Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Brimstone reduced its stake in Equites (JSE: BRT)

The recent recovery in the Equites share price perhaps prompted this move

The Brimstone story hasn’t been very exciting, sadly. The share price has halved in value over 5 years and is down over 22% in the past year. The first problem is that the market puts a substantial discount on the intrinsic NAV. The second problem is that the intrinsic NAV hasn’t shown appealing growth. The combination means a disappointing share price performance and a market cap of just R200 million.

When trading at such a discount to NAV, turning some of the assets into cash isn’t a bad strategy (depending on what happens to the cash thereafter). Brimstone has used the recent improvement in the Equites share price to sell R123.9 million worth of shares, cutting its stake to just over a third of what it used to be.

The disposals were achieved at an average price of R13.02 per share. Hindsight is perfect obviously, but the Equites share price was trading at double this level in 2021. They must be kicking themselves about not selling sooner.

The proceeds will be used to meet funding obligations in the near to medium term. In a perfect world of course, the company would be able to use the proceeds for share buybacks, thereby helping to close the discount to intrinsic NAV.

enX has distributed the Eqstra disposal circular (JSE: ENX)

Shareholders can get all the information they want on the proposal deal with Nedbank

A couple of months ago, enX announced a firm intention to dispose of Eqstra Investment Holdings to Nedbank. It’s a clever deal in my view, as the leasing and fleet management business will benefit greatly from a cheaper source of funding (and nothing is cheaper than being owned by a bank). It also gives Nedbank more scale in its fleet management business and a strong route to market. For enX, it gets a capital hungry business off the balance sheet.

Acting as independent expert, Valeo Capital has opined that the transaction is fair and reasonable to shareholders. The independent board of enX has recommended that shareholders vote in favour of the deal. You can find the full circular here.

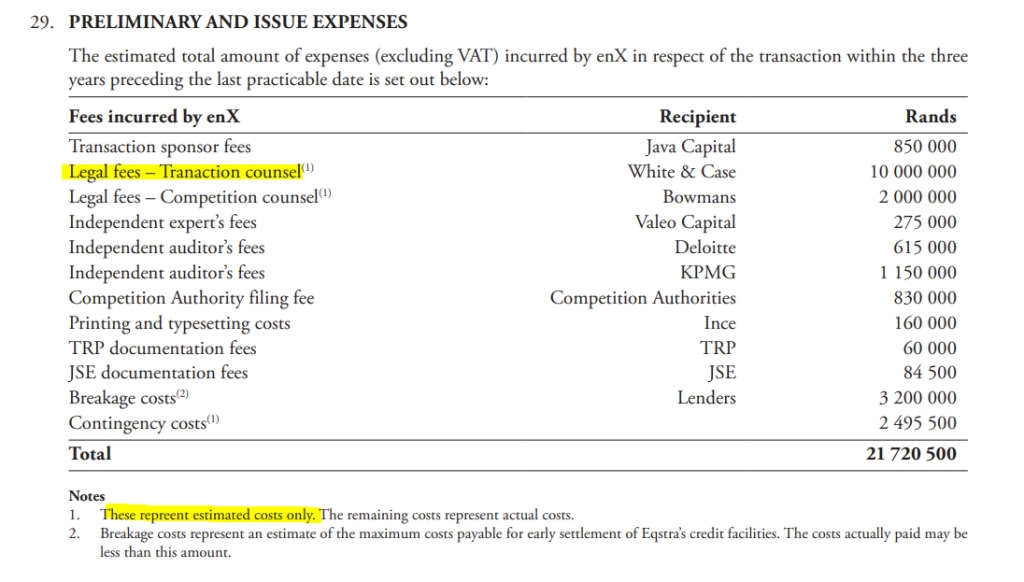

I just hope that more attention to detail was paid to the deal than the expenses table (something I always look at). It’s not every day you’ll see a typo in the description AND the footnote:

There’s great news at Kore Potash (JSE: KP2)

Finally, there’s a meaningful step forward on the project

Kore Potash shareholders (and everyone else involved) have had to be patient on this one. For months now, we’ve been reading about PowerChina (the owner of SEPCO) and all the work that the company is doing on site to put together an Engineering, Procurement and Construction (EPC) proposal. Construction projects of this scale can easily sink construction groups if they go wrong, so immense effort is put into the contract itself. The risks are even higher when the build is in a difficult jurisdiction, like the Republic of Congo.

The excellent news is that PowerChina has finally delivered an EPC proposal and draft contract offer. Best of all, the pricing aligns with expectations and confirms the capital cost that was detailed in the original study. Full commercial terms now need to be negotiated, with a targeted signing date of April 2024. Thereafter, the Summit Consortium will need to put in a funding proposal within six weeks of the EPC documentation being signed.

The share price jumped 23% on the news. You can be sure that whether things go well or extremely badly in the next few months, each major update will drive a significant move in the share price, either up or down.

Sasol shareholders continue to take a beating (JSE: SOL)

The latest trading update isn’t helping

Sasol’s share price has halved in the past year, having decoupled considerably from the oil price in recent times. The chemicals side of the business has a substantial bearing on the share price performance, as do the operational realities in the energy business in South Africa.

Battered shareholders don’t seem to be getting any relief, with another 3.9% drop on Friday after the company released a trading statement. Results for the six months to December were hit by a bunch of issues, ranging from commodity prices through to infrastructure problems in South Africa and the weaker global growth outlook.

Adjusted EBITDA for the period will be between 8% and 18% lower. By the time you reach core HEPS level, the decrease is 19% and 33%.

Although I tend to focus on HEPS rather than EPS which is impacted by impairments (non-cash write-downs of assets), I must note that the Secunda liquid fuels refinery was written down to zero as at June 2023 and all the capital expenditure on the project in the six months to December 2023 was also fully impaired due to ongoing issues.

I would therefore argue that EPS is worth considering at the moment. That metric is down by between 29% and 43%.

Whichever way you cut it, things are not looking healthy at Sasol.

Little Bites:

- Director dealings:

- An associate of a director of Clicks (JSE: CLS) sold shares worth R2.7 million.

- The CEO of Invicta (JSE: IVT) and Dr. Christo Wiese are both still buying up shares in the company. The latest tranche saw CEO Steven Joffe pick up R720k worth of shares and Wiese took R1.05 million.

- A director of a major subsidiary of Santova (JSE: SNV) sold shares worth R1.2 million.

- After buying another R820k worth of shares, Protea Asset Management (related to Sean Riskowitz) now owns just over 20% of Finbond (JSE: FGL).

- An associate of a director of Afrimat (JSE: AFT) has bought shares worth R122k.

- Sirius Real Estate (JSE: SRE) only achieved a modest take-up of the dividend reinvestment plan, which suggests that shareholders aren’t seeing great value in the shares at these levels. Only holders of 0.46% of shares on the UK register and 7.24% of shares on the SA register elected to receive shares instead of a cash dividend.

- Having already given us significant insight into earnings earlier this month, MiX Telematics (JSE: MIX) has now released its detailed 10-Q (quarterly report under US rules) with the SEC. If you want to check out the company in detail, you’ll find it on the website.

- Insimbi Industrial Holdings (JSE: ISB) released a trading statement noting that HEPS will be at least 20% lower for the year ending 29 February 2024. This is the bare minimum disclosure required by the JSE, so it’s quite possible that the actual decrease will be significantly worse. No further details have been given.