Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

HEPS is actually lower at Blue Label, if you read carefully (JSE: BLU)

I will never understand why they make their reporting so complicated

All JSE-listed companies are required to report headline earnings per share (HEPS). It’s a well-understood concept with rules that all companies must apply. In some cases, there are good reasons for companies to report adjusted HEPS, or core HEPS, as there might be valid adjustments that aren’t captured in the standard HEPS rules.

Blue Label Telecoms takes the core HEPS route, with that metric up by 65% to 69% for the year ended May. That sounds lovely, until you read the next two paragraphs. For whatever reason, their definition of core HEPS doesn’t adjust for the recapitalisation of Cell C, which caused huge distortions to the numbers in both the previous year and the current year.

If you make those adjustments, then HEPS is actually down by 35% and core HEPS is down 34%. What exactly is the point of core HEPS, then?

Most of the growth at Curro is coming from fee increases (JSE: COH)

Filling the schools is proving to be difficult

Curro has released results for the six months to June. They tell a story of a group that is increasing revenue through fee increases and ancillary revenue, rather than meaningful growth in the number of learners. Average learner numbers were up just 0.5%, which isn’t enough to deliver much improvement in capacity utilisation.

Thankfully, the market was able to bear a 6% hike in school fees, which was responsible for most of the 6.8% increase in school fee revenue. Ancillary revenue was the A student in this case, up 17.2% and helping total group revenue increase by 8.3%. It’s also worth noting that discounts decreased to 6.1% of gross school fees from 6.7% in the prior period.

These increases weren’t enough to offset operating cost pressures, with those costs up by 8.1%. Excluding new schools, employee costs were up 6.7%. This means that school fee increases weren’t enough to cover the increases required by staff, which isn’t a great outlook for Curro’s operating margins.

Nevertheless, due to ancillary revenue growth and other line items like flat credit loss provisions despite the higher revenue, EBITDA was up by 10.4% and showed margin expansion vs. the prior period. It would just be a lot better if the mismatch between fee increases and staff increases wasn’t there.

Recurring HEPS was up 12.3%, so the leverage from EBITDA to HEPS came through nicely in this period.

The cash flow growth is another concern, with cash from operating activities up by just 2.8%. With a capex plan of R700 million for the full year (with R306 million already completed), earnings need to translate into cash flows to support the capex and provide returns to investors.

DRDGOLD’s dividend has nosedived (JSE: DRD)

The strength in the gold price didn’t save shareholders here

DRDGOLD already gave us an earnings update, so we knew that these numbers for the year ended June wouldn’t be great. It just wasn’t obvious that the final dividend would be down by 59%, despite HEPS being 4% higher. A negative surprise on the payout ratio isn’t the kind of thing that the market appreciates.

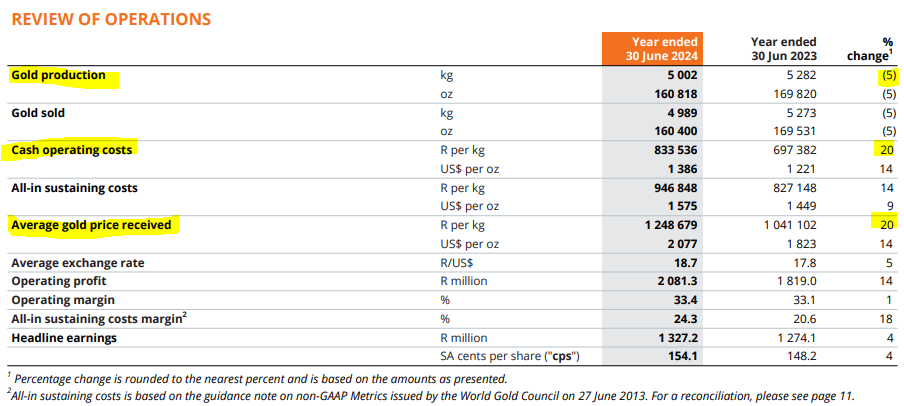

You can quite clearly see the problem in the table shown below, with production down 5% and the cash operating costs per kg therefore up by 20%, completely offsetting the benefit of the average gold price received also increasing by 20%:

Looking ahead to the next financial year, production guidance is for 155,000 to 165,000 ounces, so that sounds a lot like a repeat of 2024. Cash operating costs are expected to be R870,000/kg, which is worse than in FY24. Combined with the sharp decrease in the dividend, it’s hard to see any highlights here.

Jubilee Metals is looking strong vs. production guidance (JSE: JBL)

Chrome guidance was exceeded this quarter and copper guidance was met

Jubilee Metals has released an operational update for the fourth quarter of 2024. The company has done a great job of meeting production guidance and achieving growth, with copper units for the quarter up by 51.7% and for the full year up by 17.1%. In the chrome business in South Africa, chrome concentrate production was up 3.2% for the quarter and 20% for the full year. There was admittedly a decrease in PGM production, but they prioritised chrome as the more lucrative commodity right now.

At projects like the Roan Front-End Modules and the Project Munkoyo open-pit strategy, Jubilee is generally meeting or even beating the timelines given to the market.

Guidance for FY25 is a 6.7% increase in chrome production and a 68% – 119% increase in copper unit production. The variance in copper isn’t as severe as it sounds, as the guided production is 5,750 tonnes to 7,500 tonnes. They are just coming off a low base. PGM production is expected to be flat year-on-year.

RCL Foods updates its trading statement (JSE: RCL)

At this stage, we only have a view on total operations, not continuing operations

RCL Foods has released a further trading statement for the year ended June 2024. The initial trading statement in June indicated that HEPS from total operations would be at least 75% higher. The updated guidance is that HEPS will increase by between 102.6% and 112.6%, so that’s certainly the right direction of travel.

The improvement is largely attributable to Rainbow as well as the groceries segment. This is a good time to remind you that RCL Foods’ continuing operations don’t include Rainbow, which has been unbundled and separately listed. The other difference between continuing and total operations is the Vector segment, which was sold in the first half of this period.

To understand the underlying performance at RCL Foods that will be applicable going forward, we need to wait for the earnings from continuing operations to be released.

Sabvest’s NAV per share has ticked higher (JSE: SBP)

And so has the dividend

Sabvest is seen as one of the best locally listed investment holding companies, not least of all because it holds a portfolio of assets that you can’t get to any other way. There’s been a push back in recent years against listed funds that simply hold stakes in other listed entities. After all, what’s the point of that?

Sabvest has reported a 7.8% increase in net asset value (NAV) per share from December 2023 to June 2024. Before you get too excited about annualising that, it’s only up 2.8% over 12 months. Valuations can be volatile things. Still, it’s very helpful that the interim dividend is up by 16.7% to 35 cents per share.

The company always reminds the market of the long term track record, which in this case is a 15-year compound annual growth rate (CAGR) of 18.5% with dividends reinvested and 17.2% without the reinvestment.

Looking deeper into the portfolio, the theme is one of cost control that has helped improve results in the underlying businesses. Debt has also been reduced, funded by the sales of some holdings in Sunspray and Metrofile among other sources.

The outlook is strong, with Sabvest expecting “satisfactory” growth in NAV per share for the full year.

Sibanye-Stillwater gives an update on projects and funding (JSE: SSW)

They are being proactive with the balance sheet as the cycle continues to disappoint

Let’s start with the balance sheet news, with Sibanye-Stillwater happy to announce that the revolving credit facility has been refinanced and upsized from R5.5 billion to R6 billion. The refinanced facility matures in August 2027, so there’s some breathing room there. The interest rate is a sliding scale between JIBAR plus 2.20% and 2.80%.

To help with the balance sheet, they’ve also concluded a R1.8 billion gold prepayment arrangement, in which Sibanye has agreed to sell 1,497kgs of gold in equal monthly tranches from October 2024 to November 2026. The floor price is R1,350,000/kg and the cap price is R1,736,000/kg. The current gold price is around R1,440,000/kg, so they are retaining upside exposure to the gold price while giving themselves some downside protection. The gold prepayment amount will be used to partially repay the revolving credit facility.

In a separate announcement, the group announced that a lot of progress has been made to repurpose the Sandouville refinery to produce pre-cursor cathode active material. It’s all very technical and I certainly don’t pretend to understand it. They are trying to address the ongoing losses at Sandouville, with a plan that includes the termination of an existing supply agreement at an agreed cost of $37 million. Negotiations to terminate other contracts are ongoing. Even if they get it right, there’s still uncertainty over exactly which activities will take place at Sandouville during 2025 to 2026, as the intended technology is still being proven.

Spur goes from strength to strength (JSE: SUR)

This is the power of a focused strategy

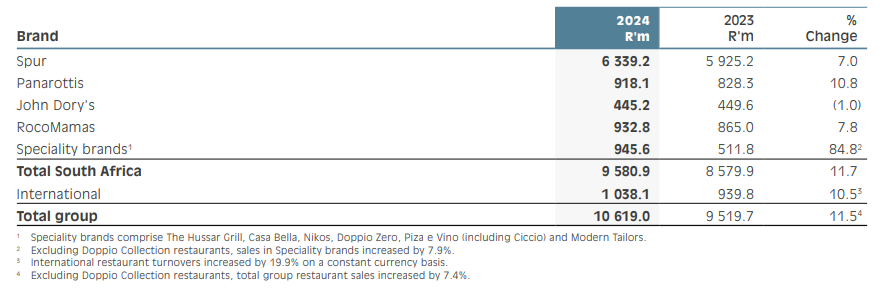

I really enjoy it when listed companies follow sensible, focused strategies. Spur is one such example, with the results clear to see in the latest numbers. For the year ended June, revenue is up 14.1% and diluted HEPS is up 9.4%. The dividend per share is 10.9% higher at 213 cents, so shareholders are enjoying growth that is well ahead of inflation.

And with a return on equity of 29.6%, shareholders should feel good about this management team managing their funds.

In understanding these numbers, it’s important to remember that the acquisition of a 60% stake in Doppio Collection was effective from 1 December 2023. This is why “Speciality Brands” has such a huge growth rate vs. the rest of the group:

Spur has been focusing on value-conscious consumers and there are many of those in South Africa, especially families with kids. Spur put great effort into the Family Club advertising campaign and attracted 1.1 million new loyalty club members, taking the tally to a record high 3.1 million members. The growth in membership in just one period is really impressive. I must note however that customer count numbers were unchanged vs. the previous year, so the story here is one of conversion of the existing client base into loyalty members. That’s still a powerful initiative.

Based on HEPS of 291.02 cents and the share price in mid-morning trade, the Price/Earnings (P/E) multiple has moved up to roughly 12x. The dividend yield is at 6%. Spur is quite the cash cow, which is why the dividend yield looks so strong relative to what is no longer a cheap P/E.

Little Bites:

- Director dealings:

- The CEO of Mr Price (JSE: MRP) exercised share options and sold the entire lot (i.e. not just the portion required to settle taxes) for R30.1 million. This is a bearish signal about the extent of the recent rally in the share price.

- The former CEO of Standard Bank (JSE: SBK) received vested share awards and sold the whole lot, not just the amount required for tax. The additional sale was worth R4.83 million.

- Here’s a trade I didn’t expect to see: Titan Premier Investments, the investment vehicle of Christo Wiese, has sold shares in Brait (JSE: BAT) worth R4.34 million. A director of Brait has bought shares worth R1.5 million.

- A non-executive director of Nedbank (JSE: NED) has sold shares worth R1.2 million.

- Just when you thought you had seen every type of deal risk, here’s a new one for you. York Timbers (JSE: YRK) has been in the process of acquiring various plantations from Stevens Lumber Mills. Prior to the implementation of the deal, two of the plantations were destroyed by a fire! They’ve had to amend the deal to exclude those plantations. When the lawyers get creative on the breach and material adverse change clauses, this is why.

- Murray & Roberts (JSE: MUR) announced that trading division OptiPower, in joint venture with Spanish energy infrastructure group Coxabengoa, has been awarded a contract to construct a 100MWp solar PV facility in the Northwest Province for a mining company. The contract is worth R1.2 billion and OptiPower’s share is 50%.

- Attacq (JSE: ATT) announced that Global Credit Ratings has assigned an initial credit rating for the company of A+(ZA) long-term and A1(ZA) short-term, with a stable outlook. This speaks directly to the quality of the Attacq portfolio.

- Randgold & Exploration Company (JSE: RNG) released a trading statement for the six months to June. The headline loss per share is expected to be between 10.77 cents and 12.43 cents, which is an improvement of between 35.16% and 25.16% vs. the loss in the previous period.