Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Bell Equipment has released the scheme circular (JSE: BEL)

The all-important general meeting is scheduled for 12th September

After what feels like the longest time in the process of the Bell family taking Bell Equipment private, we’ve finally arrived at the release of a circular. If you think back at all that has happened in the past couple of years, including tough stuff between the controlling family and activist minority shareholders, it’s all come down to this.

The offer on the table is for R53 per share. The independent expert report puts the valuation range at R50.83 to R56.54 per share, so that’s smack in the middle. Perhaps the offeror and the expert worked off the same model. Anyway, it’s clearly fair and reasonable, with the report available here.

The detailed circular is available here, with the most important point being that IAB (the Bell family entity) and concert parties hold a combined 84.95% of the shares. This leaves a very thin voting base of roughly 15% of total shareholders, within which Bell needs to achieve 75% approval. A couple of major non-concert shareholders could block this thing, which is why Bell had to dig deep to make a juicy offer. Although the offer is fair on paper, the reality is that it’s a huge premium to where the stock was trading, as it was stuck at a significant discount to fair value. Without a monetisation event like this, it would likely go back there.

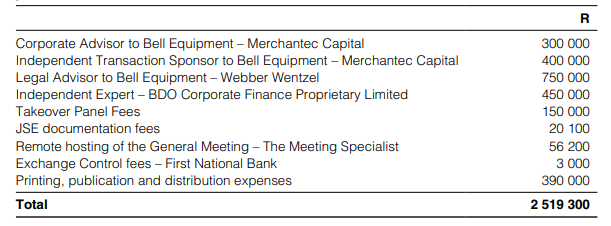

I always look at the schedule of fees on deals like this. Bell managed to get this done with probably the smallest bill for fees that I’ve seen in a deal of this nature:

If you need someone to negotiate on your behalf for something, send in the Bell team!

Chrome recoveries are under pressure at Eastern Platinum (JSE: EPS)

Revenue and operating income went in the wrong direction in Q2

In the second quarter of the 2024 financial year, in other words the three months to June, Eastern Platinum experienced a nasty drop in revenue of 48.6%. Mine operating income fell by 66.9%, with the usual story in mining of a percentage move in revenue being magnified at operating income level. By the time you reach earnings per share and look at it over six months, the drop is from $0.05 in the comparable period to $0.01 in this period.

The group still has a working capital deficit, an issue that has been going on for a while now.

The reason for the poor result is mainly that chrome recoveries from the tailing resource weren’t nearly as strong as they were in the prior period, with a drop in the tailing feed and the chrome concentrate achieved from the feed. They are effectively managing down those operations, while working to ramp up production in the Zandfontein underground section at the Crocodile River Mine.

It also didn’t help that PGM production was down, along with the problem facing the entire PGM industry: depressed commodity prices.

HomeChoice signs off on an excellent interim period (JSE: HIL)

The market gave thanks with the share price closing 13% higher

HomeChoice has released results for the six months to June. They really are strong, with revenue up 15% and operating profit up 36%. Weaver Fintech is where the money is really being made, contributing 95% to operating profit before group overheads.

With 89% of transactions are being conducted digitally, HomeChoice’s retail operations seem to ultimately be the storefront for the distribution of fintech solutions. Think of it like a smart furniture store, as the economics for furniture have always relied on selling the products on credit to get strong enough margins.

Importantly, there’s a much broader play here in the fintech space. The focus on Buy Now, Pay Later (BNPL) products is working really well, with many retailers using the PayJustNow system. BNPL is an excellent concept and I’ve tried it myself. The merchant carries the cost and you effectively get interest free credit if you pay the goods off in time. I know that sounds like a credit card, but a card is a license to spend on anything, whereas BNPL isn’t available everywhere and seems to be focused more on consumer discretionary items rather than all the online temptations that are available with a credit card. Also, credit cards come with monthly fees, whereas BNPL costs you literally nothing.

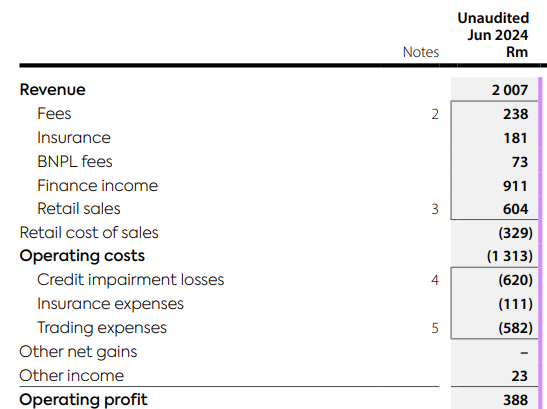

HomeChoice also has funeral and personal accident insurance businesses, so they are working hard to build a larger fintech ecosystem. To give you an idea of how just large the fintech side of the business is vs. retail sales, here’s a snippet from the income statement:

With HEPS up 37% to 196.9 cents and an interim dividend of 95 cents a share, there’s much for investors to smile about. The share price is 44% higher over the past 12 months, showing that plenty of money can be made in companies that don’t usually feature on the stock picking lists. With a market cap of R3 billion, perhaps it’s time that HomeChoice got more attention?

Santam celebrates better underwriting results (JSE: SNT)

The interim results have shown substantial growth

Santam has released a trading statement for the six months to June. Thankfully, the trading statement has been triggered for all the right reasons, with HEPS expected to be between 25% and 35% higher.

Aside from growth in gross written premium, the major driver here is better underwriting results for conventional insurance business, with the net underwriting margin expected to be within the long-term target range of 5% to 10% despite weather and other large loss events. Another important driver is earnings growth in the alternative risk transfer business.

An insurance business makes money by writing premiums, pricing them correctly to lock in the right underwriting margin, managing expenses and investing the float in the right places. When results are released on 29 August, we will have more information on all the various elements.

Little Bites:

- Director dealings:

- A prescribed officer of Dis-Chem (JSE: DCP) has been selling shares in the group recently and there’s another sale of R2.8 million to add to the tally.

- The CFO of Hammerson (JSE: HMN) acquired shares in the company worth £60k.

- The CEO of British American Tobacco (JSE: BTI) reinvested dividends into shares worth £6.4k.

- Sasol (JSE: SOL) has announced that Walt Bruns will take over as CFO of the group. He is currently the CFO of Sasol Southern Africa and has been with the group for 15 years, so this is an internal promotion which is always encouraging.

- Trencor (JSE: TRE) is effectively a cash shell that is set to commence the winding up process by 31 December 2024. Although there will be a few regulatory hurdles along the way that could delay it, that’s the plan at least. As at the end of June, the net asset value per share is R8.22. The current share price is R7.19.

- Sirius Real Estate (JSE: SRE) announced the results of the dividend reinvestment plan (DRIP) alternative. It didn’t get huge uptake, with holders of 0.31% of shares on the UK register and 2.23% of shares on the SA register electing to receive shares under the DRIP. The rest wanted the cash. Of the total distribution of €41 million, only €1 million was settled in shares.

- Winds of change have blown at Pick n Pay (JSE: PIK) in a big way, with the Ackerman family deciding to reduce its voting rights in Pick n Pay from 52% to 49%. Although in practice this is still effective control as you’ll never get 100% attendance at a meeting, it does send a message about their willingness to step away and let the management team fix the group.

- Although I feel like Jubilee Metals (JSE: JBL) told us this just the other day, they’ve confirmed that Roan’s Front-End Module has produced its first copper concentrate. This comes a week after announcing the commencement of production. The nuance here must be the concentrate, which I assumed was a foregone conclusion after the commencement of production.

- Brait (JSE: BAT) announced that the implementation date for the exchangeable bonds has now been reached. This means that the rate on the bonds has now increased and the price at which they are exchangeable into shares has changed.

- Efora Energy (JSE: EEL) has finally released earnings for the year ended February 2024. Although revenue was up massively by 424% to R41.9 million, there was a headline loss per share of 1.72 cents vs. headline earnings of 0.51 cents in the comparable period. Importantly, the auditors have highlighted that there is a material uncertainty around the company’s ability to continue as a going concern.

- Cilo Cybin (JSE: CCC), which recently listed as a special purpose acquisition company (SPAC), is still in negotiations to acquire Cilo Cybin Pharmaceuticals as a viable asset. It’s hard to imagine a world in which that deal doesn’t go ahead, given the structure of the listing.

- Trustco (JSE: TTO) is proposing an issuance of 9.5 million shares in total to various non-executive directors. They are justifying this based on fee reductions implemented during Covid. At the current share price, that works out to R3.2 million in value.

No liquidity. 91.8% held by 2 shareholders. Wonder why company is listed.