Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

AYO Technology is even more loss-making (JSE: AYO)

Unsurprisingly, the group is getting worse

It’s hard for me to understand why anyone would ever invest in AYO Technology. Reputational problems aside, even the numbers are terrible. For the year ended August 2023, the headline loss per share got a lot worse. In a trading statement, the company guided that the loss has moved from 60.25 cents to between 171.36 cents and 183.41 cents.

The share price, by the way, is just 80 cents.

The increased loss is due to lower gross margin in the operating companies, fair value adjustments on investments and other issues like derivatives.

Brimstone’s intrinsic NAV keeps moving lower (JSE: BRT)

Many of the investments have taken a knock since December 2022

Brimstone Investment Corporation has released a quarterly update to its intrinsic net asset value (NAV) disclosure. As an investment holding company, the intrinsic NAV is basically the directors’ opinion on what the portfolio is worth.

The market’s opinion is reflected in the share price, which sits at R5.40 vs. the fully diluted intrinsic NAV per share of R12.48. The discount to intrinsic NAV tends to be between 50% and 60%. The JSE is a tough place for these groups.

The intrinsic NAV per share has dropped 3.7% between December 2022 and September 2023. The growth in Oceana was largely offset by Sea Harvest, with those positions contributing a combined 75% of the portfolio. They’ve also taken big knocks in Equites (the listed property group) and Phuthuma Nathi, the MultiChoice B-BBEE scheme.

The direction of travel for intrinsic NAV has been lower for the past few years. It’s down 6% since December 2019.

The local logistics portfolio remains the backbone of Fortress (JSE: FFA | JSE: FFB)

Don’t forget that there’s a proposal on the table to deal with the dual-share class structure

Fortress Real Estate (not Fortress REIT – it lost that status, as you may recall) has released a pre-close update dealing with the months since the June 2023 year-end.

The highlight is the South African logistics portfolio, with record low vacancy of 0.5% by rental. They’ve been recycling capital through disposals of non-core properties. There’s a comment in the result that makes it sound like selling properties at decent prices is getting harder, so they are happy with the sales achieved in recent months.

The Central and Eastern European logistics portfolio has seen its vacancies increase from 3.9% to 6.4%. The increase is attributable to two buildings, so it shows how lumpy vacancies are in logistics vs. say a retail portfolio with many shops.

Speaking of retail, vacancies are down from 1.5% to 1.3% and tenant turnover is up 7.2% on a rolling 12-month basis.

In the industrial portfolio, vacancies were up from 6.8% to 7.8%. The group notes that there is still strong demand for well-located smaller industrial properties.

The office portfolio remains a mess, but is luckily less than 4% of total assets in the fund. Vacancies are up from 22.3% to 23.1% and they seem to be experiencing some luck with getting offers for properties.

The loan-to-value ratio is 35.5%, which is a decent level for any property fund.

A potentially big setback at Kibo Energy (JSE: KBO)

When a deal starts getting weird, it often ends in tears

If you’ve been keeping an eye on Kibo Energy, you’ll know that the group’s subsidiary in the UK (Mast Energy Developments) has been trying to put a joint venture together. The partner is Proventure Holdings. Well, the theoretical partner at least. In order to get the deal done, Proventure actually needs to pay across some money. That’s where things have been getting weirder and weirder.

For months now, we’ve been listening to silly excuses about why Proventure can’t pay. Frankly, I did think that Kibo sounded a bit naive about all this. Good partners don’t miss payment dates, especially not repeatedly. The latest long-stop date has been missed and it sounds like reality is dawning on Kibo, as they’ve now given Proventure 7 days to remedy the situation.

Even if the money arrives, that’s a terrible way to start a relationship. If it doesn’t arrive, there are theoretically penalties paying, but that’s a process in court to recover them.

There’s a simple lesson here: when deals start to get strange and partners get the basics wrong, there’s a very high chance that everything will fall over.

Where will the growth come from at PBT Group? (JSE: PBG)

Things are definitely tougher in a post-pandemic environment

PBT Group is one of the best local small caps. The business model is good and the company behaves like a much bigger company, evidenced by a proper reporting strategy that includes a bunch of really useful KPIs. In a market where some small caps think a trading statement and final results should go out 2 hours part, it’s always refreshing to take a look at PBT Group.

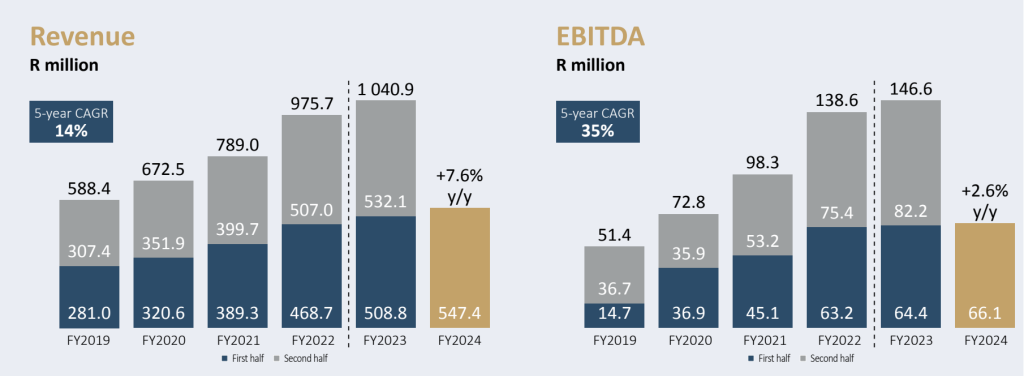

For example, they do the hard work for you with charts like these:

It’s really great to be able to just eyeball what’s going on here. If you do detailed research on companies, charts like these are worth doing for yourself.

The 5-year Compound Annual Growth Rate (CAGR) is much higher for EBITDA than for revenue. That means the group has achieved substantial margin expansion. If you look over the past couple of years though, there’s a different story. Despite revenue being R78.7 million higher in 1H24 than in 1H22 (R547.4 million vs. R468.7 million on the top left chart), EBITDA is only R2.9 million higher. All the margin expansion over the past five years happened right in the beginning, with the post-pandemic period reflecting a difficult operating environment where they are struggling to maintain the current level of profits.

What certainly hasn’t helped is the PBT Australia business, which contributes roughly 5% of revenue and still makes a loss. Due to difficulties in making progress in that market, PBT will sell that business to its management team.

Another important point is that the software business in which PBT holds a 58% stake outperformed the wholly-owned subsidiaries. Even though the profits from that business are consolidated into PBT’s numbers (i.e. 100% of its revenue and operating profits), the adjustment at the end for non-controlling interest is what really matters. Simply, when you look at PBT’s income statement for this period, there’s a larger proportion going to minority shareholders further down in the structure than before. This is part of why normalised HEPS has dropped by 4.3% to 31.4 cents.

This is a well-managed company that is dealing with the same issues in South Africa that so many other companies are dealing with. It looks like the share price got too far ahead of itself during the pandemic, with this chart now looking rather dangerous:

Quantum Foods is proof that margins are everything (JSE: QFH)

This is exactly why looking at only revenue multiples is foolish

Imagine sitting down at a piano. All the keys together make up the financials of a company. If you only look at revenue, you’re judging the entire piano based on what one octave sounds like. That’s a silly way to play or buy a piano. It’s also a silly way to buy shares.

Now, I don’t think anyone looks at just revenue multiples in the poultry industry, so this isn’t a comment on Quantum Foods specifically. It’s just a lesson in margins, as a company can grow its revenue and still suffer horrible numbers. Read on and see why.

For the year ended September 2023, Quantum managed to grow revenue by 15.5% to R6.95 billion. Sounds great, doesn’t it? Sadly, the operating loss is R35 million, down from operating profit of R37 million.

The highlight was the Animal Feeds division, which contributes just under half of revenue. It made an operating profit of R104 million. Here’s a quote from the result that says it all about South Africa, really:

“Whereas c. 70% of maize was delivered to the Malmesbury mill by rail seven years ago, we now deliver more than 80% via road due to the failing rail infrastructure in the country. This had a significant impact on transport costs over time.”

The Farming business was smashed by avian flu and other problems, so revenue of R1.8 billion (up 15.2%) couldn’t generate a profit. The operating loss was R80 million. If you dig a bit deeper, you’ll find that the biological asset write-off because of the avian flu was R155 million.

The Eggs business had a horrible time. Revenue fell 2.1% to R1.3 billion and the adjusted operating loss was R42 million. The highlight here is that conditions had started improving in May in terms of pricing and feed costs, but then along came the supply problems from avian flu.

The rest of Africa also struggled, with revenue of R443 million and an adjusted operating loss of R1 million.

In summary, this year would’ve probably turned out alright were it not for the flu outbreak. This is a major business risk in poultry at all times, but the industry did get particularly unlucky this year. Although the outbreak has impacted the start of the new financial year as well, FY24 will hopefully be a better period for Quantum.

Sibanye concludes retrenchments in the gold operations (JSE: SSW)

Thankfully, quite a few jobs were spared in the end

Back in September, Sibanye-Stillwater announced a restructuring of its SA gold operations, particularly at the loss-making Kloof 4 shaft.

Initially, 2,389 employees and 581 contractors were due to be affected. Through natural attrition at other operations, 1,057 employees took up roles elsewhere. 31 employees left during the process, which made life easier for the company. 176 employees and 26 contractors will retain their jobs temporarily for the decommissioning phase of the mine. 550 employees took up voluntary separation packages or early retirement, as were 348 employees elsewhere.

With all said and done, 575 employees could not be accommodated elsewhere and didn’t take the other agreed avoidance measures, so they are being retrenched. All the affected contractors are also being retrenched.

A tiger on the revenue line; a kitten further down (JSE: TBS)

Tiger Brands cannot maintain its margins

The good news at Tiger Brands is to be found right at the top of the income statement for the year ended September 2023. I was impressed that volumes are only down by 2% in a period when price inflation was 11%. Once you factor in those elements as well as forex gains, revenue increased by 10%.

If we dig a bit deeper, we find that volume growth was only in the export business. The domestic business suffered a decline in volumes, so that makes sense based on what I’m seeing around me.

Despite supply chain efficiency improvements, gross margin fell from 30.3% in the prior year to 27.7% this year. Combined with retrenchment costs this year and lower insurance proceeds than last year, operating income fell by 9% despite the juicy jump in revenue.

A useful contribution further down the income statement came from income from associates, which increased by 46% to R697 million. A large portion of this was due to a change in functional currency at National Foods from Zimbabwean Dollars to US Dollars.

A far more “real” issue to look at is net financing costs, which ballooned from R75 million to R238 million. This was driven by higher interest rates, more working capital and of course a reduction in cash because of the R1.5 billion share buybacks.

With all said and done, HEPS managed to limp higher by 2% and the final dividend is 3% higher. The total dividend of 991 cents puts Tiger Brands on a dividend yield of 5.5%.

If you read the outlook section, this company is firmly on the defensive in this environment. It’s all about cutting costs and rationalising the product range. Right at the end, they talk about growth in the informal market and in certain categories. One of them is hilariously called “snackification” – an excellent example of a made-up word in corporates.

There’s a new management team in charge to deliver on that strategy. Thushen Govender as been appointed as CFO as an internal promotion. You may recall that the company recently announced the appointment of Tjaart Kruger as CEO, seen by many as a turnaround specialist.

Little Bites:

- Director dealings:

- Calibre Investment Holdings, related to a director of Ascendis (JSE: ASC), has bought shares worth R24.9 million.

- Collins Property Group (JSE: CPP) announced that Christo Wiese bought R8.8 million worth of shares on 28 and 29 November and then sold R5.4 million worth of shares on 30 November in an off-market trade. Although the announcement isn’t explicit, it looks like associates of the Collins family bought the shares in the off-market deal.

- The CEO of Spear REIT (JSE: SEA) is buying more shares in his family investment vehicles, this time to the value of R89k.

- A non-executive director of Richemont (JSE: CFR) bought warrants for A shares with a value of R36k.

- African Equity Empowerment Investments (JSE: AEE) has made a change to the structure of its offer for an attempted take-private of the company. Instead of an offer to shareholders and subsequent delisting vote, this will now be a scheme of arrangement, still at a price of R1.15 per share. If the scheme is passed, a delisting would go ahead.

- After a few difficulties along the way, Brikor (JSE: BIK) has released the mandatory offer circular relating to the offer by Nikkel Trading 392 for the shares it doesn’t own in the company. Nikkel currently owns 68.01% of the shares. In the end, the CEO of the group changed his mind about not accepting the offer. He has now indicated that he will be taking it. This puts a lot of pressure on other shareholders to accept, as there’s little point in not being aligned with the CEO. The offer price is 17 cents per share. If Nikkel holds 90% of the shares after this offer, then a squeeze out can be used under s124 of the Companies Act to force remaining shareholders to sell. You’ll find the circular here.