Congratulations to Mazars on their appointment as auditors of Hosken Consolidated Investments (JSE: HCI)

Bowler Metcalf’s net profit margin continues to drop (JSE: BCF)

For the sake of bringing back memories of outdated formatting, I won’t change their charts

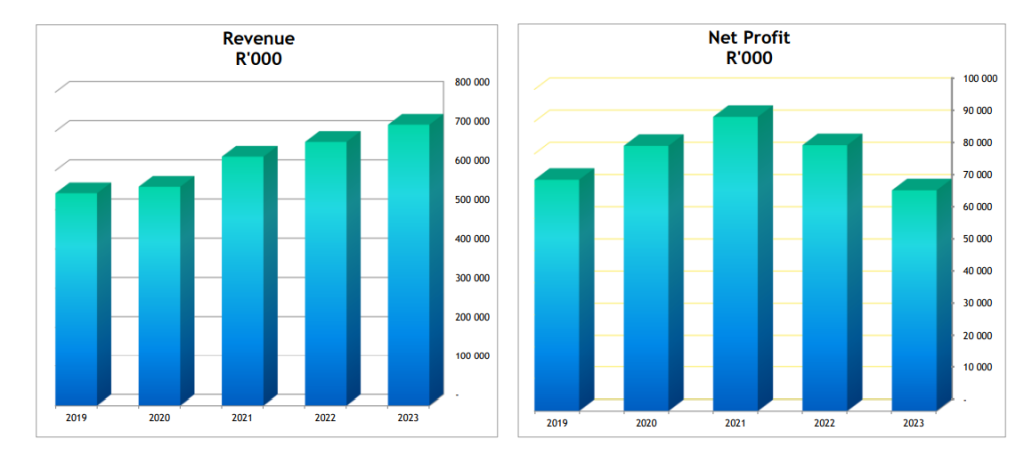

On the local market, it’s a bit of a cult thing to be one of the companies that truly doesn’t care about formatting in official documents. I can only assume that to be the case at Bowler Metcalf, as nobody on earth releases charts like these and thinks they look modern:

These are your charts of the day, just for the hell of it. I can’t bring myself to change that formatting or redo them. But more importantly, I’m actually grateful to the company for including charts like these and making it easier for investors to see what is going on.

The revenue chart looks good, doesn’t it? the net profit chart, not so much. Net profit margin was 13.3% back in 2019. It’s now dropped all the way down to 9.6% for the year ended June 2023, which means net profit in absolute terms is lower than it was four years ago despite revenue being 32% higher.

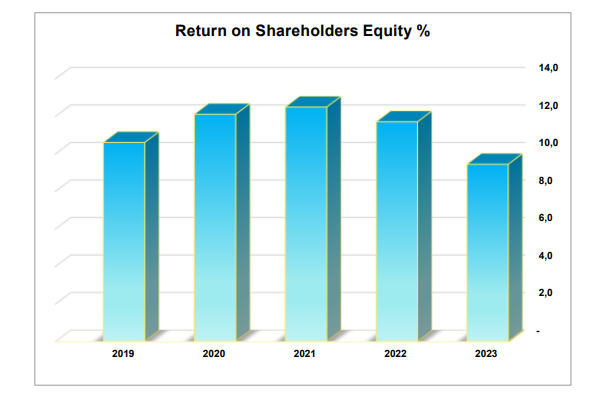

It takes working capital to generate revenue and so it isn’t surprising to see a deterioration in return on equity, down from 10.6% in 2019 to 9.4% in 2023. The only good news about return on equity is that they used slightly different formatting:

Yet despite this, HEPS has somehow increased from 88.10 cents in 2019 to 102.96 cents in 2023. Welcome to the world of share buybacks, with 15% fewer shares in issue now than in 2019. The share price is trading ahead of the levels seen in 2019 after the payment of a very large special dividend, so this strategy of buybacks has saved the day for shareholders. It’s made all the more impressive by ordinary cash dividends having been paid along the way as well.

Perhaps capital allocation is more important than chart formatting after all?

City Lodge shows us what a normal year looks like (JSE: CLH)

Well, as normal as South Africa gets

After such a terrible period during the pandemic, City Lodge had to make big changes to its business model and really improve the overall efficiencies in the group. Nothing breeds innovation quite like a crisis, with the benefits of these initiatives to be felt for years to come.

In a trading statement for the year ended June 2023, we can now see what a “normal” year of trading looks like for the company. The announcement came out at around 4pm and the share price jumped over 5%, yet it is still only flat year-to-date.

This is because although the percentage increase in HEPS looks ridiculous (as the company was loss-making last year), the range of 29.6 to 31.3 cents still isn’t exactly exciting compared to a share price of R4.97.

Time will tell on this one, but I haven’t shared the bullishness of some commentators on Twitter / X because the valuation really doesn’t look appealing. It doesn’t matter what the replacement cost of the hotels would be if they can’t generate proper returns on capital. People simply wouldn’t replace them with hotels then!

Coronation is off to the Constitutional Court (JSE: CML)

The tax matter isn’t necessarily over yet

After the Supreme Court of Appeal ruined the party (and the dividend) at Coronation this year based on upholding an appeal from SARS for a huge tax bill, Coronation decided not to give up. The dispute relates to profits in the international operations, together with interest and costs.

Coronation applied to the Constitutional Court for leave to appeal the judgement. Much to the joy of the lawyers involved, the Constitutional Court has agreed to hear the application for leave to appeal and arguments on the merit of the matter. It will be set down for hearing in due course.

Mustek suffers financial fraud at an associate owned by none other than AYO Technology (JSE: MST | JSE: AYO)

The announcement tries to soften the blow by calling it “irregular expenditure”

Whatever you want to call it doesn’t really make a difference, as the impact is that shareholders of Mustek have suffered a loss thanks to financial shenanigans at Sizwe Africa IT Group. Mustek has director representation on the board there in a non-executive capacity, which means tea and biscuits every few months and a pretty board pack. Non-executives directors are worse than useless at picking up financial fraud, with endless high profile examples of this.

The internal audit function at Sizwe Africa picked up the issue. This is what internal auditors do, although ideally the controls should already have been there to stop it happening. The employees linked to the “irregular expenditure” have been suspended.

For the year ended June 2023, the impact on Mustek’s HEPS is estimated to be between 30 cents and 40 cents. That’s material on a share price of R14.05. Despite this, the company doesn’t need to issue a trading statement, so HEPS won’t be more than 20% different from the prior period.

The real question is why a respectable company like Mustek has an investment in a subsidiary of AYO Technology, as Sizwe Africa is part of that group. It’s incredible that on the same day, the JSE can censure an AYO director (see more details in Little Bites) on a legacy matter, with the company then reporting a new financial issue as well.

And then people wonder why several banks distanced themselves from AYO and friends?

Orion Minerals keeps SENS ticking over (JSE: ORN)

It’s typical of junior miners to announce every possible bit of good news

Junior mining is all about making progress as quickly as possible and showing investors that there is hope of getting some tasty commodities out of the ground. This is why you’ll see companies in this sector announce just about anything they can, down to what the CEO had for breakfast that morning.

There’s an Orion Minerals announcement for the second day in a row, this time dealing with the award of a trial mining contract for Prieska Copper-Zinc to Newrak Mining Group. Newrak is a South African contract mining company and the idea here is to compare a fleet of conventional loaders with a continuous loading machine.

Think of it as a test drive, but for mining equipment.

Rebosis offloads another R650 million in properties (JSE: REA | JSE: REB)

The price is a large discount to the April 2023 valuations

In the first round of sales in this public sales process as part of the Rebosis business rescue, the selling price was pretty close to the valuations of the properties. Not so this time, with a sale of properties valued at R1.07 billion for R650 million. That’s quite the haircut.

The buyer is Hemipac Investments, a subsidiary of property group SKG Africa.

These are office buildings with various vacancy rates, in some cases an extraordinary 100%! I suspect that redevelopment is on the cards but I’m just speculating here. Some of them are fully tenanted, so perhaps those are to be kept as rental opportunities.

The net operating income on the portfolio is R58.5 million so the price of R650 million is decent in that context. The value of R1.07 billion was clearly blue sky stuff.

Sanlam’s alliance with Allianz has become effective (JSE: SLM)

And there’s good news for Santam shareholders (JSE: SNT) off the back of this

It takes a long time for major corporate activity to actually work its way through the regulatory approvals required for these transactions. Sanlam’s proposed joint venture with Allianz SE was first announced in May 2022. We are now in September 2023 and the deal has finally closed.

The structure of the deal is that Sanlam and Allianz will contribute their African operations to the joint venture, creating a genuinely Pan-African financial services group.

The initial split in the joint venture was agreed as being 60% Sanlam, 40% Allianz. Post-closing adjustments are provided for in the agreements as the deal has taken well over a year to close, so the performance over that period needs to be taken into account. Although a material deviation from that number is unlikely, it may move slightly.

Importantly, Allianz has the option to increase its shareholding at a later stage to 49%. This means that Sanlam will remain in charge of this joint venture. Another important point is that Sanlam’s Namibian operations will be contributed to the joint venture company at a future point in time.

In a separate announcement but linked to the same transaction, Santam previously announced that it would dispose of its 10% interest in SAN JV to Allianz. This deal became effective on the same date as the Sanlam joint venture, which means Santam received R2.6 billion in cash from the sale.

R2 billion of those proceeds will be declared by Santam as a special dividend. This works out to R14.24 per share, which is roughly 4.7% of the current share price.

The Brackenfell Bruisers look unstoppable (JSE: SHP)

Shoprite is going for the kill

It’s not often that I read something on SENS and genuinely have to sit back in my chair to let it sink in. The Shoprite results are, quite frankly, ridiculous. The Supermarkets RSA business grew 17.8%, so Shoprite won record levels of market share (140 basis points) this year.

The losers? Clearly, competitors. I think you may need to Pick n Pray for a miracle if you are taking a view against Shoprite.

Perhaps the most impressive thing about this result is that the growth hasn’t just been at the top end in Checkers. That side of the business has certainly done well, with an increase in sales of 18% and Sixty60 managing an astonishing performance of 81.5% growth. The group is also doing well with lower income consumers, as Shoprite and Usave increased sales by 15.6%.

I must note that the 92 Massmart stores have been integrated into the Shoprite and Usave operations, so that is giving the sales number a boost. Still, the point remains that the company is resonating with consumers everywhere.

Some pricing pressure has come through the system to support this market share growth, with gross margin down from 24.5% to 24.1%.

The blemish on the result is obvious: Eskom. There’s nothing that Shoprite can really do about that, as fridges need to be kept cold. R1.3 billion was incurred on diesel costs. Although there’s an offset from not paying Eskom instead, the reality is that this is still a very big number in the context of profit before tax of R9.1 billion.

By the time we work through the Eskom pain, sales growth of 16.9% is blunted to HEPS growth of just 9.6%. The dividend is 10.5% higher.

This is an annoyance for shareholders in the context of what might have been. But with a longer term view, the momentum at Shoprite is beyond incredible. Unless you have some retail experience, it’s hard to appreciate just how good this performance is.

And in case you’re wondering, Supermarkets non-RSA grew sales by 16.4% in rand terms (9.6% in constant currency). Furniture sales grew 5.1%. Other operating segments were up 13.3%, with OK Franchise sales up by 13.7%.

Finally, as another good example of how South Africa makes life far harder for our corporates than it should be, insurance costs were up by R185 million because of premium increases since the 2021 social unrest and the need for additional cover.

South Africa is a treacherous minefield for food retail at the moment. Shoprite seems to know where all the mines are. The share price told a different story on the day, with a significant drop. I would attribute this to the return of stage 6 load shedding and the realisation by the market that Shoprite’s multiple is high for a company that faces this many headwinds to profit growth, even with revenues growing quickly.

This is exactly why it is possible to (1) have massive respect for this management team and (2) avoid any exposure to this sector entirely. The uncontrollable macroeconomic problems make it too risky for even the best management teams.

The Foschini Group flags a big drop in HEPS (JSE: TFG)

Watch the share price action on Wednesday when the market opens

The Foschini Group released a trading update for the 22 weeks ended 26 August, as well as a trading statement for the six months ending September. This is because they already know that HEPS for this period will suffer a negative move that triggers the release of a trading statement.

We begin with the 22 weeks, where group turnover grew by 11.3%. This includes Tapestry, the recent acquisition.

We need to dig deeper to see the effect of that acquisition, with TFG Africa up by 16.1% including Tapestry and 9.7% excluding Tapestry, with clothing as the major contributor here with much higher growth (11.8%) than categories like cosmetics (3.8%) and cellphones (2.5%). Like-for-like growth in that business was a paltry 3.3%, so new stores are adding a lot to the story. Encouragingly, cash turnover growth in TFG Africa was 21.8%, so credit sales are growing really slowly at just 2.9%. Cash turnover contributes 73.4% of total TFG Africa turnover.

The international story is far less encouraging because it is coming off a high base, with TFG London down by 12.4% in GBP and TFG Australia down 6.6% in AUD.

Online turnover was up 23.2%, with the online contribution increasing from 9.1% to 10.1%. The launch of Bash was a major driver here, taking the contribution of online sales in TFG Africa to 4.2%. Online sales contribute 40.9% of TFG London and 6.0% of TFG Australia.

Although this sounds like a decent revenue outcome at group level, there are other problems like a 300 basis points drop in gross margin in TFG Africa as stock was cleared. The impact of inflationary increases on costs and of course load shedding means that HEPS will be 15% to 25% lower. The finance costs on the group debt definitely wouldn’t have helped matters here either.

The HEPS range for the interim period is 348.5 cents to 394.9 cents and the share price response on Wednesday will be important to watch, as this announcement came out after market close. I expect it to be negative, with my view on TFG being highly bearish at the moment because of the level of debt in this consumer environment.

Little Bites:

- Director dealings:

- You guessed it – Des de Beer has bought another R8.4 million worth of shares in Lighthouse Properties (JSE: LTE)

- The ex-CEO of Emira Property Fund (JSE: EMI) and current CEO of Castleview Property Fund (JSE: CVW), James Templeton, bought shares in Emira for just under R3 million.

- Now here’s an interesting one – the CEO of Murray & Roberts (JSE: MUR) bought shares in the embattled company to the value of R605k.

- And from large trades to very small ones – the spouse of the CEO of Calgro M3 (JSE: CGR) bought shares worth under R3.5k,

- In a long announcement that lays bare exactly why I would rather invest in a dying earthworm than AYO Technology (JSE: AYO) or any of the companies related to this group of people, the JSE has explained why Khalid Abdulla has been censured in his capacity as a director of AYO. There are a couple of reasons, including a related party asset management agreement that wasn’t adhered to and instructions given to make changes to financial statements while the former CFO was on leave. The JSE has imposed a very embarrassing public censure and fined Abdulla R2 million for his failure to comply with the listings requirements. This censure comes after a court process that included an attempted interdict against the JSE from publishing the ruling. There is still a reconsideration application to be heard by the Financial Services Tribunal.

- enX Group (JSE: ENX) renewed the cautionary related to the potential sale of the stake in Eqstra Investment Holdings. Negotiations are still ongoing.

- NEPI Rockcastle (JSE: NRP) has confirmed that the scrip distribution price is R104.70715169, a 3% discount to the 5-day VWAP (less the final dividend) as at 4 September. The company will hope that many shareholders take up the scrip alternative so that it can hang on to more capital. Based on strong recent results, there’s a good chance of that happening I think!

Interesting that Calgro had directors dealing the day before they came out with a trading statement