Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

The global nickel market is a mess – and BHP is being affected (JSE: BHG)

Western Australia Nickel’s operations are being temporarily suspended

The global nickel market is struggling with major levels of oversupply. Welcome to capital cycles and the pain they can inflict when too much capital flows into a particular service or product before demand has been fully established. When prices fall, supply must decrease as nickel miners choose to rather suspend operations than continue making losses.

This is exactly the case for BHP at Western Australia Nickel, where operations are being suspended from October 2024. BHP will review the suspension by February 2027, so they expect the oversupply to remain a problem for a while.

The transition period (i.e. the period of suspension) will cost BHP $300 million per year, so there’s no enjoyable way to deal with this problem. They have to follow a care and maintenance program and they are choosing to continue investing in exploration. They also plan to support the affected communities.

This pales in comparison to the $3 billion that BHP has sunk into Western Australia Nickel since 2020. Despite that capital investment, the expected EBITDA for the year to June 2024 is negative $300 million. Presumably they expect the losses to worsen, as that sounds a lot like the annual cost they’ve put forward for the transition period.

Every affected frontline employee will be offered an alternative role at BHP, so they are doing their best here to look after the staff.

The market hated the Bytes update at the AGM (JSE: BYI)

A 6.3% drop on the day wasn’t pretty

If you enjoy putting on a speculative long trade based on the share price that has dropped all the way down to a support level, I present you with a chart of Bytes:

The damage of a 6.3% drop in a single day was done by an announcement with just a few relevant sentences in it. At the AGM, the company gave an update on trading in the first four months of the year. Perhaps the worry is around the mix effect, with lower margin software revenue delivering much of the growth.

This is the challenge when a company is trading at a high multiple: any concerns are punished severely by the market.

Whatever the reason, the facts are that both Gross Invoiced Income and Adjusted Operating Profit grew by double digits, with Gross Profit growth in the high single digits. So yes, there is margin pressure in the revenue mix, but they still achieved double-digit growth in operating profit which is actually what counts.

It’s also important to note that Bytes makes its money offshore, so this is a rand hedge. A strong rand has a negative impact on the Bytes share price.

Insimbi releases the circular for the recently announced disposals and share repurchases (JSE: ISB)

This is basically the opposite of an asset-for-share transaction

Insimbi has released a circular that does just about everything except solve world peace. In one circular, they’ve covered the repurchase of shares from various associated shareholders representing 11.41% of shares in issue, as well as the disposal of two businesses.

But if you read closely, you’ll see that the deals are linked. This is because they are executing a deal that is the reverse of the usual asset-for-share acquisition. In those deals, a listed company usually buys assets and pays for them by issuing shares. In this case, the company is selling assets and helping the buyers pay for them by repurchasing shares from those buyers for cash.

It’s not quite that simple, as only a portion of the repurchase proceeds will be used for the acquisitions. Insimbi will part with R43 million for the repurchases and will receive R30 million back for the disposals.

The transaction cost for the deals comes to R2 million. It’s expensive as a percentage of the deal value, but perhaps not unreasonable for the level of complexity.

To read the full circular, you’ll find it here.

Showtime for the Pick n Pay rights offer (JSE: PIK)

Unsurprisingly, the underwriters really don’t want the shares

In a rights offer, you can tell a great deal about the capital raising strategy from the way that the deal is structured.

For example, in a rights offer where there’s a strategic shareholder who wants to mop up more shares at a discounted price, you’ll typically see a fairly modest discount on the shares and an inability to apply for excess applications. This encourages a situation where the demand for the rights offer is limited, so the underwriter can step in and buy a significant number of shares. In an illiquid stock where buying up a meaningful stake is difficult, this is a very effective way to build a large strategic position.

At Pick n Pay, the underwriters are the banks. They are basically there under duress, as they need to make sure that this systemically important company lives to fight another day. The banks have no interest in owning Pick n Pay shares over the long-term though, or even the near-term. Instead, they are hoping that the market will take up the shares.

How do you achieve this? Well, a rights offer price of R15.86 per share is a good place to start. This is a 32.48% discount to the theoretical ex-rights price per share as at 30 July. Perhaps the better way to think about this price is that Pick n Pay was trading at R40 a year ago. Before things started to go severely wrong, it was at R60. Today, the share price is a sad and sorry R27.50 at market close, with a 52-week low of R16.62 before the disappearance of load shedding and the GNU-phoria took over.

There are a couple of other strategies at play here, like the ability for shareholders to trade their letters of allocation. Even if they don’t want to take up the shares, they can sell the letters at a price that should reflect the difference between the rights offer price and the market price. This helps mitigate the damage from the dilution for shareholders who won’t follow their rights.

And as referenced earlier, excess applications are also part of this rights offer. Shareholders can apply for excess applications and hope that they get a decent allocation, which means buying up shares in excess of what their pro-rata amount would imply.

Like I said, the underwriters really don’t want these shares. As for the Ackerman family, they will follow their rights up to R1.01 billion. That’s a pretty big cheque to write, but I can’t see how they would’ve gotten any support at all to save Pick n Pay if they weren’t prepared to put more money in.

This process to raise R4 billion in equity capital is officially underway, with the circular to be sent to shareholders on Monday 15 July. If you are a Pick n Pay shareholder and you don’t want to follow your rights, then at least make sure you sell your letters of allocation. You also need to check how your broker operates in terms of the rights offer and how to go about following your rights – or not, as the case may be.

Either way, you cannot ignore this as a Pick n Pay shareholder. Make a note to read the circular on Monday.

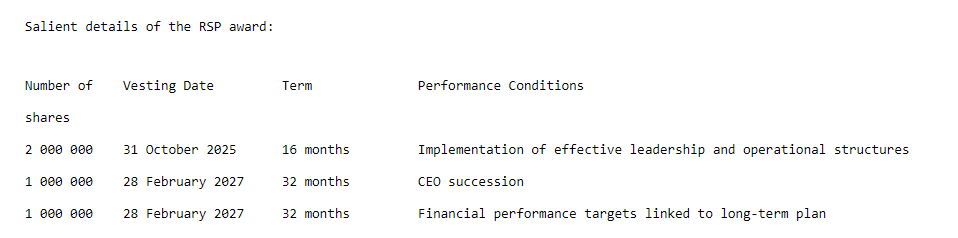

In a separate announcement, Pick n Pay announced that CEO Sean Summers has been awarded shares worth R108 million based on the deemed award price of R27. He doesn’t get them all straight away and he might not even receive all of them. Here are the vesting conditions:

There’s almost nothing fluffier than a target like “an effective leadership and operational structure” – what does that actually mean? Sadly, Pick n Pay wasn’t exactly in a strong negotiating position here, so I’m not surprised that Summers managed to attach only 25% of the award to financial targets. To make 75% of the award, all he has to do is hire people and find a new CEO.

Sigh.

Schroder’s property valuations seem to have bottomed (JSE: SCD)

This supports my thesis that the property sector is a good place to play right now

Schroder European Real Estate Investment Trust has been struggling for a while now with property valuations moving the wrong way. This is what happens when yields in the market have kept rising. When the yield is higher, the value of the underlying asset is lower, all else being equal. This is why property is an appealing place to be when rates start to come down.

At Schroder, the great news is that values may well have bottomed. In the latest quarter, the direct portfolio was valued 0.1% higher. Although the office portfolio continues to be under pressure, the valuation increase in the industrial and retail sectors more than offset this impact.

It always come down to the individual property details of course, but the overall point I’m taking from this is that European values are starting to tick higher.

Schroder’s loan-to-value is 33% based on gross asset value and 24% net of cash.

Sirius had no trouble getting the capital raise away (JSE: SRE)

Raising £150 million in a day’s work is why being listed is powerful

As covered on the previous day when Sirius announced the capital raise, the fund has identified a further pipeline of acquisition opportunities in the UK and Germany and has gone to the market to raise the required funds. This, right here, is why companies like being listed on a stock exchange. Providing exit capital for shareholders is one thing, but the ability to raise a fortune from the public (or a select group of institutional shareholders – even better) is the real highlight.

In literally one day, Sirius’ advisors made a few phone calls and raised £150 million for the fund. They get this done at a discount of 3.5% to the closing share price on 10 July. A small discount is common, as you need to give the investors an incentive to support the capital raise. The discount is only 2.1% to the 30-day VWAP prior to 10 July.

The capital raise was supported by existing and new investors, which is also a sign of a healthy shareholder register.

Distinct from the private placement, UK-based shareholders are still able to participate in the subscription of shares via PrimaryBid, with a minimum subscription of £250 per investor. It’s a pity that Sirius opted not to make this offer available to South African investors.

After raising equity in November 2023 debt in May 2024, this is another sign of not just the appeal of Sirius to large investors, but the improving health of the property sector at large.

Little Bites:

- Director dealings:

- A director of Newpark REIT (JSE: NRL) bought shares in the company worth R576k.

- It’s not worth delving into all the details, but be aware that several directors (including the CEO) of Sirius Real Estate (JSE: SRE) participated in the accelerated bookbuild.

- Vukile (JSE: VKE) announced that Encha Properties sold its entire stake in Vukile, representing 4.6% of the company’s shares. They were sold at R15.50 per share in a placement run by Investec, representing a 0.8% discount to the 30-day VWAP before the placement was launched. The total value of the sale was R820 million and the sales were required to settle loan financing from Investec. In other words, the bank helped make sure its debts were paid by running the placement!

- Sibanye-Stillwater (JSE: SSW) must have angered the ancestors. Having dealt with floods and a terrible market for PGMs, the company is now suffering a cyberattack. Presumably the locusts are next. I would love to include the link to the website, but it doesn’t work because of the attack!

- Trustco (JSE: TTO) has noted that the circular for the various transactions underway will be issued to shareholders in due course. Vunani Capital has been appointed to provide the fairness opinion. For this reason, the cautionary announcement related to the transactions has been lifted. I will now revert to my standard approach regarding Trustco: caution regarding everything.

- The business rescue practitioners of Rebosis (JSE: REA | JSE: REB) have been appointed to the board of the company as non-executive directors.