Attacq alludes to two-pot benefits (JSE: ATT)

It’s about time that companies started acknowledging this boost

As we’ve seen in company announcements this year (Mr Price and Lewis in particular, as well as Vukile further up the value chain – all covered recently in Ghost Bites), the two-pot system seems to have made a big difference to semi-durable consumer categories in the final quarter of 2024. The money went into clothes and homeware, with Attacq now giving us another important data point for this discussion. Attacq even takes the step of acknowledging the two-pot boost, noting that the Homeware, Furniture and Interior category at its malls grew beautifully in October and November. Apparel also put in a double-digit performance in November.

Overall, Attacq’s retail portfolio saw turnover growth of 8.8% in November and 3.2% in December. There were four weekends in December 2024 vs. five weekends in December 2023, so this likely contributed to a muted December relative to November. The bulk of the growth was therefore seen around the Black Friday period rather than over the Christmas period. For example, Mall of Africa as the most important asset saw growth of 10% in November and 5.7% in December.

Retailers (and their landlords) saw the benefit of two-pot liquidity at the end of 2024.

AVI squeezes out margin gains despite minimal revenue growth (JSE: AVI)

The company has a strong reputation for doing this

AVI has released a trading statement for the six months to December. Group revenue could only manage 1.1% growth, although there are much larger swings at segmental level.

The largest division is Food & Beverage, up 3.1% as a decent outcome. The star performer was Entyce Beverages, the third-largest segment, with growth of 8.1% thanks to price increases. Special mention also goes to I&J with growth of 3.9% thanks to better selling prices that offset the impact of poorer catch mix.

On the negative side, Snackworks (the second-largest segment) fell 1% due to a strong base period. Fashion Brands was down 6.9%, a really disappointing result given the strong performance we’ve seen from some clothing retailers towards the end of 2024. Personal Care fell 6.1%, so the smallest segment got even smaller.

Although the group revenue result isn’t impressive here, the margin performance certainly is. They haven’t given exact percentages, but the management narrative is that there was “sound growth” in operating margin thanks to higher gross profit margins and tight control over expenses. Net finance costs were marginally higher than last year, so most of this benefit reaches the bottom line.

With all said and done, HEPS is expected to be 8% to 10% higher for the period. To generate that kind of growth from a revenue increase of just 1.1% is really impressive.

There’s a pot of gold at the end of Rainbow Chicken (JSE: RBO)

The latest trading statement shows the recovery

Rainbow Chicken has released an initial trading statement for the six months to December. The percentages in question are a bit crazy, with HEPS expected to be at least 1,100% higher!

It’s hard to visualise that, so I’ll give you the HEPS number in cents as well. In the comparable period, they managed just 2.46 cents. In this period, they expect at least 29.55 cents.

There are a number of reasons for this, many of which relate to the operational metrics in the business. They’ve also been given a helping hand by lower input costs thanks to reduced commodity pricing, as well as the magical disappearance of load shedding and fewer avian influenza costs. On top of all this, finance costs are lower as well.

The share price is R3.76, so annualising this interim result (an extremely dangerous thing to do but useful for context) suggests a forward P/E of 6.4x. Full results are due for release on 7th March.

Renergen issued a chunk of shares (JSE: REN)

This isn’t exactly at favourable pricing

Renergen finds itself in such a tough spot. The company needs to keep raising capital in order to fund its projects, but the share price has been one-way traffic as the market has bailed on them based on production delays and other weirdness around the company, like the dispute with Springbok Solar that is due to go to court soon.

Down well over 50% in the past 12 months, this creates an even bigger problem for shareholders as this forces Renergen into a scenario where they have to issue shares at depressed prices. This is highly dilutive to existing shareholders. This snowball effect is going to continue until there’s a material improvement in the market’s trust in the Renergen story. Sadly, growth companies are all about storytelling. When the story goes the wrong way, things can unravel quickly.

This is why Renergen has had to issue shares representing 5% of shares in issue at a price of R5.33. This is a discount of 10% to the 30-day weighted average share price. It says something about the recent trajectory that it’s above the spot price!

Another powerful local result from Shoprite (JSE: SHP)

And this is despite only modest food inflation

The juggernaut that is Shoprite continues to work its magic. For the six months to 29 December 2024, group sales from continuing operations (i.e. excluding furniture) increased by 9.6%. Within that, Supermarkets RSA (almost 84% of group turnover) put in another double-digit performance, growing by 10.4%. Supermarkets non-RSA grew just 4.1% and other operating segments were up 6.2%.

There was a slowdown into the end of the year, with Q2 growth at Supermarkets RSA of 9.6% vs. Q1 growth of 11.4%. Still, it’s a tremendous outcome, particularly when viewed in the context of food inflation of just 1.9% vs. 7.7% last year. This means that they achieved substantial growth in volumes, once again picking at the carcass of struggling competitors.

Checkers Sixty60 grew by 47.1%, so the army of turquoise scooters is only growing from here.

Interestingly, it was the higher-income formats that really shot the lights out. Checkers and Checkers Hyper grew 13.5%, whereas Shoprite and Usave were only up by 6.7%. Importantly, that mid-single digits performance is still very decent when viewed in isolation. It just looks unimpressive relative to the Checkers performance.

In terms of new formats, they’ve clearly got the hammer down on Petshop Science. 53 new stores were built, taking the total to 128 stores. Checkers Outdoor added 11 new stores (now 26 in total) and Uniq grew by 11 stores to 30 stores. Little Me is taking its first steps very slowly, with just one new store to take the total to 12 stores. It must be a fun job to have responsibility for these smaller chains, with the ability to grow them as incubated businesses within the Shoprite group.

Within other operating segments, we also find important formats like OK Franchise (up 8.8%) and the new Medirite Plus standalone pharmacies. There are now 17 such pharmacies and they operate distinctly from the 122 in-store pharmacies.

Moving on, Supermarkets non-RSA was impacted by currency translation effects. Constant currency sales grew 17.9% vs. reported sales of 4.1%. They increased the store base by 10 stores to 269 stores across nine countries.

The furniture business is being disposed of to Pepkor and is awaiting Competition Commission approval. They haven’t given any further details on the financial performance of that division at this stage.

The release of results is scheduled for 4th March. Given the lack of load shedding and the ongoing strong turnover growth, I suspect that the jump in profits will be substantial.

Tiger Brands will only roar at home (JSE: TBS)

The company is selling its stake in South American business Empresas Carozzi

I’ve been writing recently about South America and whether it represents a better opportunity for growth than the rest of Africa. Tiger Brands would be best placed to opine on this issue, as they’ve given both a try. Africa was a tough story in the end, whereas the South American investment (Empresas Carozzi in Chile) has been described as performing “pleasingly” since the investment was made all the way back in 1999.

Still, Tiger Brands has decided to focus purely on the Southern African market, so there’s no space in the portfolio for a Latin American platform. It therefore makes more sense to sell the 24.38% stake. The purchaser is the holder of the remaining shares in Carozzi, which also makes sense as selling a minority stake to an unrelated third party isn’t easy.

There’s a big number on the table, with total proceeds of $240 million. The structure of the deal is that Tiger Brands will receive a dividend of $59 million and a price for the shares of $181 million.

If we just focus on the price for the shares, it works out to around R3.35 billion. The attributable earnings were R621 million, so that’s a P/E multiple of around 5.4x. This is well below the P/E that Tiger Brands is trading at, so keep that in mind when thinking about the impact on HEPS going forwards. For context as to the size of this deal, Tiger Brands has a market cap of just under R50 billion.

The share price had a muted reaction to the announcement, up 1.9% for the day.

Another poor end to a calendar year for Woolworths in the apparel business (JSE: WHL)

They really need to get the supply chain right

Another year, another set of excuses around the impact of supply chain delays on the Fashion, Beauty and Home (FBH) segment at Woolworths. In 2023, they blamed port delays. In 2024, they blamed late deliveries from suppliers. The net impact? At a time when two-pot money flowed into the likes of Mr Price and Lewis, Woolworths managed growth in the last eight weeks of 2024 of just 0.9% in the FBH segment. Highlights like 17.3% growth in Beauty and 25.2% growth in online sales don’t make up for that issue.

Thankfully, Woolworths Food continues to do the heavy lifting. Growth for the 26 weeks to December was 9.0% excluding the acquisition of Absolute Pets. Woolies Dash jumped by 49.2%, proving once more that people have money for high quality convenience offerings. The acquisition of Absolute Pets obviously had a positive impact, contributing to overall growth in Woolworths South Africa of 9.1% despite FBH managing just 2.5%.

It gets even worse across the pond, where Country Road Group saw sales decline 6.2% for the period and 7.8% on a comparable store basis. On top of this, they had cost pressures that led to a negative trend in margins. On the plus side, at least they sold the flagship David Jones property in Melbourne for a meaty A$223.5 million.

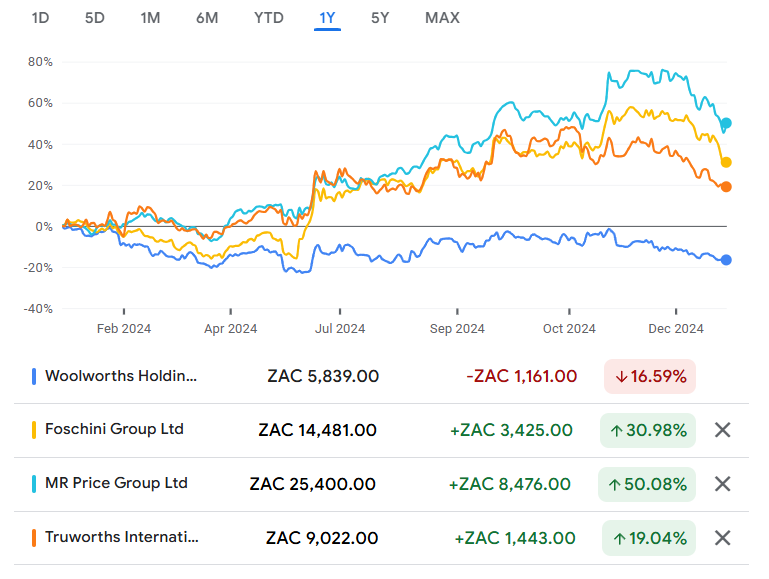

Overall, adjusted HEPS for the interim period is expected to be between 16% and 21% lower. HEPS without adjustments fell by between 22% and 27%. It’s quite incredible to look at this chart of Woolworths vs. some of its apparel competitors:

If you’re a Woolworths shareholder, even those delicious chocolate almonds will struggle to cheer you up after seeing that chart.

Nibbles:

- Director dealings:

- The CEO of Clicks (JSE: CLS) bought shares in the company worth R3.5 million.

- The CFO of Spear REIT (JSE: SEA) bought shares in the company worth R22k.

- Cash shell Trencor (JSE: TRE) has declared a gross special dividend of 730 cents per share. With the share price currently at R8.04, this gets most of the cash back to shareholders. They are retaining a buffer for the winding-down period. Separately, the company announced that HEPS for the year ended December 2024 was between 25 and 32 cents.

- Novus (JSE: NVS) has been granted an extension for the distribution of the Mustek (JSE: MST) mandatory offer circular. Novus has been granted an extension to 14 March 2025.

- London Finance & Investment Group (JSE: LNF) announced in December that they would be returning all cash to shareholders. They expect to send out the circular by the middle of February 2025, with a further expectation that any payout won’t happen before May due to the various regulatory processes. They reckon that the payment will be somewhere around 71 pence per share.

- Alex Maditse has been appointed as the chairman of Netcare (JSE: NTC). This comes after the retirement of Mark Bower in September last year. Maditse has been serving as lead independent director since July 2024, so this is a logical progression. The company will appoint a new lead independent director in due course.

The Woolies supply chain excuse is very real for me. In early spring, I went to buy 6 pairs of shorts of different colours to replace the ones I had bought at the same store 2 years ago. Just when they should be overflowing with stock.

The had exactly one colour, a dreary grey/brown. So I went to their competitors a short walk from them and bought what I wanted. Woolies told me it was the supply chain to blame (surely all other clothing sellers are faced with the same issues?).

Cheesing off repeat customers is not the way to build your business