Listen to the latest episode of Ghost Wrap here:

These earnings got hammered with a vengeance (JSE: AEG)

Aveng’s updated trading statement shows how bad things are

The Aveng share price has been weird for the past week. It started moving higher out of nowhere, then gave up all those gains after the updated trading statement was released. If punters were speculating on the release of favourable information from the company, they got it wrong.

With operating losses at both McConnell Dowell in Australia and Moolmans locally, this period is a useful reminder of how risky construction really is. For the year ended June, the headline loss per share is between 761 cents and 749 cents. The share price is only R8.16, so another year like this and there really wouldn’t be much left to this group. As you would expect, the share price has halved over the past year as these losses were priced in.

Detailed results will be out on 22 August.

Alphamin released its quarterly financials (JSE: APH)

This is a great candidate for my chart of the day

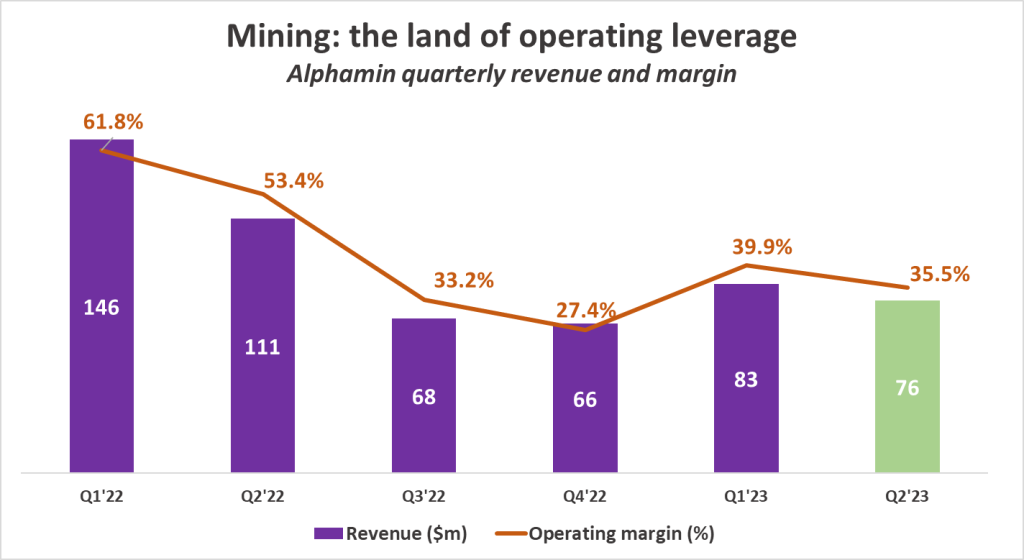

Mining is a great way to learn about operating leverage, or the impact of fixed costs on margins. Simply, when times are good, they are really good when you have a lot of fixed costs. When they are bad, well, you know the rest.

Here’s a chart of what that looks like, thanks to tin miner Alphamin releasing its quarterly financials:

DRDGOLD’s revenue grows slightly ahead of costs (JSE: DRD)

This means that HEPS is moving in the right direction

For the year ended June, DRDGOLD managed to grow its revenue by 7%.

Although gold sales at Ergo Mining fell by 5% despite a 21% increase in yield (with throughput as the problem), this was more than offset by a 16% increase in the rand gold price. At Far West Gold Recoveries, that gold price increase was the saving grace as yield fell by 8% and sales fell by 15%.

Cash operating costs increased by 6%, below revenue growth and thus giving margins a move in the right direction. Ergo was the winner here once more, with costs up by 6% vs. Far West Gold Recoveries where they increased by 11%. Although Ergo is far larger than Far West and that’s why the average has come out where it did, there’s obviously some rounding off here in the commentary as well.

Free cash flow in this period was R468.9 million, way down from R871.6 million in the comparable period. The difference lies in much higher investing activities in this period. Importantly, there’s still no debt on the balance sheet.

Exxaro gives us full details on its earnings (JSE: EXX)

When the cycle turns, it can turn quickly

You know the drill by now: commodity prices down, inflationary pressure on costs and infrastructure in South Africa that has more blind spots than Ferrari’s F1 pit strategies. Like so many other mining houses on the local market, Exxaro is having to deal with all these issues.

Exxaro generates 96% of revenue and 90% of EBITDA from its coal business. With coal revenue down 16.4% year-on-year, this was never going to be a pretty result. Very few people realise that Exxaro also has renewable energy investments in the form of wind assets, which recorded a very good six months thanks to a windier period. It’s just too small in the group context to really make a difference.

Where we desperately need the winds of change to blow is at Transnet. You know it’s bad when the results make a comment that Transnet’s performance “did not deteriorate further” – so just being bad, rather than worse, is an achievement.

HEPS fell by 29% for the six months to June and the interim dividend is 1,143 cents per share, down 28%.

Gold Fields: not too bad, actually (JSE: GFI)

In this environment, a small drop in mining is a big win

To give context to the Gold Fields numbers, I am mentioning right upfront that the company has operations in several countries. This gives it some protection from the joy of load shedding (and load curtailment for that matter).

For the six months to June 2023, HEPS came in at $0.51 (because the company is listed in the US and reports in dollars). This is a 12% drop vs. the comparable period. Despite this, the rand dividend has increased by 8% year-on-year to R3.25 per share, which tells you everything you need to know about the exchange rate over the past year.

In terms of other important metrics, gold production fell by 4% and the all-in cost per ounce increased by 3%. The balancing figure that saved the result from a sharper drop is of course the gold price, which was $1,927 in this period vs. $1,851 in the comparable period.

Due to acquisitions and dividends, net debt increased during the period and the net debt : EBITDA ratio is now at 0.42x vs. 0.33x a year ago.

The full year guidance has been maintained for both production and costs. Of course, nobody knows what the gold price will do.

CFO Paul Schmidt has indicated a desire for early retirement (I think the gold price will do that to anyone to be honest), so the company will look for a successor.

Master Drilling is still growing, but for how long? (JSE: MDI)

I suspect there’s a lag effect of the commodity cycle on Master Drilling’s earnings

Master Drilling has released a trading statement because the expected growth in HEPS for the six months to June is between 20% and 30% higher in rands. The company also gives a dollar range for HEPS growth, which is only between 0.7% and 10.7% because of rand weakness.

This is obviously a very strong growth rate, with interim HEPS expected to be between 162.70 and 176.30 cents. The share price is just over R12, so the annualised multiple is around 3.5x. When multiples are low in mining and related companies, warning bells should be going off for you.

Is it correct to annualise the interim earnings? I’m not familiar enough with Master Drilling’s business model to know for sure (and I would welcome any insights here), but logically a drop in commodity prices can’t be good news here. When prices are high, mining exploration is easier to justify. When prices drop, mining houses get tighter on capital expenditure and drilling would suffer.

The share price shows you how cyclical this stock is:

Oceana releases a trading statement (JSE: OCE)

Make sure you have read it carefully

A trading statement is usually big news, but not always. It is triggered by earnings moving by more than 20% vs. the comparable period, whether up or down. That’s a big move, which is exactly why the JSE Listings Requirements make companies give an early warning of a move this size.

Oceana’s trading statement is based on a move in earnings per share (EPS), not headline earnings per share (HEPS). This is a very good time to learn one of the big differences between the two concepts: profits and losses on disposals of assets. HEPS excludes these distortions.

Oceana sold Commercial Cold Storage Group with effect from April 2023, banking a juicy profit of R370 million after tax. This works out to 304 cents per share, which is huge vs. earnings for the year ended September 2022 of 603 cents. It’s therefore not rocket science to figure out that the move will be more than 20% in earnings.

At this stage, no guidance has been given for HEPS. Although this doesn’t necessarily mean that HEPS won’t have a significant move, it does mean that you shouldn’t be interpreting this trading statement as meaning a big jump in the core business.

Sabvest’s interim results are always worth a read (JSE: SBP)

This is one of the most respected investment holding companies on our market

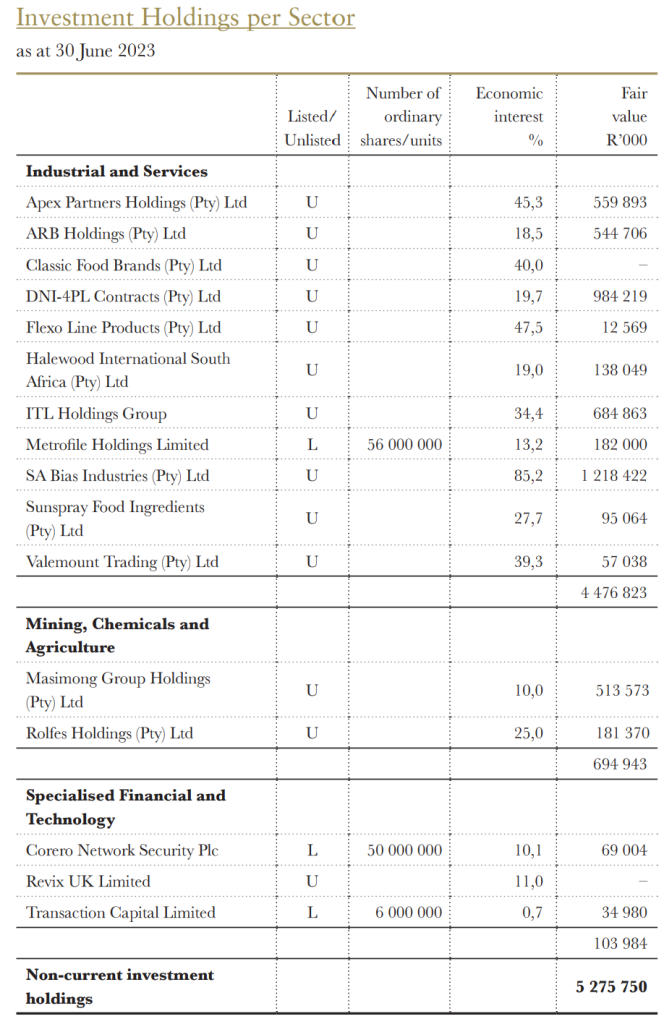

Unlike some of the other investment companies on the JSE that hold mostly a basket of listed assets, Sabvest gives exposure to assets that you can’t otherwise get. There are thirteen unlisted and three listed investments. The Seabrooke Family Trust has voting control of Sabvest through a special share class and holds a 40.5% economic interest. This has been a lucrative investment vehicle, boasting a 15-year share price CAGR of 17% (excluding dividends).

The net asset value (NAV) per share is up by 10.4% over the past year, which is a decent outcome that has been driven by resilient performance in most of the unlisted investments. The dividend per share is consistent at 30 cents, which is a tiny yield (even when annualised) on a share price of R70. You aren’t buying this thing for the dividend.

The discount to NAV is substantial, with a share price of R70 vs. a NAV per share of R114.65. That’s a discount of 39%, which isn’t materially different to other major funds like Remgro.

If you’ve been following the sad and sorry tale of Transaction Capital, you’ll be wondering what the impact is on Sabvest. Obviously now a much smaller percentage of the portfolio than it once was, the value of the stake is R35m and the total portfolio is worth nearly R5.3bn. If you’re bullish on Transaction Capital, it’s probably too small within Sabvest for this to be the right way to play that view.

If you would like to see the full portfolio, here it is:

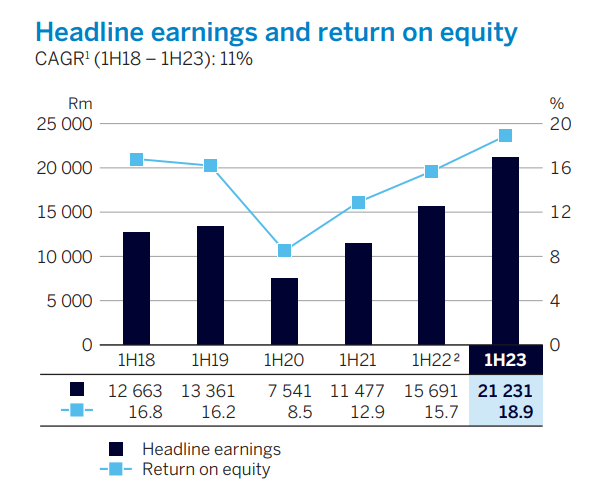

Standard Bank grows its earnings and dividend by 35% (JSE: SBK)

Return on equity has also jumped sharply

Standard Bank is a large beast. There’s far more to the group than just South Africa, with the African regions contributing 44% to headline earnings. Africa grew headline earnings by 65% and achieved return on equity of 28.4%, blowing away the South African result of 17% growth and return on equity of 15.2%. By the way, that South African result is still more than decent!

Income has experienced wonderful growth in a period of higher interest rates and larger balance sheets under inflationary conditions, up 29%. The expense base certainly doesn’t grow by this much, which is why the cost-to-income ratio has improved from 55.5% to 50.5%. That’s not the best in the sector, but it’s not bad. Remember, lower is better on that ratio.

The story of banking this year has been one of impairment provisions, which are measured by the credit loss ratio. This has increased to 97 basis points, which is right at the top of the through-the-cycle range of 70 to 100 basis points. Despite this, the banking business achieved return on equity of 19.0%, much higher than 15.3% in the interim period last year and a genuinely high number.

Net asset value per share is an important driver of the share price, so you always want to see this moving in the right direction. On this metric, Standard Bank achieved growth of 10%.

In good news for those who are barely keeping their heads above water every month, Standard Bank has echoed Nedbank’s view that local interest rates will be flat for the rest of the year.

Speaking of the outlook for the second half of the year, Standard Bank expects ongoing strong revenue growth and positive jaws (income growth ahead of expense growth i.e. further improvement in operating margins). The credit loss ratio is expected to remain in the upper half of the target range, so that suggests it won’t get any worse from the current level.

Shareholders will enjoy an interim dividend of 690 cents per share, a payout ratio of 54%.

Standard Bank must be reading Ghost Mail, because they’ve already done the work for me on a potential chart of the day going back to 1H18! With so many accounting restatements and changes in rules, I won’t try replicate this or add in the second half for each year. This tells a good enough story:

Little Bites:

- Director dealings:

- We are firmly back into a Des de Beer buying cycle at Lighthouse Properties (JSE: LTE), with the latest acquisition being R6.1m worth of shares.

- Senior executives of Karooooo (JSE: KRO) acquired shares worth R1.6m. I was surprised to see that this is a “voluntary disclosure” of this trade. The company’s primary listing is on the Nasdaq and so those rules take precedence, but I didn’t realise that the JSE doesn’t force this disclosure on secondary listed companies.

- A director at Acsion (JSE: ACS) bought shares worth R13.3k.

- A director of Afine Investments (JSE: ANI) fished some coins out from between the couch cushions and bought shares worth R4.6k.

- With the future of the company now secured, the CEO of Royal Bafokeng Platinum (JSE: RBP) will now retire as his fixed term contract expires at the end of August. The current manager of the Styldrift mine will now take over the top job at what will be a subsidiary of Impala Platinum (JSE: IMP). In a cute story, he was a bursary student at Impala Platinum many years ago and was with the company for 13 years! Talk about coming full circle.