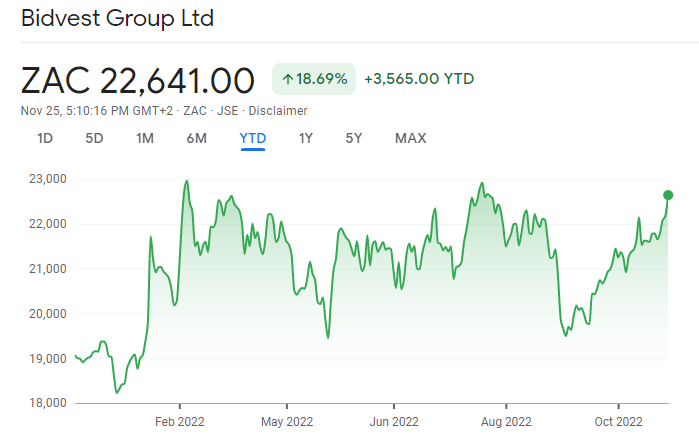

Bidvest gives upbeat commentary to the market

The AGM was an opportunity to deliver an update for the four months to October

This has been a strong recovery year for Bidvest, with the share price up 18.7% in 2022. It has exceeded pre-pandemic levels a few times this year, always hitting strong resistance just below R230 a share:

The update is long on narrative and light on numbers, so we have to sift through the wording to find the nuggets of information.

In terms of revenue growth, Bidvest has grown through new contracts, “modest” activity growth and pricing. The pricing point is important, as the announcement goes on to talk about contractual price increases being passed on to customers. It also notes that fuel and consumable prices are harder to recover.

This suggests that margin should be under pressure. Critically, the announcement also notes that “trading profit growth mirrored the top-line” and in English, this means that the margins are consistent (as profits and revenue grew by a similar percentage). As revenue growth sounds like it isn’t exactly shooting the lights out, this means that the group did a great job of managing expenses.

As such a diversified business, it’s tricky to know where to focus. For example, it helps Bidvest that more people are returning to the office, as the group has significant hygiene and cleaning businesses. With interests across everything from FMCG and automotive products through to freight terminals and financial services businesses, you can’t read too much into a specific thesis around the return to office.

The overall theme in the announcement is that the group is focusing on margins and return on capital. This is typical of a business going into defensive mode and electing to batten down the hatches in preparation for difficult economic conditions.

A lack of appreciation for this update

There’s serious trouble at GovChat for Capital Appreciation

Capital Appreciation owns some sensible, interesting businesses that play in attractive tech verticals. Then, it owns 35% in GovChat, a position that hasn’t been devoid of controversy among analysts and shareholders.

In finalising the interim results for the six months to September, Capital Appreciation released a trading statement that reflects a substantial impairment of GovChat. Earnings per share (EPS) will be between 57% and 58.3% lower than the comparable period because of this impairment. Headline earnings per share (HEPS) reverses out the impact of impairments and will be between 3.6% and 4.9% higher.

Let’s deal with the impairment first. Capital Appreciation has provided loan funding of R56.343 million to GovChat and the platform is struggling to secure formal revenue generating contracts with government and other potential customers. The announcement also talks about “anti-competitive interference by WhatsApp and Facebook” in GovChat’s affairs.

To make the problems worse (especially for Capital Appreciation), other shareholders haven’t been able to contribute their share of the capital needed for the operations. This means that Capital Appreciation is carrying most of the risk for just 35% of the equity, a really disappointing outcome for investors even if the loan is secured by a pledge of the other shares and the intellectual property of GovChat.

The loan has been impaired in full. There’s a chance of it being recovered if the Competition Commission awards monetary damages to GovChat based on Meta’s alleged anti-competitive behaviour. Relying on the outcome of a long and ugly legal process is never a good position to be in.

Looking at the business beyond GovChat, it’s worth touching on modest HEPS growth of low single digits. Although revenue increased by 22%, there were substantial costs incurred in growth and new business initiatives.

More details will be provided to the market when results are released on 29 November.

Patching up the Fortress walls

There is a last-ditch effort by shareholders to save REIT status

Following a demand by a group of shareholders for a meeting, the shareholders of both classes of Fortress shares will meet on 12 January 2023. This is technically too late, as the JSE has made it clear that the company has until 30 November to submit a compliant REIT declaration. This deadline clearly won’t be met. The JSE has also noted that the Listings Requirements do not allow for a decision to grant an extension to this time period.

Uncertainty? You got it.

With an objection process allowable under JSE rules and a shareholder meeting scheduled early in the new year, I suspect there might be a way for Fortress to kick the can down the road and give this meeting a chance to save the day.

You may recall a previous attempt by Fortress to solve its capital structure issues through proposing an exchange of FFA shares for FFB shares. This scheme was not approved by shareholders, plunging the group into uncharted waters as the potential first example on the JSE of a property fund losing REIT status.

The proposal on the table is a band-aid rather than a permanent fix, putting in place new distribution rules that apply up to and including the 2024 financial year. This would allow the board to pay distributions to shareholders without reference to the prior year FFA distribution benchmark – the rule that is causing all the trouble.

We will have to wait until January to find out whether Fortress will still be a REIT in 2023. If not, get ready for serious churn on the shareholder register as funds with REIT-only mandates are forced to exit the stock (to the extent that they haven’t done so already).

It’s worth highlighting that even if REIT status is lost, this isn’t the end of the world for Fortress. Other than the likely volatility in the share price, the company itself will enjoy far greater capital and distribution flexibility. The REIT rules are highly restrictive and are easy to work with in a bull market, but not so easy in a bear market.

Lighthouse Properties to raise up to R50 million

Capital raises by property funds are few and far between these days

The Lighthouse story goes back to 2014 when the company was incorporated as Green Bay Properties in Mauritius. It listed in Mauritius and on the AltX (the development board on the JSE) in 2015 and changed its name to Greenbay Properties in 2016. The listing was migrated from the AltX to the Main Board in 2017, which is more unusual than it should be unfortunately. The AltX hasn’t really been a success story in terms of incubating listed companies.

In 2018, the name was changed to Lighthouse Capital. In 2021, Lighthouse was redomiciled to Malta in line with a strategy to invest in Europe. The listing in Mauritius was removed.

Long story short: investors in Lighthouse Properties hold shares in a company domiciled in Malta and listed on the JSE. The focus is on retail malls located in cities in Western Europe. For example, recent acquisitions include four French shopping malls in 2021 and a regional shopping mall in Spain.

Most property funds haven’t raised capital in years because of the discount to net asset value (NAV) per share that many are trading at. Lighthouse is different, having raised R2.4 billion through an accelerated bookbuild in 2021. This helped maintain an appropriate level of gearing on the balance sheet even after these acquisitions.

The latest capital raise is a humble R50 million, which will be used for capital expenditure at the shopping centres. The issue price will be up to a 5% discount to the 3-day volume weighted average price (VWAP) or spot price as at 11 November (whichever is larger).

This is not a rights issue, so members of the public can apply for shares with a minimum application of R500,000 and thereafter multiples of R100,000. This is why the company has released an abridged prospectus on SENS, as this is an offer to the public to invest.

If there is demand for more than R50 million worth of shares, the board will consider an increase in the capital raise to accommodate the applications.

Well, cluck

Poultry is the toughest game in town, as Quantum Foods reminds us

With headline earnings per share (HEPS) for the year ended September down by 73% to 14.1 cents, it was a really tough period for Quantum Foods.

All the ingredients for pain in a poultry business were there: increases in raw material costs for chicken feed, lower egg selling prices, outbreaks of avian infleunza, increases in energy costs, load shedding and extreme weather conditions. To add further insult to extensive injury, there was labour unrest at the Kaalfontein farm in Gauteng that led to 40 employees being dismissed.

This is why profit collapsed despite revenue increasing by 11%. The company was unable to recover the significant increases in input costs and had to deal with the various other issues as well.

To give an idea of how severe the impact of avian flu is, the Lemoenkloof farm had to cull 400,000 layer hens. This farm supplies 13% of Quantum’s total production of eggs. Recovering from this takes a long time. There were also false positive tests on two other farms, which led to quarantine of hens and associated costs.

The insurance for this outbreak at Lemoenkloof was limited to direct losses and didn’t cover lost production and lower sales volumes, so this risk is simply part of investing in this industry.

The balance sheet hasn’t escaped the trouble, with cash and cash equivalents decreasing from R73 million to a net bank overdraft of R11 million.

Liquidity in this stock is very low and the share price has only fallen 5% this year.

Little Bites:

- Director dealings:

- With results now in the market (and good ones at that), it was particularly interesting to take note of three Investec directors selling shares in the company worth nearly R31 million in total

- The CFO of Spar has exercised options at a strike price of R122.81 with a total value of R1.84 million

- An executive director of Trematon has sold shares worth nearly R1.15 million

- An associate of a director of Afrimat has sold shares worth R769k

- Associates of Des de Beer are at it again with Lighthouse Properties, this time acquiring R5.4 million worth of shares

- The spouse of a director of Standard Bank has sold shares worth R1.45 million

- Finbond has withdrawn the cautionary announcement related to a potential acquisition in Mexico. Pack away the tequila folks, it ain’t happening.

- In happy news from Steinhoff subsidiary Pepco Group, ex-CEO Andy Bond (who stepped down in March 2022 as a result of health issues) has made a full recovery and will return to the company as its Chairman. Trevor Masters continues as CEO and Neil Galloway is joining the board as CFO.

- Agriculture group Crookes Brothers released a trading statement for the six months ended September. It makes for ugly reading, with the headline loss per share expected to be 193.7 cents per share vs. a loss of 51.2 cents per share in the prior period. Severe cost pressure in key agricultural inputs and logistical costs could not be recovered by the group, with large contraction in average selling prices of deciduous fruits, bananas and macadamias. Sugar volumes are slightly down due to timing of the harvest, but prices have at least remaining stable for that commodity. There is very little liquidity in the stock.

- Huge Group has released a further trading statement for the six months ended August. HEPS will be 42.19 cents, which is 21.83% higher than the comparable period. The net asset value (NAV) per share is 939.05 cents, around 8% higher year-on-year.

- RH Bophelo released results for the six months ended August. NAV per share dipped by 1.82% to R14.06, so the share price at R3.50 remains at a huge discount to NAV. Income decreased sharply in this period, but the balance sheet was improved by exits from Genric Insurance and Phelang Bonolo Healthcare, as well as a partnership with Norsad Finance.

- After acquiring Langpan Mining in July in a reverse takeover (which means a sizable asset is injected into a listed shell or a very small listed company in return for shares), the year-on-year comparisons for Mantengu Mining aren’t useful. Even the results for the six months to August are fairly useless, as the acquisition was during the period. Nevertheless, the headline loss per share is expected to be between 1.69 and 1.71 cents.

- Buka Investments has released results for the six months ended August, but you can safely ignore them because the company was just a listed shell over that time period. This situation should change soon, with a deal announced in July for the acquisition of 100% of Caralli Leather Works and Socrati Footwear. This is a reverse takeover (just like Mantengu above) and requires a category 1 circular to shareholders, which the company has until 31 December to distribute to shareholders.

- Mahube Infrastructure has released a trading statement for the six months ended August. HEPS is expected to be between 25.95 cents and 32.00 cents, a decline of between 46.9% and 56.9% vs. the prior period. This is due to lower dividend income from the subsidiary company, which made lower dividend payments after it needed to redeem preference shares instead under contractual obligations.

- Kenneth Capes, the current CEO of Metier Mixed Concrete, has been promoted to the top job at Sephaku Holdings. Having founded Metier back in 2007, he’s been on the Sephaku Holdings board since 2013. Neil Lazarus has been fulfilling the dual role of CEO and CFO and will now continue in his role as CFO.