Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Blue Label Telecoms: for IFRS professors only (JSE: BLU)

Here comes the most complicated financial update on the JSE

Even my most sadistic university lecturers would’ve struggled to dream up a case study like Blue Label Telecoms. The financials are so complicated that most people put it in the “too hard” bucket and walk away from something they don’t understand. As an investor, that’s always been my approach.

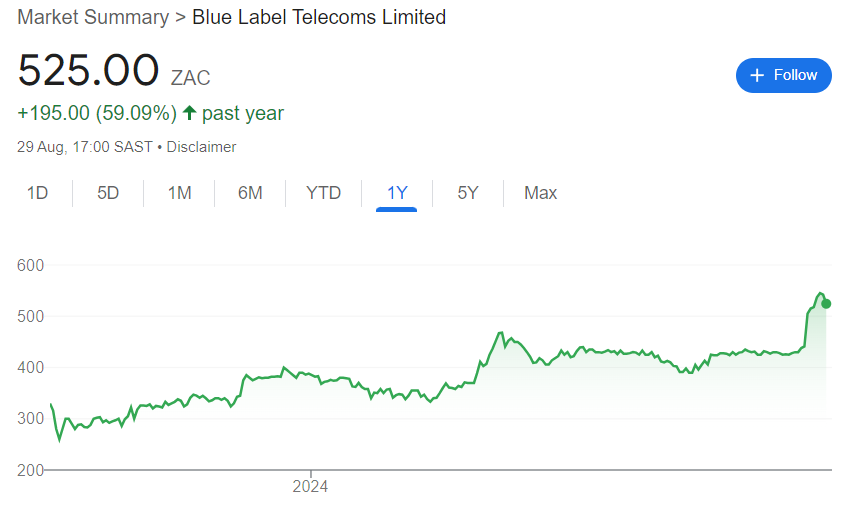

For traders who are often following the momentum rather than the deep fundamentals, this chart has delivered:

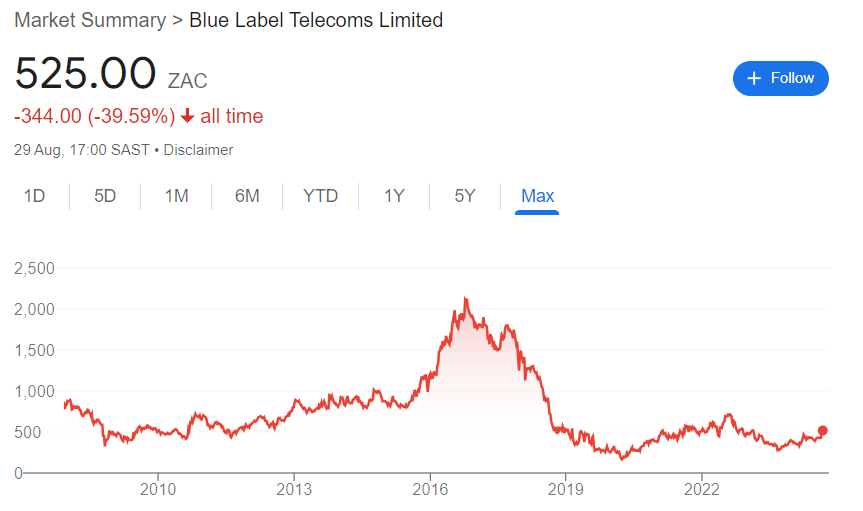

Well, it’s delivered over the past year at least. Here’s the chart that shows you why I’m not exactly fighting to get to the front of the queue to buy shares in something that has complex financial information and this track record:

Here are some highlights:

- Revenue fell by 23%, except it actually didn’t because of the gross profit on certain value-added services, so in fact it grew by 16%.

- Gross profit fell by 5% but gross margin increased from 18.41% to 22.57%, partially because of the value-added services and partially…well, who knows?

- EBITDA fell by 18%, provided we ignore the recapitalisation of Cell C, with Comm Equipment Company down R368 million and therefore responsible for the negative EBITDA move of R258 million.

- Core HEPS jumped from 45.55 cents to 76.08 cents, except it’s not really core HEPS because it still has the Cell C recapitalisation in there. If we split that out, core HEPS fell by 34% to 68.66 cents. That pesky Comm Equipment Company contributed R188 million of the decrease and all the other entities were down R124 million, even though it seemed like the rest of the group was going the right way on EBITDA.

- In many cases, the challenge in earnings is because of fewer discounts and rebates from Cell C, the very company that Blue Label has plowed a fortune into trying to save.

Believe me, it gets a lot more complicated. That’s just the highlights reel.

I like buying things that (1) I understand and (2) are growing group earnings. In this case, neither test is met.

Dipula Income Fund released a pre-close update (JSE: DIB)

There’s a useful presentation as well

A pre-close update is used to give the market an update just before the company heads into closed period – the time between the end of the financial year and the release of financial information. Year-end at Dipula is 31 August.

The full presentation is available here. As expected, they are seeing better trading conditions than in the past five years, but they do raise higher utility costs as a risk to valuations. Importantly, Pick n Pay’s troubles are not affecting their business.

What is affecting the business is the exposure to government tenants. The portfolio reversion rate is -15% with government exposure included and just -0.3% with exposure excluded. The worst of that impact is being felt in the office portfolio.

They expect the final distribution per share to be in line with the prior 6 months.

Equites Property Fund also delivered a pre-close update (JSE: EQU)

They are having to use words like being “committed to our investment in the UK”

Equites hasn’t had the easiest time recently. The UK exposure has been under the microscope, with some tough questions being asked around shareholder returns. Equites expects interest rates to fall over the next year, which will certainly help relieve some of the pressure in that market. Some of the other fundamentals look positive as well. Despite this, the approach at Equites has been to reduce exposure to the UK and bring that capital home to South Africa, hence why they have to make statements like being committed to the UK. In other words, committed despite the recent strategy.

In South Africa, there’s an interesting comment that I’ve seen in logistics funds abroad as well: a decision to hold strategic land and only develop it to meet tenant demand. Logistics supply is restricted by the very nature of those properties, as large distribution centres are specialised, enormous things that need the right road access to make sense.

On the balance sheet, Equites expects the loan-to-value ratio to fall from 39.6% at February 2024 to 38.2% at February 2025.

To get all the details, you can refer to the pre-close update here.

Fortress performed ahead of its guidance (JSE: FFB)

With underlying property demand improving, valuation uplifts will hopefully follow

Fortress Real Estate Investments had a decent year, although you wouldn’t say so just by looking at the 2% increase in the value of local assets on a like-for-like basis. You have to look at other metrics, like a 6.4% increase in trading density in the retail portfolio and the 19.2% premium to book value that was achieved on property disposals.

Fortress also has a meaningful minority stake (16.3%) in NEPI Rockcastle, one of the best REITs on the local market. That sure does help. It used to be a lot higher, but they had to use the NEPI shares to help sort out the dual share class structure at Fortress that caused so many headaches.

The final distribution for the year of 70.19 cents is well ahead of Fortress’ expectation of 62.64 cents. The total distribution for the year was 151.63 cents, so the share price of R19.10 is a trailing yield of 7.9%. Fortress is no longer a REIT, so this distribution is taxed as a dividend rather than income. That makes a substantial difference to the net yield and means that the yield isn’t directly comparable to other REITs.

There’s a rather cute additional trick, with shareholders being given the option to receive NEPI Rockcastle shares from Fortress in lieu of a cash dividend. Based on the ratio for that dividend alternative, the NEPI Rockcastle election represents 25% to 30% more value over the default cash dividend. As dividend alternatives go, this one is worth considering.

A production increase couldn’t save the Impala Platinum numbers (JSE: IMP)

When commodity prices are under this much pressure, there isn’t much that anyone can do

Impala Platinum’s production numbers were boosted by the inclusion of Impala Bafokeng (previously Royal Bafokeng, which Impala acquired recently), so keep that in mind when reading about an increase of 13% in group 6E production. To show you how significant the impact of the acquisition is, production on a like-for-like basis was down 1%! Refined 6E production was up 14% overall and 2% on a like-for-like basis.

With rand revenue per 6E ounce down by 30%, even the acquisition of Impala Bafokeng and associated production uplift couldn’t do much to save these numbers. Revenue was down 19% and the EBITDA margin was just 14%, which isn’t nearly high enough in the mining industry.

HEPS fell by a nasty 88%, with the IFRS 2 B-BBEE charge of 215 cents adding to the pain, as HEPS was only 269 cents for this period. The issuance of nearly 38 million new shares as part of the acquisition of Impala Bafokeng also didn’t do any favours for HEPS.

Much as it’s tempting to think that at least HEPS was positive and thus it could’ve been worse, the free cash outflow was R4 billion. They have net cash of R6.9 billion but they still need things to improve in the PGM market.

Libstar has reported a useful increase in earnings (JSE: LBR)

A better trading performance has led to improved earnings

Libstar has released a trading statement for the six months to June. The best metric to look at is normalised HEPS from continuing operations, which increased by between 6.5% and 16.3%. This excludes unrealised foreign currency gains, hence it’s the cleanest view on the business.

This decent increase in earnings was driven by the trading performance in key categories, better group gross profit margins (up by 70 basis points to 21.7%) and a reduction in net finance costs thanks to lower levels of debt. Detailed results are due on 10th September.

Metrofile has never appealed to me (JSE: MFL)

The latest results will do nothing to change that

I’ve written about Metrofile many times before in Ghost Mail and I’ve always ended up with the same view: it’s not for me. This is one of the biggest value traps around, having attracted many investors who enjoy low multiples. Sometimes, a multiple is low for a reason.

For the year ended June, Metrofile’s HEPS will drop by between 41% and 52%. That’s a terrible outcome that results in a very different P/E multiple once you use these numbers rather than the numbers from the previous year.

I just cannot see the appeal of a physical storage and filing model. It’s a race to zero if ever I’ve seen one, with margin pressure in their operations in the Middle East as well.

High interest rates haven’t helped either, despite a 6% to 10% reduction in net debt over the period. They expect further debt reductions in the coming year.

That’s all good and well, but the underlying business actually needs to grow.

They expect to pay a full-year dividend of 14 cents, down from 18 cents last year. That’s a 6.4% dividend yield on the current price. There are far better places to find that yield in companies that are actually growing.

Pick n Pay takes the next step in the turnaround plan (JSE: PIK)

Yes, this means the IPO of Boxer

As Pick n Pay’s recent trading update told us, Boxer is still doing really well and Pick n Pay certainly isn’t. This means that they need to get cracking on the Boxer IPO, as the market will be receptive to the Boxer story and this will help Pick n Pay maximise the value that it gets from reducing its stake in that excellent business.

To execute the plan, they need to start getting the shareholder approvals in place. There is some restructuring required, including of the group’s share capital.

They are still aiming for the Boxer IPO to take place towards the end of the year, with the price determined through a bookrunning process. This means that institutional investors will be asked to put down a price at which they are happy to take shares.

Pick n Pay is aiming for roughly R8 billion to be raised through the sale of shares in Boxer, but this amount is subject to change.

The circular for the shareholder approval is available here. Along with tons of other information on Boxer and the restructuring, it confirms that Pick n Pay will retain a controlling stake in Boxer of at least 50% plus 1 share. If you’ve ever wanted to really dig into Boxer, the circular now makes that possible.

A strong period for Sanlam (JSE: SLM)

Strong operational results plus positive returns on shareholder capital did the job here

Sanlam has released a trading statement for the six months ended June and it looks strong to say the least, with an increase of between 15% to 25% in their key metric: net result from financial services (NRFFS). This is the basis on which they pay dividends.

Ironically, HEPS still has once-offs that Sanlam doesn’t like to use to measure performance. For what it’s worth, HEPS increased by between 35% and 45%.

The results was driven by good news in various parts of the group, including the core insurance operations and other bright spots like credit and structuring in the operations in India. There were also positive returns on the shareholder capital portfolio, but to a lower extent than in 2023. For insurance businesses, a combination of strong operational performance and attractive returns available in the market is the holy grail.

Santam delivered a juicy earnings uplift (JSE: SNT)

The net underwriting margin is within the target range – but could still be better

Santam has released results for the six months to June. Insurance revenue increased by 10% and HEPS was up by an impressive 35%, so this was a great period.

The major improvement is in the net underwriting margin, which has jumped from 3.8% to 6.5%. The target range is 5% to 10%, so they are now within range. This means that the risk of the book is now in line with how it is being priced, clearly a key ingredient for success in insurance.

The positive narrative around India is interesting at the moment, with Santam highlighting strong growth from Shriram General Insurance in India. Growth in the book and the claims ratio were positive, with a lower return on insurance funds stopping it from being a perfect outcome.

The interim dividend is up by 8% to 535 cents, so the payout ratio has come down sharply from 42.3% to 34.1%.

South32 released results and other important updates (JSE: S32)

As we’ve seen elsewhere in the industry, there’s a major drop in earnings

As regular readers of Ghost Mail will know, mining companies can have really volatile earnings. It all depends on where we are in the cycle for each underlying commodity, with profits able to halve or double year-on-year without blinking an eye.

At the moment, many of the mining houses are on the wrong end of the cycle, so we are seeing substantial drops in profit. South32 is just one such example, with HEPS for the year ended June down by a most unfortunate 71%. Amazingly, this precipitous drop was driven by a decrease in revenue of just 3% and a decrease in EBITDA of 29%. This shows you how the impact filters through the income statement

The moves at underlying commodity level are not for those with weak stomachs. For example, zinc saw underlying EBITDA increase by $76 million, yet the nickel business suffered a $150 million negative move. That’s still tame compared to Australia Manganese, where underlying EBITDA fell by $187 million thanks to Tropical Cyclone Megan.

South32’s payout ratio is in the 40% – 45% range, so the dividend moves up and down with earnings. This means that the dividend is also volatile, so always be very cautious when looking at valuation metrics for mining groups. The trailing dividend yield is a poor choice of metric to use.

Aside from releasing an ore reserve declaration for the Sierra Gorda copper mine that won’t mean much to anyone who isn’t a geological expert, the company also released a third announcement for the day and one that is far simpler to understand: the sale of Illawarra Metallurgical Coal has been completed.

Little Bites:

- Director dealings:

- There’s a massive sale of Dis-Chem (JSE: DCP) shares by a prescribed officer, coming in at R178 million worth of shares.

- A prescribed officer of Standard Bank (JSE: SBK) sold shares worth R5.28 million.

- There’s more selling at RFG Foods (JSE: RFG), this time by a different director of a major subsidiary. These sales are worth R914k.

- A director of Orion Minerals (JSE: ORN) bought shares in the company worth $3,000.

- Kumba Iron Ore (JSE: KIO) is investing in new processing technology at the Sishen mine that is expected to treble the premium quality production volume at the mine from 18% to 55%. The investment is expected to generate an internal rate of return of 30%, which is a strong investment case. The total capital investment is R11.2 billion, with R3.6 previously approved and thus R7.6 billion in new investment. They’ve spent R1.8 billion thus far. Of course, it would really help if Transnet also got their act together, since this is a strong show of faith by Kumba in our country.

- Orion Minerals (JSE: ORN) announced that it has been granted the key water use licence for the Okiep Copper Project, representing the final permitting milestone in progressing the project to construction and production. Given how water sensitive the Nama-Khoi district is, this is a really important step.

- Stefanutti Stocks (JSE: SSK) updated the market that the disposal of SS-Construções (Moçambique) Limitada is taking longer than planned, with the fulfilment date for conditions precedent extended to 30 September.

- Workforce Holdings (JSE: WKF) has limited liquidity, so it falls into Little Bites on such a busy day. The company has released results for the six months to June and they reflect 10% growth in revenue, an 82% jump in EBITDA and a massive jump in HEPS from 1.7 cents to 12.6 cents. The share price is R1.35, so the annualised earnings multiple isn’t exactly demanding. If only there was decent liquidity in the stock.