BHP remains on track for FY25 production guidance (JSE: BHG)

It’s all about the copper

Although BHP mines a variety of commodities, they seem to have copper on the brain. The announcement makes that very clear, screaming the copper highlights from the rooftops. Copper production was up 4% for the quarter and they recently announced a joint venture in Argentina to make progress on what they call “one of the most significant global copper discoveries in decades” – not mincing their words there!

Of course, copper is why BHP wanted to acquire Anglo American (JSE: AGL). After that deal failed, they’ve had to look for other ways to grow in that metal.

BHP is also known for iron ore, with production up 2%. In steelmaking coal, production was up 20% if you exclude the recently divested mines. They will hope that Chinese stimulus filters down into economic activity, supporting these commodities.

Nickel remains the headache, with BHP commencing the temporary suspension of operations at Nickel West in response to depressed market prices.

Finally, in Canada, the Jansen Stage 1 potash project is now 58% complete. They expect first production in two years.

Overall, a decent start to the year that allows BHP to reaffirm guidance.

CMH: don’t say I didn’t warn you (JSE: CMH)

Just look around on the roads and you’ll see the problem

As things stand, the CMH share price is up 30% for the year. Why is that? Honestly, I can’t justify it. If the markets always made sense then they would be truly boring.

The automotive industry is being disrupted at pace, with European brands losing ground to Chinese competitors. Sure, CMH has exposure to some dealerships that do Chery and GWM, but they also have exposure to Stellantis brands that are doing very poorly on the global stage.

Does this look to you like an encouraging story?

Revenue fell 1% in the interim period and operating profit was down 22%. HEPS fell by 32% and the dividend followed suit, down 30%. Heck, even the car hire business saw a reduction in revenue and a major downturn in profits!

The only reason I can think of for the CMH share price remaining at elevated levels is that investors are hoping for a lower interest rate cycle driving more sales of new cars. Personally, I think this share price is going to end in tears. Firstly, it’s going to take longer than people think for rates to drop and sales to recover. Secondly, even when it happens, CMH will only get a piece of the action thanks to the change in the landscape of automotive brands.

WeBuyCars (up 67% YTD) and Zeda (up 12.7% YTD) remain my long-term picks in this sector. It would be wrong of me not to point out the CMH dividend underpin. On an annualised basis, the interim dividend is a yield of 5.8%.

A year from now, I’ll be surprised if CMH shareholders have achieved a positive total return over 12 months. I hope I’m wrong.

Much better numbers at DRDGOLD – and the market liked them (JSE: DRD)

After a difficult period, can this positive momentum continue?

DRDGOLD has been having a tough time recently. The share price being up 32% this year is thanks to the gold price carrying the company through production challenges. If prices hadn’t been as strong recently, the chart would look very different.

Thankfully, the group’s production situation seems to be improving. For the quarter ended September, production was up 7% vs. the immediately preceding quarter. This is thanks to a 13% increase in ore milled, with the yield down 6%.

Despite clearly having to work harder to get the stuff out of the ground, they achieved a 6% decrease in cash operating costs per tonne because of the higher throughput. It seems counterintuitive, but throughput is everything when it comes to heavy industrials. This helped drive adjusted EBITDA growth of 17%, as the gold price was up by a helpful 2% alongside this improved production result.

All of these percentages are for Q1’25 vs. Q4’24, so they reflect quarter-on-quarter momentum.

Thanks to the improved performance, cash and cash equivalents increased from R521.5 million to R594.2 million even though the group paid the FY24 dividend of R172.3 million and capex of R323.3 million.

Insimbi is having a tough time (JSE: ISB)

There’s no dividend for this interim period

Insimbi Industrial Holdings is a metals recycling business that describes its commodity exposure as being in line with the PGM cycle. That’s about as appealing a disclosure as telling someone on the first date that you’re currently married with 4 kids.

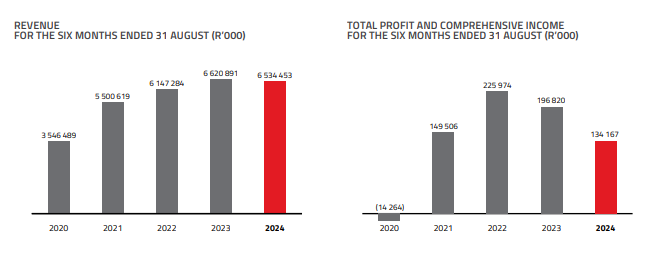

Revenue for the six months to August fell by 11% and operating profit tanked by 85% despite what the group describes as excellent control of operating expenditure. If there are any highlights here, it’s in cash generated from operations which jumped from R4.6 million to R36.6 million. Still, this wasn’t enough to drive a positive dividend decision, as the group slipped into a headline loss per share and the dividend disappeared.

It’s not the most liquid share around by any means, down 32% year-to-date as the market has reacted to the difficulties faced by the group.

Mondi’s EBITDA dips quarter-on-quarter (JSE: MNP)

The paper and packaging sector is always a rollercoaster ride

If you enjoy smooth and steady investment journeys, then stay far away from the paper sector (and other cyclical industries, for that matter). Earnings are impacted not just by the prevailing selling prices and the level of production, but also by the value of the forests!

For the third quarter, Mondi reported EBITDA of €223 million. That’s well off €351 million in the second quarter, driven by planned maintenance shuts and forestry fair value losses. Those two issues were responsible for €90 million of the €128 million decrease.

Selling prices in Corrugated Packaging and Flexible Packaging were higher thanks to price increases introduced earlier in the year. Unfortunately, pulp and paper selling prices in Uncoated Fine Paper were down in this quarter after a recovery earlier this year.

Looking ahead, the fourth quarter should have fewer planned maintenance shuts and a seasonal increase in demand. Going into 2025, they expect to see growth boosted by organic investments and the recently announced acquisition of Schumacher Packaging.

NEPI Rockcastle to raise €300 million (JSE: NRP)

If your phone hasn’t already rung, you won’t be participating

When the bubble is about to pop in the property sector, accelerated bookbuilds are an almost daily occurrence on the JSE. We aren’t nearly at that stage yet, but the capital raises are starting to become more frequent and it’s the best funds on the market that are leading the charge, as one would expect.

Sadly, these bookbuilds mean that only institutional investors are phoned up and asked if they would like to take shares. In the case of NEPI Rockcastle, they are using European banks, so it seems like this is an initiative to bring more foreign capital onto the share register to help fund the substantial investment pipeline of €1.6 billion. In this particular raise, they are looking for €300 million to deploy across the various opportunities.

Despite handing out NEPI shares to its own shareholders, Fortress Real Estate (JSE: FFB) intends to participate in the bookbuild in proportion to its existing shareholding. Perhaps they want to lock in more shares at the discounted bookbuild price and use them later to keep shareholders happy.

Retail investors are excluded from something like this unfortunately, as is the case far too often on the market. The company is looking for a quick capital raising solution and there’s nothing quicker than raising this kind of money from a few phone calls.

Pick n Pay is still performing poorly (JSE: PIK)

A new CEO and a capital raise doesn’t change the facts

Death, taxes and a massive outperformance of Boxer vs. the Pick n Pay segment within the Pick n Pay group – these are the certainties in life. Again, you don’t need to wait for results to come out to know this. You can just talk to your friends, examine your own shopping habits and make a point of going to different stores to see how things are going. I strongly advocate a common sense approach to investing.

For the 26 weeks to 25 August 2024, Boxer grew 12.0% and 7.7% on a like-for-like basis. That’s another really strong outcome for them, which is exactly what is needed as they prepare for an IPO.

Pick n Pay, on the other hand, declined 0.3% overall and grew 0.5% on a like-for-like basis. If we focus just on Pick n Pay SA in an attempt to clutch at positive straws, growth was 0.1% overall and 1.1% like-for-like. I think the bonsai on my shelf has a more energetic growth story.

Although clothing is usually a bright spot, growth was just 0.2% on a like-for-like basis. They blame the late arrival of winter and port delays, which is consistent with commentary I’ve seen at competitors. Due to a major store rollout strategy, overall sales were up 9.8%.

Online sales growth was 60.6%, a solid performance after 74.4% growth in FY24. People love convenience and are willing to pay for it.

Inflation has moderated significantly, coming in at 4.3% vs. 7.3% in FY24. This has a negative impact on growth that is supposed to be offset by higher volumes thanks to affordability. Alas, Pick n Pay continues to lose volumes as they try to turn the ship around.

The most amazing thing about the current situation is that company-owned supermarkets are outperforming franchise supermarkets and by quite some margin. Perhaps franchisees have just given up all hope. Either way, given the importance of the franchise base to the overall story, they have to find a way to breathe some life into franchisees.

Overall, with such dire growth in revenue, I’m not surprised to see the headline loss per share getting even worse. It is expected to deteriorate by between 10% and 20%. If you strip out hyperinflation related to Zimbabwe, the deterioration is between 30% and 20%.

Somehow, they still expect the full-year numbers to be better than last year. The reduced interest charges thanks to the major equity raise will help here, but what they really need is the core business to start performing. I remain extremely skeptical.

Premier focused on margins (JSE: PMR)

Manufacturing groups can show solid earnings growth if they run more efficiently

Premier is giving shareholders their daily bread, with HEPS at the food group up by between 25% and 33% for the six months to September. That’s exceptional.

How did they do it? Unsurprisingly, not from top-line growth. These are mature markets and there aren’t suddenly 30% more people running around looking to buy food. They talk about “moderate” revenue growth without giving more detail on pricing vs. volumes at this stage. As for where the magic happened, they focused on margin management (this implies that they were able to put up prices) and cost containment.

All details will be revealed when interim results are released.

PSG’s advice-led model is still cooking (JSE: KST)

As I wrote earlier this week about Quilter in the UK, you need to go hunt for assets to manage

PSG Financial Services has released its results for the six months to August. They look strong, with recurring HEPS up 28% to 48.2 cents and the dividend per share up 26% to 17 cents. It’s always good to see the dividend payout ratio maintained within a range.

With return on equity of 26.2%, PSG operates a financial services model that e.g. banks can only dream of. The advice-led model is a lucrative business, driving an increase in assets under management of 15.9% and growth in PSG Insure’s gross written premium of 10.3%. Of course, a general uptick in equity values in the market doesn’t hurt the business either.

In my view, distribution is everything in a business. It counts for so much more than IP or performance. If people can’t see your products, they can’t buy them!

Of course, distribution comes at a cost. Technology and infrastructure spend increased 20% and remuneration costs were up 14%. But when a company is bringing you dividend growth of 26%, do you really care?

The share price is up roughly 20% this year. Although it trades at a demanding valuation, those multiples will be supported for as long as earnings can keep growing at these levels.

Nibbles:

- Director dealings:

- A director of Attacq (JSE: ATT) sold shares worth R2.7 million.

- Aside from dealings to cover taxes on share awards, the company secretary of Growthpoint (JSE: GRT) sold shares worth R1.4 million.

- A director of Nedbank (JSE: NED) sold shares worth R1.1 million.

- An executive director of Metrofile (JSE: MFL) has added to the recent buying of shares by insiders at the group, this time to the value of R339k.

- A director of a major European subsidiary of Bell Equipment (JSE: BEL) – i.e. not one of the Bell family members – sold nearly R200k worth of shares.

- The CEO of CA Sales Holdings (JSE: CAA) sold shares worth R141k.

- Coronation (JSE: CML) has noted an uptick in assets under management from R632 billion as at June 2024 to R667 billion as at September 2024. For more context, it was R629 billion as at December 2023.