Astral + Eskom = profit shedding (JSE: ARL)

There’s no room for error with skinny margins in the poultry industry

This sector isn’t for chickens. When you’re dealing with very small net profit margins, the law of small numbers means that modest changes in ratios further up the income statement (e.g. a seemingly innocent drop in gross margin) can have a massive percentage impact at net profit level.

This leads to earnings volatility and a potentially wild ride for investors. In a country like South Africa that dishes up so many challenges, it’s more like riding a wild stallion than just an erratic donkey.

After alerting the market to its current troubles in January, Astral has updated its guidance with a trading statement for the six months ended March 2023. HEPS is expected to decrease by between 87% and 92%. The only positive here is that this means that the company is still profitable, if only just!

Aveng banks the Trident Steel disposal (JSE: AEG)

There’s no feeling quite like money in the bank, right?

It’s one thing to agree to a transaction. It’s quite another to open up the online banking platform and see cold, hard cash in the account. This is especially true when the inflow is over R1.2 billion!

Aveng’s disposal of Trident Steel was a “locked box” deal based on the 30 June 2022 balance sheet. This means that the balance sheet is frozen in time for purposes of the deal value. The alternative is to work with a post-completion adjustment, which adjusts the purchase price for the state of the balance sheet when the asset finally changes hands.

This was perhaps a “semi-locked box” if such a thing exists, as there are working capital adjustments that applied. There was also a “ticking fee” which is an interesting thing that is a sign of the times in terms of the cost of funding. This fee increases the selling price based on how long it takes the deal to complete.

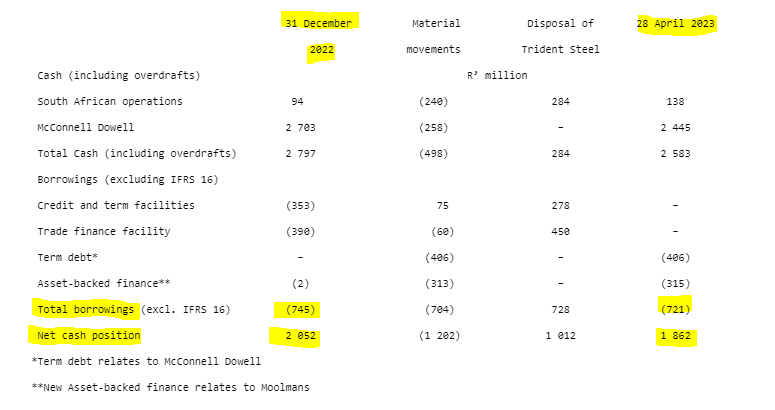

With all said and done, Aveng has received just over R1.22 billion. R700 million was the actual purchase price, R264 million was net cash retained by Aveng, R75 million was the ticking fee and R183 million was the return of additional liquidity that was previously provided to the business to fund growth.

Be careful here, as some of this cash was obviously already inside the Aveng group. It’s not as though a fresh inflow of R1.22 billion took place at group level. This was the total amount received by the Aveng group holding company, with a smaller (but still very important) amount received on a net group basis.

You should also take note that Aveng has provided a loan of R210 million to facilitate a 30% subscription in the equity of the business that is reserved for B-BBEE participation. Remember, R700 million was the actual purchase price, hence 30% is R210 million. Interest is payable on the loan of 17%, which is a much better return than Aveng has historically achieved for shareholders!

The intention is to find a B-BBEE party who can come into the deal and take Aveng out within 12 months.

Aveng’s share price closed over 5% higher as the market celebrated the news that Aveng no longer has any legacy South African debt. At one point, it peaked at R3.3 billion! It certainly hasn’t been all good news lately, as the McConnell Dowell subsidiary in Australia has had to increase its debt to R406 million in respect to a project guarantee call. That debt is expected to be settled in full by June 2024.

It’s a complicated story, so I’ve included this table from the announcement with my highlights on it to guide you:

In one pocket and out the other, basically.

Calgro M3 puts out a strong trading statement (JSE: CGR)

The market liked it, closing 7% higher on the day

For the financial year ended February 2023, Calgro M3 delivered a strong performance across both its divisions and it shows in the numbers. HEPS will be between 147.90 cents and 158.46 cents, reflecting growth of between 40% and 50%. With the share price having closed at R3.00 on the day, it trades on a P/E multiple of roughly 2x!

It’s going to take time for Calgro M3 to trade at a higher multiple, as investors have been burnt before by erratic earnings. For value investors who love digging into stocks at low multiples, this surely has to be on the research list.

This is especially true when the construction and handover of properties was in line with expectations in 2023, with the company talking about “sustainable returns” in the year to come. Another useful update is that a new burial product has been introduced in the Memorial Parks business, with more success than the previous efforts. The Memorial Parks segment delivered its best final quarter to date.

The company also managed to effect a major share repurchase on a single day, with shares worth R15.4 million repurchased at R2.20 per share. This was through the JSE order book, so the seller wasn’t aware (in theory at least) that Calgro was on the bid. In practice, brokers sometimes do some work behind the scenes to get the trades away for their respective clients.

This repurchase represents 4.99% of issued share capital at the time that the general authority for a repurchase was granted. Up to another 10.73% of shares may be repurchased under the existing authority, which is valid until the next AGM.

That seller must be mildly irritated about the share price movement since that sale, though I would caution that the bid-offer spread can be horrific in illiquid stocks, especially when trying to sell a significant volume of shares.

CMH is still purring like a V8 (JSE: CMH)

For how long can this continue?

CMH has been one of the unlikeliest winners of the aftermath of the pandemic. At a time when people lost their jobs or took pay cuts after companies dug into reserves to survive the worst lockdowns, CMH has somehow been finding a way to make an absolute fortune. This is despite consumers paying far more for petrol and food.

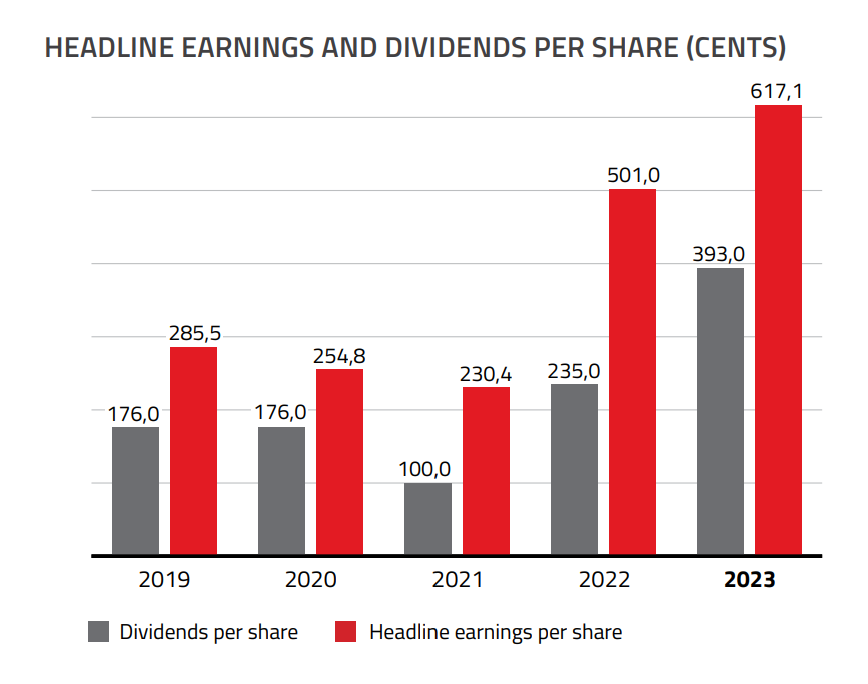

I understand that supply chain constraints were rather useful in boosting car prices, but a chart like this is just ridiculous:

At revenue level, the sale of vehicles is still the bulk of the business, contributing 92% of revenue. Car hire made a huge comeback in the past financial year, with revenue up 82%. Thanks to economies of scale in that business as it bounced back, car hire profits more than doubled from R116 million to R269 million.

This is where we get to the most interesting thing about CMH. Because of the vast difference in segmental margins, car hire may only contribute 7% of revenue but it also contributes 43% of profit before tax!

A recovery in tourism helps the car rental business. The ongoing collapse of Uber in South Africa certainly helps too, with no shortage of complaints on Twitter about how erratic the service has become. Still, I am amazed that car sales are holding up like this, as I expected that side of the business to suffer.

After a couple more interest rate hikes, we will surely see a slowdown in performance.

The dividend declared per share has increased by only 6.7%, despite the company choosing to focus on dividends paid this year (a timing thing) which was 67% higher. Nothing like a factor of 10x difference when trying to drive a particular narrative, right?

With HEPS up 23.2% and the dividend declared up by 6.7%, management is getting tighter with cash. I would be doing the same if I was in their position.

MTN Uganda releases quarterly results (JSE: MTN)

The results of the African subsidiaries are always worth reviewing

MTN Uganda is nowhere near as important as MTN Nigeria that I covered a few days ago, but it’s still worth looking at the underlying numbers.

For the quarter ended March, revenue grew strongly across all the major lines: service revenue +15.8%, data revenue +25.7% and fintech revenue +20.7%. In contrast to what we’ve seen elsewhere in telecoms, EBITDA margin actually expanded by 40 basis points to 52.0%.

Capital expenditure fell by 16.3%, driving a huge drop in capex intensity (capex divided by revenue) of 600 basis points to 15.2%. This is now within MTN Uganda’s target range, so the base period was simply an outsized capex number. That bodes well for free cash flow generation, although capex intensity is expected to rise over the medium-term as investment is accelerated.

Rebosis shows the value of a working email address (JSE: REA)

No, really. It helps when people can contact you.

Rebosis is in business rescue and “rescuing” a property fund isn’t exactly rocket science. There are buildings and there is debt against them. The only way to try and save any kind of equity for shareholders is to try and sell off the portfolio at maximum prices and settle the debt. If there’s a sliver of value left after that, shareholders would get something.

To achieve this, you need a slick sales process. It didn’t get off to a great start, with a truly embarrassing announcement in April that the email address for prospective buyers to register their interest didn’t work for a couple of days. Thankfully, it seems as though buyers had enough perseverance to resubmit their interest, as a “number of participants” have been given access to the virtual data room. Site visits will also be made possible for qualifying potential buyers.

As for the identify of the buyers, this is of course a secret. The fund has indicated that “several listed and unlisted retail-focused property groups” have indicated interest in properties in the fund. That’s no surprise, as Rebosis is a desperate seller and every buyer loves a desperate seller.

Little Bites:

- Director dealings:

- GMB Liquidity Corporation is happily mopping up further shares in Grand Parade Investments (JSE: GPL), with several trades worth over R1.75 million in total.

- An associate of a director of Astoria (JSE: ARA) has bought shares worth R1.06 million.

- A number of Brimstone (JSE: BRN) directors have cashed in on a specific repurchase of N ordinary shares by the company that were granted as part of a forfeitable share plan. This looks to me like a liquidity mechanism for management to sell shares at the 30-day VWAP.

- It sounds like a small change, but Tsogo Sun Gaming Limited (JSE: TSG) is looking to change its name to Tsogo Sun Limited. In case you aren’t concentrating, the drop of “gaming” from the name signifies the diversified holdings in various entertainment offerings. Well, that’s according to the company at least. I suspect that is says more about the future strategy than the current portfolio.

- In case you’re following the progress of Castleview Property Fund (JSE: CVW) as essentially a listed shell for a much larger transaction, you’ll be interested to know that shares worth nearly R270 million have been issued to the subscribers under a specific issue of cash at R6.48 per share. A further R40 million in shares is expected to be issued in July 2023.

- The new CFO of Accelerate Property Fund (JSE: APF) has been announced. Marelise de Lange has prior experience as CFO of Texton Property Fund, Rebosis Property Fund and Delta Property Fund. I guess that’s an interesting path, if nothing else. The most recent role was as CFO of Delta, so that fund is now looking for a new CFO.