Bell Equipment tightens its earnings guidance (JSE: BEL)

It’s not pretty, but could’ve been worse based on initial guidance

In Bell Equipment’s initial trading statement released in December 2024, they guided for a drop in HEPS of “at least 40%” for the year ended December 2024. Now, the words “at least” can work really hard here, so investors always need to be nervous of that.

The good news is that the guidance wasn’t far off at all. In an updated trading statement, they’ve tightened the range to a drop of between 40% and 44%. That’s not what shareholders want to see of course, but it could’ve been much worse based on the initial guidance.

Metair expects more pressure to come in the automotive manufacturing sector (JSE: MTA)

Disruption can be an ugly thing

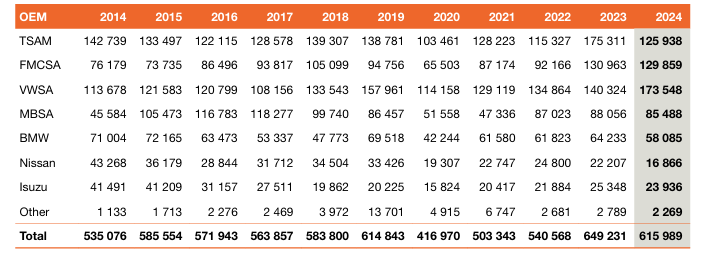

Metair has now released its results for the year ended December 2024. They include this fascinating table that shows passenger vehicle production in South Africa from 2014 to 2024, by manufacturer:

The SA Auto Industry Master Plan apparently had a vision of 735,000 units. Then along came COVID, followed by the Chinese. Alas, it doesn’t look like we are going to get there, as there is now massive disruption in the sector for the European brands. This means that Metair has had to downscale production estimates based on meetings with key customers like Ford and Toyota.

This is of course the reason why Metair has acquired AutoZone. They have little choice but to find ways to extract value from the existing cars out there, not just the manufacturing of new cars. The synergies are pretty clear here, with the ability to push manufactured parts through that distribution channel.

To be fair, they are also making solid progress in turning the business around within this difficult context. For example, Hesto shifted from negative EBIT of R608 million in 2023 to a profit of R257 million. This was despite the drop in vehicle production volumes.

Although the group reported a headline loss, you can blame the discontinued operations for that. The thing to focus on is continuing operations, in which case HEPS fell by 9% to 89 cents per share. Cash generated from operations was up 28%, so there’s some more good news.

All eyes are on the balance sheet, as Metair needed to navigate a situation that included R5.2 billion in group debt as at 1 January 2024. By the end of December 2024, it was down to R4.5 billion. They’ve managed to restructure bank debt of R3.3 billion at Metair into term loans of R1.7 billon and a secured mezzanine facility of R1.6 billion. They’ve also restructured R1.4 billion worth of debt in Hesto.

The cost of debt will vary based on net debt : EBITDA. As the metrics improve, the debt gets cheaper. I wish I could tell you what the metrics are for the mezzanine facility, but I cannot find them in the annual report. Unless I’m missing something obvious, that’s now gone from a concern to a red flag, as mezzanine funding can be extremely expensive based on the usual equity kickers.

If anyone has seen that disclosure, I would love to know where.

An approach has been made to Metrofile (JSE: MFL)

Will long-suffering investors finally get a good outcome here?

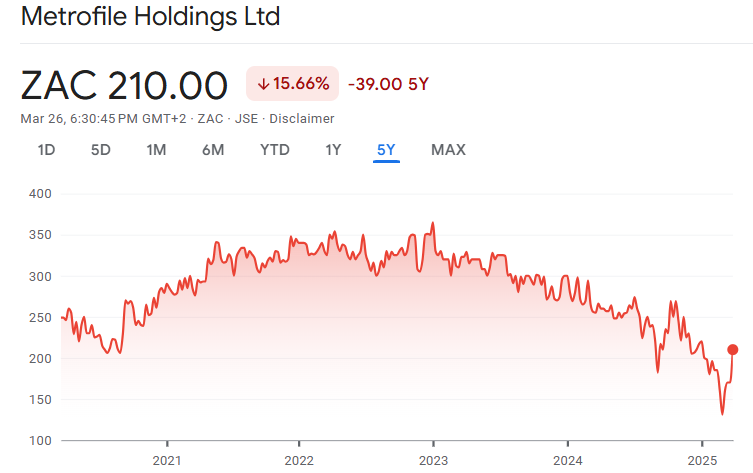

Metrofile hasn’t exactly been a bastion of organic growth. Recent results have been uninspiring to say the least, which is why the share price had lost 28% of its value thus far this year. Over three years, it had lost half its value. There hasn’t been much to smile about.

Those who bought in recently had a great day on Wednesday though, as the company released a cautionary announcement related to a potential acquisition of the company. Although there’s no firm offer just yet, the company has appointed advisors and things seem to be moving in that direction. Remember, until there’s an offer on the table, there’s no guarantee of one coming through.

The share price closed 28.8% higher in anticipation. That sounds amazing, until you see what that looks like on a chart:

As you can see, the latest rally has effectively taken the share price back to where it started the year. Other than investors (or is that punters?) who bought the stock this year, practically everyone else is in the red.

Here comes another disposal by Zeder Investments (JSE: ZED)

This time, it’s a business within Zaad Holdings

Zeder has been firmly in value unlock mode, which is a fancy way of saying that they’ve been selling off assets and paying the proceeds out to shareholders. There have been a bunch of disposals in this regard, leaving the company much smaller than it used to be.

The latest such example is a disposal of Bakker Brothers and Pristine Marketing, which fall under Zaad Holdings. The operations in question are in Zimbabwe, Mozambique and Zambia, along with intellectual property held by Bakker Brothers in the Netherlands. Zimbabwe is a difficult region and has been struggling with hyperinflation.

The total price is R135 million and the purchaser is an entity that is owned by ETG and SABIC Agri-Nutrients. R118 million is payable up-front and the rest will be held in escrow for 12 months. When you adjust the earnings for hyperinflation to get to a recurring number, the assets in question generated headline earnings of R65.7 million for the year ended June 2024. They aren’t exactly getting much of a multiple here, are they?

Before the fair value loss recognised in the interim results ended August 2024, these businesses were held at R440 million. They’ve therefore taken quite a bath here. The good news is that the fair value loss in the interim period already brought the value down to this selling price, so there’s no further impact on the net asset value or sum-of-the-parts value of the company.

Zaad will use the proceeds to reduce debt, so shareholders won’t get a special distribution. This is different to what investors in Zeder have become accustomed to.

Nibbles:

- Director dealings:

- Des de Beer has bought just under R2 million worth of shares in Lighthouse Properties (JSE: LTE), adding to his rather extensive collection of shares in the company.

- An associate of a director of The Foschini Group (JSE: TFG) sold shares worth R975k.

- A handful of directors of Anglo American (JSE: AGL) elected the “shares in lieu of fees” scheme. This is effectively a purchase of roughly R740k worth of shares.

- A prescriber officer at the JSE (JSE: JSE) sold shares worth R62k.

- Labat Africa (JSE: LAB) is pushing forwards with its IT strategy. The group has concluded the previously announced acquisition of Ahnamu and has issued the associated shares. They’ve also entered into a royalty distribution agreement with Ubits, an ICT company focused on the financial sector. They talk about generating “substantial value” without giving any real details of the economics, apart from throwing the number R2.5 billion around without any context. The announcement is a good example of a company using SENS as a PR platform.

- SAB Zenzele Kabili Holdings (JSE: SZK) released its annual report for the year ended December 2024. This structure has some pretty serious risks given the underlying exposure and the way the whole thing is funded. The dividend is down 31% for the year and the net asset value plummeted by 57%. The net asset value per share is now just R28.26, so the share price of R39 is once again way above the underlying value. I genuinely don’t know where the bottom is for this thing.

- Supermarket Income REIT (JSE: SRI) has completed the internalisation of its management function. In other words, it has cost shareholders a lot of money to put a normal situation in place where executives earn salaries and bonuses, rather than a fee linked to the size of the fund. It really is incredible how generational wealth was created by property executives (at a number of funds) who found themselves in the right place at the right time. There are very few external management company structures left.

- Sibanye-Stillwater (JSE: SSW) announced that the Keliber Lithium project in Finland and the GalliCam project in France have been designated as strategic projects under the EU Critical Raw Materials Act. If this sounds terribly familiar to you, that’s because you read it just one day prior in an Anglo American announcement regarding their Sakatti copper project in Finland. Sibanye gave an interesting additional insight that there were 170 applications received and 47 strategic projects selected. The Keliber Lithium project is expected to start production in the first half of 2026. The GalliCam project is at pre-feasibility stage.

- Gemfields (JSE: GML) requires more time to finalise the full year results. They will make more announcements in due course.

- Perhaps something is finally going to happen at PSV Holdings (JSE: PSV), which has been suspended from trading since forever. There was a meeting with the JSE in March to understand how a potential recapitalisation would work. The JSE has requested information that the liquidator will need to provide. Overall, the company is still under a cautionary announcement – not that you’re able to trade it on the JSE right now anyway! You’ll struggle to even find a website for them.