“There is no news” – the 18:45 news bulletin on BBC, 18 April 1930

This looks a little different, doesn’t it? With so many delistings on the JSE, we finally reached a point where there was (almost) no company news of any real importance on Thursday. Sad. Luckily, there’s a big world of things you can invest in, so I decided to give Ghost Bites an international flavour rather than writing it off altogether.

Welcome to Ghost Bites – but with a passport. And as luck would have it, two of the companies (Delta Air Lines and PepsiCo) have been covered in detail in Magic Markets Premium before. At just R99/month, this research library is your best way to learn about far deeper pools of capital than we are seeing on the local market. >>”>You can subscribe here>>>

Right at the bottom, you’ll find information on the only two local announcements of the day, one of which was embarrassing.

A record quarter at Delta Air Lines ($DAL)

Yes, aviation businesses CAN make money

In the quarter ended June, Delta Air Lines demonstrated that Americans have money and will travel. A lot, actually.

This was the largest ever trans-Atlantic summer schedule in the company’s history, with over 650 weekly flights to 32 destinations and a 20% increase in seat capacity vs. the prior year.

Operating revenue was a record $15.6 billion. Operating income was a record $2.5 billion, at a pretty healthy operating margin of 16%. Quality of earnings was solid, with operating cash flow of $2.6 billion that enabled payments on debt and finance lease obligations of $1.8 billion.

The full-year outlook is for revenue growth of 17% to 20%, with operating margin of over 12%. Earnings per share is expected to be between $6 and $7, with the share currently trading at just under $48.

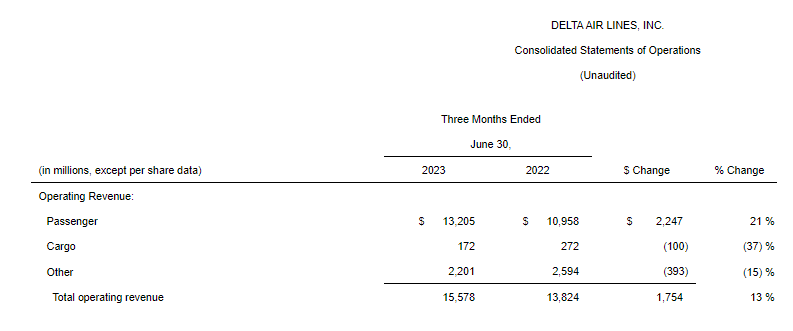

In case you’ve ever wondered what the revenue split at a predominantly passenger airline is, here’s some insight into that:

Note the drop in cargo revenue as the costs of moving goods around has come off substantially. The growth in passenger revenue is what Delta really cares about.

Before you jump into this stock, you may want to consider the recent flight path and how much of the recovery has been priced in:

PepsiCo upgrades guidance for the year ($PEP)

We sure do love our Doritos

PepsiCo is one of the best performing businesses you’ll find in an inflationary environment. When we want our calorie fix, we tend to be less worried about what it costs. Realistically, there is no known alternative in the universe for blue Doritos. That’s my hill and I’m dying on it.

There’s far more to PepsiCo than the drink you’re forced by Burger King to occasionally have instead of Coke. The Frito-Lay side of the business is brilliant, with numerous dominant products in your local snack aisle. We don’t know the brand in South Africa, but Pepsico also plays in the consumer staples space with Quaker oats.

After a brilliant performance in the last quarter, Pepsico followed it up with another solid quarter that boasts 13% revenue growth in constant currency. Frito-Lay achieved 14% revenue growth with a 1% increase in volumes, so pricing increases were 13% and people still bought more chips.

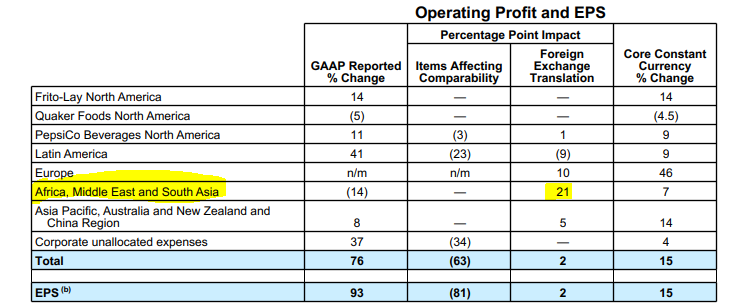

This table shows you the segmental performance in operating profit, as well as the huge impact of the strong dollar on earnings from Africa, Middle East and South Asia:

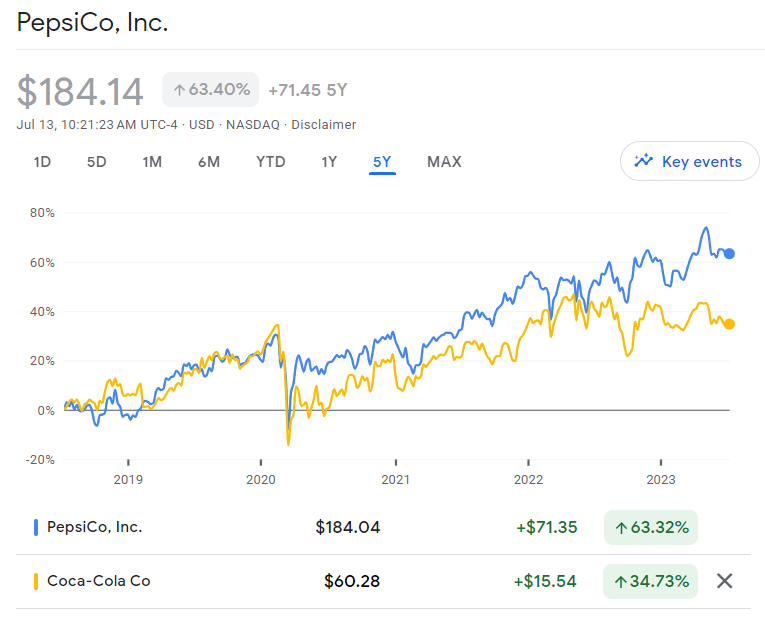

Don’t judge a share price by the soft drinks available in the fridge at your local grocery store. South Africa is a small place in the global context. Exhibit A:

Swatch is running like a Swiss clock (SWX: UHR)

The first half of 2023 is a record period for the watch company

For the first six months of the year, Swatch grew sales by 18% at constant exchange rates, or 11.3% as reported. That’s a good reminder that even European companies have been struggling with currency volatility.

The group achieved double-digit growth in all watch and jewelry price segments, though the cheaper stuff achieved the strongest growth. That makes sense in an environment of constrained consumer spending. We want to look good, but on a budget.

Operating profit grew by a delicious 36.4% as operating margin expanded from 13.9% to 17.1%. Net income was 55.6% higher, with net margin of 12.4% vs. 8.9% in the comparable period.

Best of all, Swatch sounds bullish on the second half of the year. With net sales having smashed the record set in the first half of 2018, it seems like the full-year record may be under threat here. To make sure that happens, Swatch is focusing on product innovation in the lower and mid-range segments.

This is the beauty of an adaptable brand.

Northam’s production for FY23 (JSE: NPH)

All operations have made strong contributions

Mining is a tough industry, so it’s impressive to note that all the Northam Platinum operations were either flat or up for the year. Eland was the star of the show in terms of Northams’ owned operations, with Zondereinde bringing up the rear with a flat performance.

Refined production from own operations was up 13% and the inclusion of purchases from third parties takes this to 19.5%.

A whoopsie at RMB Holdings (JSE: RMH)

When in doubt, the mic is hot

To add insult to injury on a day of almost no local news, one of the announcements was an example of amateur hour at RMB Holdings. Mistakes happen obviously, but microphones should always be treated as hot.

The recording of the formal results call earlier in the week including a portion of private conversation between the CEO and CFO. I don’t know what was said, but it was juicy enough for the company to issue an apology and replace the recording. I’m sad that I missed it!

As a reminder, RMB Holdings is in dispute with investee Atterbury, requiring the immediate payment of a R487 million loan. This will almost certainly end up in court. If RMB Holdings is found to be correct, then Atterbury will need to come up with the liquidity to pay this loan.

Little Bites:

- Blink and you’ll miss it! Telemasters (JSE: TLM) announced a dividend of 0.1 cents per share.