Barloworld trading statement: look closely (JSE: BAW)

The difference between continuing and discontinued operations is critical

At first glance, Barloworld’s results for the year ended March 2023 don’t look good. HEPS fell by between 4.5% and 6.3%, which suggests that the core operations are struggling.

You need to dig deeper, particularly after the mobility business Zeda was unbundled to shareholders and the Logistics business was sold. When earnings have been sold off or simply passed on to shareholders, then group earnings obviously move lower.

This is why the concept of “continuing operations” is so important, as it tells you about what is left in the group. On that measure, HEPS increased by between 28.5% and 31.0%. That’s more like it!

DRDGOLD reports a huge positive swing in EBITDA (JSE: DRD)

The company has enjoyed a higher gold price

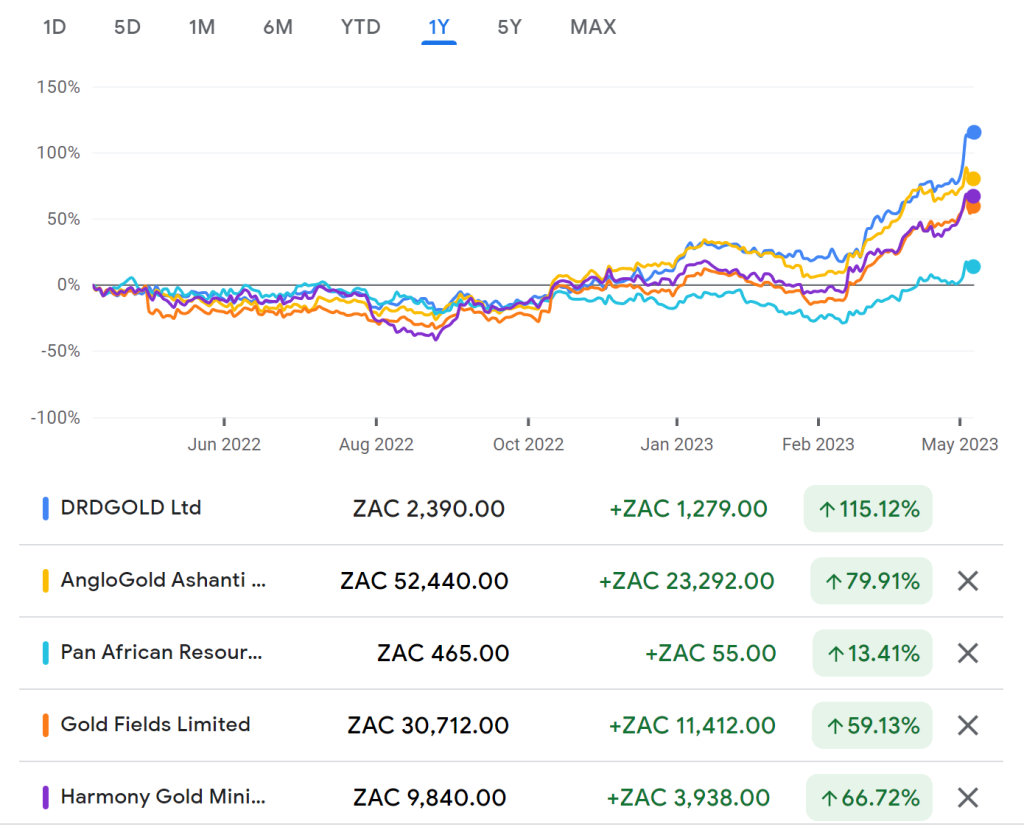

DRDGOLD gives punters an exceptionally leveraged play on gold. This chart of DRDGOLD vs. competitors will show you that if you believe gold is going higher, then picking the company with the highest operating leverage (i.e. DRDGOLD) is the way to go:

The reverse is also true, in case you’re wondering. Get it wrong and DRDGOLD will bite your head off.

The reason for this is that DRDGOLD is a tailings business, so it processes ore that was previously mined to get more gold out of it with modern techniques. This isn’t exactly the most efficient way to find the yellow stuff, so the production cost is high and margins are very thin unless the gold price moves higher. You can see where this is going.

Quarter-on-quarter production increased by 4% and the average gold price received was 11% higher in rand. With all-in costs per kilogram only up by 2% over the same period (thanks to improved yield in the process of extracting the gold), the net result is a 54% jump in adjusted EBITDA!

There is no debt in this business, which is why investors see it as a cash cow during a period in which gold prices are rising.

Eastern Platinum completed a rights offering (JSE: EPS)

Most of the capital was raised in Canada

Eastern Platinum has raised roughly R96.5 million through a rights offering, with the vast majority of the capital (around R94.5 million) being raised on the Toronto Stock Exchange.

Ka An Development Co now owns 49.9% in the company after following its basic rights and exercising what the announcement refers to as a subscription privilege.

Orion gets a step closer to unlocking funding (JSE: ORN)

A crucial condition precedent has been met

Orion Minerals rallied 16.7% on the news that the company managed to repay the Anglo American sefa Mining Fund loan facility. The loan dates back to 2015 and was used for exploration and development of the Prieska Copper-Zinc Project.

Thanks to the share placement with Clover Alloys and major existing shareholders, the company settled the loan and has released the shares held as security against the loan. This is the key in unlocking the IDC convertible loan facility and Triple Flag Precious Metals Corp early funding arrangement, as those shares are needed as part of the related security package.

Drawdown on those packages is expected imminently, with the initial capital earmarked for trial mining, dewatering and feasibility studies.

Redefine gets a bloody nose from the market (JSE: RDF)

A significant drop in the dividend never puts a smile on the faces of REIT investors

Redefine (JSE: RDF) finds itself in the unfortunate position in which a large proportion of its portfolio is in the Office sector, which is still a horrible place to be. 38% of the South African portfolio is Office, with a 14.3% vacancy rate and -12.4% rental reversions in the six months to February 2023.

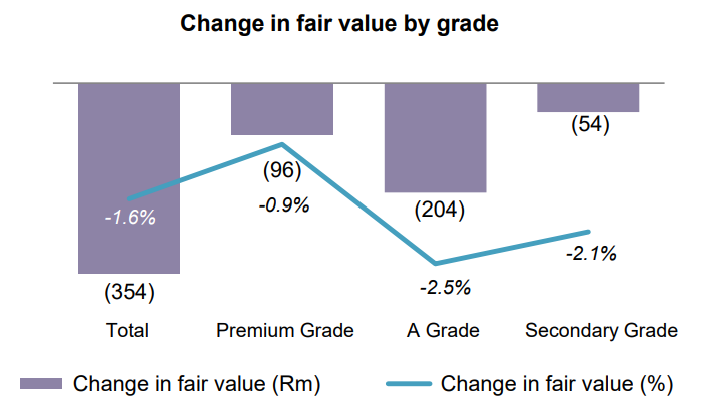

The fair value movements in the Office portfolio make for sad reading regardless of the grade of the property:

In the South African Retail portfolio, reversions were also negative at -3.7%. In other words, new leases are being concluded at lower rates than the expired leases. The vacancy rate of 4.4% is steady year-on-year and the portfolio’s fair value moved higher by R139 million – nowhere near enough to offset the Office move.

Enter the Industrial portfolio: an asset class that is still doing very well. Although vacancies increased from 3.1% to 4.9%, reversions were positive at +1.3% and the total fair value was R141 million higher. In case you’re keeping score, that still doesn’t make up for the Office move.

We can’t just look at the R59.4 billion South African portfolio, as there’s also the R34.7 million portfolio in Poland as part of the Redefine story. 82% of that portfolio is in the Retail sector and only 3% is in Office, with the rest in Industrial – a much better split than in the local business. Metrics are mixed in the overseas business, with reversions still negative as a headache for investors.

If we look at the balance sheet, the SA REIT loan-to-value increased from 40.2% to 40.9% and the weighted average cost of debt in South Africa moved from 8.7% to 9.2%. This really isn’t the right time for debt to be going up, which is part of what the market didn’t like. Although 81.2% of group debt is hedged for an average term of 1.7 years, these hedges can’t be achieved for free and the cost is becoming increasingly more expensive.

With all said and done, distributable income per share was down by 9.2% and the dividend per share fell by 14.2%. The market punished Redefine with a 6.6% drop in the share price.

South32’s Hermosa project gets FAST-41 status (JSE: S32)

Zinc and manganese are of strategic importance

South32 is the proud owner of 100% of the Hermosa project, the only advanced project in the US that could supply two federally designated critical metals: zinc and manganese. With the project now given FAST-41 status, South32 expects a more efficient and transparent process in achieving the federal permits required as the development of the Taylor and Clark deposits continues.

The feasibility study for the Taylor zinc-lead-silver deposit is expected to be completed in the second half of the calendar year and early stage work is underway at the Clark battery-grade manganese deposit, with the focus on moving to a pre-feasibility study.

Little Bites:

- Director dealings:

- Des de Beer has bought another R2.75 million worth of shares in Lighthouse Properties (JSE: LTE).

- An associate of a director of Ascendis Health (JSE: ASC) has bought shares in the company worth R211k.

- Sanlam’s (JSE: SLM) partial offer to AfroCentric (JSE: ACT) shareholders is now wholly unconditional, with regulatory approvals having been met.

- Claims filed by market purchase claimants in relation to Steinhoff’s (JSE: SNH) global settlement will be settled through the Stichting Steinhoff Recovery Foundation on a rolling basis from 10 May 2023.

- Jasco Electronics (JSE: JSC) has received the necessary compliance certificate from the Takeover Regulation Panel (TRP) that will enable the offer and delisting to go ahead.

- Efora Energy (JSE: EEL) is suspended from trading and released a trading statement noting a headline loss of between 33.51 cents and 34.51 cents. With a suspended price of 12 cents per share, that doesn’t sound good.