Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

More than just a bite at Bytes (JSE: BYI)

Juicy double digit growth is impressive – especially measured in hard currency

South African investors love getting exposure to locally listed groups with offshore earnings. I always caution against buying low-growth companies purely for their dividend, with some of the offshore options having that flavour. Bytes is different, with operations in the UK and Ireland that are growing quickly.

Bytes plays in major growth areas like software, security, AI and cloud services. Lucrative industries tend to attract competition, so fast growing revenue doesn’t necessarily translate into margins being maintained at a high level.

We can see this by comparing gross invoiced income (up 37.6%) to Bytes’ revenue growing by 16.3%. Gross profit is only up 15%. Gross profit as a percentage of gross invoiced income has fallen from 8.3% to 7.0% for the six months to August, which is a significant negative move driven by large contracts where pricing needs to be more aggressive.

Expenses are also under pressure, with adjusted operating profit up by 13.8%. This is lower than the gross profit growth. Margins are high (adjusted operating profit is 31% of revenue) but are trending in the wrong direction.

HEPS has increased by 17% and the interim dividend per share is up 12.5%. Remember, all these growth rates are based on GBP earnings, so that’s before the benefit of rand weakness for South African investors.

This is a really strong result overall, though investors will need to keep an eye on margins.

Pressure on costs makes DRDGOLD’s life difficult (JSE: DRD)

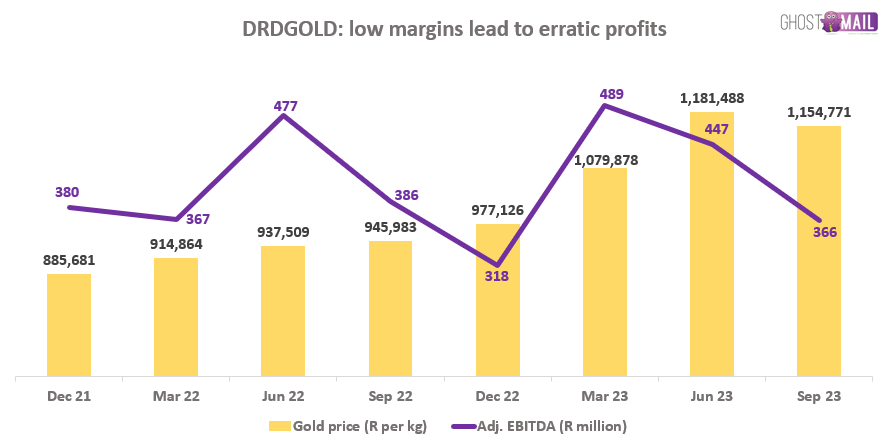

Charting EBITDA against the rand gold price is fascinating

DRDGOLD releases an operating update every quarter. It includes information on gold produced and sold, as well as the average gold price, operating costs and adjusted EBITDA.

In other words, everything you actually need to know is in here.

The important thing to remember about DRDGOLD is that this is a tailings business, so margins are tight as the gold is being reclaimed from mine dumps etc. rather than mined for the first time. This leads to a more erratic profit performance, dependent on not just the gold price but also the significant inflationary pressures in operating costs in South Africa.

This chart tells the story, thanks to the quarterly updates:

In the latest quarter, the average gold price received per kilogram is down 2% vs. the preceding quarter and cash operating costs per kilogram increased by 6%. This is why margins have gone backwards once again.

From a cash flow perspective, it helps the balance sheet that sustaining capex is 25% lower than the immediately preceding quarter and non-sustaining or growth capex is 34% lower.

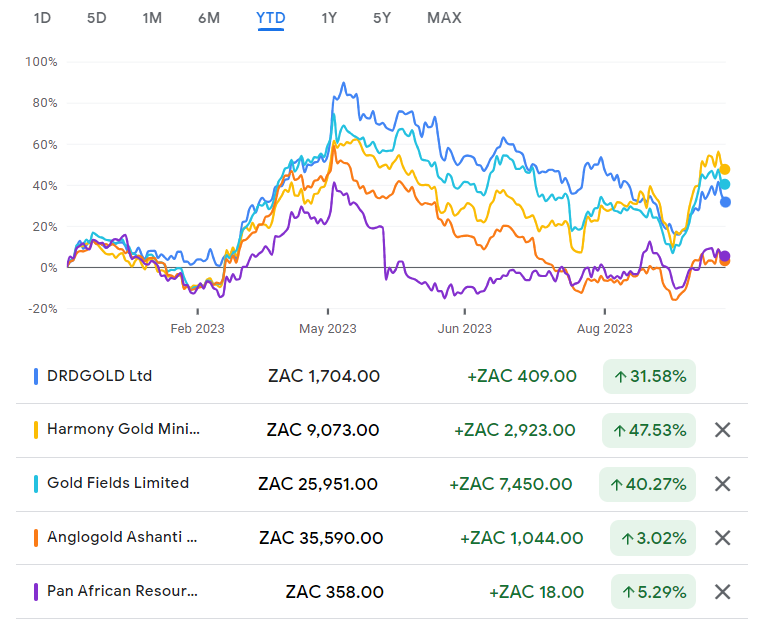

Although performance has varied significantly this year within the sector, all of the gold players are in the green in 2023:

If you’ve ever wondered what large ships cost… (JSE: GSH)

…wonder no more

Grindrod Shipping, like all shipping groups, is always on the look-out for opportunities to buy and sell ships. This is a core part of managing the fleet.

The announcements dealing with such purchases and sales are always a fun read because they go into detail on what the ships cost. For example, the 2015-built ultramax bulk carrier IVS Bosch Hoek has been sold along with the 2016-built ultramax bulk carrier IVS Hayakita for $46.5 million. The net result of all this is that $10 million worth of debt has been repaid on the $114.1 million senior secured credit facility.

There are two other sales with expected delivery in December, being the IVS Merlion for $11.6 million and the IVS Raffles for $11.6 million. Both these numbers are before costs and the vessels don’t have any debt specifically attached to them. The underlying contracts must be interesting, as Grindrod Shipping makes it clear that delivery might not take place by December – or at all!

In a separate announcement, Grindrod Shipping pointed to disclosure by Taylor Maritime Investments (the London-listed company that owns 83.23% of Grindrod Shipping) about shipping rates. Across the Taylor and Grindrod Shipping fleets, the blended net time charter equivalent was $10,695 per day for the quarter ended September. 29% of remaining days have been contracted to March 31 2024 at a rate of $12,200 per day.

Total Grindrod Shipping debt reduced by $7.7 million to $168.9 million during the quarter ended September. Debt to gross assets is around 38.5%.

Life Healthcare’s normalised EBITDA inches forwards (JSE: LHC)

Alliance Medical Group is recognised as a discontinued operation

Life Healthcare has released an update for the year to September 2023. The important nuance here is that Alliance Medical Group is being disposed of by the group, so it’s been recognised as a discontinued operation.

This means that the focus should be on performance from continuing operations, as this is what shareholders will be left with. It’s not exactly a rocket of excitement, with revenue up by between 7% and 13% and normalised EBITDA only 1% to 6% higher.

Interestingly, the split of medical to surgical paid patient days is now very similar to 2019. COVID has thankfully nearly worked its way out the system entirely.

In case you weren’t sure whether Life Healthcare’s acquisition of Alliance Medical Group had been a success over the years, perhaps the impairment in this period of around R950 million will answer the question. The transaction costs are an astonishing R700 million. The only saving grace here is that a forex gain is likely to be recognised on the actual disposal, as the rand has obviously lost a lot of value since that asset was acquired at R17.78 to the pound.

The weak profit growth at EBITDA level coupled with increased finance costs means that earnings per share (which also includes the impairment) has fallen by 75% to 95%. The group also reports “normalised EPS from continuing operations” which miraculously grew by between 10% and 29%.

I’ll wait for the full results and that magical term “HEPS” before forming a final view. In general, I am bearish on hospital groups as eternally bad allocators of capital. Nothing I’ve seen in this trading statement makes me want to change that view.

More pain at Sibanye-Stillwater, this time in PGMs (JSE: SSW)

This is going from bad to worse

The sharp downturn in the PGM sector has been quite something to witness. Just yesterday, I published a chart showing Anglo American Platinum’s basket PGM price and how this has dropped over the past year. Now, Sibanye-Stillwater is entering into a Section 189 process regarding four shafts at the local PGM operations. A total of 4,085 employees and contractors could potentially be affected.

Two of the shafts are mature, with one having ceased production in 2022 and the other at the end of its operating life. The other two need to be restructured to achieve sustainable production.

Regarding the closed Simunye shaft at Kroondal, where production ended in 2022, employees not yet deployed to other sites will be consulted under the s189 process. The 4B shaft at Marikana was restructured during 2019 and then spent a few years using the last of the economically extractable reserves, with the closure of that shaft subject to consultations with labour representatives and non-unionised employees.

The Rowland shaft at Marikana is only running at 64% of planned production year-to-date. To be viable, management has proposed a reduction in employee numbers.

The Siphumelele shaft in Rustenburg experienced seismic activity in 2022 which restricted access to certain areas. The production forecast dropped as a result, necessitating a proposal to decrease the workforce.

This kind of thing is bad news for the country as a whole and has a significant impact on the families who depend on these mines. It’s never nice to read.

Super Group finds it easy to raise debt (JSE: SPG)

The latest debt raise was strongly oversubscribed

Whenever people talk about the JSE, they inevitably refer to the equity market. This is only one part of the overall picture, as the JSE also has a vibrant debt market that allows corporates to issue debt (or “issue paper” as it is commonly called in the industry) to banks, financial institutions and funds looking for corporate credit opportunities.

These are often structured as Domestic Medium-Term Note Programmes, or DMTNs. The framework is set up when the debt is issued and then more debt can be raised through the programme without much additional work.

Super Group’s DMTN programme goes back to April 2020. Under this programme, the company aimed to raise another R1 billion from the market recently. The auction was held the other day and it was way oversubscribed, with bids of R3.2 billion coming in.

The three- and five-year tranches were priced at 2 basis points and 6 basis points respectively below the pricing guidance. In simple terms, this means the debt is cheaper than Super Group anticipated, thanks to the level of demand.

When companies have a solid track record, they benefit from cheaper debt.

Little Bites:

- Director dealings:

- A director of a subsidiary of AVI (JSE: AVI) received R865k worth of shares and sold the whole lot. I usually ignore share-based awards as this isn’t a useful signal about the share price. But when everything is sold rather than just the taxable portion, that’s a genuine insider sale in my books.

- A prescribed officer of ADvTECH (JSE: ADH) has sold shares worth R614k.

- Steinhoff Investment Holdings (JSE: SHFF) – the preference share structure rather than the now worthless and delisted ordinary shares – has withdrawn the cautionary announcement about a potential deal.