BHP looks to be on track to achieve guidance this year (JSE: BHP)

At the halfway point, they are optimistic about hitting the upper half of production guidance

BHP has released its operational review for the six months to December. This is the precursor to the release of interim financial results.

Unsurprisingly, the focus of the announcement is on copper, BHP’s pride and joy at the moment. Copper production increased 10%, with Escondida doing the hard work (up 22%) as Copper SA suffered power outages related to the weather. This is the benefit of diversification at a company the size of BHP. This diversification will be further enhanced by the recently completed Filo del Sol and Josemaria deals in Argentina.

Other operational milestones included the signing of the settlement agreement for the Samarco dam failure, as well as moving the WA Nickel operations into a period of temporary suspension.

Overall, BHP is on track to deliver full-year production guidance. In fact, they reckon they could hit the upper half of guidance at a number of facilities. For now, they’ve left FY25 guidance unchanged other than at Copper SA where they have had to lower guidance based on the first-half weather impact.

They also expect to deliver unit cost guidance across all assets.

In terms of pricing, copper prices increased 9% year-on-year and that’s pretty much where the highlights end. Iron ore and steelmaking coal fell 22% and 23% respectively, while nickel continued its problematic trajectory with a 12% decrease. Thermal coal increased by just 1%.

For now, the focus on copper is paying off.

For some reason, it seems that the market has now decided that Clicks is growing too slowly (JSE: CLS)

Keep an eye on this share price

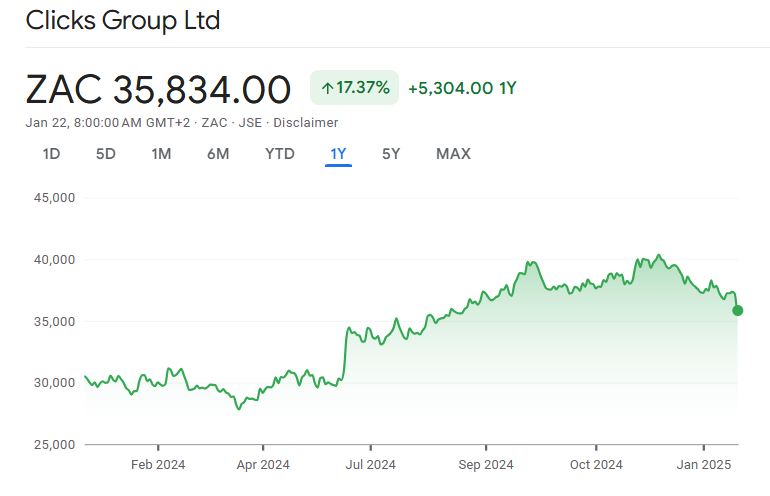

The Clicks share price has a reputation on the local market for trading at stubbornly high valuations. Despite the high valuation base coming into 2024, the stock benefitted from the general improvement in SA sentiment and delivered a 12-month chart that looks like this:

Now, take note of how things have started washing away this year. Clicks fell 3.7% on Tuesday after releasing a trading update. In case you’re wondering, the JSE ended the day flat, so we can’t attribute this to a broader sell-off. No, in this case, it seems that the market is nervous about growth.

Clicks is still growing, but only by high single-digits. For the 20 weeks to 12 January, group turnover was up 8.1%. That’s very similar to the 8.0% in the comparable period, so it’s odd that the market suddenly doesn’t like that number.

The retail stores (Clicks / The Body Shop / Sorbet) grew 8.7% overall and 5.9% on a comparable basis. That might be where the worry lies, as comparable store growth was 8.4% in the comparable period. Inflation has come off significantly, down at 3.5% vs. 7.5% last year. The increase in volumes (2.4% vs. 0.9% last year) wasn’t enough to make up for the slower increase in prices.

There’s also a sign that gross margins might be under some pressure, as commentary in the announcement points to stronger growth in promotional sales than in non-promotional sales.

On the wholesale side of the business, UPD has a positive story to tell with wholesale turnover up by 9.5%. That’s much better than a drop of 0.8% in the comparable period.

Interim results are only due for release in April. Until then, that share price is looking vulnerable to me.

Grindrod’s Port of Maputo saw a slight reduction in volumes in 2024 (JSE: GND)

Under the circumstances, that’s pretty good

Doing business in the rest of Africa is no joke. Sure, there are good news stories like Jubilee and MTN today (you’ll see them further down), but in both cases those stories are actually just improvements on really bad situations that probably shouldn’t have happened in the first place.

Over at Grindrod, their particular challenge is that there has been major political unrest in Mozambique. Naturally, this has impacted the safety of road travel – not that the country is exactly famous for hassle-free road trips on a good day!

Despite this, when we look at the full year numbers for 2024, the Maputo Port Development Company suffered only a 1% decline in volumes. That’s encouraging for 2025, which will hopefully be a far less disrupted year.

I must also note the tone of the press release, which is basically a love letter to the Mozambique government that is dripping with please-don’t-hurt-us energy. Why? Because property rights are a fluid concept in many frontier markets, so companies operating in that space need to walk a tightrope with government and constantly point out the value flowing to those in power.

Also note that the wording is always about the benefits to “government” rather than the people of the country. It’s sad how different those concepts tend to be in practice.

Why should investors pay attention to this? Simply, because it’s a risk. A major risk, in fact. The JSE is littered with sad stories about companies that got hurt by African risks like post-election conflicts and crazy regulatory moves. Investing is about balancing risk and reward. Always ask yourself whether the rewards are sufficient to compensate you for taking the risk.

Great news for Jubilee – they’ve secured power for Roan (JSE: JBL)

At least this uncertainty has been taken off the table

Jubilee Metals‘ last set of results were a cautionary tale of the many challenges of doing business in frontier markets, such as the rest of Africa. Power availability has been a major challenge, impacting the ability of the Roan facility to operate and thus negatively affecting production.

Investors were left hanging after the results, with no obvious timeline regarding a dependable power supply and thus a restart of Roan. The happy news is that they didn’t have to wait very long for an update, as Jubilee has now announced that regulatory approval has been granted for the power supply agreement and that power delivery commenced on 20 January.

That must feel even better than when the TV used to work again after 6 hours of load shedding!

Importantly, the new deal sources power from multiple sources, so reliance on a single source has been mitigated. The cost of the power is comparable to the existing power agreement, so there isn’t even a cost downside to offset the reliability upside.

The company is now preparing to flick the big switch on Roan to get it up and running again. The share price closed 7% higher in appreciation.

MTN finally has some luck in Nigeria (JSE: MTN)

Now they just need to solve the other major problems

After much pain suffered by telecoms companies in Nigeria (of which MTN is most relevant to us in South Africa), the Nigerian Communications Commission has finally approved a 50% tariff adjustment. That’s a huge jump, which calls into question why they didn’t just do smaller increases each year? Anyway.

This won’t be popular with consumers of course, but it helps the telecoms sector be more sustainable. At the end of the day, if companies cannot operate profitably in the country, then consumers lose over the long-term anyway and to a far greater extent.

Nibbles:

- Director dealings:

- An executive of Richemont (JSE: CFR) sold share awards worth R44 million. Again, it’s not clear whether this is the taxable portion or not.

- An associate of the CEO of Invicta (JSE: IVT) bought shares worth R9.4 million.

- Acting through Titan Fincap Solutions, Christo Wiese bought R8.2 million worth of shares in Collins Property Group (JSE: CPP).

- An independent non-executive director of Bytes Technology (JSE: BYI) and his associate bought roughly R740k worth of shares.

- An associate of an independent non-executive director of iOCO (JSE: IOC) – formerly EOH – bought shares worth R130k.

- An associate of the CEO of Purple Group (JSE: PPE) bought shares worth just under R100k.

- The CEO of Spear REIT (JSE: SEA) bought shares worth R27k for members of his family.

- The CEO of Thungela (JSE: TGA), July Ndlovu, is retiring soon. In fact, he’s retiring in July this year, surely one of the easier facts to remember! Moses Madondo has been appointed as CEO designate. He is currently the CEO of De Beers Group Managed Operations. Frankly, I would also jump at the opportunity to move from diamonds to coal.

- Trematon Capital (JSE: TMT) is one of the many companies that has moved its listing to the General Segment of the Main Board of the JSE.