Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

AVI loves offering coffee and biscuits (JSE: AVI)

You won’t find a more attractively shaped income statement move than this one – but do they need all those divisions?

In investing, what you really want to see is a company that can turn a modest revenue result into an excellent profit result. In other words, a shape on the income statement that sees a small percentage revenue increase leveraged up into a much larger percentage move in profits. This leverage comes with risk of course, as it tends to work just as effectively in reverse, which means things can get tough when revenue drops.

There’s no reward without risk. That’s how finance works.

In the year ended June, there was plenty of reward at AVI. From revenue growth of just 6.3%, they grew gross profit by 13.5% (hence margins went up) and HEPS by 24.1%. Considering the challenges still being faced in the I&J business, that’s really good. Cash quality of earnings is also clearly there, with the dividend up 22.4%.

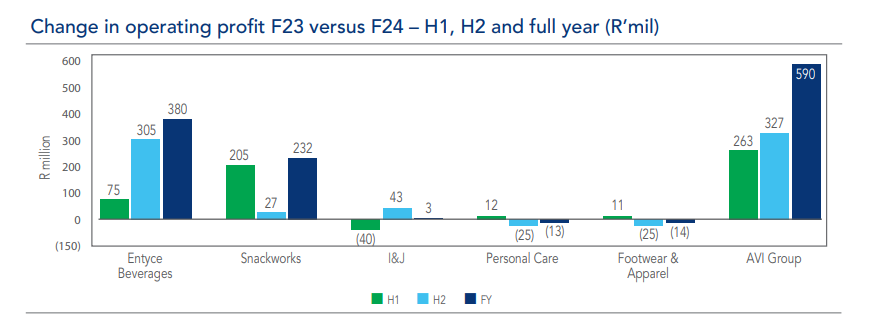

We need to look deeper to really understand the results, starting with the food and beverage brands. Entyce Beverages and Snackworks both grew revenue, up by 18.2% and 6.4% respectively. They achieved profit increases of 41.3% and 22.4%, with a combined jump of a wonderful 31%. This helped make up for I&J, where revenue was down slightly and profit increased by 1.5%.

Over at Personal Care, a focus on margins rather than revenue means that although revenue fell by R200 million year-on-year, profit was down by just R10 million. That’s a far more efficient business, with the Coty business now out of the system and unlikely to be missed.

The Footwear & Apparel segment could only manage revenue growth of 3.6%, while profits fell by 3.9%.

So in reality, Entyce Beverages and Snackworks are pretty much carrying the team right now. AVI includes a great chart in the earnings report that makes this point loud and clear:

In summary, the coffee, creamers and biscuits are doing very well, thank you. The fish catch rates are a challenge at 20-year lows, with further pressure on I&J from the abalone market and its supply and demand dynamics. As for Personal Care as well as Footwear & Apparel, one can only dream of a world in which AVI gets great offers for those businesses and simplifies its group accordingly.

Diversification is a thing, but so is diworsification.

Unimpressive numbers at Bell – and just as shareholders need to weigh up the buyout offer (JSE: BEL)

There’s food for thought here for those who believe the offer price should be higher

From what I’ve seen on X, the scheme of arrangement at Bell is by no means a guaranteed success. Because of the shape of the shareholder register, there are a couple of shareholders who can swing the vote. The deal is a game of cat-and-mouse, yet the new earnings information looks like somebody moved the cheese entirely.

After releasing generally strong results in the past couple of years, Bell could only manage revenue growth of 6% for the six months to June. Even worse, operating profit was down 2% and HEPS fell by 6%. None of that is good news. There’s no dividend per share due to the potential corporate action.

There are a number of important underlying initiatives underway, like the growth in manufacturing capabilities at the German factory and the launch of the new motor grader product. As great as that sounds, it needs to be balanced against the softer commodity and construction cycles, with Bell always exposed to the level of investment by players in those sectors.

Despite inventory levels remaining elevated across the industry, Bell did at least generate net cash of R80.5 million for the period. That’s a vast improvement on the nearly R400 million in cash that was absorbed in the comparable period.

Capitec just doesn’t stop growing (JSE: CPI)

These are seriously impressive numbers

Capitec has released a trading statement for the interim period to 31 August. This is an update to the previous announcement in July that suggested earnings growth of between 25% and 35% for this period.

It’s even better than that, with the updated earnings giving a much tighter range of 35% to 37% – which means they had an even stronger finish to the period than they anticipated.

Detailed results are due on 1 October. These are great numbers that the market will dig into in detail, with Capitec’s share price up more than 4% for the day and nearly 50% this year!

Sunbet is the growth highlight at Sun International (JSE: SUI)

The group result isn’t too shabby either

Sun International has released results for the six months to June. With adjusted HEPS up by 9.1% and the interim dividend up 8.8%, this is a decent if not spectacular result.

There are slow growing parts of the group, like gaming income up just 3.4%. As this contributed 77.4% of group income, it explains why the overall growth in income was just 5%. Urban casinos grew just 2.2% and smaller regional casinos couldn’t even match that number. The highlight, by far, was Sunbet: 71.8% growth and running ahead of targets.

A decent runners-up trophy goes to hospitality income, which was up 12.3%. People seem to want to stay at the casinos but aren’t so keen on actually gambling!

The wooden spoon? Sun Slots, where income fell by 4.3%. For context, Sun Slots contributed income of R686 million vs. R512 million at fast-growing Sunbet.

Despite the underlying mix effect, group adjusted EBITDA margin was consistent at 27.3%. This helped decrease debt (excluding IFRS 16) from R5.7 billion at December 2023 to R5.4 billion at June 2024. Despite the drop in debt, the interest charge increased by 2.7% due to higher rates.

The acquisition of Peermont Holdings is still underway, with regulatory approvals still being obtained. Credit approved funding has been received from lenders. The casino businesses aren’t achieving much growth right now, but they remain great cash cows that are capable of servicing debt.

Trematon is selling Aria (JSE: TMT)

Now we know why the company was trading under cautionary

Trematon has turned an investment into cash, with the 60% stake in property group Aria being sold for R293 million. The deal is being structured as a share repurchase, so the other shareholders in Aria are effectively taking Trematon out of the picture.

Trematon’s net interest in Aria’s assets as at 29 February 2024 was R274.2 million, so this deal is at a premium to that number. Admittedly, that number is now 5 months old, so one would hope that there was growth over that period.

Aria holds a portfolio of 13 properties, almost exclusively in the Western Cape. They include commercial, retail and industrial properties.

I think this is a good move, Trematon’s net asset value per share as at the end of February was R3.39 and the current share price is R2.44. If the cash from this disposal is used for share buybacks, it should help close the gap.

Vukile gets more exposure to Iberia through the Portuguese market and looks to raise equity capital (JSE: VKE)

Iberia seems to be the new Poland for locally listed property funds

It’s funny how things seem to happen in waves when it comes to JSE-listed property funds. At one point, all we could hear about was the UK. Then, Eastern Europe was in vogue, a push which turned out far better than most of the UK acquisitions. These days, Iberia is in fashion, with Lighthouse Properties putting its focus in the region and Vukile deepening its exposure there.

To be fair to Vukile, they’ve already been in Spain as their international growth story for a long time. 99.5% held subsidiary Castellana Properties is now venturing into Portugal, announcing the acquisition of three properties in the country on a initial net income yield of 9%.

This is a deal with one seller across the three properties. To facilitate it, Castellana will set up a new subsidiary that will be 80% held by Castellana and 20% held by an RMB entity. Our local bankers are smart enough to see the opportunity in Iberia and participate in it.

The three properties are all shopping centres, with two in Lisbon and one just outside of Porto. Interestingly, a retailer named Continente Hypermarket is the anchor tenant in all three, so hopefully they won’t be having any Pick n Pay experiences over there.

The purchase price is EUR176.5 million and acquisition costs are EUR4.4 million. Existing lenders will refinance an in-country asset-based debt package of EUR72.5 million and the remaining EUR104 million will be funded by equity, with 80% coming from Castellana and 20% from RMB. It’s interesting to see the bank playing in the equity section of the capital stack in this deal.

This is a category 2 deal, so there will not be a circular issued to shareholders.

Late in the day, Vukile also announced an accelerated bookbuild to raise equity representing approximately 5% of the company’s market cap. This implies a raise of over R1 billion, with the right to increase the raise if there is strong demand. As usual for funds this size, selected institutions will be able to buy shares (probably at a discount) and retail investors will watch from the sidelines.

Although the announced acquisitions in Portugal are fully funded, Vukile is looking to raise a warchest for further acquisitions. This is typical behaviour of a property fund that really has the wind in its sails, so just be cautious of how this share price behaves and the valuation that it gets to.

I found it incredibly interesting that although Vukile is investing alongside RMB in Portugal and has Java Capital as its sponsor, it has appointed Investec as the bookrunner for the capital raise. Welcome the The Corporate Bachelor, with the zebra getting the rose this time!

Wesizwe Platinum’s operational update has unusual stuff in it (JSE: WEZ)

Aside from concentrator plant issues, there’s also an odd outcome for the retrenchment process

Let’s start with Weziwe Platinum’s concentrator plant, which has some problems. During hot commissioning, defects were identified and experts needed to be appointed to fix it. This won’t be a quick problem, with the plan only commencing in the fourth quarter.

Another major bit of operational news is that the s189 retrenchment process at Bakubung Platinum Mine has been concluded. It’s an unusual outcome, with 345 redundant positions and only 13 employees actually being retrenched. The rest left under natural attrition or voluntary separation packages, or transferred to in-house vacancies. And of the 13 employees, 7 are being absorbed by the company’s training services provided. It’s not common to see so few retrenchments vs. the number of redundant positions.

Speaking of Bakubung, the production ramp-up will commence in Q1 2025. The concentrator ramp up will commence in Q4 2025, with the rectification work needing to be completed first. Mining is a complicated beast.

Little Bites:

- Director dealings:

- Titan Premier Investments, one of Christo Wiese’s main investment companies, acquired shares in Brait (JSE: BAT) for R332k.

- To help with cash preservation at Orion Minerals (JSE: ORN), the non-executive directors are taking a portion of their director fees in shares rather than cash. 1,625,000 new shares have been issued in that regard, worth just over R300k at the current market price.

- Grand Parade Investments (JSE: GPL) released a trading statement for the year ended June. HEPS is up by between 640% and 660%, with that rather daft percentage being due to the costs of the restructuring transactions in the base period. Less important than the percentage move is the range for HEPS of 18.94 cents to 19.46 cents for the year. The mid-point implies a Price/Earnings multiple of 17.7x, which tells you that the group is trading based on the value of underlying investments rather than the current earnings.

- DRA Global (JSE: DRA) has been in a legal dispute over the ironically named Mount Pleasant Project. There’s nothing pleasant or cheap about fighting in court, with DRA ordered to pay Mach Energy Australia a total of $96 million in three tranches over two years. This is in full and final settlement of the claims. After existing provisions and insurance, DRA will have to recognise additional expenses of A$30 million to A$40 million in the 2024 numbers. At least it finally brings an unpleasant situation to a close.

- The scrip dividend alternative at Lighthouse Properties (JSE: LTE) was strongly supported, with take-up of roughly 73% of the total number of shares that were available to be issued as an alternative to cash dividends. It’s always worth remembering that these scrip dividends are like miniature rights issues, so they preserve cash for the group but put pressure on per-share metrics like dividends per share going forward.