Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Attacq to buy the remaining 20% in Mall of Africa (JSE: ATT)

Shareholders in RMB Holdings (JSE: RMH) will want to pay attention as well

Attacq has announced that its 70%-held subsidiary, Attacq Waterfall Investment Company, will acquire the remaining 20% in Mall of Africa. This will take it to a position where it owns 100% of the property.

The seller is Atterbury Property, which should ring a bell if you’ve been following RMB Holdings. The relationship between RMB Holdings and Atterbury is anything but simple, but this is perhaps a step closer to a realisation of further specific dividends for RMB Holdings. I was more than a little surprised that RMB Holdings didn’t release a SENS announcement related to this transaction.

This is a solid property and is obviously already extremely familiar to Attacq, so the deal makes sense from a strategic standpoint.

The purchase price is R1.07 billion and the forward yield is 8.0%, so they are paying what looks like a pretty high price for the it. The independent external market valuation is even higher though, as this price is a 7.7% discount to the valuation. I’m not qualified to argue with that valuation, but this seems like a low yield in this environment and thus a full price for the mall. I wouldn’t call this a bargain by any means.

CMH managed steady operating profits (JSE: CMH)

But the banks got a much bigger slice of those profits than in the prior year

Combined Motor Holdings, or CMH, is facing winds of change in the South African motoring industry that are blowing with increasing severity. In the CEO’s report for the year ended February 2024, the company noted that over half of vehicles sold in South Africa are from China or India. This is because South Africans are getting poorer on the global stage thanks to the rand and our economic policies.

OK, that last bit is from me, not the CEO of CMH. I doubt he would disagree, though.

CMH has a substantial dealer footprint that includes a number of marginal brands that aren’t easy to sell to consumers who are under pressure. This makes life difficult for them, especially when OEMs are putting pressure on dealers to move stock out the door. This leads to discounting in a market that is already known for low margins.

This is precisely why WeBuyCars is my position in this sector, rather than new car dealers. WeBuyCars is brand-agnostic and can stock whatever they want in the warehouses. CMH doesn’t have anywhere near that level of flexibility. Although they have brands that must be really killing it right now, like Haval and Chery, they are also stuck with European brands that are already tough sells – and that’s before the ranges become increasingly focused on expensive EVs that are suffering from low levels of adoption in South Africa.

This isn’t a simple footprint to manage:

With such difficult conditions, it’s impressive that the group saw only a slightly drop in operating profit from R791 million to R781 million. The problem is that finance costs have risen from R193 million to R280 million on a similar level of working capital in the business. When consumer spending is tight and interest rates are high, new car dealerships struggle. To add to the pain, the financial services joint ventures saw an 18% drop in profits because of higher bad debts. At least the insurance cell captives did a lot better, with 25% growth in profits.

The car hire business has a better story to tell, although it’s not smooth sailing there either. The average daily hire rate is down 3% due to increased competition in the sector. This has impacted the fleet utilisation rate. First Car Rental has benefitted from the relationship with FlySafair though, so there’s a highlight.

As a reminder of how substantial the difference in margins is across the two segments, car hire generates 50% of group profit before tax from just 7% of group revenue. Sometimes, you need to see the numbers to fully appreciate the significance. Car hire made profit before tax of R280 million off revenue of R891 million. Motor retail could only manage nearly R188 million in profit before tax off R11.74 billion in revenue.

And of course, motor retail is far more capital intensive, with R2.8 billion in assets vs. R1.4 billion in car hire. This adds to the challenges when financing costs are high.

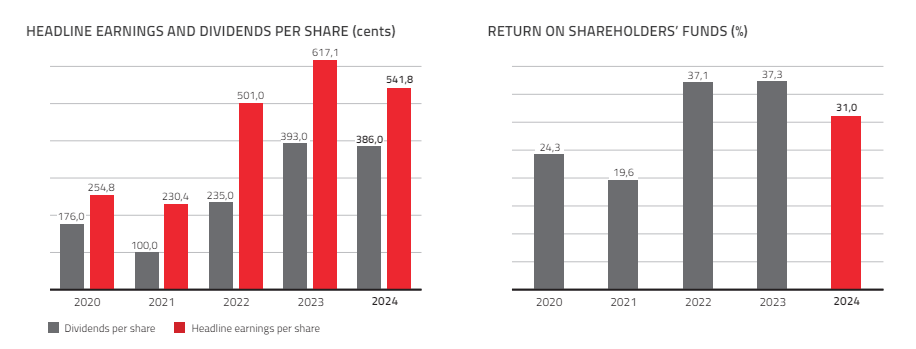

I think these two charts from the report do a very good job of showing that (1) earnings are coming down to earth, but (2) the business still generates strong returns on capital:

With a full year dividend per share of 386 cents (down 1.8%), CMH is trading on a dividend yield of around 14.6%. The market is pricing in a fair bit of pain in the year ahead. Although this is a classic example of where value investors get excited about a stock, I would be cautious of an unwind in the share price that delivers an unimpressive total return despite the potential for a high dividend yield.

There are structural weaknesses in the motor retail business model that make me worried.

Gold Fields has given investors a negative surprise (JSE: GFI)

All-in sustaining costs (AISC) are through the roof

Gold Fields found itself on the wrong end of the “physical gold vs. miners” debate, with a poor outcome for the quarter at a time when gold prices are doing well. With weather-related issues and operational challenges at various mines, attributable equivalent gold production is down 18% year-on-year and 22% quarter-on-quarter. These numbers are excluding Asanko, which was sold in the quarter.

As you’ll know by now if you regularly read mining updates, a drop in production means an increase in all-in sustaining costs (AISC). AISC from continuing operations came in at $1,738/oz, a horrible jump from $1,372/oz in the three months to December 2023 and even worse when compared to $1,149/oz in the quarter ended March 2023.

Net debt at the end of the quarter was $1.143 billion, which is up from $1.024 billion at the end of December 2023. Net debt to EBITDA was 0.51x, so the overall leverage doesn’t look problematic. It’s just the direction of travel that is a concern.

Despite the poor start to the year, annual group production and cost guidance remain unchanged. They will need a very strong performance for the rest of the year to manage that. AISC is expected to be between $1,410/oz and $1,460/oz including the capital expenditure on the St Ives renewable energy project.

The market wasn’t impressed, with the share price trading over 5% lower in late afternoon trade.

Little Bites:

- Director dealings:

- Various associates of a director of Brimstone (JSE: BRT | JSE: BRN) bought shares worth a total of almost R390k across the two classes of shares.

- The chairman of London Finance & Investment Group (JSE: LNF), a company you almost never hear anything about, bought shares in the company worth £54k.

- Kibo Energy (JSE: KBO) released an announcement by subsidiary Mast Energy Developments that is an incredibly long-winded story about Riverfort putting in a further £1.1 million in funding for the company to do work on its gensets. The VAT portion of the spend will be reclaimed and paid back to Riverfort within a couple of months. There’s also a new term loan of £325k priced at 10% and repayable in 10 months, also with Riverfort. Finally, there’s a settlement of £325k related to a legacy facility with Riverfort, settled by a director of the company in exchange for shares that were subsequently placed in the market. For a company trading at R0.01 per share, Kibo sure does know how to make things complicated.

- It’s a pretty small point, but Accelerate Property Fund (JSE: APF) made a technical correction to its rights offer circular. The company already has sufficient unissued share capital to implement the rights offer, so CIPC accepting the amendment to share capital is no longer a condition precedent for the transaction.