Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Balwin targets growth in the KZN market (JSE: BWN)

This deal also has an interesting funding mechanism

Balwin has agreed to acquire 13.41 hectares of land in Shongweni in KZN. The property is adjacent to Westown Square, which is a 50,000 square metre retail site due to be completed in 2025. The broader area includes plans for a hospital, hotels, warehousing, schools and all sorts of other things. I don’t know this particular area at all, but Balwin reckons its an LSM 8 – 10 opportunity that has strong population growth among 30-somethings in particular.

What makes this deal particularly interesting is the “pay-as-you-register” model that Balwin has put in place with the seller. Basically, a contracted amount per apartment is paid to the seller on the registration of each apartment. Balwin will acquire development rights once all infrastructure has been installed by the seller and the property is fully serviced.

The benefit here is obvious: Balwin can do this deal with far less strain on the balance sheet than would otherwise be the case. They will develop 1,260 residential apartments and pay for the development rights as each one is sold. The value of the development rights is R133.7 million.

The price paid to the seller will be R100k for a 1-bedroom, R110k for a 2-bedroom and R120k for a 3-bedroom apartment. Balwin must settle the full price within 6 years and expects to sell all the units within 4 years, so they’ve built in some fat. Importantly, there are no inflation escalations on the purchase price.

There’s a further R27 million payable to the landowner when apartments are sold to clients. This is based on 1.5% of the selling price of each apartment. The seller of the development rights must also pay 1.5% over to the landowner, so Balwin and the seller are sharing the cost equally.

Long story short, Balwin has found a way to defer the payment of the development rights and make this a less capital-hungry exercise. Importantly, the company must still fund the development of the apartments and of course takes the risk on the development being a success, as the development rights must be settled within 6 years regardless of how well the development performs.

This is a category 2 deal, so shareholders won’t be asked for an opinion or a vote on it. The share price closed 5.4% lower on the day but this announcement came out after market close, so keep an eye on share price action on Monday when trade reopens.

Brikor is back in the green (JSE: BIK)

The company has guided a return to profitability

Brikor has released a trading statement for the year ended February 2024. It’s an important one, as it reflects a move from a headline loss per share to positive headline earnings.

With full details due to be released before the end of May, we at least know in the meantime that HEPS will come in at between 1.2 cents and 1.4 cents per share vs. a headline loss of 0.1 cents per share in the comparable year.

The share price is trading at R0.15 and there is limited liquidity in this thing, with a market cap of just over R100 million.

Brimstone’s intrinsic NAV is heading the wrong way (JSE: BRT)

Sea Harvest is the source of pressure on intrinsic NAV in the past three months

Brimstone’s intrinsic net asset value (NAV) per share is the key metric to assess the performance of the business, as this is an investment holding company with a variety of investments ranging from very small stakes through to control.

The investments in Oceana (a 25.1% stake) and Sea Harvest (53.4% stake) contribute the bulk of the intrinsic NAV per share. These are valued based on the market value per share, so this can lead to significant swings in the Brimstone intrinsic NAV.

Between December 2023 and March 2024, intrinsic NAV fell by 6.7%. Pressure on the Sea Harvest share price is largely to blame, although some other investments also went the wrong way (like MTN Zakhele Futhi). A reduction in net debt helped limit the pain at least.

If we take a longer-term view, it’s easy to see that the intrinsic NAV per share has been a really disappointing story in recent years. On a fully diluted basis, it reduced from R12.827 per share as at December 2020 to R11.097 per share as at March 2024. The market has valued the share price at roughly a 55% discount to intrinsic NAV, with little sign of that discount closing.

4Sight: full of buzzwords, but also growth (JSE: 4SI)

Revenue is up substantially

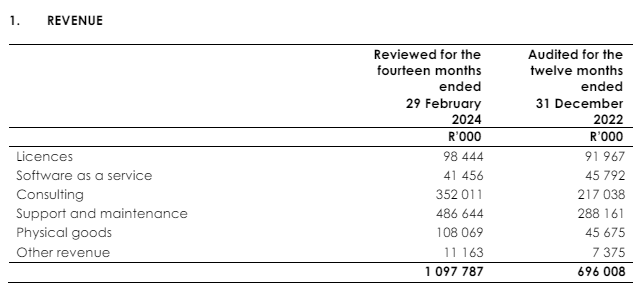

4Sight operates in the technology space and it really won’t take you long to figure that out, with words like digital transformation and artificial intelligence featuring prominently. Buzzwords aside, the growth in the business across Africa and the Middle East is significant. This table shows how they make money:

Total revenue is up by 57.7% and the increase in support and maintenance is particularly encouraging, as that sounds recurring in nature. Operating profit is up by 76.9%, so the revenue growth is being accompanied by an improvement in margins – a wonderful combination for investors. Gross margin did dip though, so the operating expense management was where the good stuff happened.

But here’s the trick: you need to read really carefully. The latest period is for the 14 months to February 2024 and the comparable period is the 12 months to December 2022. This is because of a change in year-end. Those growth rates are impressive regardless, but clearly that plays a role.

HEPS is up by 153.8%, coming in at 6.037 cents per share. The dividend is 5 cents per share vs. no dividend in the comparable period. Again, this is for 14 months, so you can’t use this in the normal way to calculate a dividend yield or P/E multiple. They did also release 12-month results which help, but there’s an odd situation here where January and February added plenty of revenue but not much profit. It’s not clear how much of this is seasonal.

Change in reporting period and other questions aside, there’s still a very high growth rate and the dividend is a high payout ratio vs. HEPS, suggesting that these are high quality earnings.

The share price is R0.84.

ISA Holdings is another tech small cap on a charge (JSE: ISA)

Revenue and profits are up strongly

ISA Holdings seems to be in the right place at the right time, with a business model focused on cybersecurity solutions. This is a major area of investment by corporates at the moment. ISA offers a consumption-based solution that is resonating with consumers.

Revenue is up by 33% and profit before tax is up 23% for the year ended February 2024. These are great growth rates, even if there is some margin contraction. They attribute the dip in margin (gross profit margin down from 53% to 49%) to product sales during the current period that excluded any of the higher margin services.

Share of profits from equity associate DataProof (another cybersecurity offering) increased by 63%. This helped drive HEPS higher by 35% to 18.9 cents.

But here’s the real kicker: the dividend payout ratio is 100%. The interim dividend was 7.7 cents and the final dividend is 11.2 cents. This adds up to 18.9%, which is equal to HEPS for the year. As cash quality of earnings goes, you won’t find better than that.

And in case you think it’s a fluke, they did exactly the same thing in the comparable period with a 100% payout ratio.

A chance for MC Mining shareholders to sell to Goldway (JSE: MCZ)

There is no compulsory squeeze-out envisaged

Goldway is giving the remaining shareholders in MC Mining another chance to sell their shares on the same terms and conditions as the recent buy-out offer. This means a cash price of A$0.16 per share.

This gives remaining shareholders until 25th June to accept the offer. Those who do not accept it will then sit with a highly illiquid stake in the listed company. There’s no guarantee whatsoever of being able to sell those shares to Goldway or anyone else.

Goldway intends to delist the shares from the ASX and the JSE but has not commenced the process yet. The listing on the AIM in London is being cancelled, though.

A most unusual situation at Pan African Resources (JSE: PAN)

The company needs to rectify a technical problem with previously paid dividends

Here’s one that you won’t see every day! Pan African Resources has released a circular that seems to reclassify the share premium account on the balance sheet as a distributable reserve. The reason is that dividends paid from 2019 to 2023 met the net assets test on a ZAR basis, but not on a USD basis which is the presentation currency for the group.

The substantial depreciation in the rand over the past few years led to a Foreign Currency Translation Reserve with a negative equity balance of $171 million. It gets deemed as a distributable reserve under the rules for assessing whether a dividend can be paid, leaving the group with a serious problem. Even though the ZAR numbers look perfectly capable of supporting a dividend, the USD balance sheet tells a different story.

Share buybacks over the same period suffer from the same problem.

The company has no intention of trying to recover the past dividends from shareholders. Instead, the goal is to get shareholders to agree to remedial resolutions that take the form of a capital reduction, which means reclassifying some equity as distributable reserves.

What isn’t clear at this stage is how the company fixes this problem going forward. They note that a number of accounting strategies are being considered to ensure adequate distributable income going forward. Changing the presentation currency to ZAR is presumably one way to do it, although this goes against the company’s attempts to appeal to a global shareholder base.

Like I said: you won’t see this every day.

Revenue dropped at Quantum but HEPS is way up (JSE: QFH)

This was a period of margin improvement

Revenue at Quantum Foods fell by 13% for the six months to March 2024. That doesn’t sound like the start of a great highlights package, yet operating profit was up a ridiculous 327% and HEPS jumped by an even sillier 653%.

To put more sensible numbers to it, headline earnings increased from R6 million to R43 million. This is a good reminder of how touch-and-go the base period was.

Although there was an impact from avian flu outbreaks in this period, the real win came in higher egg prices and a drop in input costs in the form of raw materials for feed (yellow maize and soya meal). This is despite the weaker rand, as international prices thankfully fell by enough that the rand couldn’t offset the benefit. And of course, less load shedding took some strain off the system in terms of diesel costs etc.

In summary, despite the pressure on revenue from a drop in egg volumes, the unit economics improved so much that profitability went firmly in the right direction. This is a great reminder that margins matter more than revenue. It doesn’t help to sell more of something that is barely profitable.

Of course, first prize would be a recovery in egg volumes along with these improved margins.

As this paragraph in the outlook section shows, Quantum isn’t buying the story that load shedding is gone for good:

No interim dividend has been declared despite the improved results.

Little Bites:

- Director dealings:

- A director of a major subsidiary of Shoprite (JSE: SHP) sold shares worth R1 million.

- Telkom (JSE: TKG) shareholders have approved the category 1 transaction to dispose of Swiftnet to an infrastructure investment consortium that includes Actis and Royal Bafokeng Holdings. In fact, the deal achieved 100% approval from shareholders in attendance at the meeting, which is an unusual level of support.

- Afine Investments (JSE: ANI) released a trading statement noting that earnings per share will be 94.70 cents for the year ended February 2024. This is because of upward revaluations of properties. They haven’t given a specific number for HEPS but they have noted that it will be within 20% of the prior comparative period, so cash earnings aren’t as exciting as the property revaluations.

- Accelerate Property Fund (JSE: APF) released an announcement correcting an error in the circular regarding the directors’ intention to subscribe for the rights offer shares. The circular initially noted that it is likely that the directors won’t subscribe for them. The correct position is that directors have disclosed an intention to participate, which makes sense given how discounted the rights offer is price is.

- Hammerson (JSE: HMN) announced the results of the dividend reinvestment plan alternative. It had very little uptake, which isn’t a great show of faith in the company. Holders of 1.57% of shares on the UK register and 0.58% of shares on the SA register elected to receive shares in lieu of a cash dividend.

- Momentum Metropolitan Holdings (JSE: MTM) is looking to do all of us a favour by shortening the name to Momentum Group. This requires the issuance of a circular to shareholders – admittedly a very small one. In case you’re curious, you can find it here.