Bidcorp catches a bid

Is there room to celebrate or is the market getting ahead of itself?

It’s easy to get confused, so let’s clear this up immediately: Bidcorp is the food service business that was unbundled from Bidvest a few years ago. It no longer has anything to do with Bidvest, which is more of an industrial services player.

This is a truly global business, with a low percentage of profits generated in South Africa. The share price has historically traded at a high multiple, which is why shareholders have been on a mostly sideways journey since it listed:

In a trading update for the four months to October, the company surprised the market by talking about “record” results. Against a backdrop of high energy costs and constrained consumer spending, this is a lot better than I was expecting. A jump in the share price of over 5% suggests that I wasn’t the only one who was surprised by this.

This trading period covers the Northern Hemisphere summer, so the worst of the European issues arguably haven’t been felt yet. Still, there’s no denying the resilience in the business model here. Some of this resilience comes from non-discretionary demand from institutional customers, like schools and hospitals. This is obviously far less volatile than demand in the restaurant and entertainment industries.

On a constant currency basis, the group has been running at between 23% and 30% higher than last year’s levels over the past few months. Australasia is the standout region because of the base effect of Covid lockdowns. The Emerging Markets segment has been negatively impacted by China and ongoing lockdowns.

Of course, revenue is only part of the story. Gross margin is critical and the company says that most businesses have been able to pass through inflation increases to date.

The most impressive thing about this result is that operating expenditure increased by 20.8% on a constant currency basis and revenue increased by 25.5%. This is operating margin expansion at a time when most people expected the opposite. EBITDA margin is now ahead of 2019 levels.

As is the norm at this time of the year for Bidcorp, the business has absorbed working capital through buying-in inventory and paying suppliers earlier to secure supply. If you want to understand more about working capital, this recent bizval webinar is really useful. I spoke about working capital from around 12 minutes in:

Finishing off on Bidcorp, the investment in working capital led to a free cash outflow of R2.6 billion. Bolt-on acquisitions in this period came to R292 million. A bolt-on acquisition is a deal to buy a company that slots in very easily with existing operations.

So, has the market gotten too excited here? It all comes down to your view on the European winter. If you believe that the Europeans will get through the current crisis, then Bidcorp’s recent trading update makes a strong case for success.

The share is still trading at a very high multiple though, so be warned.

Coronation takes a big knock to earnings

When equity markets are down, asset managers suffer

Coronation has R610 billion in assets under management (AUM) after the recent market rally. At the end of September, that number was R574 billion, down 9% year-on-year. Interestingly, average AUM for the year ended September was slightly higher than the prior period, so the earnings drop isn’t because of a drop in AUM.

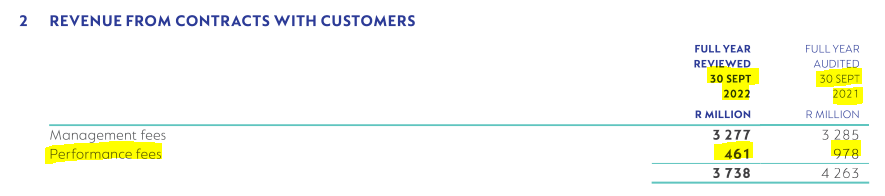

If you’re wondering why revenue has dropped, you need to find Note 2 in the financial statements. Management fees are consistent, as you would expect when AUM is flat. The year-on-year pain lies firmly in performance fees:

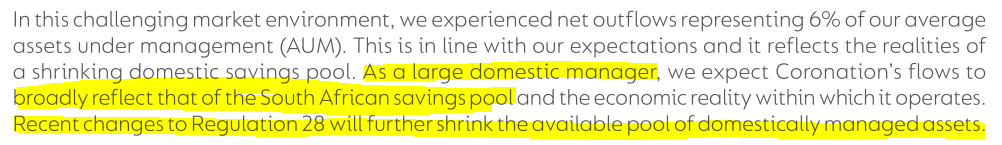

The more concerning statistic relates to net outflows at 6% of average AUM. This means that clients pulled their funds out and either invested them elsewhere or left the market altogether.

I would pay close attention to this section of the report if I were you:

To soften the blow of revenue pressure, expenses fell by 12%. This was achieved through a variable expenditure model, which I think means that the top fund managers only earn big bonuses where there are large performance fees. This would certainly make sense. Fixed costs were up by just 2%.

Fund management earnings per share (which excludes any fair value movements) decreased by 18% to 387 cents. Diluted HEPS fell by 25% to 366.3 cents. The final dividend per share is 172 cents, taking the annual total to 386 cents. This is 18% lower than the prior year.

As you can see, Coronation pays out practically its entire fund management earnings per share number as a dividend. The trailing dividend yield is now 11.8% and the share price has lost roughly 40% of its value this year.

There’s momentum at Momentum

A quarterly operational update reveals far higher profits

For the three months ended September, Momentum Metropolitan managed to achieve a huge year-on-year increase in return on equity from 15% to 20.9%. You won’t see a swing like that every day! This was driven by a 73% increase in normalised HEPS.

Of course, there’s a significant base effect here from Covid. An improved mortality experience has assisted the numbers this year, a trend that you’ll also see in the Old Mutual update below.

The value of new business is below the group’s expectations and new business margins have dropped, which isn’t good obviously. The present value of new business volumes has also decreased by 3%, which the group attributes to a high base effect. Another irritation for the management team is that institutional and retail assets under management declined by 3%.

The short-term insurance businesses are under pressure overall. Guardrisk experienced a decline in normalised headline earnings of 13%, though Momentum attributes this to once-offs in the prior period (despite being a headline number). In good news, Guardrisk improved operating profit by 13%. Momentum Insure is where the real pain was felt in this segment of the business, with a loss of R16 million for the quarter because of a high claims ratio of 70% vs. 58% in the prior period. Rather than being due to a specific event, this was because of inflationary pressure on the cost of claims, offset slightly by premium increases on policy renewals.

The share price rallied 4.7% in response to this update.

Old Mutual will be applying for a banking licence

At what point will the banking sector be overtraded?

Before we get into the big news of the banking licence, let’s deal with the rest of Old Mutual’s business.

For the quarter ended September, there’s significant jump in Life APE sales (up 17%) after the Covid disruptions in the base period. Despite a decrease in gross flows of 7%, net client cash flow recovered from the prior period thanks to reduced mortality claims and lower client disinvestments and terminations. Unsurprisingly, funds under management fell by 6% at a time when global markets have come under pressure. Loans and advances were flat year-on-year. Gross written premiums increased by 12%, driven by higher renewal rates and new business sales.

Looking at profits, fewer Covid excess deaths in the current period means that profits in the life insurance business improved. Old Mutual Investments even managed to increase its profits thanks to higher asset-based fees on higher average asset levels despite market troubles. There were issues elsewhere in the group, like net catastrophe losses in the KZN floods.

With that out the way, let’s talk about the banking licence. Old Mutual has received Section 13 approval from the Prudential Authority to proceed with the application for a banking licence. Old Mutual wants to hold the primary relationship with customers who currently make use of existing lending products and other financial services. This will allow Old Mutual to accept retail deposits, which is a cheaper source of funding than most other options.

This isn’t a cheap strategy, as anyone at Discovery will tell you. Old Mutual has budgeted R1.75 billion to build the transactional capability and R830 million has already been incurred, with 10% of these costs capitalised. Launch is expected in the second-half of 2024 and breakeven status is only expected to be achieved within three years of launch. The group is targeting a return of 400 basis points above the cost of equity once the bank has achieved scale.

With savings of more than R700 million achieved in the business, much of the build cost is being achieved through finding efficiencies in the group.

Does the country need another bank? Probably not. Does this mean that Old Mutual won’t make a success of it? Also probably not. This is a huge group with a deep understanding of banking from the previous relationship with Nedbank.

I wouldn’t just ignore this initiative.

Omnia is up on key metrics

All three operating divisions grew revenue and operating profit

For the six months ended September, Omnia put in a strong result under tricky supply chain conditions. A strategy of ensuring supply to customers has paid off, even if it led to huge increases in net working capital.

Group revenue increased by 22.8% and operating profit was 18% higher, so there was some margin pressure. Operating margin fell by 30 basis points from 6.9% to 6.6%. Group HEPS only increased by 3% but adjusted HEPS from continuing operations increased by 32%.

This result came at a cost on the balance sheet, with net working capital increasing sharply from R3.1 billion to R5.2 billion, an increase of 69%. This was a direct result of higher investment in a rising commodity cycle, reflecting the strategy of making sure sales weren’t lost because of shortages.

Looking deeper, the Agriculture segment grew revenue 17% and operating profit 33%. The net working capital pressure in this segment is expected to unwind in the second half of the financial year. The Mining segment grew revenue by 32% and operating profit by 44%. The Chemicals business could only manage 0.3% revenue growth, but operating profit increased rather spectacularly by 108%. This is a direct result of product mix improvement.

The tax dispute with SARS is ongoing. The group has lodged an appeal against the revised assessments following the partial allowance of the objection. With literally hundreds of millions at stake here, this is important.

The outlook is upbeat, with the group noting the potential for significant additional upside within the business. I suspect that the overhang of the tax issue needs to disappear before the market will show Omnia much love.

Pepkor sells a lot of cellphones

7 out of 10 cellphones in South Africa, to be precise

In the year ended September, Pepkor achieved 5.3% growth in revenue. The floods and the change in Flash’s product mix were negatives here, with the group highlighting 8.1% growth excluding those factors. This gives some idea of the underlying momentum in the business.

Normalised HEPS (the right measure in this case) has grown by 15.7% and the dividend increased by 24.9%, so the group is falling more confident and is using a higher payout ratio.

That confidence has been earned, with 4.2% compound annual growth in like-for-like sales over three years. A gain in market share of 123 basis points has been achieved since pre-Covid times.

Distinct from all-important organic growth (215 net new stores opened during the period), the major step of acquiring Avenida in Brazil is working out well so far. Given the disastrous amounts of load shedding we are currently experiencing, exposure beyond our borders isn’t a bad idea. The double-whammy is severe, with the cost of power backup (70% of group stores have backup) and the negative impact on revenue from fewer customers visiting stores during periods of load shedding.

Here’s the most fascinating statistic of all: the group sold 12 million cellphones this year! This is 7 out of 10 handsets sold in South Africa.

Fun stats aside, the outlook for South African retail isn’t great. Load shedding as we head into the peak trading period is an absolute disaster and higher levels of inflation are expected into next year. The good news is that the cost of shipping has reduced.

This is probably why the share price dropped despite the strong growth in earnings, closing nearly 1.6% lower on the day. There’s been plenty of volatility along the way, with a year-to-date result that is rather flat:

Little Bites:

- Director dealings:

- A director of Mustek has bought contracts for difference (CFDs) on the company’s stock worth nearly R1.2 million

- An associate of a director of Afrimat has sold shares in the company worth R3.3 million

- An associate of a director of Sea Harvest has acquired shares worth R88.8k

- Premier has released its pre-listing statement in all its 288-page glory. If you want to learn about this company that lists Tiger Brands, Pioneer Foods and RCL Foods as its three largest competitors, then you’ll find the document at this link

- Tradehold released results for the six months to August 2022. The big news is that the company will be turning into a REIT, having now sold off the UK operations for £102.5 million. This has led to a special dividend to shareholders of R4.34 per share, in addition to the 30 cents per share interim dividend. The remaining assets are a 74.3% holding in the Collins Property Group and full ownership of the Nguni Group and the Tradehold Africa Group. These holdings will be the underpin for Tradehold’s new positioning as an industrial / logistics-focused REIT under the name Collins.

- Jubilee has released an update on its operations. The cobalt operation at the Sable Refinery has achieved the production of export grade cobalt and has significantly increased its processing capability through bypassing a traditional, power-intensive smelting process. Targeted cobalt margins at capacity are in excess of 45%. As a reminder that Zambia is one of the friendlier jurisdictions in Africa for mining companies, Jubilee has been awarded a water licence to have its own, dedicated water supply infrastructure for operations at Project Roan. The group’s focus is on taking the learnings from the resource in the South to the resource in the North, which has the potential to far exceed the original stated production target.

- Renergen announced the successful placement of shares with investors in Australia, New Zealand and South Africa. A total of R107.6 million was raised at a price of R24.64 per share. This is a 10% discount to the 30-day volume weighted average price (VWAP). The share price has dropped by over 20% in the past 90 days as the market has become jittery about delays to helium production.

- Trematon Capital Investments holds a diversified portfolio of property and education assets. For the year ended August, revenue increased by 22% and operating profit increased by 25%. The group has swung from a loss-making position to a profit of R34.5 million. HEPS has increased from 2.1 cents to 8.7 cents, a 314% increase. A capital distribution per share of 40 cents per share has been declared.

- Indluplace released a trading statement for the year ended September 2022. With a final dividend of around 18.8 cents per share, the full-year dividend of 31.86 cents per share is 13.6% higher than last year.

- Primeserv Group released a trading statement for the six months ended September. HEPS is expected to increase by between 46% and 50%.

- Huge Group released a trading statement for the six months ended August. HEPS will be between 12.6% and 31.4% higher than the comparable year and NAV per share is between 19.6% and 39.2% higher.

- With Cobus Loubser moving from the CFO role to that of CEO, Curro has announced that Burtie September is the new CFO. He has been with the group since 2016, so this is a solid example of internal succession planning.

- Safari Investments has posted its response circular to the general offer by Heriot Properties. Safari’s independent board is unanimous in its view that the offer price is unfair but reasonable, which means it is below the fair value of the company but higher than the market price before the offer, particularly in light of the liquidity in the stock and how difficult it is to sell large positions. You can find the circular here. Heriot and its related parties now own 37.49% in Safari.

- Afrocentric expects the circular for the partial offer by Sanlam to be posted on 8 December.

- Buka Investments expects its headline loss per share for the six months ended August to be between 6.0 and 7.4 cents.