Aveng: proof that construction is always a knife’s edge (JSE: AEG)

The share price has more than halved this year

There’s genuinely nothing riskier than construction. Just one bad project can almost sink an entire firm, or at least cause significant financial distress.

Speaking of distress, for the year ended June 2023, Aveng will report a headline loss per share. That’s a big and ugly swing from a headline profit of 252 cents per share in the previous year.

After the sale of Trident Steel, there are only two subsidiaries in the group.

The Australasian and Pacific business is McConnell Dowell. An operating loss of AUD65 million is expected vs. a profit of AUD70 million in the comparable year, driven by massive losses (AUD114 million) on the Batangas LNG (BLNG) terminal project in Southeast Asia.

They still need to finish that awful project, with completion and handover expected later this year.

The good news is that the McConnell Dowell debt of AUD43 million has been reduced by AUD20 million, with the remainder converted to term debt. This debt was linked to the BLNG project guarantee.

The business closed the financial year with a cash balance of AUD177 million. With work in hand of AUD3.5 billion, the group sounds confident about its 2024 revenue budget.

At South African subsidiary Moolmans, there has been significant investment (R900 million) in heavy mining equipment for the secured Tshipi é Ntle project. Equipment is being delivered to site and commissioned, with final delivery expected by September 2023.

Sadly, delays in the delivery from OEM suppliers means that the improved result in the last quarter wasn’t enough to mitigate losses in the first nine months of the financial year. The operating loss for the year is expected to be R105 million.

To add to the uncertainty, the managing director of Moolmans has left to pursue other opportunities. Group CEO Sean Flanagan has taken the role of executive chairman of Moolmans while they find a successor.

Although the underlying losses are obviously bad news, Aveng still has a net cash balance of R1.3 billion (cash of R2.3 billion and debt of R1 billion). Around 70% of the debt is asset backed finance in Moolmans and the rest is in McConnell Dowell, with the latter expected to be settled in the next financial year.

There is no debt in parent company Aveng, as this was settled when Trident Steel was disposed of.

Glencore sounds bullish on full-year guidance (JSE: GLN)

With the first half of the year out of the way, things are looking good

Mining groups are complicated, particularly when they are as large as the likes of Glencore. Production results vary wildly across the various commodities, especially when you take into account planned maintenance and the impact of acquisitions and disposals. There are always unplanned issues, like a strike at one of the nickel mines.

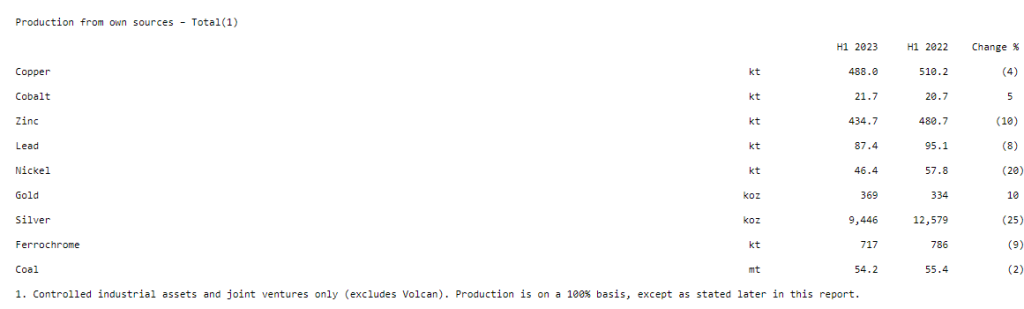

In the first half of the financial year, copper, coal and zinc performed in line with expectations and guidance previously given to the market. This doesn’t mean that production was higher, by the way. As this table shows, its a real mixed bag across the group:

Full-year production guidance is unchanged.

Production is only one part of the story. Pricing is the other. Individual commodities are incredibly volatile, like cobalt which declined to historic lows in May 2023 due to oversupply. This materially impacted earnings from African copper operations.

The investment case for a group like Glencore is built around taking overall mining exposure through a single investment, rather than highly risky bets on individual commodities. The group result is always smoother than the results as you dig deeper into the operations.

There’s also no shortage of mergers and acquisitions at Glencore, with three recent examples. The deal with Bunge Limited will close in mid-2024, the sale of Cobar Management to Metals Acquisition Corp already closed and the acquisitions of a 30% stake in Alunorte and 35% in MRN are expected to complete in the second half of 2023.

Hulamin kept strike disruptions to a minimum (JSE: HLM)

The entire thing was wrapped up within two weeks

Although there’s no “good” strike action for a company, sorting it out quickly keeps the pain to a minimum. You just need to think back to the strike by workers in Sibanye’s gold business for a perfect example of the financial destruction that labour action can bring.

Hulamin seems to have sorted it out quickly. Workers affiliated with NUMSA embarked on a strike on 10 July and operations will resume as normal on 24 July, after a resolution was reached on 21 July. No details are given of the resolution, which is a disappointing omission from the announcement.

Mr Price is treading water (JSE: MRP)

Like-for-like growth is hard to come by at the moment

Mr Price is down more than 8% this year, with a volatile ride along the way for investors. It’s been a rewarding stock for traders playing the load shedding game, although that is true for most local retailers.

The company needs to improve its image with investors after a pretty poor performance in the last financial period due to inadequate preparations for load shedding. This is a very tough environment to operate in, so there’s no room for scoring own goals.

In the 13 weeks ended 1 July 2023, Mr Price managed to grow like-for-like retail sales by 0.9%, which is in the green but not by much. This excludes the Studio 88 acquisition, which obviously adds a lot of revenue to the system vs. the base period. If you include other income like debtors book income, then income was up 1.2% without Studio 88.

Selling price inflation excluding Studio 88 was just 2.4%, so volumes are down by roughly 1.5%. With plenty of commentary in the result about higher markdowns, I am quite confident that input cost inflation was higher than the selling price inflation. In other words, Mr Price took a bath on gross margin. The gross margin will be further impacted by the inclusion of Studio 88 in the results, as this is a lower gross margin business than the rest of the group.

The cash vs. credit sales relationship is important and the differing growth levels are quite surprising here. Excluding Studio 88, cash sales (87.8% of total retail sales) were up 1.5% and credit sales fell 2.7% as the group used stricter credit granting criteria. This ties in with recent bank updates that highlighted a quickly deteriorating credit environment. Several other apparel retailers have been less conservative on credit sales, particularly with cash sales under pressure.

And in case you’re wondering, higher-income customers at Yuppiechef aren’t feeling the pinch. Double-digit sales growth has been reported. Admittedly, this really is a great retailer with a solid brand and dominance in its niche.

The shape of the quarter is important here, which is why Mr Price gives detailed disclosure. April was still a rough period of load shedding with backup in only 60% of stores, so sales fell by 5% excluding Studio 88. In May and June combined, sales were up by 5.6% on the same basis. This is encouraging heading into the next quarter.

The group footprint is still expanding, with trading space up by 5.8% on a weighted average basis excluding Studio 88. With the acquisition included, trading space was up 22.6%.

In summary, the interim result isn’t going to be pretty. Although no specific guidance has been given, it’s not difficult to read between the lines that profitability is under significant pressure. It sounds like the promotions aren’t over either, with “responsible stock management” and the goal of achieving just low single digit inventory growth by the end of the interim period.

Tongaat announces an equity partner (JSE: TON)

This is surely good news for the local sugar industry

I doubt that Tongaat-Hulett shareholders will get much out of this process, but at least it looks like the company has found a saviour.

After a process to find a strategic equity partner, the company has selected Kagera Sugar – a sugar manufacturer in Tanzania which also has assets in the DRC and refineries in the Middle East. It looks like Kagera will acquire the entire South African business, as well as the investments in Zimbabwe, Mozambique and Botswana.

An updated business rescue plan will reveal full details to interested parties.

Vodacom manages mid-single digit growth (JSE: VOD)

You have to strip out Egypt to properly understand the numbers

Although Vodacom group revenue was up 36.9% in the quarter ended June 2023, you have to remember that Vodafone Egypt wasn’t in the base period. If you strip that out, you get growth in group service revenue of 9.8%. If you then take out foreign exchange movements for a “normalised” view on revenue growth, you get 4.3%.

Vodacom didn’t own Vodafone Egypt a year ago, so the year-on-year growth isn’t a true reflection of the impact on Vodacom numbers. It’s important to help us assess performance though, with that business doing very well. Vodafone Egypt services revenue grew by 27.6% in local currency, as financial services revenue more than doubled.

If we look at the South African business, service revenue increased by 3.9% and total revenue was 5.6% higher. Capital expenditure is 21.5% higher, so that’s a significant drag on free cash flow and is one of the major issues with the investment case in the telecoms industry. It’s also worth noting that customers fell by 0.6%, with pressure in the prepaid business year-on-year. They did increase prepaid customers this quarter when compared to the immediately preceding quarter.

The International business (i.e. everything other than South Africa and Egypt) grew service revenue by 4.9% on a normalised basis and total revenue by 4.2%. The problem is that capital expenditure more than tripled, so the free cash flow story doesn’t look good anywhere. A major driver of this jump was the purchase of additional spectrum in the DRC.

Looking beyond the core business, the mobile money platforms across the group processed $360.6 billion in transactions over the past twelve months, up 5.8%. That’s an annual number in a quarterly update which is a bit naughty, but it’s worth mentioning anyway. The “super-app” in South Africa has reached 6.7 million downloads.

Regulatory approval is still outstanding for the acquisition of a 40% stake in MAZIV, the fibre initiative in South Africa that will be a major play for Vodacom if it all goes through.

Little Bites:

- Director dealings:

- A director of a major subsidiary of Tharisa (JSE: THA) has sold shares worth R1.4 million.

- A director of Acsion Limited (JSE: ACS) has bought shares worth R39.4k.

- Although Trematon Capital Investments (JSE: TMT) closed 18.4% after releasing a cautionary announcement, this should be interpreted with great caution as this is an illiquid stock. There was very little in the way of detail on the potential deal. We don’t even know if they are looking at buying or selling an asset.

- Reinet Investments (JSE: RNI) always releases the net asset value (NAV) movement in Reinet Fund as a precursor to the change in NAV for the group. Reinet Fund is the bulk of the group balance sheet, but not all of it. Between March 2023 and June 2023, the NAV of Reinet Fund fell from EUR 33.40 to EUR 32.98, a 1.3% decline.