinion of a market. You can figure out for yourself which one carries more weight. It does help that there was an equity deal in Optasia that helps confirm the value of the largest of the unlisted investments, driving a small uplift in the average valuation multiple in the portfolio.

Here’s the summary of net asset value per share, in which I’ve highlighted Brait and Optasia to show the combined contribution of 56.3% to group assets.

If you want to dig into this in great detail, you’ll find the results presentation at this link.

The current share price is R4.25, so the discount to the NAV per share of R8.56 is over 50%.

You have to read Grand Parade’s numbers carefully (JSE: GPL)

There are many once-offs and distortions

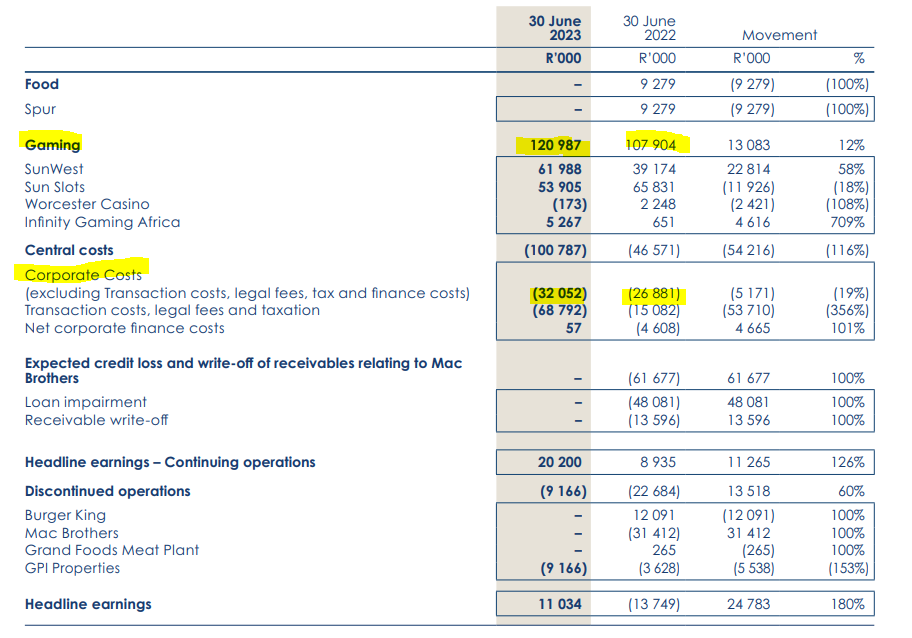

Grand Parade’s numbers are tricky. There has been a great deal of corporate activity, including the unbundling of the stake (steak?) in Spur and various restructuring transactions. The base period includes a number of discontinued operations, like Burger King and the disaster that was Mac Brothers.

The split between continuing and discontinued operations doesn’t even tell the right story, as Spur gets included in continuing operations and so do loans to Mac Brothers.

To help you look through the noise, I’ve included this table showing the contributions to headline earnings. Gaming grew by 12%, with around half of that amount in absolute terms going into increased corporate costs.

The group is now exclusively focused on the gaming sector, including “robust oversight” of its existing gaming investments, whatever that practically means.

Investment flows at Old Mutual are a sign of the times (JSE: OMU)

Inflation and high interest rates are eating into savings

Old Mutual has released results for the six months ended June. This includes the adoption of IFRS 17, which means major distortions and accounting restatements.

I’ll try and ignore the IFRS nonsense and focus on the operational metrics instead. Life APE sales excluding China grew by 14%. They were only up 1% including China, as the base period included product sales that were subsequently discontinued in anticipation of regulatory channels.

The value of new business margin increased to 2.6%, putting it within the medium-term target range of 2% to 3%.

Although gross flows grew by 17%, net client cash outflows of nearly R7.3 billion were worse than the prior period because clients needed to access their funds to survive these economic conditions. Despite this, funds under management grew by 6% to R1.3 trillion, supported by equity market performance.

Return on group equity value was only 10.5%, which is way below the performance of banking groups in South Africa. Return on embedded value in the Life and Savings business was 13.9%. The group uses a couple of other metrics, like return on net asset value of 11.9% and core return on net asset value of 13.1%.

I don’t really care which of those metrics you use, performance is still well below our local banks. Growth also isn’t exciting, with results from operations at Old Mutual only up by 3%. In this environment, would you rather be lending money to consumers or hoping they save and invest with you?

The group equity value per share is R18.806 and the share price is R12.10, so the market is quite correctly valuing Old Mutual at a discount. This discount is why the year-to-date share price performance of over 15.5% actually beats local banks. Like everything in investing, it comes down to valuation.

The Rebosis fire sale continues (JSE: REA | JSE: REB)

The selling price is way below the recent valuation

As you are probably aware by now, Rebosis is in business rescue and has been executing a “public sale process” to try and sell as many properties as possible to pay down the debt.

The latest such sale is to Katleho Property Investments, a subsidiary of Heriot Investments. The portfolio being sold is four office buildings, three of which are in Ekurhuleni and the other is in Midrand. The portfolio was valued at R291 million on 1 April 2023.

Perhaps that was an April Fool’s valuation, as the actual selling price is R160 million. Based on net operating income, the implied yield is a whopping 26.8%. Rebosis has practically given these properties away. A desperate seller is a terrible thing.

Unless you’re the buyer, of course.

York Timber has given far more detailed guidance (JSE: YRK)

At least cash from operations is positive, if we are looking for silver linings

York Timber has released an updated trading statement that gives a much tighter range for HEPS. Importantly, it also gives guidance for EBITDA and cash from operations.

I’ll start with HEPS, which is shouting timberrrrrr all the way down from 53.30 cents to a loss of between 73.27 cents and 77.00 cents for the year ended June. If we strip out various items (including biological asset fair value movements), we find EBITDA coming in between 58% and 63% lower than the comparable period. Cash from operations is also on the right size of zero at least, despite being between 48% and 53% lower.

Even without the biological asset fair value movements that cause big swings in earnings, this was a poor period for York.

Wesizwe Platinum nosedives (JSE: WEZ)

The headline loss is much higher than the comparable period

With unprotected strike action and ongoing pain in the PGM sector, this was never going to be a happy financial update from Wesizwe Platinum. Still, the extent of the loss is quite breathtaking, especially as this is an interim period.

For the six months to June, the headline loss per share has vastly deteriorated, coming in at between 59.22 cents and 60.04 cents. The loss in the comparable period was just 4.09 cents.

Keeping in mind that the share price is only 76 cents, this isn’t looking good.

Little Bites:

- Director dealings:

- I usually ignore sales by directors related to vesting of share options. Half of the Woolworths (JSE: WHL) announcement related to those types of sales. The other half was very interesting, with a director of the holding company selling shares worth R1.7 million and a director of the operating subsidiary selling shares worth a massive R19.1 million,

- A director of Liberty Two Degrees (JSE: L2D) has sold shares worth R1.57 million.

- A director of Novus (JSE: NVS) has sold shares worth R608k.

- I’m not sure these are director dealings in the truest sense of the word, so I’m showing them separately. Three directors of Nampak (JSE: NPK) were announced as having followed their rights in the rights offer. Andre van der Veen (part of A2 Investment Partners) is obviously the largest, with an investment of over R72 million.

- Heriot Investments has been busy. Not only has the company bought the Rebosis properties at a bargain price, but it has also transferred a 10.02% stake in Safari Investments (JSE: SAR) to its subsidiary, Thibault REIT Limited. This is only relevant because Thibault has applied for a listing on the Cape Town Stock Exchange.

- AYO Technology (JSE: AYO) renewed its cautionary announcement related to the settlement agreement with the PIC. The company says that the parties have made significant progress in finalising the terms of the settlement agreement to ensure compliance with the JSE Listings Requirements.

- Conduit Capital’s (JSE: CND) disposal of subsidiaries CRIH and CLL continues to hang in the balance, with the closing date for fulfilment of conditions extended yet again, this time to 31 October.

- Basil Read (JSE: BSR) is currently in business rescue. The CEO of the company has resigned, so that doesn’t do much to help with stability. An acting appointment has been made internally.

- Sable Exploration and Mining (JSE: SXM) has a share price of just 6 cents per share. It’s therefore not ideal that the headline loss per share for the six months ended August is between 65 cents and 75 cents per share! It’s worse than the comparable period, despite the company claiming that the loss has decreased. The maths is not mathing at this company.