Virgin Active has injected some energy into Brait (JSE: BAT)

Membership numbers and pricing are up at the gym group

Virgin Active represents 61% of Brait’s total assets. The other really important stake is Premier (JSE: PMR), which you can invest in directly on the JSE. Premier just released excellent numbers showing growth in HEPS of 34%, so that set the scene for Brait to hopefully come out with a decent story at Virgin Active.

Sure enough, memberships at Virgin Active grew 6% year-on-year and pricing was up 9%, so that’s 16% revenue growth excluding Kauai. Add in the growth at Kauai (my favourite takeaway option) and you’re at 23%. All territories grew solidly, with the UK the lowest at 11% and Singapore the highest at 34%.

With this kind of growth and a fixed cost base, the revenue drops to the bottom line beautifully. There’s been a more than fourfold increase in EBITDA!

As Brait has been valuing Virgin Active based on their estimate of maintainable EBITDA, there’s actually no valuation uptick here. The carrying value on the investment came down slightly if you can believe it, despite debt being reduced. It just shows how daft the valuation approach has been, which is why the market ignores the Brait net asset value per share and conducts its own valuations.

If you’re wondering about New Look, the fashion retailer in the UK that comprises 5% of Brait’s total assets, I’m afraid that it isn’t good news. Revenue fell 3.5% and EBITDA was down 22.7%. We’ve seen really mixed numbers out of UK fashion retailers recently, with Truworths doing well there and TFG struggling. New Look has always been a poor cousin to those businesses, so I’m not surprised to see the numbers down.

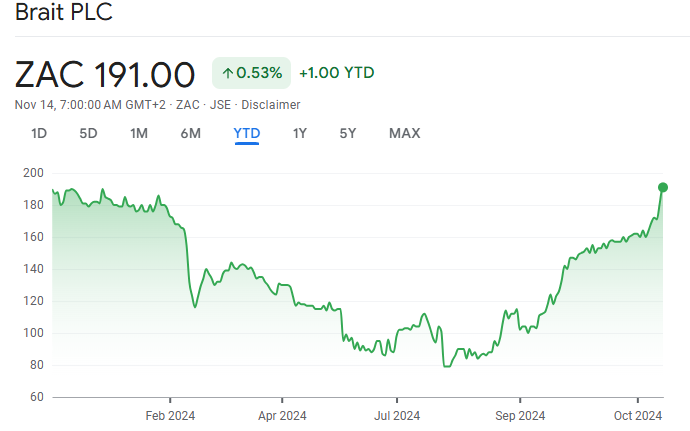

The share price closed 5.5% on the day. The chart this year looks like a pretty decent gradient profile on a spinning bike:

Property costs are hurting Dipula Income Fund (JSE: DIB)

Distributable earnings per share is down 4%

Dipula Income Fund holds a portfolio of property assets across various property types in South Africa. Even though they have really painful exposure like a government-tenanted office portfolio, they still achieved 7% growth in revenue for the year ended August 2024.

Alas, there was a 15% increase in property expenses, driven by issues like municipal tariff hikes and maintenance – you know, all the things that make property an unattractive asset class in many cases. Net property income therefore only increased 2%.

To make it worse, net finance costs were up 3%, so distributable earnings ended up decreasing by 4%. At least the net asset value per share increased by 5.2%, so there’s something to make shareholders feel better. Another small highlight is that the loan-to-value ratio has been quite stable, coming in at 35.48% vs. 35.18% the prior year.

Unsurprisingly, the best uptick in value is in the retail portfolio, up 8.3%. At the other end of the spectrum, we find the office portfolio down 2.0%.

The group pays out 90% of distributable earnings per share as a dividend. This puts the share price on a trailing dividend yield of almost exactly 10%.

A slight increase in the Emira dividend (JSE: EMI)

The office sector is still facing difficulties

Emira isn’t shy of doing deals and building an unusual portfolio. For example, they have the residential portfolio inside Transcend Residential Property Fund. They also have exposure to the US and Poland. Remember, complications are usually a negative rather than a positive, as time has shown us on the JSE.

The dividend for the six months to September has increased by just 1.1% to 62.39 cents. This is despite distributable income being 6.9% higher. Whilst you would immediately assume here that this must be due to more shares being in issue, that isn’t actually the case at Emira. The difference is due to the adjustment for the equity-accounted investments in the US, with a new approach of simply paying out 95% of distributable income rather than actual dividends received.

The loan-to-value ratio has improved from 42.4% to 42.0%. I would argue that this is still on the high side, although we are at least in a decreasing interest rate cycle now.

The net asset value (NAV) per share increased by 12.3% to R19.455. The share price is R11.01, so as usual the market cares much more about the dividend yield than the theoretical NAV.

I must also note that the office sector remains difficult. Emira holds a high quality portfolio and although vacancies continued to decline (down from 10.9% to 9.4%), negative reversions worsened from -6.3% to -9.6%. In other words, there’s still pricing pressure on landlords.

Ethos Capital saw NAV grow in the past three months on an adjusted basis (JSE: EPE)

And yes, you do need to adjust for the Ethos unbundling

When an investment holding company unbundles part of its portfolio to shareholders, it is literally making itself smaller. You therefore need to adjust for this when comparing the net asset value to the previous period, otherwise it will look as though the value decreased when the reality is that some assets were simply passed upwards to shareholders.

This is the case at Ethos Capital, which unbundled R121.3 million worth of Brait shares in July this year. It was a busy period of other corporate actions, with R73.3 million of Brait exchangeable bonds sold to Brait, the sale of Synerlytic for R286.4 million and the sale of Adumo for R55.9 million. This is why net debt has come down to R234 million as at the end of September and R180 million based on subsequent repayments.

Thanks to valuation gains in Optasia which more than offset some pressure in the unlisted asset portfolio, the net asset value per share is up 5.6% on a like-for-like basis since June 2024. The NAV per share is R6.95 and the current share price is R5.00.

Southern Sun tightens up its earnings guidance (JSE: SSU)

This has been an excellent period for the group

Southern Sun released a preliminary trading statement back in mid-September, dealing with the six months ended September. They initially guided for an increase in earnings of at least 20% – the vaguest disclosure allowed under JSE rules. When you see that, there’s always a great chance that the move could be a lot higher.

Indeed, a further trading statement confirms growth in HEPS of 33% to 39% and adjusted HEPS of 33% to 44%. Either way, that’s excellent.

Even more encouragingly, the group notes that trading in the month of September was a highlight, so the exit velocity in this period sets them up very nicely for the busy summer.

Interim results are due to be released on 21 November. With the share price up 60% year-to-date, there will be many interested parties.

Nibbles:

- Director dealings:

- An entity associated with the Sassoon family has sold R37.6 million worth of shares in Sasfin (JSE: SFN) to Wiphold.

- An associate of Michael Georgiou, the man who put together Accelerate Property Fund (JSE: APF), was forced to sell R25 million worth of shares pursuant to a lending arrangement. This is what happens when shares are put up as security and things don’t go well. Together with previous similar sales, this means that RMB now holds 6.99% in the company, based on lending arrangements being settled with shares.

- There’s another sale by the director of CMH (JSE: CMH) who has been selling shares recently, this time to the value of R3.2 million.

- Dr Christo Wiese and an associate of the Collins family each bought shares in Collins Property Group (JSE: CPP) worth R313k (so a total of R626k).

- The Capital & Regional (JSE: CRP) deal with NewRiver REIT has been strongly supported by shareholders. This means that the scheme of arrangement will go ahead and Capital & Regional will soon disappear from the JSE.

- Lighthouse Properties (JSE: LTE) has noted potential tax changes in Spain that would eliminate the benefit of SOCIMI structures. Although Spain is 42% of Lighthouse’s assets, they further note that even if the tax change goes ahead (and it’s by no means a guarantee), it won’t have a material impact on distributable earnings. Interestingly, Vukile (JSE: VKE) noted the same potential issue but wasn’t prepared to make a statement on materiality.

- Workforce Holdings (JSE: WKF) is trying to head for the exit, releasing the circular detailing the offer by Force Holdings. Force Holdings has 45.63% of shares in issue and concert parties to the offer have another 51.61%, so the shares eligible to participate in the scheme represent just 2.76% of issued shares. Despite such a narrow voting class, the scheme consideration is a premium of just 16% to the 30 day VWAP. Irrevocable undertakings have been obtained from holders of 32.71% of the shares eligible to vote, so they actually have a long way to go here and I’m not sure the premium is juicy enough for such a small voting class. Time will tell.

- Universal Partners (JSE: UPL) released its quarterly earnings. The net asset value per share has decreased by 0.8% in the past year in GBP. You simply won’t find a more varied portfolio than this, ranging from a dental group in the UK down to the company that always makes me laugh: Propelair, which claims to have reinvented the toilet. The fact that Propelair is always behind on its business plan suggests that perhaps the toilet didn’t need to be reinvented?

- Montauk Renewables (JSE: MKR) releases its 10-Q each quarter and doesn’t add any management commentary on SENS, making it painful to try and follow the company. That’s a real pity, as earnings per share have almost doubled year-on-year for the nine months to September, driven by a decent increase in revenue.

- Burstone Group (JSE: BTN) has completed the transaction that puts in place a strategic partnership with Blackstone in Europe.

- Europa Metals (JSE: EUZ) has completed its disposal of the Toral Project in exchange for shares in Denarius Metals. This effectively turns Europa Metals into a cash shell under AIM rules on the London exchange, with the planned reverse takeover by Viridian Metals set to address that issue.