If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

Bytes in Bites

Although Bytes closed 4.5% higher, the share price is still down 25% this year

Bytes was spun out of Altron in 2020 and listed in the UK, representing the more “exciting” part of the technology group with software, cybersecurity and cloud offerings.

With detailed interim results set to be released on 26 October, the company has given a high-level trading update for the six months to August.

Key metrics like Gross Invoiced Income and Gross Profit were both up by more than 20% year-on-year. Adjusted Operating Profit growth was in the “high teens” which sounds good. The company enjoyed solid demand from the corporate and public sectors.

Cash conversion has been impacted by customers switching to subscription-based products. Bytes is confident that cash conversion will normalise in the second half. The cash balance at the end of August was approximately £35 million.

City Lodge pivoted, survived and is looking stronger

The occupancy rate has exceeded 52% for the past three months

When it comes to companies that were on the wrong side of the pandemic, City Lodge has pride of place. The tourism industry was decimated, claiming numerous scalps including Comair.

City Lodge managed to survive, although investors will need more than a great holiday to forget the pain.

In the year ended June 2022, revenue was R1.1 billion. To give that number more context, revenue in FY19 was R1.55 billion. There’s still a long way to go to return to pre-pandemic levels. FY21 was an unimaginable disaster, with revenue of just R0.5 billion.

Adjusted EBITDAR margin (operating profit net of turnover-based rentals) was 38.6% in FY19 and came in at 27% in FY22 (or 20% excluding unrealised forex movements). Again, one would expect to see considerable room for improvement in margin when capacity utilisation was low.

Speaking of that utilisation, average occupancy in FY19 was 55%. In FY22, it was 38%. The more important news is that the July to September period saw occupancies of between 52% and 56%, so that’s looking a whole lot better. Anyone taking a long position in City Lodge at these levels is considering the potential performance over the next few months, not the horror story of FY20 – FY22.

Even in these tough times, City Lodge managed to generate positive operating cash flow of R265.8 million in this period. That’s impressive.

It’s interesting to note some of the strategic changes made over this period. For example, the restaurants now offer lunch and dinner in addition to breakfast, appealing to business travellers seeking convenience. City Lodge has also coined the term “bleisure traveller” – a reference to those who take advantage of hybrid working arrangements to travel while working. The group was historically focused on business travel and now has a higher proportion of leisure travel than before.

It’s also worth highlighting that City Lodge has sold its East African operations. Those hotels are not included in results from 1 July 2022. The proceeds were used to improve the balance sheet, with the added benefit of new debt facilities that have more favourable rates and covenants.

The share price is down more than 33% this year. Having a punt at it? Let us know in the comments!

Sasfin’s ROE is lower than the 10-year SA bond yield

Recent reputational damage probably won’t help matters either

Almost every bank’s share price has performed well this year. Sasfin is part of why I have to say “almost” – the share price is down 17% this year, although liquidity is so thin that “crossing the double” (the bid-offer spread) can bring that a lot closer to a flat performance for the year.

Either way, it hasn’t done well. It’s never really done well to be honest, down 42% over 5 years.

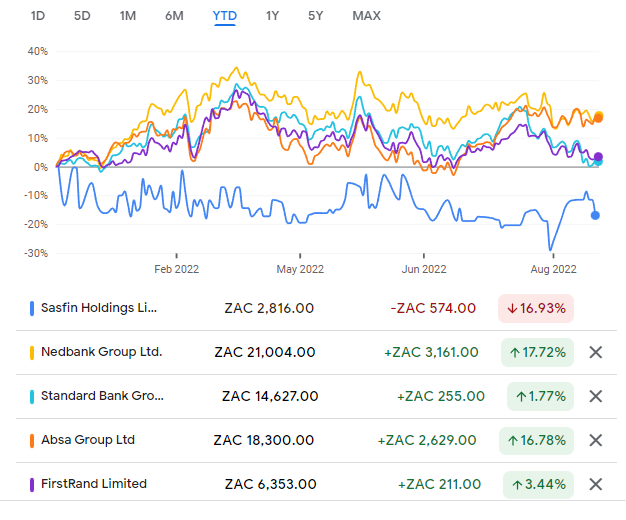

Spot the odd one out in this chart:

With return on equity (ROE) of just 10.46%, Sasfin is generating economic losses i.e. it is not achieving an appropriate return on shareholder funds. These days, you can get that return on a 10-year South African bond. Literally.

The price/book ratio of 0.54x reflects the market view on this bank. It puts the effective ROE at 19.4% (calculated as 10.46 / 54), so investors have little faith in Sasfin’s ability to grow. They also aren’t fans of the extent of the founding family’s influence in the business.

In Asset Finance, total income dipped slightly to R605 million. Loan growth exceeded pre-Covid levels but higher interest rates impacted fixed rate deals. I don’t know much about the business, but it was clear to absolutely everybody that interest rates would be going up. I’m not sure why the bankers couldn’t put steps in place to prepare for that outcome. This is what bankers do!

Business and Commercial Banking achieved strong income growth of 13.4% thanks to loans and advances increasing by 26.2%. It’s still a loss-making business though, albeit with an improved loss of R37 million vs. R49 million in the prior year.

Sasfin Wealth is a decent business, achieving profit of R58 million off total income of R363 million. Assets under advice and management increased to R59.2 billion. Profit was lower though, impacted by a once-off operational loss of R45 million.

The final dividend of 120.89 cents is lower than 131.02 cents last year. This is a dividend yield of 4.3%.

York: it rained and it poured

Shareholders “will require patience” with this one after a very tough year

For all the excitement around shareholder activism at York, the share price has fallen over 33% this year. It’s been a disappointing follow-on from record EBITDA in the year ended June 2021.

Like all primary agriculture businesses, York faces Mother Nature’s wrath. She had a rather sick sense of humour in the past year, with 60% more rainfall between October 2021 and February 2022 than the long-term average. This made it difficult for York to access and transport logs, an issue that wasn’t helped by a NUMSA strike after the rains.

Indeed, it never rains but it pours in South Africa.

After an ugly fight with NUMSA that really damaged the business and employee relations, the recognition agreement with NUMSA was terminated and striking employees cited for gross misconduct were dismissed. Doing business in South Africa carries risks far beyond load shedding.

The Processing segment and Wholesale divisions carried the team, with EBITDA of R203 million and R158 million respectively. The Forestry and Fleet segment suffered an EBITDA loss of R128 million due to rainfall and strikes. The Agricultural segment made a loss of R16 million.

Despite such a tough period, York managed to eke out a profit. HEPS was 9 cents per share, down from 42 cents. Net debt was reduced from R444 million to R404 million.

In the outlook section, the management team notes that “patience will be required from shareholders” – that’s not what investors want to hear in an environment of rising yields. The cost of money is increasing and people want higher returns today, not tomorrow.

Little Bites

- Director dealings:

- Another director of Barloworld has bought shares in the company, this time to the value of R546k.

- Thungela’s CFO was thrilled to find coal under his Christmas Tree rather than presents, having sold shares in the company for R22.7 million.

- Cautionaries:

- There’s some potential action on the table at Grand Parade Investments, with the company issuing a cautionary announcement regarding a potential sale of the group or its assets.

- Nutritional Holdings has renewed its cautionary announcement regarding its fight in court against the liquidation of certain group companies. Honestly, I would just exercise caution on this one forever. They don’t need to renew those announcements.

- Conduit Capital is getting closer to death. After a subsidiary contributing over 90% of revenue was placed into liquidation, the audit has been delayed and the share has been suspended from trading. It’s difficult to see a way back from here.

- Kibo Energy has agreed to acquire a 100% stake in a waste reception, anaerobic digestor and CHP power plant. It may sound like medicine to help with stomach ache, but this is a 12MW waste-to-energy project that is in line with Kibo’s strategy to acquire and develop a sustainable energy portfolio. The deal value is £600k, with £350k payable in Kibo shares and the rest in cash. Kibo estimates an IRR (internal rate of return) on the deal of 22.78%.

- Choppies Enterprises closed over 12% higher after releasing results for the year ended June 2022. Revenue increased 13% and HEPS jumped by 91%. Notably, the retail group’s inventory grew by 35.2% due to inflation and supply chain pressures. Stock levels are higher to avoid stock-outs that negatively impact revenue.

- Emira Property Fund has increased its stake in Transcend Residential Property Fund to 45.13%.

- Ascendis Health seems to be in a state of flux again, with the company secretary resigning.

Yes I’m taking a punt on City Lodge!