If you enjoy Ghost Bites, then make sure you’re on the mailing list for a daily dose of market insights in Ghost Mail. It’s free! SIGN UP >>>

The DIY and building industry keeps falling

The latest update from Cashbuild isn’t good news at all

Cashbuild has released a voluntary operational update for the first quarter of the 2023 financial year. Revenue is down 4% year-on-year, with existing stores 5% lower. Volumes in existing stores fell by 8% and pricing increases helped mitigate some of that pain. Selling inflation was 4.8%.

Once again, the P&L Hardware business is taking the most pain. That segment is down 11% year-on-year and contributed 8% of sales. The core Cashbuild South Africa segment (81% of sales) fell by 2% overall, with new stores contributing 1% growth and existing stores down 3%.

This was a negative update that drove the share price down by 6%, taking the year-to-date drop to over 24%. The share price is back to September 2020 levels and there seems to be little relief on the horizon for this particular sector of the market.

CMH posts another bumper earnings result

The outlook tells a very different story

CMH is primarily a car dealership business and has had a great time of things in the aftermath of the pandemic. High used car prices means that margins have been great, with the impact of operating leverage leading to bumper profits.

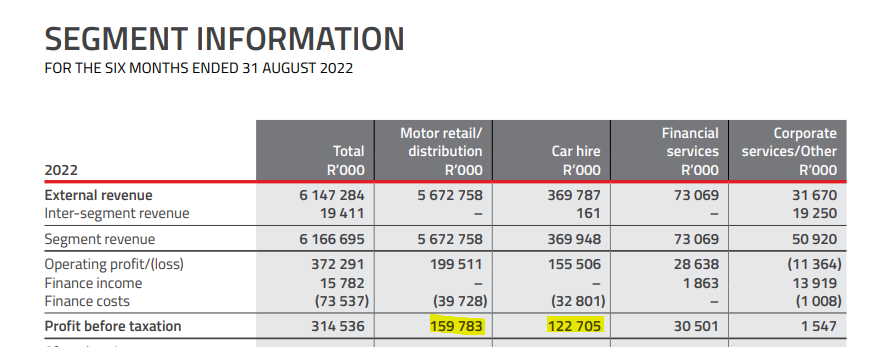

There’s also a car hire business. Although it makes far less revenue than the car dealership segment, you need to look at profit before tax to get the real picture:

I also suggest that you pay close attention to the commentary in the result. Investing is about what will happen next, not what has already happened. The group talks about “weathering a short- to medium-term storm” driven by rising interest rates, worsening loadshedding and economic despondency, pressure from manufacturers to reduce inventory and a fall in confidence levels.

That final point is critical, measured by the number of deals initiated by customers and approved by finance houses before the customer has a “change of heart” and pulls out of the deal.

CMH is up 14% this year. I would be careful here.

Hyprop gets a positive credit outlook

In a REIT, equity investors need to pay attention to the credit rating

In many cases, you can largely ignore a company announcing its credit rating. As an equity investor (and provided the company is in sound financial health), the credit rating is no indication whatsoever of potential equity returns.

I see it a bit differently in REITs, as these are highly leveraged structures where the return to shareholders is heavily influenced by the availability and cost of debt.

I bought Hyprop shares earlier this year at R33 and they are currently trading just below R38, so this is proof that there have been ways to make money this year. My thesis is that retail property funds are due a significant recovery in a post-Covid world and I felt that the share price was undervalued.

GCR Ratings has given Hyprop a solid investment grade credit rating and has also noted a positive outlook, driven by a faster than anticipated recovery in the group, reduced risk on the balance sheet from recent transactions in Europe and the overall strategy around deleveraging the balance sheet.

As a happy shareholder, all of this is music to my ears.

Pick n Pay is on sale

You can QualiSave right now on the share price, which lost 9% on Tuesday

Pick n Pay has released interim results for the 26 weeks ended 28 August and the market appears to be upset. There isn’t much to fault in the results themselves, so this could be a function of a high valuation multiple that is finally unwinding. It may also be linked to visibility on Boxer vs. the rest of the group.

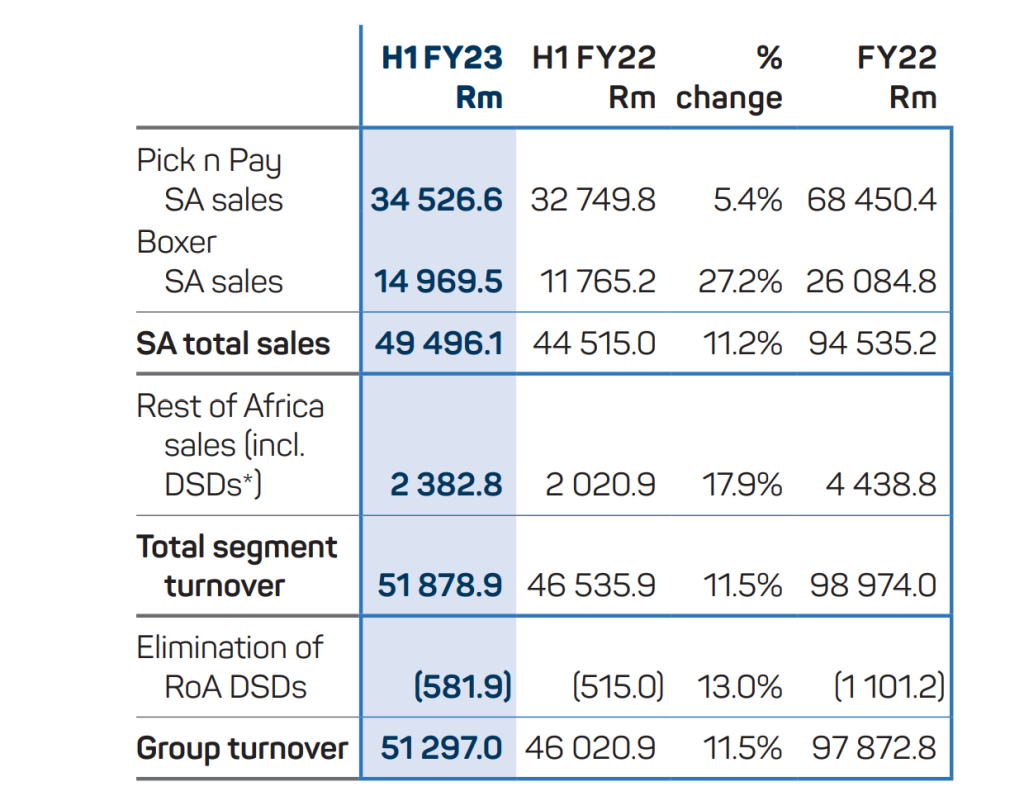

Recognising that the comparable period was impacted by the pandemic, turnover is up 11.5% and gross margin improved from 18.2% to 19.4%. The company suggests that 8.2% turnover growth is a normalised view after adjusting for civil unrest and liquor trading disruptions. If you read carefully in the detailed results, you’ll also find that gross margin on a normalised basis actually fell from 20% to 19.4%. The year-on-year improvement (as reported) is thanks to disruptions in the base.

Trading expenses were 10.6% higher, so operating margin expanded and profit before tax increased by 22.2%.

In Pick n Pay South Africa, like-for-like sales and expense growth were similar at 4.5%. The margin expansion didn’t come from that part of the business.

Although HEPS was 59.5% higher, pro-forma HEPS is what matters as this adjusts for the business interruption proceeds that were in this period and not in the base. That metric is 25.3% higher, which makes sense compared to the increase in profit.

To help you understand the group strategy, it’s useful to note that Pick n Pay refers to “high performance but under-penetrated formats” – in this case Boxer and Pick n Pay Clothing. The group believes that there is a significant runway for growth in these formats and I agree with that assessment, with Boxer posting growth of 27.2% and Pick n Pay Clothing up 14.8%.

In the core business, it’s all about separating the Pick n Pay footprint into two differentiated banners: Pick n Pay (for higher income shoppers) and Pick n Pay QualiSave (for lower- to mid-income shoppers). Although I still think it’s a terrible name, all that will ever matter is the financial results. The QualiSave name has been rolled out to 93 stores and a further 41 stores have been refurbished in line with the new plan.

In case you’re wondering, the difference is the amount of choice in store vs. how aggressive the pricing is. Higher income shoppers value choice and quality above all else. Lower income shoppers struggle to put food on the table and need the best possible prices. It’s as simple as that.

Online sales grew 82%. I would caution that this is still off a very low base.

Ultimately, the biggest news for investors who closely follow Pick n Pay is that Boxer is now separately disclosed for the first time. As this table shows, it is the crown jewel of the group in terms of future prospects:

With no other obvious reasons for the sharp decline in the share price, perhaps it was because the market realised that Boxer has been flattering the group story and that Pick n Pay needs more work than people thought?

Little Bites

- Selected director dealings:

- A director of Blue Label Telecoms sold shares worth R558k. In general, I’ve seen Blue Label insiders as being net sellers despite (or because of?) the deal with Cell C.

- A prescribed officer of Standard Bank sold R2 million in shares.

- Insimbi Industrial Holdings reported results for the six months ended August 2022. Revenue increased by just 1% but net profit jumped by 47%, helped along by an increase in gross margin thanks to higher commodity prices. For a real example of how badly Transnet is hurting the economy, switching from rail to road transport caused direct transport costs to increase by 219%! Cash generated from operations was down by 17%, driven by a significant decrease in trade payables. The best news in the result is that debt has come down considerably.

- Ninety One has confirmed its assets under management (AUM) as being £132.3 billion. That’s lower than £134.9 billion at the end of June and £140 billion a year ago.

- In a nasty display of the yield curve, British American Tobacco has priced $600 million of notes due 2032 (i.e. 10-year borrowings) at 7.75%. Debt is nowhere near as cheap as it used to be.

- African Rainbow Capital Investments has sent out the circular related to the proposed change to the management fee. If you are invested in that company, I highly recommend you check it out as this has been a major source of underperformance since the group listed.

- After acquiring another 0.03% in Royal Bafokeng Platinum, Impala Platinum now owns 40.49% of the company.

Thanks for the concisely written and informative daily Ghost Bites as well as other useful insights.

“… as this adjusts for the business interruption proceeds that were in this period and not in the base.” What does this mean in layman language?

What is Boxer (Pick ‘n Pay)?

Business interruption proceeds refers to the amounts received from insurers from the recent civil unrest/ looting. This proceeds were not included in the prior period( base) and therefore makes it hard to compare to current. Pro forma HEPS would adjust for this making it more comparable period on period.

There is no greater joy than watching readers answer each other’s questions! Apologies for my delayed response. There was a question about Boxer – this is Pick n Pay’s grocery format that is aimed at lower income earners. You typically find them in areas with high foot traffic e.g. near taxi ranks. Excellent business that has been growing at great pace for years now!