Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Brait takes a 17% bath in a single day (JSE: BAT)

Here they are, tapping the market to try fix the balance sheet

Brait’s share price chart is a wonderful way to see exuberance, disappointment and then utter despair all in one place, showing us beautifully when the JSE was fertile ground for investment holding companies that convinced the market that they were Very Clever Indeed and worth investing in:

I’m no technical analyst, but that chart pattern isn’t one that I think you’ll find in many textbooks. It also doesn’t tell the full picture, as those who avoided the absolute murder from the peaks of 2016 still got smashed anyway by the pandemic, with the share price down 95% over the past five years:

It really has been an awful experience. Virgin Active was severely broken by the pandemic, but it’s not like there was an encouraging balance sheet heading into the pandemic.

Although the partial disposal of Premier (which is now separately listed) did wonders for the debt on Brait’s balance sheet, the problem is that it now has convertible bonds and exchangeable bonds that it has little chance of dealing with in the current environment. This has necessitated a recapitalisation of the balance sheet, with the maturities on the bonds extended by three years to December 2027. An equity raise of R1.5 billion will be needed, with the convertible bonds to be repaid up to R150 million and the exchangeable bonds up to R750 million.

Your maths isn’t letting you down. This means they are raising more than they need. They will use the excess for general working capital, investing in existing portfolio companies or repayment of debt.

Does it make sense to do an outsized capital raise when the share price is so depressed? A 17% drop on the day of the announcement probably answers that question.

A strong clue is found in the news that Titan Financial Services (part of the Christo Wiese stable) will underwrite the equity raise in full. No surprise there, with the rights offer priced at a 25% discount to the theoretical ex-rights price. Basically, if you don’t follow your rights, you are donating value to Titan.

The announcement goes on to remind the market that Premier is hoping to pay a maiden final dividend for the year ended March 2024. Over at Virgin Active, the EBITDA run-rate has improved but they are still running below pre-pandemic levels. New Look is reporting flat EBITDA.

All this, a highly leveraged balance sheet and the ever-present risk of a rights offer with Titan swooping in to get more equity? No thanks. I would rather clean the showers at the gym than hold these shares.

Fairvest reports modest growth in the dividends (JSE: FTA | JSE: FTB)

That wasn’t a typo – there are two classes of shares

Fairvest has reported earnings for the six months to March 2024, with like-for-like net property income up by 7%. The loan-to-value ratio has improved to 32.6%, which is a comfortable place for a REIT to be.

Fairvest has two classes of shares, so they report the movement in net asset value (NAV) and the dividend for each class of share. The A shares enjoyed a 13.4% uplift in NAV and 5% growth in the dividend. The B shares weren’t so lucky, with the NAV down 1.5% and the dividend up 1.3%.

The distribution per A share increases by the lesser of 5% or the most recent consumer price index, with the B shares then carrying the variability in underlying earnings. In other words, the B shares ride the wave of good times and bad times.

If you annualise the distribution on the A share, you get a yield of just under 9%. The guidance for the B shares is a full-year distribution of between 41.50 cents and 42.50 cents, with the company expecting to be at the upper end of this. Assuming they hit 42.50 cents, that’s a 10.9% forward yield on the current price of the B shares.

Over the past five years, the A shares did much better than the B shares during tough times:

But over the past year, you can see how improvements in the property sector have driven the B shares:

Mahube Infrastructure reports improved performance in the renewable energy assets (JSE: MHB)

Prepare yourself to read about negative revenue in the base period

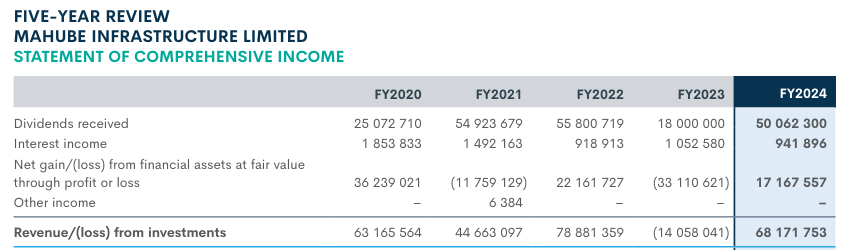

You won’t often see a company talk about negative revenue, yet here we are with Mahube Infrastructure pointing out that revenue improved from -R14 million (!) to R68 million. For this to make any sense at all, you need to see the income statement that shows fair value changes in the underlying financial assets going through revenue:

Moving on from this strange situation, we find the company enjoying a more positive narrative around the wind assets, leading to revised forecasts and positive fair value movements. The company has investments in two wind farms and three solar PV farms. The assets sell electricity to Eskom under 20-year power purchase agreements. Dividends received from the investments increased from R18 million in the comparative period to R50.1 million in this period (as you might have noticed in the table), so cash flow into this group has improved.

This was enough for the full-year dividend to be 55 cents per share, up from 45 cents per share in the prior year.

The tangible net asset value is R10.52 vs. R9.91 in the comparable period. The share price of R4.99 is a substantial discount to NAV and a rather appealing dividend yield, but be very careful of the almost non-existent liquidity in the stock.

Marshall Monteagle to sell its stake in a South African tool distributor (JSE: MMP)

The buyer already holds the other 50% in the company

Marshall Monteagle announced that it has agreed to sell its 50% stake in L&G Tool and Machinery Distributors. The stake is held by a subsidiary of the group called Monteagle Merchant Group Southern Holdings. This the entity that will be sold to Des Lyle Family Holdings, which holds the other 50% in L&G.

L&G imports and distributes tools, machinery and household products in South Africa. This isn’t a fit with the rest of Marshall Monteagle’s business, even though the group is a smorgasbord of investments in listed companies, industrial properties and financing and trading businesses internationally. Perhaps L&G simply isn’t a fit because the group isn’t a fan of South African exposure?

Whatever the reason, the price is R64.3 million for the shares and debt in the company. Of this, R13 million is payable up-front and the rest is payable in instalments. Here’s the surprise though: the loan doesn’t carry any interest and they reckon it will take 10 years for the loan to be settled in full, which is an incredibly long time.

I don’t think I’ve ever seen a corporate be willing to take exposure for this length of time. It really makes one wonder why they are even bothering to sell the entire stake now vs. selling it off piecemeal as the buyer can afford it. If the equity value of the business tanks, it’s unlikely that the buyer could afford to pay them anyway.

To try and build in some protection, there are some mechanisms to allow the remaining balance on the loan to be adjusted based on the net asset value at certain milestones.

It gets even weirder when you see the numbers for the business. It has net asset value of R12.7 million and profit after tax of just R301k for the year ended March 2023. Although its possible that the bulk of the value sits in the loans rather than the equity (with the related interest charge then crushing profits), it still raises eyebrows that the price for the 50% stake plus the debt is R64.3 million. That’s a big number vs. the profitability.

MAS is telling a more positive story (JSE: MSP)

Key metrics are up and there’s progress on the balance sheet

MAS is a property fund that owns properties in Central and Eastern Europe. That’s a good place to be right now, as evidenced by metrics like 5% growth in like-for-like footfall for the four months to April and tenant sales per square metre growing by 6%. Occupancy cost ratios are steady and there is good demand from tenants, so life is good at the properties themselves.

The problem is the balance sheet, particularly as MAS doesn’t enjoy a credit rating as high as the large funds like NEPI Rockcastle. In a risk-off economic climate, this makes debt difficult and expensive to raise.

MAS took the approach of stopping dividends years ahead of the bond maturities in an effort to avoid a catastrophe down the line. JSE investors panicked when that news came out towards the end of 2023, as this share price chart shows:

The previous estimate assumed that dividends aren’t paid until the debt maturities in June 2026. On that basis, MAS will need at least €414 million in new capital. Since June 2023, MAS has raised €156 million in new secured loans and signed term sheets for secured funding of another €90.5 million. A positive surprise is that a private placement to an existing noteholder raised €40.2 million in April, with those notes maturing in April 2029. They were issued in exchange for the notes maturing in 2026. They do come with more onerous financial covenants, but it shows what is possible to solve the 2026 problem.

A funding structure with PKM Development, in which MAS has 40% of the ordinary equity, obliges MAS to provide funding to PKM in the form of preferred equity. This structure is designed to provide a stream of development properties for MAS, although the latest approach by the joint venture has been to drawdown on the preference shares (which helps MAS earn a return) and use that funding to buy shares in MAS at the price that is currently a deep discount to the NAV per share. That’s a pretty interesting and supportive approach from the joint venture partner.

Those who enjoy unusual situations and who don’t require dividends might want to dig deeper here.

Sirius Real Estate reports decent growth on a per-share basis (JSE: SRE)

It’s very important to look at the per-share numbers, not the total results

When property funds are growing by issuing shares and executing acquisitions, then total revenue etc. will go through the roof because the fund is literally buying earnings. As a shareholder, you need to consider what the per-share growth has been. This is the way to take into account the dilutive impact of the issuance of new shares.

Sirius Real Estate is a very good example of this. Operating profit was up 28.6% and profit before tax was up 32.4% thanks to valuation gains, but funds from operations (FFO) per share (the key metric) was only 2.4% higher. If cash is king, then cash per share is emperor.

The total dividend per share for the year grew by 6.5%, which is a commendable outcome particularly in hard currency.

Adjusted net asset value per share increased by 1.8%.

The net loan-to-value ratio came in at 33.9%, which is much better than 41.6% at March 2023. Shareholders have been supportive of the various corporate actions, which have included acquiring and disposing of properties and raising equity capital.

Little Bites:

- Director dealings:

- Carel Vosloo was recently appointed as an alternate director to Jannie Durand at Remgro (JSE: REM) and he has invested heavily in the company’s shares, buying R24.2 million worth of shares in Remgro.

- A director of a major subsidiary of RFG Holdings (JSE: RFG) sold shares in the company worth R2.5 million.

- The new CEO of Bytes Technology (JSE: BYI) has bought shares in the company worth almost R1.2 million.

- A director of Afine Investments (JSE: ANI) bought shares worth R127k.

- Associates of the CEO of Spear REIT (JSE: SEA) bought shares with a total value of R41k.

- There has been further investment by directors of Hammerson (JSE: HMN) under the dividend reinvestment programme. This certainly isn’t as strong a signal as a director investing from funds unrelated to a dividend from the company, but it’s still worth highlighting.

- I don’t include this as a typical director dealing, as this is an institutional purchase by an investor that has director representation on the board. Still, it’s worth noting that Capitalworks has bought shares in RFG Holdings (JSE: RFG) worth R45.4 million.

- Between 19 March and 3 June this year, Thungela (JSE: TGA) repurchased shares representing 2.35% of shares in issue. The average price paid was R133.21 per share.

- Capital & Regional (JSE: CRP) achieved pretty good take-up of the scrip dividend election, which means cash is retained by the company vs. paid out as a dividend. This has a dilutive effect for those who chose to take cash rather than shares. Under this scrip dividend, shares in issue will increase by around 3%.

- Oando (JSE: OAO) is suspended from trading but is playing catch-up on its reporting. The company has now released results for the year ended December 2023. They reflect a 71% increase in turnover and a swing into profitability.

- Powerfleet (JSE: PWR) has applied to delist from the Tel Aviv Stock Exchange. The last day of trading of the company’s stock on that exchange will be on August 27th. It will then only be listed on the Nasdaq and the JSE.

- Salungano (JSE: SLG) released a quarterly progress report, made necessary by the listing being suspended on the JSE. The company is hoping to catch up by July 2024 with the release of interim results to September 2023. They will then need to do FY24 results. The company is dealing with business rescue at Wescoal and court processes around a provisional liquidation hearing for Keaton Mining. And to make everything worse, KPMG suddenly resigned as auditors and the board needs to find a replacement.

- Tongaat Hulett (JSE: THL) has applied for leave to appeal in the Supreme Court of Appeal against the judgement of the High Court in December 2023 related to the sugar industry levies. If you would like to see what a founding affidavit for the supreme court of appeal looks like, you’ll find it here.