Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Some challenges at Bidvest, but earnings are still up (JSE: BVT)

Five of the seven divisions reported profit growth

For the year ended June 2024, Bidvest achieved revenue growth of 6.7%, trading profit growth of 8.5% and HEPS growth of 6.6%. That’s not going to go down as their best period in history, but the direction of travel remains the right one. Note that normalised HEPS was only up by 4.3%, so this was a rare example of Bidvest not delivering an inflation-beating return for the year. The total dividend for the year was also up by 4.3%.

At least cash generated from operations has a double-digit story to tell, up 15.3%. With Return on Funds Employed of 37.3%, you can still feel pretty good about Bidvest management allocating that cash into the business.

With five out of seven divisions reporting profit growth and four of them achieving double digits, the immediate thought is of course where the problems were. Commercial Products faced a high base effect in the renewables market and Automotive dealt with a declining vehicle market.

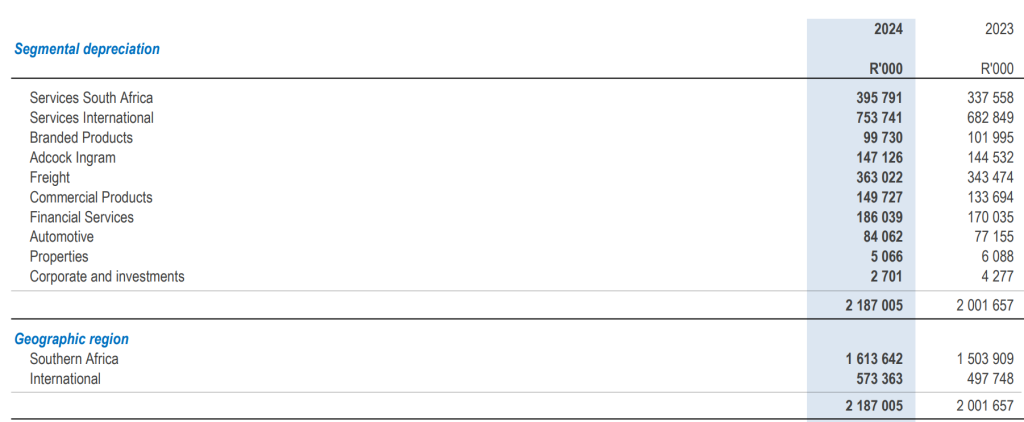

This gives you an idea of the level of diversification in the group, both geographically and in terms of segments:

Burstone moves ahead with the Blackstone deal (JSE: BTN)

The partnership is focused on the European logistics portfolio

Burstone has announced a rather interesting deal related to the Pan-European Logistics portfolio. At a price that implies a 5.6% net initial yield, global investment group Blackstone will take an 80% stake in the portfolio. The key here is that Burstone will continue to manage the portfolio, so this flicks them neatly into more of a capital-light strategy.

Blackstone is getting it at a good price, representing an 11.7% discount to the FY24 net asset value. In return, Burstone shareholders will see the loan-to-value of the fund drop to 33.5% thanks to immediate cash proceeds to be received by Burstone. With the balance sheet in better shape, the dividend payout ratio will increase from 75% to between 85% and 90%.

This approach of managing portfolios with co-investors is now the focus at Burstone, with initiatives underway to do much the same thing in Australia and South Africa. They are also looking at another opportunity in Germany, so it doesn’t look like Blackstone has exclusivity over that region with Burstone.

Combining balance sheet exposure and management fees is a way to juice up the return on equity over time for Burstone shareholders. You also see this strategy playing out at Stor-Age, another JSE-listed REIT, as well as hotel groups internationally.

The market seemed to like it, with the share price closing 5.5% higher.

CA Sales Holdings marches on (JSE: CAA)

The business model is working

CA Sales Holdings is up 27% this year and 63% in the past year, with the market paying an increasing amount of attention to this story. Through a combination of organic growth strategies and bolt-on acquisitions, CA Sales Holdings is doing a great job of participating in the African growth story across various markets.

For the six months to June, revenue increased by 9.2% and HEPS was up by 19.2%, so that’s a great outcome. Although operating profit fell by 21.1%, a closer read reveals that this was due to a bargain purchase gain in the previous year (the opposite of goodwill – i.e. buying a business at a price below its net identifiable assets) that didn’t repeat in this year. If you strip that out, operating profit growth was roughly in line with HEPS growth.

The key demographic trend here is not just urbanisation of populations in Africa, but also growth in rural areas and demand for FMCG products. CA Sales specialises in taking brands to people and they do it well, with no other business on the JSE playing in this space.

The company only pays an annual dividend, so there’s no interim dividend.

MAS still has work to do on the balance sheet, but underlying retail exposure is helping (JSE: MSP)

Central and Eastern Europe remains a hotbed of activity for retail property landlords

MAS has released results for the year ended June. If you adjust for the impairments in the DJV joint venture, then they came in at 9.19 euro cents per share of adjusted distributable earnings. That’s within the guidance that was provided in March 2024.

These earnings are being supported by strong footfall and tenant sales growth metrics in Central and Eastern Europe (CEE), where retail property owners have been thoroughly enjoying themselves in recent years. The same can’t be said for MAS’ exposure to the residential market through DJV, with a net loss for the period.

The big story at MAS in the past couple of years has been one of balance sheet challenges, with the company taking a highly proactive approach to managing the debt maturities in coming years. MAS cut their dividend to retain cash for balance sheet flexibility, with the worry being around capital availability and costs of debt for a sub-investment grade property fund. Recent progress has been encouraging though, particularly as they have found way to raise further debt funding from an existing noteholder.

The net asset value per share at MAS is 157.9 euro cents, or roughly R31.20 per share. The current share price is R17.15, with the discount reflecting the local market’s distaste for property companies that aren’t paying dividends. With the tangible net asset value at MAS growing by 8.1% between December 2023 and June 2024, that’s a pity.

Nampak makes more progress on its restructuring (JSE: NPK)

These deals are part of the broader asset disposal plan

Nampak has been busy with deals to try and save its balance sheet. One of them is the disposal of Liquid Cartons, a deal which has now closed – and that means that Nampak has received the selling price.

On the Bevcan Nigeria disposal, the merger application has gone to the competition authorities in Nigeria. At this stage they can’t give any guidance on the timing.

In further transactions, Nampak has sold the drums business and liquid business, as part of the broader asset disposal plan that was announced in August 2023. These are small deals, so no further details have been announced.

RCL Foods has released results – and Rainbow Chicken shareholders also need to read them (JSE: RCL | JSE: RBO)

Rainbow is separately listed now, but the results came out together one last time

RCL Foods has released results for the year ended June 2024. As Rainbow Chicken was only unbundled on 1 July (and this is no coincidence relative to year-end), the results for RCL include results for Rainbow. We therefore have an unusual situation in which the results for two listed companies are in one set of numbers.

In this case, the term “continuing operations” is doing the heavy lifting. It excludes Vector (sold in August 2023) and Rainbow, so isolating the RCL Foods result is made possible by looking at earnings from continuing operations. On that basis, revenue was up 6.8% and underlying EBITDA was up 15.5%, with HEPS up 8.3%.

RCL Foods is therefore doing decently at the moment, although there are input cost pressures that need to be passed through to consumers in the form of pricing increases. In a group this size, there will always be positive and negative stories as you dig deeper. For example, the pet food business enjoyed better operating conditions this year with less load shedding, yet the baking business had a tough time in bread where there was intense competition. Notably, the sugar business performed well.

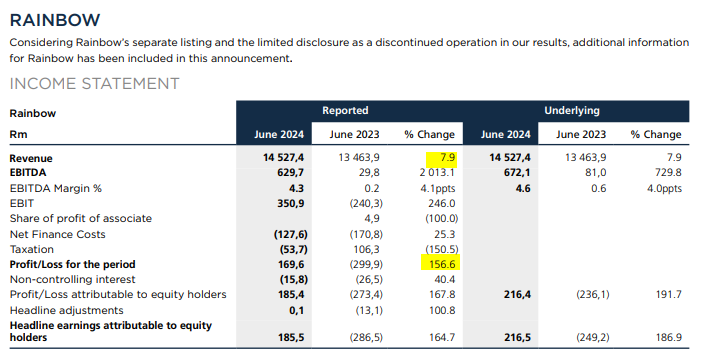

Moving on to Rainbow, they describe the turnaround as being “well advanced” with “every component of the process yielding positive results” – great news indeed. Load shedding was an absolute catastrophe for the chicken business, so it’s great to see improvement there. You have to dig a bit to find the Rainbow numbers, with this table showing just how strong the turnaround has been:

Note that a 7.9% revenue increase is all that was needed for Rainbow to swing from losses to profits. The EBITDA margin is only 4.3% for the period, with these incredibly thin margins driving highly volatile earnings. It also helped the net profit story that net finance costs were far less severe than in the prior year. There’s still a long way to go for Rainbow to be considered lucrative, as Return on Invested Capital was only 8.6% in this period.

When there are lots of corporate actions, there is money to be made for advisors. Advisory costs were R58.8 million in the current year for the Rainbow and Vector deals and R25.6 million in the prior year for Vector.

Sanlam gets even closer to African Rainbow Capital (JSE: SLM)

Sanlam wants a bigger slice of the action in the ARC portfolio – especially Tyme Bank

The relationship between Sanlam and African Rainbow Capital is already incredibly close, as it was a B-BBEE investment in Sanlam that provided the capital base off which ARC was ultimately started. Key executives at ARC are ex-Sanlam senior management, so the parties are very familiar with each other. They are about to get even more familiar, as Sanlam is looking to take a 25% stake in African Rainbow Capital Financial Services Holdings (ARC FSH), which means a cash subscription for shares as well as a restructuring of Sanlam’s existing investment in the ARC stable.

ARC FSH is an important holding company in the ARC group but is not the listed company, so Sanlam will hold further down in the structure than the listed shares. They currently have a 25% stake in ARC Financial Services Investments (ARC FSI) which they will exchange for exposure in ARC FSH. That share swap covers R1.492 billion of the investment. That’s only part of it, with a cash subscription worth R2.413 billion to make up the rest.

The net effect here is that Sanlam is pumping cash into ARC’s financial services portfolio and moving further up in the structure, which means they like the look of investments like TymeBank, which will be held entirely by ARC FSH as part of the implementation of the transaction.

Speaking of that asset, it’s interesting to note the outperformance fee structure that will see Sanlam Life pay ARC an outperformance fee based on the extent to which the investment in Tyme Investments Asia as at 30 June 2028 exceeds an annual hurdle rate of 14.64%. That’s not a very demanding hurdle rate for what is essentially a startup, so ARC has a good chance here of earning the fee. It will be capped at R70 million.

Sibanye-Stillwater is now barely profitable (JSE: SSW)

Welcome to new all-time lows since the company relisted in 2020

There really doesn’t seem to be much relief on the horizon for battered Sibanye-Stillwater investors. In a trading statement for the six months to June, HEPS has dropped down to almost nothing. A decrease of between 97% and 98% takes them to between 4.6 cents and 5.0 cents per share vs. 208 cents in the comparable period, which is horrific.

The results were ruined by not just the decline in PGM prices, but also production issues in both the platinum and especially gold businesses. The increase in the gold price got nowhere close to making up for this. Although production for PGMs overall was higher, it would’ve been better if not for production challenges and related pressure on unit costs. As for gold, production was down 21%.

The rats and mice stuff in the group, like Reldan in the US, zinc in Australia and nickel from the Sandouville refinery are just noise compared to how critical the PGM performance is to the group.

This is not pretty:

Sun International continues to grow (JSE: SUI)

By no means a rocketship, but the trajectory is up

Sun International has released a trading statement dealing with the six months to June. Adjusted HEPS is their preferred metric and is up by between 4.5% and 11.6% to between 206 and 220 cents. If you want to stick to HEPS, that metric is up by between 5.4% to 12.4%, with a range of 182 to 194 cents. The differences between the two related to the SunWest put option liabilities and the transaction costs for the Peermont acquisition.

Looking at the underlying businesses, it sounds like Sunbet is the most exciting story at the moment, exceeding its targets with an “exceptional” growth trajectory – and that’s what investors like to hear. Casinos are focused on protecting margins right now and urban hotels and resorts achieved growth in the EBITDA margin. A word that is less exciting is “resilience” which is how they describe Sun Slots, so there’s clearly pressure there.

Despite paying a dividend and executing share buybacks, debt in South Africa (excluding IFRS 16 – i.e. on the right basis for our purposes here) is down from R5.7 billion to R5.4 billion. They are firmly on the right side of debt covenants and generating cash.

Trellidor locks in a strong earnings recovery (JSE: TRL)

To understand these numbers, we need to look further back

Trellidor has been through a pretty torrid time recently, with the share price having shed half its value over 3 years. They initially bounced back strongly in the pandemic as everyone took “stay home and stay safe” very literally, but then there were labour problems and other challenges that ruined the party.

In a trading statement dealing with the year ended June, Trellidor can happily say that HEPS has jumped from 4.2 cents in the comparable period to at least 22.4 cents for this period. The percentage increase isn’t relevant when you’re talking about a 5x increase. Far more relevant is to work backwards and see what the earnings used to be, as FY23 isn’t exactly a demanding base.

It won’t help us to go back to FY22, which was even more awful at just 0.4 cents in HEPS. Like I said, times have been tougher than the doors themselves.

In FY21, HEPS was 40.8 cents. Now we are getting somewhere. Sadly, this means that the recovery in FY24 has only taken them back to around half of FY21 levels. With the share price down over 50% since those levels, it feels like this recovery was largely priced into the stock already.

Hopefully, things will only improve for Trellidor from here.

Little Bites:

- Director dealings:

- A prescribed officer of Standard Bank (JSE: SBK) has sold shares worth R5 million. There’s been quite a bit of selling from Standard Bank directors and prescribed officers recently and I wouldn’t ignore this.

- Two directors of a major subsidiary of Stefanutti Stocks (JSE: SSK) bought shares worth R278k.

- Directors of Astoria (JSE: ARA) entered into CFDs over the shares worth nearly R83k.

- I’m not going to pretend to be close to the details on what is going on at Quantum Foods (JSE: QFH), where there’s a major fight between different groups of shareholders and the board. An unusual director dealings announcement came out that shows a transaction by various directors with a third party related to call options over their shares. There’s still plenty of stuff going on there.

- Harmony Gold (JSE: HAR) released a further trading statement for the year ended June 2024. They are able to almost pinpoint HEPS now, coming in at between 1,852.0 and 1,852.4 cents vs. 800 cents in the comparable period, a jump of around 131.5%.

- Anglo American (JSE: AGL) seems to be putting the steps in place for the potential demerger of the stake in Anglo American Platinum (JSE: AMS). Although Anglo American still holds 78.56% in Amplats for now, they’ve restructured that stake through a couple of steps into a new subsidiary within the group. This is typical of the preparation steps required for a major corporate action, so watch out for this in the near future.

- Renergen (JSE: REN) has appointed Standard Bank as Joint Underwriter for the Nasdaq IPO and has secured a funding facility with the bank ahead of the IPO. Key directors are having to take on risk here, with associates Stefano Marani and Nick Mitchell pledging their shares in Renergen as security for the loan. This is an unusual situation, as minority shareholders benefit from the loan but aren’t exposed to the security for it.

- Trustco (JSE: TTO) announced that Meya Mining (in which Trustco holds 19.5%) has released a technical report prepared at a Preliminary Economic Assessment level. It evaluates the viability of underground mining for the diamonds and suggests a post-tax net present value of $95.1 million discounted at 10% over seven years life of mine. A 10% discount rate is woefully inadequate in my view, so I went digging to see what the post-tax IRR was. The report suggests 65%, which is a much more respectable return for the risk. I have no idea why they bothered showing the NPV based on a 10% discount rate.

- If you are a shareholder in MTN Zakhele Futhi (JSE: MTNZF), then be aware that the financial statements for the scheme have been released. Due to the underperformance of MTN’s share price, they are having to extend the structure to 2027 to avoid it expiring underwater i.e. with no value for the B-BBEE shreholders.

- Salungano (JSE: SLG) is suspended from trading and thus has to release a quarterly update on the state of affairs. Due to delays in the handover process from KPMG to SNG Grant Thornton, the results for the six months to September 2023 will only be published by 31 October, not 31 July as previously advised. They still need to get the FY24 results done thereafter. At best, the board expects the suspension to be lifted by 31 January 2025.