British American Tobacco: can smokers still afford it?

Big on trademarked ESG-friendly terms, low on volumes

I never cease to be amazed by British American Tobacco’s public relations onslaught. The website looks like a tech company or a special needs school that promises a brighter future:

Of course, this is a cigarette company that is trying hard to figure out how else to make a profit. Because ESG index inclusion is all about intent and meeting rules, rather than a company’s actual value to society, British American Tobacco is a favourite. This is why most of the ESG industry is just window dressing of the worst kind.

The New Category business (vapes etc.) has 21.5 million customers and is still loss-making, with a plan to be profitable by 2025 when the target of £5 billion revenue is met.

The cigarettes make the money, though industry volumes are under pressure because of macroeconomic factors and post-Covid normalisation of consumption. With a core business that is essentially a sunset industry, there’s a major focus on cost savings (£1.5 billion annualised savings by the end of 2022) and pricing initiatives to recover inflationary pressures.

Investors treat British American Tobacco as a cash cow. It manages to grow revenue slightly each year and converts over 90% of adjusted profit from operations into cash.

With a market cap of R1.75 trillion, British American Tobacco is an absolute monster and is used as a defensive stock because the customers are, shall we say, rather sticky. Here’s what that looks like in a tricky market:

Rebosis business rescue update

To meet JSE requirements, a quarterly update on the process is required

The Rebosis business rescue plan was supposed to be released on 1 December, but the practitioners have requested an extension to 20 January. That’s the boring news.

The financial statements are a sticking point, as the annual financials for the year ended August can’t be released until the auditors can make a reliable assessment of the company’s ability to continue as a going concern. That isn’t going to happen until the business rescue plan is approved and the valuations of the properties are completed.

The company also released an operational update that reflects vacancies of 11.8% in the R5.3bn retail portfolio and 26.2% in the R5.9bn office portfolio. The negative reversions on the office portfolio are quite spectacular at -29%.

Government tenants are clearly hard negotiators.

Transnet keeps letting Thungela down

And not just Thungela, but all of us in South Africa who depend on the economy

If it was possible to win a FIFA World Cup through scoring economic own goals, South Africa would put any of the big names to shame. We might even be granted a Cricket World Cup as an adjacent prize, just to make sure we eventually get one of those trophies.

These sporting fairy tales are about as likely as Transnet sorting out its rail business or Eskom keeping the lights on. The frustrations are immense, as we are a resource-rich country at a point in the cycle where it should be our turn to shine.

Instead, the only thing shining is my rechargeable light while I write Ghost Bites late at night.

The pain is made clear by Thungela, our coal superstar that is losing out on exporting coal because of poor rail performance by Transnet Fright Rail. A strike in October by Transnet employees certainly didn’t help either. Because South Africa appears to have angered the ancestors, we also had a derailment on the coal corridor in November that took 10 days to clear.

Mitigating actions included a focus on railing higher-grade products to ports and using trucks to supplement that supply. That’s not cheap when the price of diesel is so high. In the final cruel irony, the price of diesel is partly being driven by demand from Eskom.

Truly, it’s a mess.

Against this delightful backdrop, Thungela’s pre-close statement paints a picture for the year ended December 2022 that remains lucrative. As a regular flick of your light switch will no doubt remind you, there is an energy crisis and we aren’t the only country dealing with it.

This crisis comes through in demand and hence the price for export coal, which has increased from $103.82/tonne to $236.11/tonne. You don’t need your calculator to figure out that this is a big jump. Sadly, thanks to Transnet, export saleable production at 12.8Mt is lower than the revised range of 13.0Mt to 13.6Mt issued in August and 15% lower than the 2021 number.

Lower production has a direct impact on costs per tonne, with the FOB cost per export tonne (excluding royalties) expected to be around R955/tonne (4% higher than the revised range issued in August and 21.7% higher than in FY21). Included in this number is a non-cash charge of R85/tonne related to an increase in environment provisions based on closure estimates.

Including royalties, the cost is expected to be R1,106/tonne vs. R812/tonne last year.

Despite this, Thungela is a cash machine of note, boasting a ridiculous net cash position of R19.8 billion on 30 November compared to R8 billion a year ago. It won’t improve in December because of operational disruptions, which shows how costly the strikes and derailments are.

South Africa desperately needs Thungela, with the company expected to pay taxes and royalties of R4 billion this year.

Headline earnings per share (HEPS) is expected to be at least 97% higher than last year, coming in at a minimum of R131 per share. This is a good time to remind you that Anglo gifted this company to the market at a price of R25 per share in June 2021.

With perfect hindsight of course, that was a forward P/E multiple of 0.2x.

Incredible.

Little Bites:

- Director dealings:

- One must be careful with reading too much into directors selling off their shares received under performance awards, but I did note that a few Transaction Capital directors didn’t hold on to any of their shares

- A prescribed officer of Nedbank and the company secretary have collectively sold shares worth just over R3 million

- In a reminder of how much your bank balance sucks in comparison to some of the directors on the JSE, the CEO of Omnia has sold shares worth R15.3 million just to cover the tax on a performance award

- There’s always a bigger fish, with Stephen Koseff of Investec fame selling shares worth around R155 million

- Sanlam has released the circular for the Afrocentric deal that would see Sanlam taking a stake of between 55% and 64.45% in the company. This is being executed through a partial offer at R6.00 per share. You’ll find the circular here.

- Transpaco is executing a specific repurchase of shares worth R42.9 million from a related party to the company’s CEO. As the price has been set at the 30-day volume weighted average price (VWAP), no fairness opinion is necessary. This represents 4.95% of the issued shares of Transpaco.

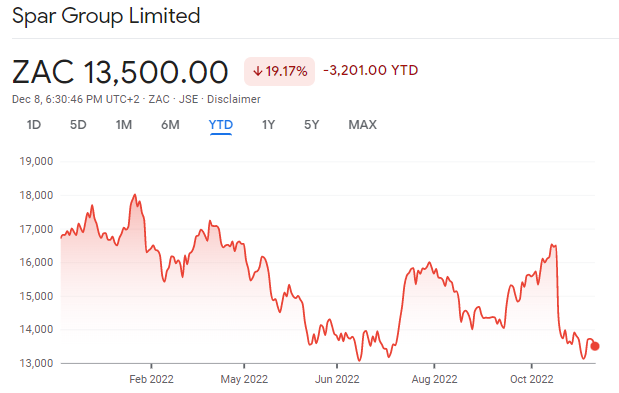

- Old Mutual has seen value in Spar despite a horrible year and no shortage of bad press, taking the stake to 5.23% despite a share price chart that reminds me of last week’s polony that fell down the back of the shelf:

- Spear REIT announced that the sale of 15 on Orange for R246 million has received approval from the Competition Commission, which means the disposal has met all outstanding conditions and can go ahead.

- Sebata Holdings has released a trading statement for the six months ended September, with the headline loss per share improving substantially to between 5.25 cents and 5.36 cents (vs. 132.25 cents last year). I would love to hyperlink it, but the website doesn’t work.

- Nictus released its financial statements for the six months ended September, with revenue down by 1.34% to R18.8 million (this company is tiny) and a headline loss of 2.03 cents, which is at least better than a loss of 2.94 cents in the comparable period

- Randgold & Exploration Co released a trading statement for the year ended December 2022, in which the loss per share has more than doubled because of further operating expenditure incurred by the company.

So what’s your recommendation on BATS?

Transnet Fright Rail – brilliant!