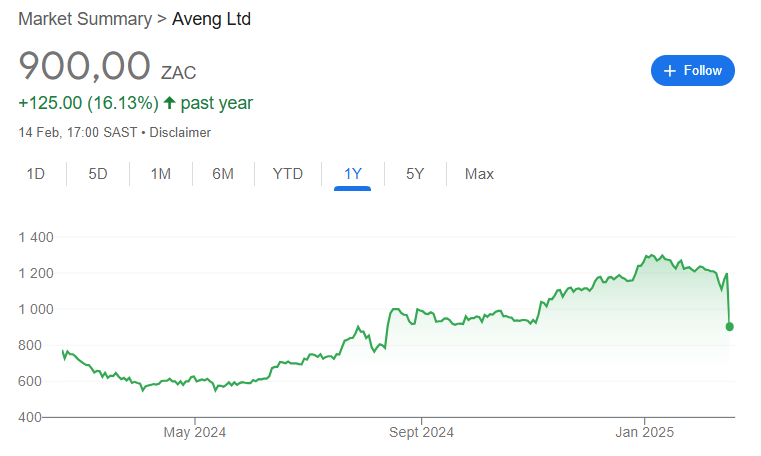

Aveng shareholders are licking their wounds (JSE: AEG)

The construction industry just loves breaking hearts

I don’t like to use the word “never” unless I absolutely have to, but I am very confident that I will never invest in the construction industry. It always strikes me as gambling rather than investing, as there’s just so much that can go wrong. Aveng is the latest example, with a 25% drop in the share price on Friday in response to the release of a trading statement.

Why the long face in the market? It’s simple, really: Aveng is loss-making in the latest period. They expect a headline loss per share of between A$26.0 cents and A$27.0 cents for the six months to December 2024.

For all the effort to make McConnell Dowell the focus of investors (hence the reporting in Australian dollars), it was that part of the business that broke in this period. In New Zealand and Pacific Islands, they were pretty flat year-on-year. As for Australia and Southeast Asia, there are various legacy projects that have ruined profitability.

It takes just two bad apples in the basket of projects to contribute losses of A$77 million, more than offsetting the rest of the projects that made profit of A$50 million in aggregate. I don’t like businesses that are this lumpy and carry these kinds of risks.

Aveng has recognised the forecast costs to complete these projects, so the pain is theoretically captured in these numbers. The same can’t be said for the cash outflows that are expected to materialise over the next 18 months. Aveng reckons that the current cash balance along with expected profitability in other projects will cover the outflows. I must of course remind you that if these forecasts were super reliable, there would be no such thing as loss-making projects in construction.

As for Moolmans, the South African mining-focused business, there are positive earnings for the period and they are close to finalising a new 60 month contract. It’s therefore purely the offshore business letting the team down, a story that is far too common for South African listed companies.

You won’t often see a chart nosedive like this:

Jubilee’s copper catch-up at Roan is underway (JSE: JBL)

The feed material is double the grade of material previously processed

After having suffered issues with the power supply to the Roan facilities in Zambia, Jubilee Metals needs to make up lost production. They are firmly in the process of doing exactly that, with the new high-grade copper feed material now being processed at Roan.

Jubilee recently announced that they had secured the rights to an initial 200,000 tonnes of this material, with the ability to get their hands on more of the stuff as well. Roan’s processing capacity is 45,000 tonnes per month, so this will keep them busy for a few months. The major benefit is that the high-grade material is roughly double the grade of the material that they previously processed, so this is part of an accelerated production plan to recoup lost production.

The share price is down 34% in the past six months and it doesn’t look like the momentum has turned just yet:

Metair is making a strategic shift (JSE: MTA)

I think they are tired of client concentration risks

If Metair didn’t have bad luck, they would have no luck at all. From hyperinflation in Turkey to floods at a key customer in South Africa, the world has dished up many a challenge for Metair in recent times.

The Turkish business really became a completely nightmare, with Metair eventually walking away with just $1 million in cash and a loss on sale of a breathtaking R4 billion. I will say it for the hundredth time: the track record in offshore investments for South African corporates is truly awful.

Thankfully, Metair seems to have recognised this, although they aren’t shy of taking on more risk in executing a strategy to be more focused on South Africa and to reduce customer concentration risks. The recently announced acquisition of Autozone comes at a time when group net debt is at R4 billion, most of which is short-term in nature. With a net debt to EBITDA ratio of between 3.4x and 3.6x, they are reliant on the lenders playing nicely with a refinancing package. There is a non-trivial chance of an equity capital raise being needed here, so tread carefully.

Moving on from these major strategic changes at the group, we find a set of results from continuing operations that don’t tell a promising story. For example, local vehicle production fell by 5%, with pressure at Toyota South Africa as a major drag on results. Although automotive battery volumes were higher in the Energy Storage business, Metair’s revenue from continuing operations fell by roughly 2.5% and EBIT is down by 21% at the midpoint of guidance. This included some once-off restructuring costs, without which the drop was 14.5% at the midpoint of guidance.

The net impact is a drop in HEPS from continuing operations of between 0% and 20%. This isn’t a position of strength for negotiations with banks. Even if there’s no rights issue coming, it’s likely that the cost of debt will be ratcheted in such a way that Metair spends the next few years working hard for the banks rather than shareholders.

The share price fell another 3.3% on the day, taking the one-year drop to a very ugly 48%.

Nibbles:

- Director dealings:

- There’s been some significant selling of shares by Richemont (JSE: CFR) executives. A member of the board sold shares worth R635k (with no indication that this was linked to stock compensation) and another board member sold shares worth R1.1 million (in this case linked to compensation, but it’s not clear whether it was the taxable portion or not).

- The spouse of the CEO of Huge Group (JSE: HUG) bought shares worth R185k.

- An associate of a director of Mantengu Mining (JSE: MTU) bought shares worth R133k.

- The spouse of the CEO of Purple Group (JSE: PPE) bought shares worth R63k.

- Labat Africa (JSE: LAB) has issued a sizable chunk of shares at a premium to the current traded price. The number of shares in issue has increased by 18.8% based on this share issue and the issue price was 12 cents per share, which is 50% more than the current traded price. The rand value is R17.7 million and the funds will be used to settle creditors and claims against the company.

- Texton (JSE: TEX) announced that the aggregate holding of Heriot REIT (JSE: HET) and its subsidiary has ticked up to 22.77%.

- Richemont (JSE: CFR) has done some juggling of its board and Senior Executive Committee, with three new appointments to that committee including the CEOs of two of the Maisons (one of which is Cartier). Not all of the Maison CEOs are automatically appointed to the committee. For example, one of the existing committee members is stepping down to become the CEO of Jaeger-LeCoultre.

- Vodacom (JSE: VOD) and Remgro (JSE: REM) are still hoping for a positive outcome in the ongoing negotiations around the Maziv fibre deal. They’ve once again extended the transaction long stop date, this time to 14 March.

- There is yet another delay to AYO Technology’s (JSE: AYO) financial results for the year ended August 2024. The auditor hasn’t yet finished the engagement quality control review, with AYO’s results now expected to be released by 28 February.

- Delta Property Fund (JSE: DLT) announced that Brett Copans has resigned from the board as he is taking a role at a bank that has a business relationship with Delta and hence there would be a conflict of interest. You might remember his name from 2022 when he was appointed as Cell C’s chief restructuring officer. Some people really do enjoy turnarounds!

- Fairvest (JSE: FTA | JSE: FTA) announced the appointment of Bridget Duker as an independent non-executive director. Again, I tend to ignore non-executive appointments, but in this case there’s a particularly impressive CV including previous stints as CFO of African Rainbow Capital Investments and COO and Head of Legal and Compliance at Rothschild & Co South Africa.

- Trellidor (JSE: TRL) has added its name to the list of companies that have transferred to the General Segment of the Main Board of the JSE.

- Deutsche Konsum (JSE: DKR) has zero liquidity in its stock on the JSE, so quarterly results only get a passing mention here. With a loan-to-value ratio of 54.7% (which is very high) and funds from operations per share down from EUR 0.23 to EUR 0.13, I personally don’t lose any sleep over the lack of trade in this company’s shares.

Mantengu – director being buying a lot lately.

Year end is Feb

Something good cooking there