British American Tobacco reaffirms guidance at the AGM (JSE: BTI)

This is despite all the recent noise around tariffs

If you search for the word “tariff” in the chair’s address at the British American Tobacco AGM, you won’t find it. Instead, you’ll find the usual paragraphs of gumph about the company’s commitment to the environment (and it’s remarkable Triple-A rating for its disclosures, indicating what a great corporate citizen this company is).

If you can get past the fact that you’re investing in a wildly harmful product that ESG index providers love based on the aforementioned Triple-A rating, then the guidance for the 2025 financial year will be of relevance to you. Constant currency revenue growth is expected to be just 1%. On the assumption of a 1.5% currency headwind, they indicate adjusted profit from operations up by between 1.5% and 2.5%. The currency situation is a problem though, with an expected impact of 2% on full-year numbers and 3% on half-year numbers. In other words, growth as reported could be close to zero for the year.

The focus, as always, is on delivering free cash flow. Based on the mid-term growth algorithm of 3% to 5% revenue and 4% to 6% in adjusted profit from operations, they expect to generate £50 billion in free cash flow from 2024 to 2030.

The weaker rand does wonders for the local share price, as British American Tobacco is a rand hedge. The share price is up a whopping 50% over 12 months and around 19% year-to-date.

Clicks banks another strong set of numbers (JSE: CLS)

Even UPD put in a better performance this time around

Clicks is one of the most impressive businesses on the local market. People know this, which is why you’ll typically find it trading at a huge Price/Earnings multiple of over 30x.

To support this multiple, we find growth in group turnover of 6.2% and diluted HEPS of 13.2%. As an indication of the cash quality of earnings, the interim dividend was up by 13.3%. Numbers like that are excellent, especially accompanied by return on equity being 200 basis points higher at a massive 46.2%!

Digging deeper, retail turnover growth of 6.4% was supported by solid comparable store turnover growth of 5.4%. If you adjust for Unicorn Pharmaceuticals, which was sold in the prior year, growth was actually 8.3%. That’s a strong number. This performance was further enhanced by a 50 basis points improvement in margin, driven by a greater penetration rate of private label products. Retail costs grew by 8.5% (and 6.0% on a comparable store basis), so retail trading margin was stable at 9.1%.

On the wholesale side, distribution turnover increased by 7.6% as things came right at UPD. Margins were down by 20 basis points though, impacted by modest increases in the single exit price of medicines – a regulatory minefield of note. Distribution costs were only up by 1.6% though, as the base period included major systems implementation costs. This led to trading margin improving by 20 basis points to 2.6%.

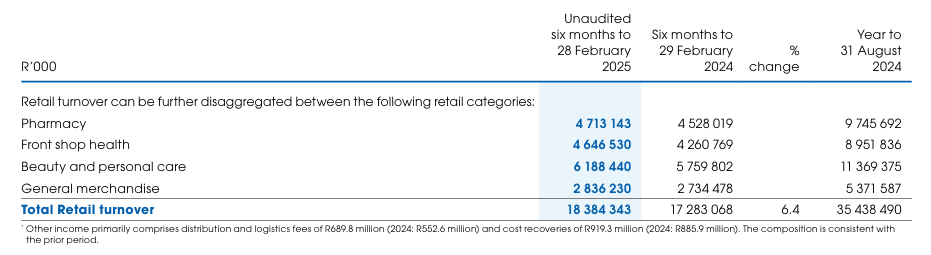

As you can see, the retail business runs at much higher margins than the wholesale business, so a relatively stronger performance in retail leads to a better margin mix at group level. Here’s the breakdown of retail sales, to give you a sense of how the different categories perform:

And no, I have no idea why they don’t include the percentage change per line item. I’ve done the maths to save you the irritation of getting the calculator out. The laggards were general merchandise (up 3.7%) and pharmacy (4.1%), while the strong performers were beauty and personal care (7.4%) and especially front shop health (9.1%).

Although general merchandise sales are most at risk in my opinion, given how easy it is to buy similar or competing products anywhere, it’s also the smallest part of retail sales with a contribution of 15.4%. The excellent Clicks rewards system is a defensive underpin here, encouraging shoppers to make general merchandise purchases at Clicks.

In support of the dividend increasing in line with HEPS, net working capital days only increased slightly from 44 days to 45 days. They generated cash from operations of R1.7 billion and had capital expenditure of R222 million. This is about as good an example as you’ll find of a cash cow.

Clicks has noted that a VAT increase will have a negative impact on consumer spending. Despite this, they expect to open 45 – 55 stores and pharmacies for the year, with a medium-term target of reaching 1,200 stores. They expect diluted HEPS to grow by between 11% and 16% for the full financial year.

This is why the share price is now roughly flat for the year, despite all the macroeconomic turmoil. Clicks is a defensive stock, provided they can continue to keep the front shop sales ticking over. For now at least, there’s no reason to believe that they can’t.

Copper 360 has restructured short-term debt into long-term debt (JSE: CPR)

This is a major step for the balance sheet

Copper 360 has restructured short-term debt obligations of R267.6 million. They’ve replaced this debt with long-term debt that has a funding rate linked to changes in the copper price. Although this isn’t great when copper prices go up, as it limits the financial leverage in the business, it does wonders for managing downside risk. In junior mining, it’s all about risk management.

It’s still a much better deal than the immense funding rate of 24.3% per annum on the current debt, which is right up there with personal loans! The restructured debt rate is 11% per annum at current prices and can go as high as 17.4% if copper prices reach $15,000 per tonne. The rate is capped there, so any further price increases would be purely for the benefit of Copper 360. In case you’re wondering, the base price per tonne that delivers the 11% funding cost is $9,652.

In addition to the funding benefit, Copper 360 has managed to extend the term of the debt considerably. The current package has R172.3 million due and payable now, with R15 million due on 31 July this year and the remaining R80.3 million due in February 2026. The new structure repackages all of this into a five-year bond that will be listed on a local exchange.

This is a perfect example of the vibrant local debt market that I discussed with Ian Norden of Intengo Market in a recent podcast.

Here’s a good example of how to interpret trading statements Insimbi previously released a trading statement in which they noted that earnings would drop by at least 20%. Now, as I often remind you, the words “at least” tend to work really hard in these situations. “At least 20%” is the minimum required disclosure under JSE rules, so the move can be a lot higher. We now have a perfect example of this from the company, with an updated trading statement reflecting a drop in HEPS of “more than 100%” – an acknowledgement that (1) they are now loss-making and (2) they still don’t know to what extent. Clearly, the year ended February was a disaster. Although some of this has to do with accounting technicalities related to corporate activity, the reality is that the aluminium and steel sectors are in trouble and Insimbi just isn’t sitting on a strong enough balance sheet to make up for it. Detailed results are due on 30 May. If you’re wondering why it sounds so positive, it’s because it only covers South Africa As I read this announcement, I couldn’t understand why the overall narrative was so positive. After all, it felt like it was just a few months ago when Jubilee Metals was under pressure with disappointing production figures due to power issues in Zambia. Therein lies the nuance: the latest operational update covers only South Africa. When they talk about being on track to exceed performance targets and all the other positive things in this announcement, be aware that this excludes the problems in Zambia. So, based on this very flattering way to view the group, chrome production was up 10.7% for the quarter and 26.7% for the nine months year-to-date. On the PGM side, the quarter was up a substantial 34% and the nine months year-to-date view is an increase of 3.6%. Based on this, production guidance for South Africa has been increased for FY25. Chrome guidance is up from 1.65Mt to 1.85Mt. PGM guidance has increased from 36,000oz to 38,000oz. In the case of chrome, this increase has been driven by the Thutse project. In PGMs, the recently announced joint partnership for excess PGM feed stock has driven the increase. But as I say, no word on Zambia… These are excellent growth numbers PSG Financial Services released results for the year ended February 2025. They are rather excellent, with recurring HEPS up by 25% and the total dividend up 24%. Return on equity was 26.6%. What’s not to love? Underpinning this result were metrics like growth in assets under management of 15.7%, along with a 9.2% increase in gross written premium at PSG Insure. These are solid top-line growth drivers, which are then accompanied by cost management practices that leverage these percentage moves into much higher moves in profit. Speaking of costs, the standout spend was in technology and infrastructure (up 18.6%), with fixed remuneration up 6.1%. This isn’t any different to what we are seeing in other financial services businesses. At least PSG is actually growing after spending this kind of money on tech, whereas many others are not. Importantly, performance fees were 3.7% of headline earnings in this period, up from 2.8% in the comparable period. We can therefore safely conclude that the vast majority of earnings are recurring in nature. If we dig deeper into divisional performance, PSG Wealth saw recurring headline earnings increase by 14.5%. This is the power of the network of advisors that PSG has built, with an enormous R20.6 billion in positive net inflows in the year. PSG Asset Management was up 36.9%, with growth in the mid to high teens across assets under management and assets under administration. Once again, there were positive net inflows, something that very few local asset management can point to at the moment. PSG Insure was the best of the lot, up 41.4%. Although gross written premium growth was “only” 9.2% as mentioned earlier, the underwriting performance was fantastic with a net underwriting margin of 12.7% vs. 9.7% in the prior period. When insurance businesses do well, they do really well. These strong performances across the board were made even better by a 1% reduction in the weighted average number of shares outstanding, helping to boost HEPS. Clearly, this is an impressive performance.Insimbi is in a loss-making position (JSE: ISB)

Jubilee Metals released an operational update (JSE: JBL)

It’s hard to fault PSG Financial Services (JSE: KST)

Nibbles: