Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Astoria has experienced a dip in NAV per share (JSE: ARA)

This is always the right metric to consider for an investment holding company

Between 31 December 2023 and 30 June 2024, investment holding company Astoria’s net asset value (NAV) per share declined by 3.5% in rand. With a diversified portfolio across several industries, the move in NAV is always a function of the underlying changes in investment values.

The largest investment is Outdoor Investment Holdings, comprising 47.9% of NAV. The valuation is up 7.3% based on higher profits and lower debt in the business. Next up is Trans Hex Marine at 18.4% and Trans Hex at 5.6% of NAV, where diamond prices seemed to buck the trend for the broader industry. Although production was below budgeted levels, diamond prices picked up the results and the valuations increased. The other uptick in value was at ISA Carstens, which is only 8.4% of NAV.

On the negative side, valuation declines were experienced at Goldrush, Leatt and VCG. Goldrush is separately listed as part of RACP (the name is changing) and is valued based on the listed share price. Leatt is valued on the same basis, with the share price having come under great pressure in an overstocked market for their products. VCG is a private company that is small in the broader context, contributing 5.2% of NAV.

Although the group NAV is higher, the dip on a per share basis is because of the purchase of additional Leatt shares during the period and the associated issuance of Astoria shares. The net asset value per share is R14.04 and Astoria is currently trading at R7.80, a discount to NAV per share of around 45%.

Exxaro Resources has experienced a major drop in earnings (JSE: EXX)

If you’re investing in resources, you have to be ready for volatility

In the mining sector, volatility is practically guaranteed. The price of commodities will fluctuate and then earnings will typically fluctuate by a higher percentage due to the operating leverage (fixed costs) in the mining groups. The volatility is even worse for mining groups focused on only one or two commodities rather than a basket of commodities.

So, painful as it is to see Exxaro’s HEPS for the six months to June decrease by between 31% and 45%, these are not unusual numbers in the industry. Coal and iron ore prices weren’t favourable and there were other issues, like logistical challenges and reduced offtake from Eskom.

Detailed results are due on 15 August.

Gold Fields isn’t shining right now (JSE: GFI)

The company hasn’t taken advantage of strong gold prices

Gold Fields released a trading statement for the six months to June that doesn’t tell a great story at all. Despite gold counters doing really well at the moment, the mining group will report a drop in HEPS of 25% to 33%. Sadly, production issues have ruined what should’ve been a strong result.

There are various reasons for this, ranging from rainfall at one of the mines through to a delayed ramp-up at Salares Norte. This caused gold volumes to drop by a nasty 20%, with the company hoping for improvement in the second half of the year.

This is a very hard lesson about gold: if you want to buy that theme, do not just go and stick your money in one gold mining group. There are way too many variables in mining.

Jubilee Metals has happy news about the Roan Project (JSE: JBL)

Operations have commenced at the newly constructed front-end upgrade project

Jubilee Metals must be feeling good about sharing the news that operations have commenced at the Roan front-end upgrade project in Zambia. This project increases the overall capacity of Roan to a maximum design of 13,000 tonnes of copper per annum.

They are also busy with the Sable refinery upgrade project, with the combined processing capacity targeted to reach 25,000 tonnes of copper per annum over the next 12 months.

Zambian copper is a huge opportunity for Jubilee, with the resources classified into three groups: previously processed material (e.g. tailings), previously mined material (e.g. stockpiled low grade material) and open-pit mining of near surface copper reef. Roan will focus on the previously processed and mined materials, while Sable is being built as a dedicated refiner for the processing of open pit operations such as Munkoyo.

Importantly, Roan and Sable are independent operations that are part of the broader strategy.

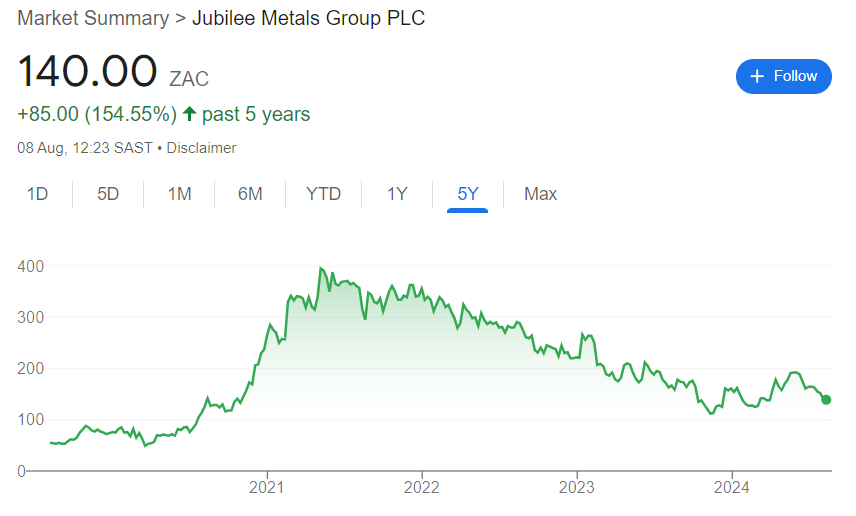

The Jubilee share price has been a wild ride:

Orion Minerals has been granted two prospecting rights (JSE: ORN)

This is part of the Okiep Copper Project

After a three-year process, Orion has been granted prospecting rights over the greater Flat Mines Area. This is an important milestone at the Okiep Copper Project, with the company able to access this prospective ground thanks to the recent acquisition of surface rights over some of the area covering these prospecting rights.

Junior mining is a complicated world that I have a limited understanding of, but this does sound like good news. For the geologists among you, the next step will be results from drilling activities at new targets that Orion can now gain access to.

Sappi’s latest numbers have been skewed by tax (JSE: SAP)

Strong growth in EBITDA hasn’t translated into any HEPS growth at all

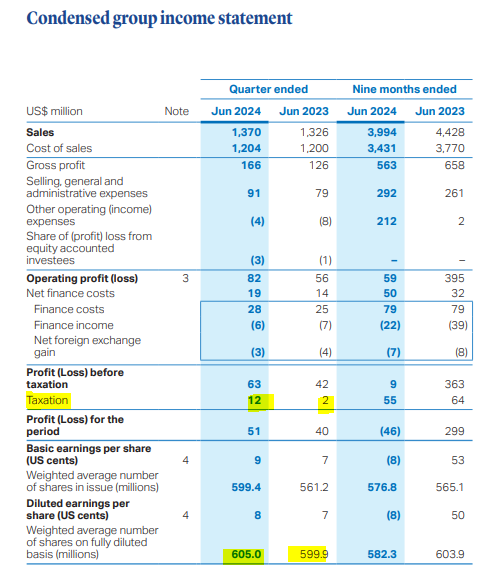

Sappi is a cyclical business of note, so seeing substantial percentage movements is actually nothing new. For the latest quarter, sales were only up by 3% and yet EBITDA excluding special items was 42% higher. That sounds exciting, but HEPS appears to be flat for the period at 7 US cents for the quarter. That warrants a more careful read, especially since it wasn’t flat. Sappi just didn’t highlight that fact and instead used lazy rounding off of numbers.

Before we dive into that, it’s worth noting the nine-month results for context. Over the three quarters, revenue is down 10% and EBITDA excluding special items is down 13%. The group has made a loss of -8 US cents per share vs. a profit of 53 US cents per share in the comparable period.

Complicated, isn’t it?

To make sense of this, we need to go past the SENS announcement and into the financials themselves. I was expecting to see finance costs as the cause of the disconnect between EBITDA and HEPS, as that is usually the culprit. Instead, I found an odd taxation move:

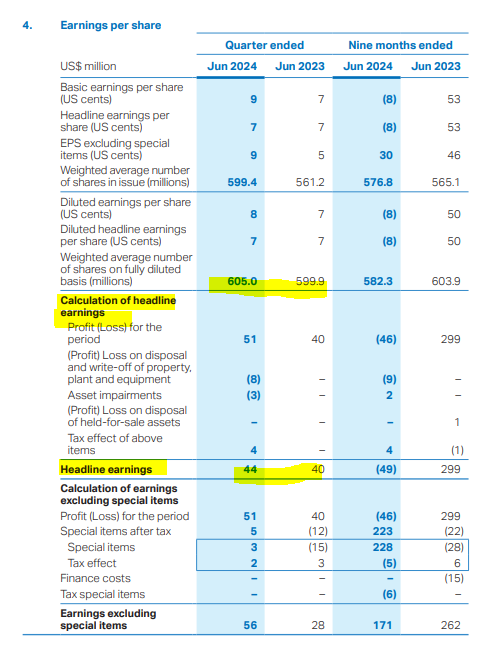

The tax expense in the comparable quarter was just $2 million vs. $12 million in this quarter. Tax calculations are complicated things and it’s possible to see different effective tax rates, but that’s the main reason why operating profit growth of 46.4% only translated to 27.5% growth in profit for the period. This still doesn’t explain why HEPS is “flat”, which is why I highlighted the weighted average number of shares at the bottom of the income statement. This tells us that there are more shares in issue on a diluted basis (taking into account share options etc.) and this impacts HEPS. But it still doesn’t have the full answer.

For that, we must go hunting for the earnings per share note:

Not only does this reinforce the number of shares outstanding, but it shows us that the big jump in profit for the period has only translated into 10% growth in headline earnings. This is because headline earnings ignores things like profit on disposal of properties and other things. The market uses HEPS because these distortions come out.

Still, why is HEPS flat? If headline earnings increased 10% and there were only a few extra shares in the calculation, how can it be flat? The answer is that it’s only flat if you round off to the nearest cent. The comparable period is actually 6.7 cents and this period was 7.3 cents. I find it quite odd that Sappi didn’t highlight this in the SENS announcement, as it’s an important point.

Looking at the operations, the packaging and textile markets showed some improvement and the graphic papers market could only manage a gradual recovery. Volumes and prices tend to be volatile in these markets, making it really difficult to forecast what the performance might end up being at Sappi. It’s even difficult for them to form an accurate view, as there are just so many moving parts that include logistics costs as well.

Where there’s no debate is around the net debt number, which has improved vs. the preceding quarter by $26 million. It’s still 14% higher than it was a year ago, which means the net debt to EBITDA ratio has jumped from 1.2x to 2.0x. The inflow of cash from the disposal of the Lanaken Mill will help reduce this further.

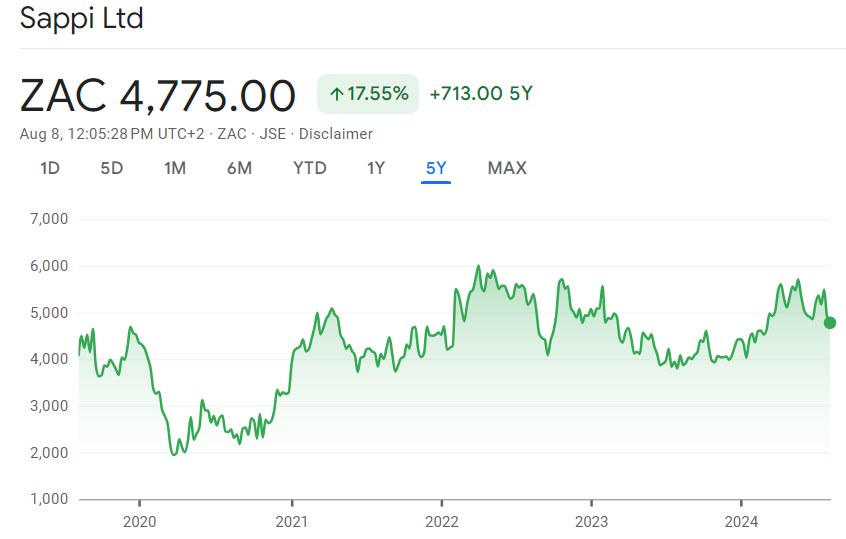

As you can see from the share price chart, it’s been a choppy few years with no obvious indication that Sappi will reward investors with share price growth. This does exclude dividends of course, with Sappi currently trading on a trailing dividend yield of 5.85%.

Little Bites:

- Director dealings:

- The CEO of Prosus (JSE: PRX) bought shares in the company worth over R80 million in an “on market trade” – and although a deeper read identified some allocations of performance units as a separate thing, I engaged with the company and it appears that he did indeed buy these shares in a trade that was distinct from performance units. That’s a huge purchase of shares.

- Aside from stock option sales, it looks like two executive directors of Richemont (JSE: CFR) sold shares worth around R65 million.

- A director of Clicks (JSE: CLS) bought shares in the company worth R992k.

- An associate of a director of a major subsidiary of PSG Financial Services (JSE: KST) bought shares in the company worth R594k.

- The company secretary of Oceana (JSE: OCE) has sold shares worth R346k.

- An associate of a director of Spear REIT (JSE: SEA) bought shares worth R21k.

- South Ocean Holdings (JSE: SOH) is a R540 million market cap company that has nothing to do with fishing. Instead, they are mainly involved in the manufacturing and distribution of electrical cables and other industrial products. Revenue for the six months to June increased by 5.7%, yet HEPS was down 10%. The culprit was a significant jump in administrative expenses and finance costs.

- Is Mantengu Mining (JSE: MTU) throwing good money after bad, or is there a smart tactic at play here? We will have to wait and see, with the company announcing the acquisition of the mining right from New Venture Mining Investment Holdings that was initially supposed to be acquired by Birca Copper as part of that deal. They’ve also entered into a sale and contractorship agreement that will entitle the Mantengu subsidiary to mine and process chrome ore in the interim period. The mining right is worth R7 million and the agreement is worth R10.3 million. It seems that they are basically going around the disastrous Birca entity to get their hands on the real assets in this deal, while working with lawyers to unscramble the Birca egg. Not easy.

- Here’s an interesting one: Prosus (JSE: PRX) and Naspers (JSE: NPN) CFO Basil Sgourdos will retire from 30 November 2024. He’s been with the group for 29 years and has been CFO of Naspers since 2014. He was appointed a CFO of Prosus when it listed in 2019. No successor has been named as of yet. Combined with the recent change in CEO as well, it’s a big year for the group and its executive team.

- Citing personal circumstances, Astral Foods (JSE: ARL) CEO Chris Schutte has indicated an intention to retire a year early. He has been in the top job at Astral for 16 years, surely one of the most stressful industries to be in. He will consult for a year to the group to assist the incoming CEO. The new CEO hasn’t been announced yet.

- Trustco (JSE: TTO), never shy to take on a corporate structuring opportunity of some kind, has decided to upgrade its US ADR program from Level 1 to Level 3, which means the ADRs could be listed on the Nasdaq or New York Stock Exchange. This is the same company that told the world that it dislikes being listed because of all the regulations on the JSE.

- I’m not close to the intricate details of the Tongaat Hulett (JSE: TON) business rescue plan, but be aware that shareholders did not approve the equity subscription that would’ve seen Vision Investments end up with 97.3% of total shares. As this was voted down, the plan will now be implemented on the basis of a sale of the company’s assets as a going concern to the Vision consortium.