Listen to the latest episode of Ghost Wrap here, brought to you by Mazars:

Strong revenue growth and share buybacks boost Calgro M3 (JSE: CGR)

This is a good example of the value that can be found on the local market

Full credit to those who bought Calgro M3 recently. The share price is up 44.9% this year, helped along by a combination of strong core results and a major share buyback programme. When a company is trading at a low valuation, share buybacks are a very powerful tool.

For the six months ended August, HEPS is between 73.18 cents and 84.58 cents, an increase of between 28.4% and 48.4%. This was driven by solid revenue growth (13.5%) and extensive share repurchases, representing 18.6% of opening share capital. The average repurchase price of R2.63 per share is way below Monday’s closing price of R4.55 per share.

Importantly, cash generated from operations is in line with profit after tax.

Detailed results are expected to be published on 16 October.

Merafe’s ferrochrome price inches higher (JSE: MRF)

The company announces the benchmark ferrochrome price each quarter

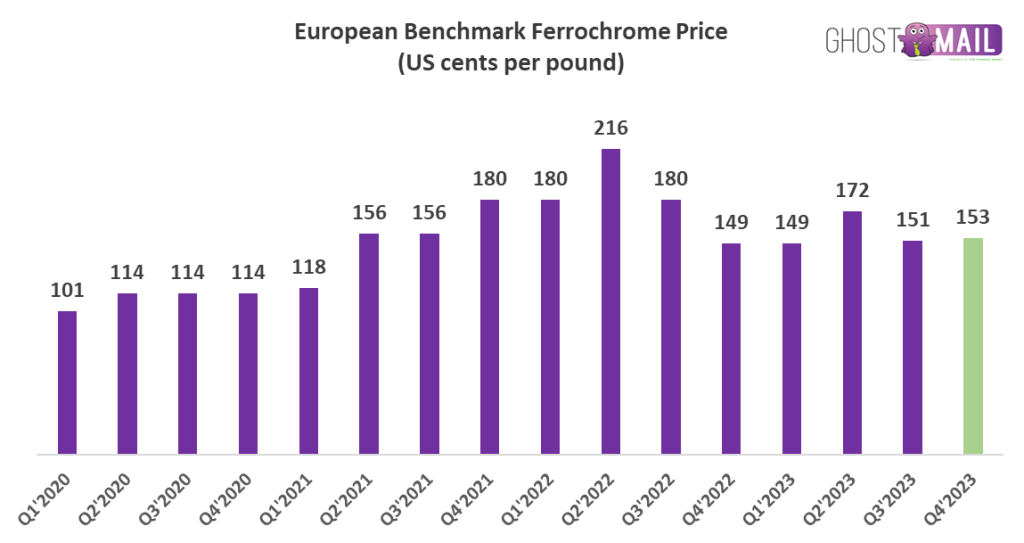

Merafe announced that the European benchmark ferrochrome price for the fourth quarter of 2023 is 153 US cents per pound, up 1.32% from the preceding quarter.

To give you a better idea of the trend in the price during and after the pandemic, I pulled together this chart:

Over three years, the share price is up 230%! The picture is much less exciting over five years, with the stock down 24%.

Nampak has completed the debt restructuring (JSE: NPK)

This is a short, sweet and very important update

With the rights offer now out of the way and the equity side of the balance sheet brought to where it needs to be, Nampak has announced that the debt restructuring has been finalised with effect from 29 September.

Financials for the year ended September are due for release on 4 December.

Pick n Pay gets absolutely slaughtered (JSE: PIK)

Gradually, and then suddenly…

The Ernest Hemingway quote about bankruptcy refers. Although Pick n Pay is far from bankrupt, the group is making losses. Yes, headline losses. This is astonishing, with years of dicey strategy and the absolute strength of Shoprite combining to really hurt shareholders.

Next time you think grocery stores are defensive, just remember this chart:

CEO Pieter Boone is the fall guy, getting fired with immediate effect after 2.5 years in the job. I personally think that Boone’s strategic moves have been in the right direction, trying to address issues that were there long before his time. Anyway, every war has its casualties.

Speaking of long before his time, Sean Summers (who was famously caught for speeding in his Ferrari back in the 2006 bull market) is back in the top job, having run the group for 11 years in a previous stint. He was in charge at Pick n Pay when it was the grocery market leader in South Africa. Many disappointed customers later, that is certainly no longer the case.

I really do wish him luck. He inherits a mess. The core business is no Ferrari, with Pick n Pay SA managing growth in the 26 weeks ended 27 August of just 0.3%, or 0.8% on a like-for-like basis. That is truly awful compared to Shoprite. Boxer SA grew sales 16.1% overall or 4.2% on a like-for-like basis, with even Boxer’s like-for-like performance starting to give investors grey hairs now. A Ferrari F1 pit strategy, more like it.

The star of the show remains the clothing business, up 13.8%.

It’s so bad that the company now expects to report a loss even after adjusting for abnormal costs. Notably, they include diesel for load shedding as an abnormal cost. In other words, Pick n Pay is now making losses before load shedding.

Make no mistake: Shoprite is going in for the kill. Its opponent is a bloody mess who has dusted off an old-school coach to try and turn the fight around. I suspect that Summers is in for a shock when he sees how different the landscape is to when he was living the dream with Ferraris, lots of electricity and an environment of economic growth.

Schroder European Real Estate refinances debt (JSE: SCD)

It really is tight out there for property funds

Schroder European Real Estate has given us a strong indication of how difficult the debt markets are for property companies at the moment. To improve the margin on the five-year debt by 15 basis points, the company has included two unencumbered industrial assets in the security package. This also helped extend the facility by €4.5 million to €13.8 million.

The fixed rate on the facility is 5.3%, being the five-year euro swap rate (3.3%) plus the margin of 2.0%. The Dutch industrial portfolio to which the debt relates is yielding 6.2%. Shareholders are making a margin, but it really doesn’t leave any room for error, does it?

The company’s third party debt is €85.5 million across seven loan facilities, with a loan-to-value ratio of 31%, or 23% net of cash.

The weighted average loan term has increased by nine months to 2.6 years and the blended all-in interest rate is up 30 basis points to 2.9%. There are two more debt expiries due in 2024, so hold on to your seats.

Southern Palladium submits a Mining Right application (JSE: SDL)

This is a critical milestone for the project

Southern Palladium has submitted the Mining Right application to the Department of Mineral Resources and Energy for the 70% owned Bengwenyama Platinum Group Metals project. This is the next major step, kicking off many more workstreams if all goes to plan.

Resource modelling with results of the ongoing drill programme is also underway. The company recently increased the total Mineral Resource by 34%.

Trustco loses its battle with the JSE (JSE: TTO)

The Financial Services Tribunal has now put this issue to bed

This has been a long and protracted battle that has done nothing to win over the hearts of investors. In fact, it goes all the way back to a transaction in 2015!

In simple terms, the CEO of Trustco provided a loan to a private company that was reflected as an equity loan. These were the facts made available to shareholders at the time of approving an acquisition of the company from the CEO, which is clearly a related party transaction. The terms of the loan subsequently changed, which meant it was classified as debt rather than equity. The problem here is that Trustco never disclosed this fact to shareholders.

In other words, the net asset value of the company was nothing like the disclosure initially made to shareholders.

After much legal wrangling, the Financial Services Tribunal dismissed Trustco’s reconsideration application. This has therefore allowed the JSE to publicly censure the company.

The share price is down over 91% in the last five years, so there really isn’t much to love here.

Little Bites:

- Director dealings:

- In a pretty big show of faith, Alan Pullinger used the gross vested amount of share awards to buy R67 million worth of shares in FirstRand (JSE: FSR). He will settle the tax amount separately, which is why this is notable. There was also a prescribed officer (Emmarentia Brown) who took the same approach, with a purchase of R15.8 million in shares.

- Stephen Koseff has sold shares in Investec (JSE: INP | JSE: INL) worth £1.2 million.

- A prescribed officer of ADvTECH (JSE: ADH) has sold shares worth R850k.

- Des de Beer has bought shares in Lighthouse (JSE: LTE) worth R614k.

- Heriot Investments has transferred an 18.67% stake in Texton Property Fund (JSE: TEX) to subsidiary Thibault REIT, which is being listed on the Cape Town Stock Exchange. I’m envisaging layers of discounts here, as Texton is already at a very discounted price to book multiple.

- In other news related to Texton Property Fund (JSE: TEX), the company has withdrawn the option for shareholders to choose to receive shares in lieu of a cash dividend. This is based on “current market conditions” which can only be a reference to the huge discount to NAV. Investors are tired of being diluted at huge discounts.

- To give you an idea of how complicated large mining debt packages can be, Gold Fields (JSE: GFI) has entered into a sustainability-linked syndicated revolving credit facility agreement

of up to A$500 million, with a A$100 million “accordion option” that allows the facility to be enlarged. There are no fewer than 10 banks in the loan syndicate, with Commonwealth Bank of Australia having acted as mandated lead arranger and bookrunner. The bank also acted as sustainability coordinator, as there are sustainability-linked KPIs for the term of the facility (five years).

- The payments dates for the capital reduction tranches in Grindrod Shipping (JSE: GSH) are 26 October and 11 December. The first payment is $1.01598 per ordinary and the second is $0.63193 per ordinary share.

- AECI (JSE: AFE) announced the appointment of Rochelle Gabriels as group CFO, joining from a senior finance role at Imperial (now part of DP World).

- Labat Africa (JSE: LAB) is late in releasing its annual report and is in the naughty corner with the JSE.

- Sebata Holdings (JSE: SEB) declared a special dividend of 25 cents per ordinary share. The share price closed 9.5% higher at R2.20.

- Steinhoff Investment Holdings has declared a dividend on the preference shares (JSE: SHFF) of 452.79 cents.