Get the latest recap of JSE news in the Ghost Wrap podcast, brought to you by Mazars:

Burstone expects interim results in line with guidance (JSE: BTN)

The deal with Blackstone is an exciting story going forward

Burstone Group is a property fund with around 65% of the portfolio sitting in Australia and Western Europe. There’s a big push into managing third-party properties as well as Burstone’s own properties, as this is a potentially strong boost to return on equity. Like in the hotel industry and as we are also seeing in the self-storage industry, return on equity really benefits from generating returns through helping someone else manage their assets. It’s quite simple: this approach doesn’t require any additional equity, so the numerator (the return) is going up and the denominator (equity) stays the same.

Through a transaction with Blackstone, Burstone will receive net proceeds of R5 billion through selling most of its stake in the Pan-European Logistics portfolio. They will continue generating returns through not just the remaining 20% stake, but also management fees on the entire thing. Although shareholders still need to approve the deal in late October, I can’t see why they won’t.

A similar approach to property asset management is already underway in Burstone’s Australian business. In South Africa, they are looking to do much the same thing.

If the Blackstone deal goes ahead, group loan-to-value will drop to 33.5% and the dividend payout ratio should increase to between 85% and 90% thanks to the leaner and meaner balance sheet.

For now, the interim results aren’t nearly as interesting as what the future could hold. Distributable income per share is expected to be in line with guidance, which means a decrease of 2% to 4%.

Barloworld is having a tough year (JSE: BAW)

The mining sector has cooled off considerably

Barloworld has released an update for the 11 months to August. They have a number of headaches, including the pressure in the local mining sector and of course the ongoing issues faced by the Russian subsidiary. They recently announced a voluntary disclosure to the US Department of Commerce, Bureau of Industry and Security (BIS) regarding potential export control violations at the Russian subsidiary, leading to a nasty drop in the share price.

At group level, Barloworld’s revenue declined by 7.4% and EBITDA fell by 14.3%, with operating leverage working against Barloworld in a period where revenue dipped. EBITDA margin contracted from 12% to 11.1% and operating margin fell from 9.4% to 8.0%. The silver lining is that net debt has reduced from R6.3 billion to R3.5 billion.

In Equipment Southern Africa, they actually managed to achieve some margin expansion despite revenue going the wrong way. Revenue was down 13% but EBITDA ended up flat, with EBITDA margin up from 10.6% to 11.8%. The firm order book sits at R2.4 billion vs. R2.9 billion in the comparable period.

In Equipment Eurasia, the business in Mongolia is doing the heavy lifting with growth in revenue of 61%. The business is doing so well that they are likely to meet earn-out thresholds, triggering a provision of $10 million for additional payments to the sellers of the business. As a reminder, Barloworld acquired it back in 2020. As for VT, the Russian business, revenue fell by 25% and $30 million was raised as a provision for inventory obsolescence. Operating profit was slightly up vs. the previous period without the provisions, but fell to $49.1 million vs. $84.4 million after taking them into account. The firm order book is vastly higher than before though, thanks to the business in Mongolia.

Moving on to Ingrain, the consumer business, we find a dip in sales volumes of 2.5% and a flat revenue performance. EBITDA fell 4.1% despite several turnaround efforts, some of which perhaps need to be given more time to succeed.

Results for the full year are due for release on 25 November.

CMH hits the brakes (JSE: CMH)

This is what I’ve been warning about

I’ve written in a few places recently about the disruption to the car dealership business model. With a combination of high interest rates and the onslaught of Chinese brands in the South African market, CMH’s diversified dealership base looks vulnerable.

Sure enough, for the six months to August, HEPS will be between 25% and 35% lower. The share price has run extremely hard this year and I would be very careful here:

Emira’s local portfolio has some worries (JSE: EMI)

The company has released a pre-close update covering the five months to August

Emira’s reporting is a bit unusual in this sector, mainly because they have a significant residential property portfolio as well. This means they bundle retail, office and industrial as the “commercial portfolio” and give an overview of that collective, like negative reversions of -3.1% (ever so slightly better than in the year ended March at -3.3%).

Thankfully, they do give more detailed breakdowns, like the office portfolio still in trouble with negative reversions of -10.7%. That’s worse than FY24 at -6.3%. The retail portfolio is particularly worrying, with negative reversions of -5.7% vs. -0.5% in FY24. Thank goodness for the industrial portfolio at positive 4.4% vs. -4.8% in FY24.

Through a complicated deal structure, Emira has gained exposure to the Polish economy through an investment in DL Invest Group. This has led to the loan-to-value ratio moving higher from 41.2% to 43.4%. Certain properties are in the process of being disposed of and these deals will lead to a reduction in the debt ratio once they are completed.

Overall, with those negative reversions in the local portfolio, I can’t help but wonder if an investment in Poland is that last thing that they should be focusing on.

FirstRand is absorbing the HSBC South Africa branch (JSE: FSR)

This is a win for the local bank’s corporate and investment banking unit

HSBC seems to be leaving South Africa. To ensure that its largely multinational client base is adequately looked after (as those client accounts are worth a fortune overseas), HSBC is transferring the clients and its staff to FirstRand. Operationally, they will land in RMB as FirstRand’s corporate and investment banking division.

The transfer is expected to be completed in the fourth quarter of 2025. It takes a long time!

Metair: working hard every day for the bankers (JSE: MTA)

The disposal of the Turkish business needs to close as quickly as possible

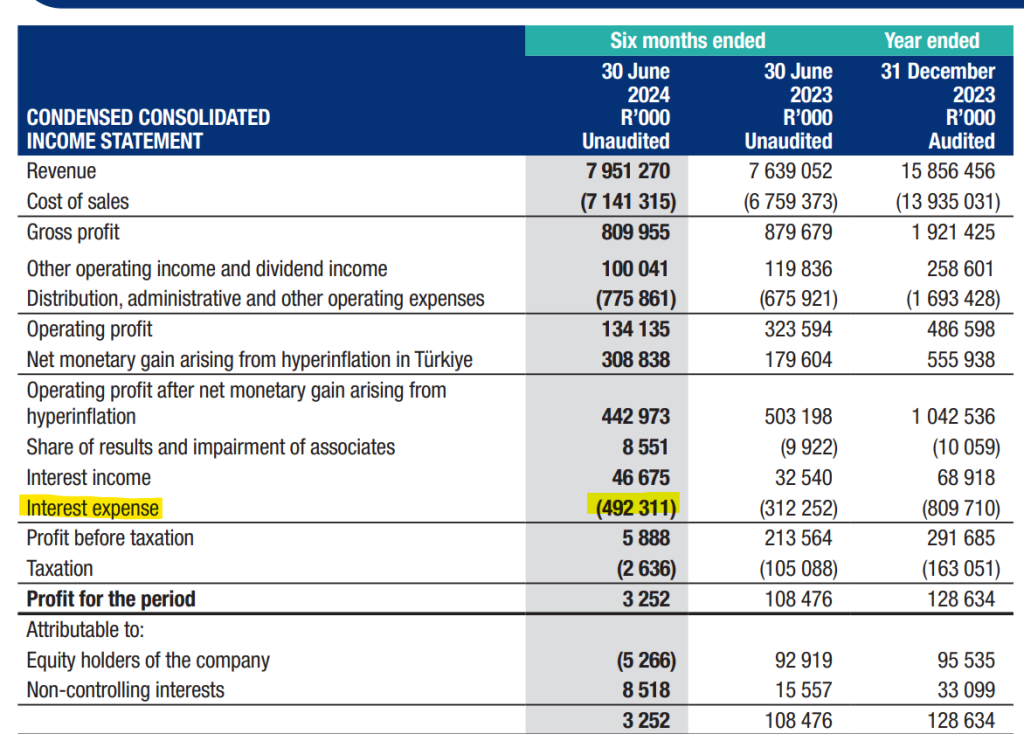

Metair has been having an extremely difficult time of things. Right now, they are just keeping their heads above water in terms of servicing financing costs, as evidenced by a quick look at the income statement:

Revenue for the six months to June was just 4% higher, while operating profit fell by a nasty 59%. The EBITDA story is less severe but in such a capital-intensive business, I would caution against using EBITDA as it doesn’t take into account depreciation.

One of the major pressure points has been the local vehicle industry, as Metair is a supplier to major OEMs operating in South Africa. There have been other issues, like a knock to Toyota’s ability to export vehicles to Europe due to a certification issue on their engines. The challenge for Metair is that they are impacted by many factors that are way outside of their control.

Net debt has increased from R2.8 billion to R3.4 billion, with the business in Turkey as a major drain on the balance sheet. With the disposal of that operation recently announced, this should reduce pressure on debt. It can’t come a minute too soon, as net debt to EBITDA of 3.5x is danger zone stuff. Only the bankers are getting any value out of Metair right now, with HEPS plummeting from 41 cents to a loss of 3 cents per share.

Old Mutual managed mid-single digit growth (JSE: OMU)

This result is far less exciting than what we’ve recently seen at other life insurance houses

When making an equity investment, your first hope is to at least beat inflation. Over and above that, the idea is to earn a return that is at least equal to the cost of equity, which in South Africa is typically in the mid-teens depending on the business you’re looking at. With growth in the Old Mutual dividend of just 6% for the full year, the group has barely managed to achieve inflationary returns for investors.

Return on net asset value was 70 basis points higher at 12.6%, which is below the cost of equity in my view. They try make it sound better by disclosing return on net asset value excluding growth initiatives, which comes in at 15.5%. I would ignore that number.

The whole “excluding growth engines” theme comes through a lot in the disclosure. I’m really not sure why any investor would be happy to look at a company on the basis of ignoring the costs of initiatives that could achieve growth in the future. With return on embedded value of 12.5%, the story at Old Mutual is one of slow growth and performance below the cost of equity. This explains why the share price has severely underperformed Sanlam this year:

Watch out for the change in reporting period at Safari (JSE: SAR)

You have to read this one carefully

Safari Investments is a property fund that recently changed its year-end from March to June, so the latest period is a 15-month period rather than a 12-month period. Going forward, they will report on a 12-month basis as usual. This limits comparability of this period to the previous period of course, so be careful when you read these numbers.

For example, although the fair value of investment properties was up by 8.7%, that covers 15 months worth of growth. Thankfully they do give us some numbers to work with on a like-for-like basis i.e. on a 12 month basis, with operating profit up by 15.9% through that lens.

The loan-to-value ratio decreased from 35% to 33% and the net asset value per share increased from R9.15 to R10.06. The share price is only R5.70, so the market prices Safari at a deep discount.

Nibbles:

- Director dealings:

- A member of the founding family of Famous Brands (JSE: FBR) sold shares in the company worth nearly R12 million.

- Gary Bell (obviously part of the Bell family) has sold shares in Bell Equipment (JSE: BEL) to the value of R8.87 million at a weighted average price of R43.54. If there is a better offer coming for this company, the family is doing an excellent job of hiding it.

- The buying of Metrofile (JSE: MFL) shares continues, with a non-executive director buying nearly R1.8 million in shares. Keep an eye on this one.

- An associate of Carl Neethling bought shares in Ascendis (JSE: ASC) worth R1.1 million.

- An entity related to the Christo Wiese stable (but not the usual Titan Premier Investments) has bought shares in Brait (JSE: BAT) worth R920k.

- A director of Kumba Iron Ore (JSE: KIO) sold shares worth R841k.

- Showmax, the streaming initiative at MultiChoice (JSE: MCG), is a cash-hungry beast. This is no different to what we’ve seen at streamers elsewhere in the world. If I understand the announcement correctly, it looks as though Showmax in its current form (i.e. as a venture in which Comcast is the 30% partner) has swallowed $284 million in equity funding. MultiChoice and Comcast have injected that funding in line with their respective 70-30 holdings.

- NEPI Rockcastle (JSE: NRP) has priced its green bond offering. €500 worth of green bonds at a 4.25% fixed coupon were priced at 99.124%. Simply, this means that the market was happy to pay very close to par value, which would yield 4.25%. In other words, the market priced NEPI’s debt as slightly more expensive than the rate that NEPI hoped to achieve. The book was many times oversubscribed, peaking at over €3 billion.

- Property group Putprop (JSE: PPR) is disposing of an industrial property in Gauteng for R42 million. The property is a logistics hub in Soweto for Putco buses. The property was independently valued at R47.5 million, so they are letting it go at quite a discount. The property’s profit after tax in the last financial year was R10.3 million. That’s a huge yield and presumably for very good reasons.

- Goldrush (JSE: GRSP) is removing the last of its cross-holding with Astoria (JSE: ARA) by looking to place its Astoria shares in the market in exchange for Goldrush preference shares. The trade is on a 1-for-1 basis, with Astoria trading at R9.00 and Goldrush at R7.06. This is to entice Goldrush shareholders to part with a preference share in exchange for an Astoria share.

- Rex Trueform (JSE: RTO) released a trading statement noting that HEPS is down by a huge 90.6% to 37.4 cents. No further details have been given at this point but earnings are due for release this week, so they really waited until minute 99 to release the trading statement. African and Overseas Enterprises (JSE: AOO) is part of the same group and reported a drop in HEPS of 85.4%.

- I’m not going to go into this deal in huge detail, as Kibo Energy (JSE: KBO) is such a small and thinly traded company, but shareholders should be aware that the notice for the general meeting to approve what is effectively a reverse listing of a portfolio of renewable assets has now been sent to shareholders.

- Andrew Hannington is resigning as CEO of enX Group (JSE: ENX). Robert Lumb is being promoted from CFO to CEO, having been with the company as CFO for over 4 years and having worked with Hannington throughout that period. Jessica Dawson is the new CFO as an internal promotion. That’s a pretty good succession story all round!

- London Finance & Investment Group (JSE: LNF) has practically zero liquidity, so the results get only a passing mention here. Net assets per share increased from 59.2p per share to 71.6p. The dividend for the full year was 1.2p.

- African Dawn Capital (JSE: ADW), which is suspended from trading, is in discussions with a third party regarding a possible subscription for shares in a subsidiary of the company.